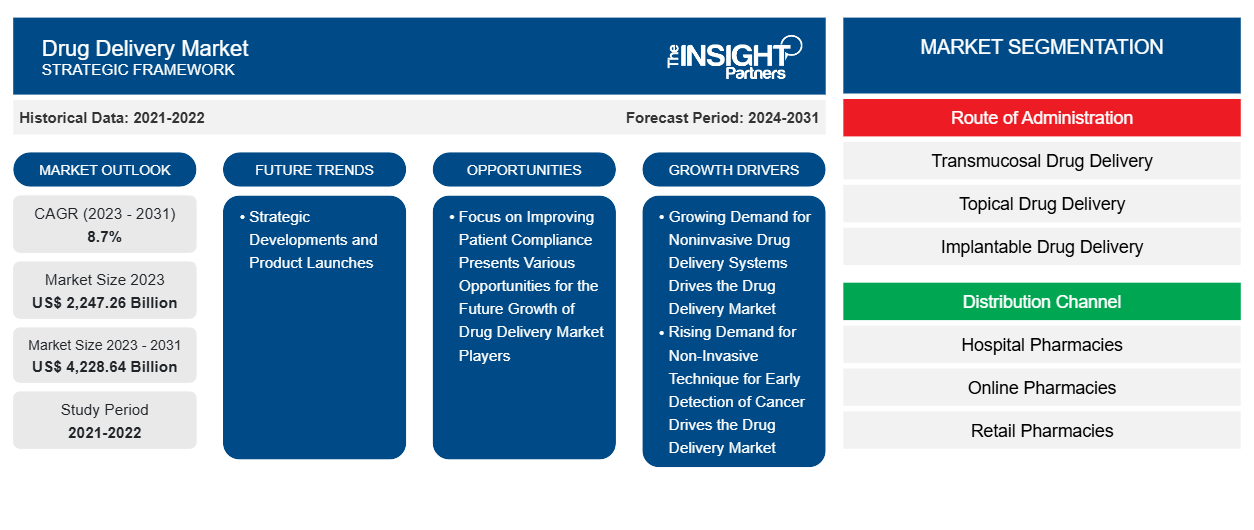

Drug Delivery Market Outlook and Strategic Insights by 2031

Drug Delivery Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Route of Administration (Transmucosal Drug Delivery, Topical Drug Delivery, Implantable Drug Delivery, Injectable Drug Delivery, Oral Drug Delivery, and Ocular Drug Delivery), Distribution Channel (Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies), End User (Hospitals & Clinics, Home Care Settings, and Other End User), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Mar 2026

- Report Code : TIPRE00029924

- Category : Life Sciences

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

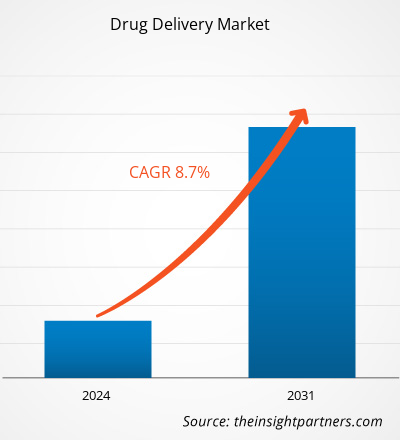

The drug delivery market size is projected to reach US$ 4,228.64 billion by 2031 from US$ 2,247.26 billion in 2023. The market is expected to register a CAGR of 8.7% during 2023–2031. Strategic developments and product launches is likely to remain key trends in the market.

Drug Delivery Market Analysis

Chronic diseases tend to worsen over time, creating a significant burden on patients, their families, and society. According to the International Diabetes Federation (IDF), about 425 million people were living with diabetes in 2017, and this number is expected to reach 629 million by 2045. Diabetes is a life-threatening chronic disease for which there is no specialized cure. Diabetes can lead to number of complications in different parts of the body, increasing the risk of premature death. Major complications associated with diabetes include kidney failure, heart attack, stroke, leg amputation, vision loss, and nerve damage. The number of diabetes cases has been increasing significantly worldwide.

