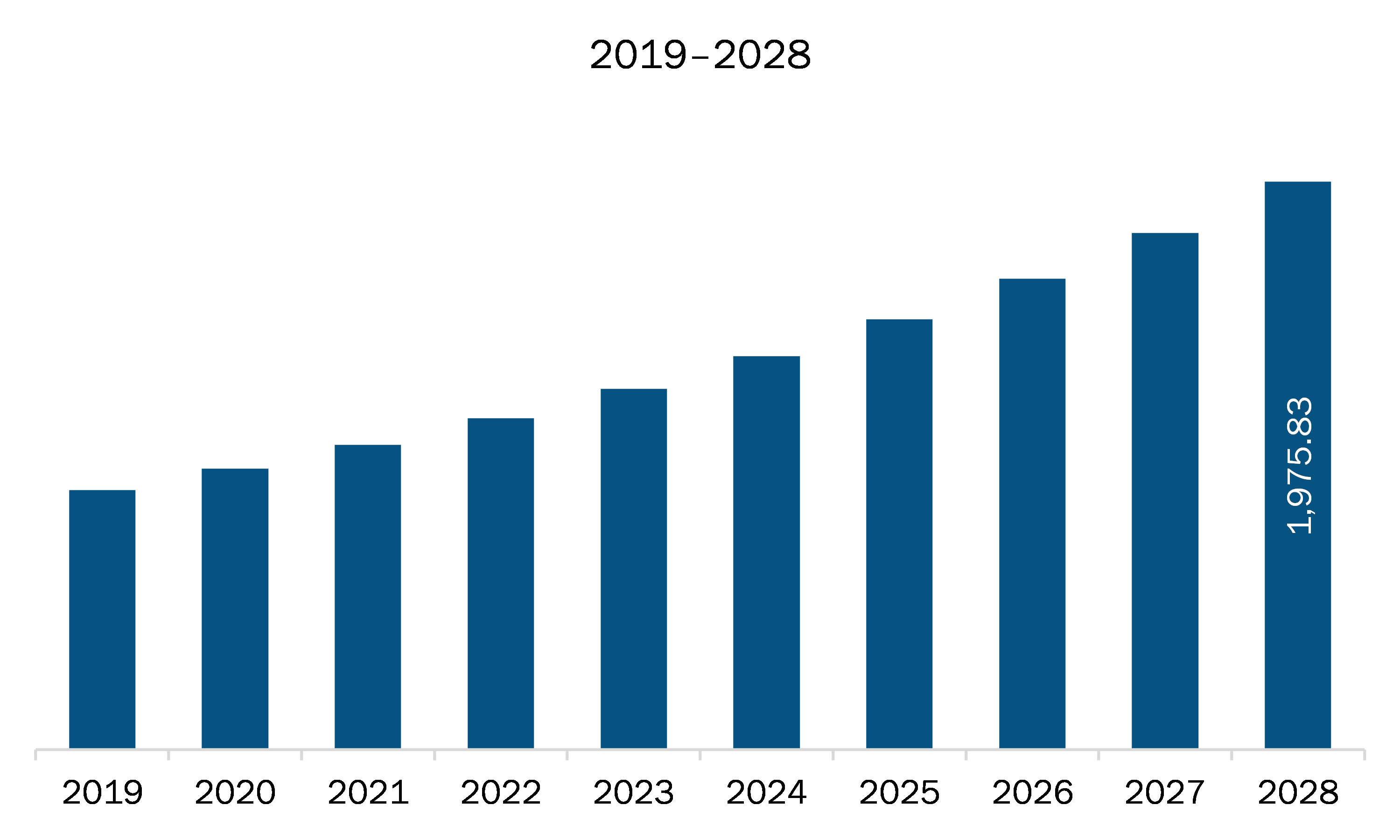

The APAC pharmaceutical isolator market is expected to grow from US$ 1,060.82 million in 2021 to US$ 1,975.83 million by 2028; it is estimated to grow at a CAGR of 9.3% from 2021 to 2028.

