Robotics Lubricants Market Size, Share, Growth, Demand & Revenue Analysis 2025-2031

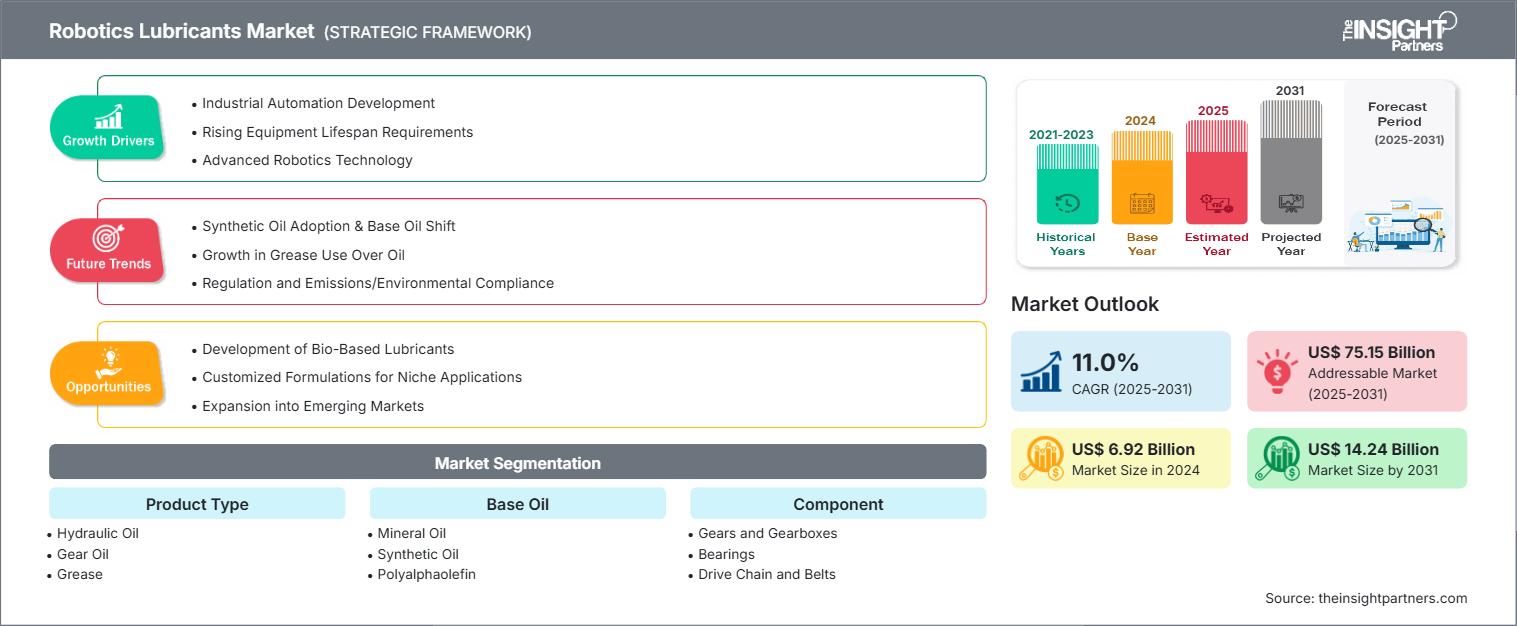

Robotics Lubricants Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type (Hydraulic Oil, Gear Oil, Grease, Dry Lubricants, and Solid Lubricants), Base Oil (Mineral Oil, Synthetic Oil, Polyalphaolefin, Perfluoropolyether (PFPE), Others of Synthetic Oil, and Others), Component (Gears and Gearboxes, Bearings, Drive Chain and Belts, Reducers, and Others), Robot Type (Industrial Robots, Collaborative Robots, Service Robots, Humanoid Robots, and Others), End-Use Industry (Automotive, Food and Beverage, Medical and Healthcare, Electrical and Electronics, Metals, and Others), and Geography

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Sep 2025

- Report Code : TIPRE00029966

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 1556

The Robotics Lubricants Market size is projected to reach US$ 14.24 billion by 2031 from US$ 6.92 billion in 2024. The market is expected to register a CAGR of 11.0% during 2025–2031.