The rising prevalence of chronic diseases has led to intensified research and development (R&D) in drug delivery systems in recent decades. Using a drug delivery system can help reduce the systemic side effects of drugs. Various drug delivery vehicles have been developed for targeted and controlled delivery of therapeutics for a wide range of chronic diseases, including myocardial ischemia, asthma, pulmonary tuberculosis, Parkinson's, diabetes, cancer, atherosclerosis, and Alzheimer's. An appropriate drug delivery system can enhance the therapeutic efficacy of a drug by ensuring high drug bioavailability for an extended period. Targeted drug delivery systems (TDDS) release drugs in a controlled manner at a specific site in the body. Nanotechnology-based delivery systems are having a significant impact on cancer treatment. In addition to the types of the administration route, nanotherapeutic drug delivery systems (NDDS) offer several technological advantages, including increased drug circulation time, controlled and sustained drug release, prolonged half-life, improved biodistribution, and elevated intercellular drug concentration.

Patients with chronic diseases depend on ongoing drug treatment, which comes with a continuous risk of side effects. Creating effective delivery systems for specific drugs can help concentrate the medicines in affected areas, minimize overall side effects, and enhance patient outcomes. As a result, the rising prevalence of chronic and lifestyle diseases supports the expansion of the drug delivery market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONDrug Delivery Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Drug Delivery Market Overview

Major factors driving the drug delivery market growth include growing demand for non-invasive drug delivery systems, increasing R&D expenditures in pharmaceutical companies, and rising incidence of chronic diseases propel the market growth. However, high cost associated with development of drugs and delivery systems and product recalls in drug delivery systems hinder the market growth.

Drug Delivery Market Drivers and Opportunities

Increasing R&D Expenditures in Pharmaceutical Companies to Favor Market

R&D is an essential part of any company’s business. According to a study "Total Global Pharmaceutical R&D Spending 2014–2028" by Matej Mikulic, spending on R&D in the global pharmaceutical industry amounted to US$ ~238 billion in 2021. Compared to other industries, pharmaceutical companies are more driven by the need to create innovative products and spend significant investment on R&D. This is mainly due to the time-limited patent protection of drugs and the resulting threat of a collapse in sales due to competition from generics and biosimilars. Pharmaceutical and medical device companies focus on R&D to introduce new molecules for various therapeutic applications with the most significant medical and commercial potential. Strong R&D capabilities also help them bring high-quality and innovative products to the market. R&D spending by biopharmaceutical companies has also increased over the years.

According to a study "Global Trends in R&D 2022" by IQVIA, 84 Novel Active Substances (NAS) were launched worldwide in 2021, which brings the total number of launches to 883 over the past 20 years. The US continues to be the country with the earliest and highest number of launches. 44 (over 60%) of the 72 NAS launched worldwide in 2021 were approved as a first-in-class medication by the FDA, and 40 (more than 50%) carried the orphan drug designation, indicating their use for treating rare diseases. Venture capital deals and investment flows in the US have increased in the past two years owing to the high interest in life sciences. The country recorded over 2,000 deals with a transaction value of US$ 47 billion in 2021. In addition, the 15 largest pharmaceutical companies spent US$ 133 billion in R&D in 2021, up by 44% since 2016.

Strategic Developments and Product Launches

Companies operating in the drug delivery market constantly focus on strategic developments such as collaboration, partnerships, agreements, and new product launches, which help them improve their sales. The new product launches are mainly directed toward increased security, user-friendly features, better dosing capabilities, etc., to attract a large patient base. Through improved dosing capabilities, drug delivery systems complement the therapeutic outcomes and increase the potential of disease management in home care settings. A few of the noteworthy developments in the drug delivery market are mentioned below.

• In June 2022, Esteve Pharmaceuticals GmbH launched INBRIJA 33 mg (levodopa inhalation powder in hard capsules) in Germany. INBRIJA is indicated in the EU for the intermittent treatment of episodic motor fluctuations in adults suffering from Parkinson’s disease, prescribed with a levodopa/dopa-decarboxylase inhibitor.