China, India, Japan, South Korea, and Australia are major economies in APAC. Burgeoning adoption of automation in pharmaceutical isolator is expected to fuel the market growth. In the pharmaceutical industry. automation of aseptic procedures, with the help of dedicated workstations and system software, has lowered manual interference in manufacturing processes, increased efficiency, and enabled researchers to concentrate on important tasks and avoid human errors. The increased adoption of automated pharmaceutical isolators can also be attributed to factors such as maintaining stringent regulatory compliance, increasing efficiency and productivity, and driving the safety and integrity of pharmaceutical products. The advancement of automation, including robotics, is one area of progress for aseptic fill-finish processes. Recent emerging technologies in aseptic processing, such as advanced isolators, robotics, and increased automation, are expected to change the industry and markedly reduced contamination risks for sterile products. Conventional isolator systems routinely require many operators at a time when regulators have long stated the need for aseptic filling systems to use robotics and reduce human interaction in drug manufacturing. Gloveless isolator technology for biopharmaceutical processes is getting traction in the industry. Future trends in technology are making isolators increasingly attractive for aseptic operations. Automated isolators are a perfect fit for parenteral solution products that can ensure the highest level of aseptic conditions. Therefore, growing use of automation is expected to fuel the APAC market growth.

In case of COVID-19, APAC is highly affected specially India. The APAC biopharmaceutical industry has been disturbed for few months of 2020 during the outbreak of the COVID-19 pandemic. However, with the rising demand for products to treat the COVID-19 infection, the biopharmaceutical, and pharmaceutical companies in the countries such as India and China have increased their production of APIs as the countries are the largest exporters to western companies. For instance, Wockhardt Ltd is in talks with the Indian government to offer its sterile development facility for the covid-19 vaccines that will be developed in the country, as well as with some firms whose vaccines are currently in phase I/II trials globally. Moreover, on 07 May 2020, Ajinomoto Bio-Pharma Services, a leading provider of biopharmaceutical contract development and manufacturing services with sites in Belgium, United States, Japan, and India, announced it has entered into a manufacturing services agreement with CytoDyn Inc., a late-stage biotechnology company, for the supply of the investigational new drug, leronlimab (PRO 140), which is currently being used in clinical trial protocols for Mild-to-Moderately Ill and Severely Ill COVID-19 patients. The countries are experiencing growth in biologics production also; there is growth in the contract manufacturing for biopharmaceutical and pharmaceutical products. For instance, in January 2020, STA Pharmaceutical Co., Ltd. (WuXi AppTec) has expanded its oligonucleotide API manufacturing in China. Similarly, companies have engaged in the production of vaccines and have sent them to clinical trials. For instance, in Japan, Gilead's Remdesivier and Fujifilm's antiviral Avigan are in Phase III clinical trials. Thus, with the growing production by the biopharmaceutical industry, the pharmaceutical isolators market is likely to have vital growth opportunities in the following years.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the APAC pharmaceutical isolator market. The APAC pharmaceutical isolator market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC Pharmaceutical Isolator Market Segmentation

APAC Pharmaceutical Isolator Market – By Type

- Open Isolators

- Closed Isolators

APAC Pharmaceutical Isolator Market – By Pressure

- Positive Pressure

- Negative Pressure

APAC Pharmaceutical Isolator Market – By Configuration

- Floor Standing

- Modular

- Compact

- Mobile

APAC Pharmaceutical Isolator Market – By Application

- Aseptic

- Sampling & Weighing

- Fluid Dispensing

- Containment

- Others

APAC Pharmaceutical Isolator Market – By End User

- Pharmaceutical and Biotechnology Companies

- Hospitals

- Research and Academic Laboratories

- Other

APAC Pharmaceutical Isolator Market, by Country

- China

- Japan

- India

- Australia

- South Korea

- Rest of APAC

APAC Pharmaceutical Isolator Market -Companies Mentioned

- Azbil Telstar

- Bioquell (Ecolab Solution)

- Comecer

- Fedegari Autoclavi S.p.A.

- Gelman Singapore

- Getinge AB

- Hosokawa Micron Group

- Nuaire Inc.

- Schematic Engineering Industries

Asia Pacific Pharmaceutical Isolator Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,060.82 Million |

| Market Size by 2028 | US$ 1,975.83 Million |

| CAGR (2021 - 2028) | 9.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For