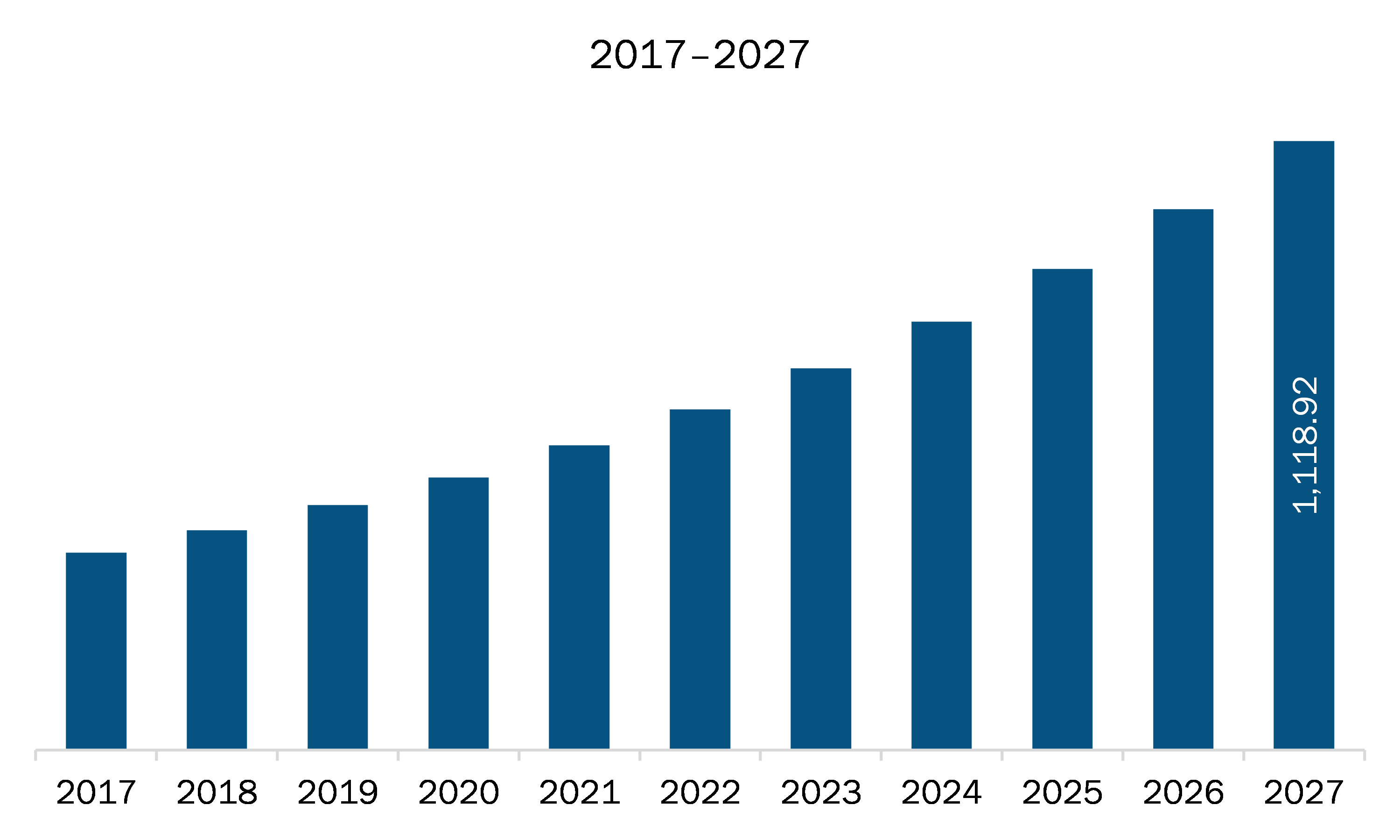

The silicon carbide market in Asia Pacific is expected to grow from US$ 436.40 million in 2019 to US$ 1,118.92 million by 2027; it is estimated to grow at a CAGR of 12.6% from 2020 to 2027.

Asia Pacific held the largest share of the Asia Pacific silicon carbide market. The manufacturing sector in these countries has experienced a huge shift over the years. The Asia Pacific manufacturing sector is rapidly adopting innovation accelerators that include advanced technologies and processes. Over the past few years, the manufacturing spending of the region has grown significantly and is further anticipated to grow at the highest estimated growth rate. The high demand for silicon carbide from the automotive, electronics & semiconductor, medical, and other industries is further driven by market growth in the Asian region. In addition to that, favorable conditions for production activities, in addition to the growing market demand, have attracted Asia Pacific companies to make strategic investments in this region. The demand for silicon carbide materials is anticipated to witness considerable growth in the near future because of its unique physical & chemical properties and lucrative market opportunities created for all the key players in the Asia-Pacific market.

In case of COVID-19 outbreak, countries in Asia Pacific, especially India, reported an unprecedented rise in the number of confirmed cases, which led to the discontinuation of silicon carbide manufacturing activities. Other chemical and materials manufacturing sector has negatively impacted the demand for silicon carbide during the early months of 2020. Moreover, decline in the overall manufacturing activities has led to the discontinuation of silicon carbide components manufacturing projects, thereby reducing the demand for silicon carbide. Similar trend was witnessed in other Asia Pacific countries, such as Australia, Japan, and China. However, the countries are likely to overcome this drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Asia Pacific silicon carbide market. Silicon carbide is a semiconductor, and it is being used widely in electronics and semiconductors industries as a replacement of silicon. It offers greater breakdown electric field strength, band gap, and thermal conductivity, along with enabling a wider range of p- and n-type control required for the construction of a device. For instance, silicon has a band gap of ~1.12, whereas silicon carbide offers a band gap of ~3.26. Similarly, thermal conductivity for silicon carbide is 1490 W/m-K, which is significantly higher than the thermal conductivity of silicon—150 W/m-K. A majority of silicon carbide is being used to make diodes that are used in power supplies and hybrid modules such as PV7. According to the statistics cited by the Semiconductor Industry Association (SIA), Asia Pacific sales of semiconductors witnessed a hike of 4.8% on year-to-year basis and a hike of 6.0% on month-to-month basis. Moreover, 2021 is likely to be a promising year for semiconductors businesses as per the predictions by the World Semiconductor Trade Statistics (WSTS) organization. Such promising statistics depict the growth of electronics and semiconductor industries, making them a lucrative market segment for the Asia Pacific silicon carbide market vendors.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Silicon Carbide Market Segmentation

Asia Pacific Silicon Carbide Market – By Type

- Black Silicon Carbide

- Green Silicon Carbide

Asia Pacific Silicon Carbide Market – By End-User Industry

- Automotive

- Aerospace and Aviation

- Military and Defense

- Electronics and Semiconductor

- Medical and Healthcare

- Steel

- Others

Asia Pacific Silicon Carbide Market, by Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

Asia Pacific Silicon Carbide Market-Companies Mentioned

- Fiven ASA

- Carborundum Universal Limited

- Futong Industry Co. Limited

- Electro Abrasives, LLC

- Grindwell Norton Ltd.

Asia Pacific Silicon Carbide Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 436.40 Million |

| Market Size by 2027 | US$ 1,118.92 Million |

| CAGR (2020 - 2027) | 12.6% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For