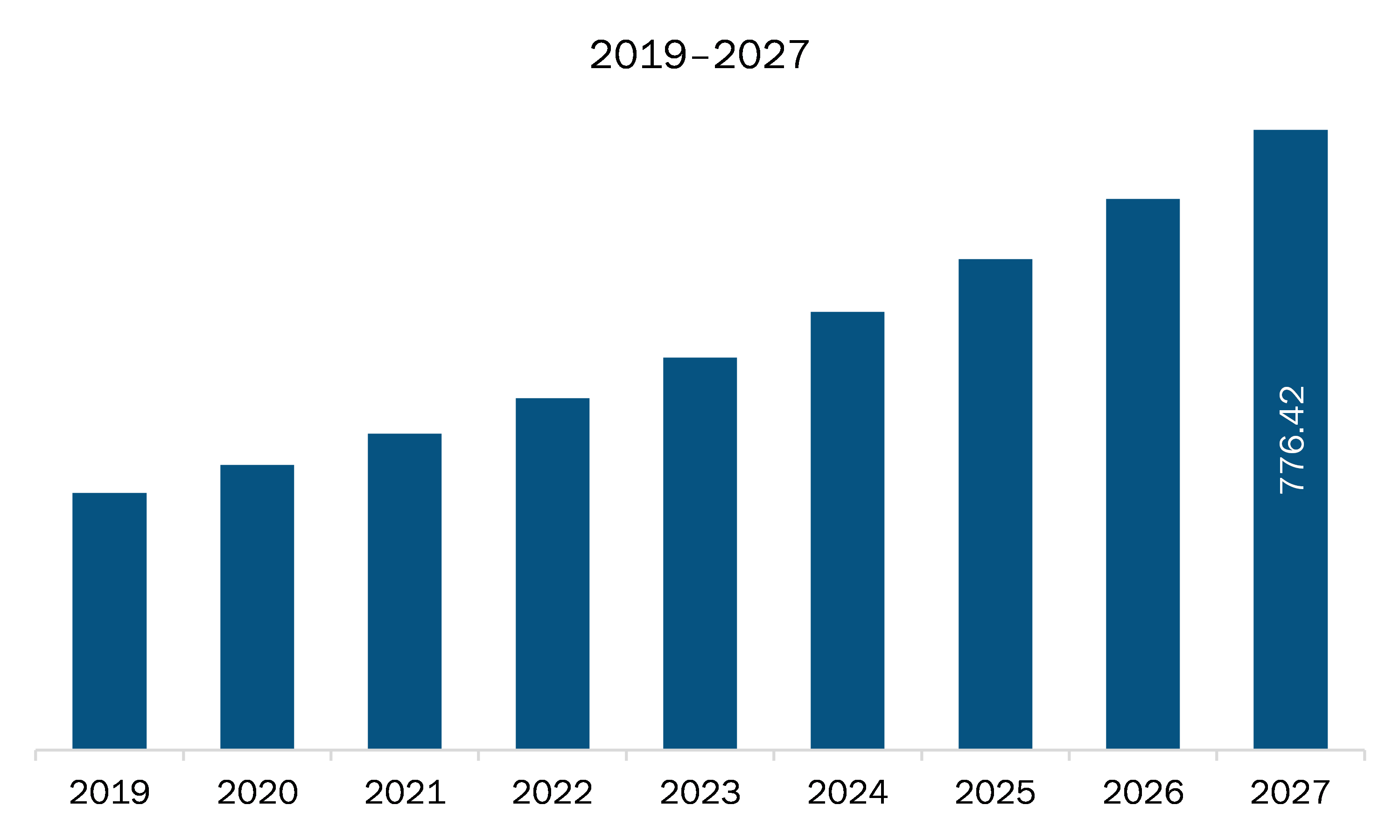

The medical affairs outsourcing market in APAC is expected to grow from US$ 356.69 million in 2020 to US$ 776.42 million by 2027; it is estimated to grow at a CAGR of 11.8% from 2020 to 2027.

Australia, China, India, Japan, and South Korea are major economies in APAC. Rising market collaboration is the major factor driving the growth of the APAC medical affairs outsourcing market. The contract research organization (CRO) services’ industry is highly fragmented, with several hundred small and medium-sized limited-service providers, and a small number of large, full-service, APAC CROs. There are few barriers to entry for smaller CROs into the APAC market, whereas a full-service CRO with APAC capabilities requires building the necessary infrastructure with the ability to simultaneously manage multiple complex testing services across numerous geographies, establishing the requisite relationships with strategic partners, developing relevant therapeutic and development of expertise to serve the needs of the end users. Over the past few years, the consolidation across the industry is an emerging trend followed by the majority of the prime players to strengthen their service offerings and garner the major market share in the APAC CRO market. For instance, For instance, Parexel International Corp. acquired The Medical Affairs Company in 2017. This has led to the generation of larger CROs with the wide geographic diversification, extensive therapeutic and development expertise, enormous capital and technical resources to manage the demanding drug development programs, medical device designing and research as well as management of regulatory affairs for pharmaceutical and biopharmaceutical companies.

Countries in APAC are facing an increasing incidence of COVID-19. Currently, India is the second worst-hit country worldwide. The COVID-19 pandemic has severely impacted the region; however, it has also allowed stakeholders to realign their future path based on strategic intent and focus. India and China are the most preferred destinations for outsourcing, where a large pool of skilled labor is available at a lower cost. With the increasing pressure to reduce manufacturing costs and accelerate time-to-market, many devices and diagnostics companies are looking to conduct clinical trial operations in APAC. Countries such as China, Japan, Singapore, and South Korea are seeing an increased interest in clinical trials. High costs in western countries are also contributing to the flow of medical affairs outsourcing to APAC. To expand sales to the Asian market, pharmaceutical companies are becoming aware of new and changing regulatory environments for drugs, devices, and in-vitro diagnostics. New or improved regulations are implemented frequently in Asia, including changes in GMP standards, drug price controls, and medical device regulatory systems. Third-party guidance and advice are required as part of any acquisition or any improvement of current standards. Increasingly, third-party outsourcing service providers are playing a greater role in supporting and managing the delivery of the key business functions like drug development, sales and marketing, and regulatory compliance services in APAC.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the APAC medical affairs outsourcing market. The APAC medical affairs outsourcing market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC Medical Affairs Outsourcing Market Segmentation

APAC Medical Affairs Outsourcing Market – By Services

- Medical Writing and Publishing

- Medical Science Liaisons (MSLs)

- Medical Information

- Medical Monitoring

- Others

APAC Medical Affairs Outsourcing Market – By Application

- Pharmaceuticals

- Medical Devices

- Biopharmaceutical

APAC Medical Affairs Outsourcing Market, by Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of APAC

APAC Medical Affairs Outsourcing Market - Companies Mentioned

- ICON PLC

- Indegene

- IQVIA Inc

- PAREXEL INTERNATIONAL CORPORATION

- PPD Inc

- Syneos Health

- UDG Healthcare plc.

- WuXi AppTec

Asia-Pacific Medical Affairs Outsourcing Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 356.69 Million |

| Market Size by 2027 | US$ 776.42 Million |

| CAGR (2020 - 2027) | 11.8% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2027 |

| Segments Covered |

By Services

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For