• In June 2022, EVERSANA and Accord BioPharma partnered to support the launch of CAMCEVI (leuprolide) 42 mg injection emulsion for the treatment of advanced prostate cancer in adults.

• In March 2023, Stevanato Group collaborated with Recipharm to develop and manufacture pre-fillable syringes that would be integrated into a new soft mist inhaler for inhaling sensitive biological products. The new strategic collaboration aims to provide innovative primary packaging to pharmaceutical and biopharmaceutical companies using Recipharm’s proprietary soft mist inhalers.

The growing number of such strategic developments and product launches are expected to invite new growth trends in the drug delivery market in the coming years.

Drug Delivery Market Report Segmentation Analysis

Key segments that contributed to the derivation of the drug delivery market analysis are route of administration, distribution channel, and end user.

- Based on route of administration, the drug delivery market is divided into transmucosal drug delivery, topical drug delivery, implantable drug delivery, injectable drug delivery, oral drug delivery, and ocular drug delivery. The injectable drug delivery segment is further bifurcated as conventional injection devices and advanced devices. Oral drug delivery segment further segmented as solid oral drugs, liquid oral drugs, and semi-solid oral drugs. Topical drug delivery segment further segmented as semi-solid topical drug delivery, liquid topical drug delivery formulations, solid topical drug delivery formulations, and transdermal. Transmucosal drug delivery further segmented as pulmonary and nasal drug delivery, buccal and sublingual drug delivery, rectal transmucosal drug delivery, and vaginal transmucosal drug delivery. Ocular drug delivery further segmented as eye drops and sprays, gels and ointments, ocular inserts and punctal plugs, and therapeutic contact lens. The injectable drug delivery segment held the largest market share in 2023.

- By distribution channel, the market is segmented into retail pharmacies, hospital pharmacies, and online pharmacies. The hospital pharmacies segment held the largest share of the market in 2023.

- In terms of end user, the market is segmented into home care settings, hospitals and clinics, and other end users. The hospitals and clinics segment held a significant share of the market in 2023.

Drug Delivery Market Share Analysis by Geography

The geographic scope of the drug delivery market report is mainly divided into five regions: North America, Middle East & Africa, Asia Pacific, Europe, and South & Central America.

North America has dominated the market. According to the Centers for Disease Control and Prevention (CDC) reported that in 2022, nearly 37.3 million people in the US had diabetes. Type 1 diabetes accounted for approximately 3.75% of this total, which amounts to around 1.45 million people. As a result, the growing diabetic population in the country is expected to drive the demand for different drug delivery systems to treat diabetes patients.

Drug Delivery Market Regional Insights

The regional trends and factors influencing the Drug Delivery Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Drug Delivery Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Drug Delivery Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,247.26 Billion |

| Market Size by 2031 | US$ 4,228.64 Billion |

| Global CAGR (2023 - 2031) | 8.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Route of Administration

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Drug Delivery Market Players Density: Understanding Its Impact on Business Dynamics

The Drug Delivery Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Drug Delivery Market top key players overview

Drug Delivery Market News and Recent Developments

The drug delivery market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the drug delivery market are listed below:

- Johnson & Johnson announced Robert Langer, Sc.D., of Massachusetts Institute of Technology (MIT) as the winner of the 2023 Dr. Paul Janssen Award for Biomedical Research. Dr. Langer was honored for his groundbreaking work in designing novel drug delivery systems that can deliver medications continuously, precisely, and at controlled rates over extended periods. His pioneering research into biomedical compounds for drug delivery has impacts on a wide range of medical technologies, including anticancer therapy, vaccine development, gene therapy and more. (Source: Johnson & Johnson, Newsletter, February 2024)

- Aptar Pharma, part of AptarGroup, Inc. (NYSE: ATR), a global leader in drug delivery systems, services and active material science solutions, today announces the launch of APF Futurity, its first metal-free, multidose nasal spray pump developed to deliver nasal saline and other comparable over-the-counter (OTC) formulations. (Source: Aptar Pharma, Press Release, January 2024)

Drug Delivery Market Report Coverage and Deliverables

The “Drug Delivery Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Drug delivery market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Drug delivery market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Drug delivery market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the drug delivery market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For