Robotics Lubricants Market Analysis

The robot lubricants industry is rising with the increasing use of automation in manufacturing, logistics, health, and service industries. With the growing use of robotics in sectors to enhance efficiency, labor cost, and consistency in production, there is a corresponding increase in the demand for high-performance lubricants. Precision and reliability of robotic systems require a specific lubrication to run appropriately and avoid wear of their components, mainly when used in continuous or high-speed mode. Moreover, the development of high-level robotics, such as collaborative robots and mobile automation, is providing new applications with defined lubrication requirements. Moreover, increasing investments in smart factories are contributing to the growth of the market, as companies are interested in special lubricants that may be integrated with monitoring systems. Environmental and safety laws are also pushing toward the creation of more eco-friendly and sustainable lubricant solutions, which further widens the market.

Robotics Lubricants Market Overview

Robotic lubricants are special oils or greases that are designed to minimize friction, wear, and heat in robotic components such as gears, joints, actuators, and bearings. Such lubricants play a vital role in ensuring smooth and accurate operations of the robotic systems, particularly when working around the clock or when the machines are under mechanical pressure. In contrast to general-purpose lubricants, robotic lubricants are engineered to work consistently at high temperatures, at variable speeds, and in locations that demand nontoxic, low-residue, or cleanroom-friendly lubricants. They assist in increasing the life cycle of the robotic components, reducing maintenance requirements, and maintaining the same performance over time. With the growing demand for automation, robotic lubricants are essential in ensuring industrial, commercial, and service uptime optimization, accuracy, and equipment protection.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONRobotics Lubricants Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Robotics Lubricants Market Drivers and Opportunities

Market Drivers:

- Industrial Automation Development: Favorable government initiatives supporting the development of industrial automation across various industries.

- Rising Equipment Lifespan Requirements: Rising demand for increased lifespan of equipment requires a demand for high-performing lubricants.

- Advanced Robotics Technology: The development of advanced robotics technology aiming to automate manufacturing drives the demand for robotic lubricants.

- Growth of Clean and Controlled Environments: Rising demand in food processing, pharmaceuticals, and medical manufacturing is providing a demand to utilize nontoxic lubricants that are cleanroom-friendly and under strict safety and hygiene standards.

Market Opportunities:

- Development of Bio-Based Lubricants: Rising environmental concerns create opportunities for bio-based lubricants.

- Customized Formulations for Niche Applications: Rising demand for application-specific lubricants on collaborative robots, service robots, and AGVs, where safety, low residue, and specialty performance are paramount.

- Expansion into Emerging Markets: As the smart manufacturing trend is growing in emerging markets, such as South & Central America and Southeast Asia, the demand for robotic lubricants is expected to increase.

Robotics Lubricants Market Report Segmentation Analysis

The robotics lubricants market is segmented to give a broad view of market growth potential and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Product Type:

- Hydraulic Oil: It is used in robotic lubricants for precise control movements in automated systems.

- Gear Oil: Gear Oil is used to reduce friction and improve performance under extreme conditions.

- Grease: A semi-solid lubricant that is applied in robot joints and bearings where the lubricant needs to last long and be highly maintenance-free.

- Dry Lubricants: It helps reduce friction and wear in the joints and bearings of the robotic components.

- Solid Lubricants: It is used during extreme conditions and high temperatures to reduce friction in robotic systems.

By Base Oil:

- Mineral Oil: A base oil that is petroleum-based and is used in standard lubricant formulations that provide basic performance in general-purpose robotic applications.

- Synthetic Oil: These are highly stable in thermal conditions, resistant to oxidation, and enhance the service life of high-performance robotic systems.

- Others: These include bio-based, ester-based, or specialty fluids that reduce friction.

By Component:

- Gears and Gearboxes: Lubricants, when applied to gears and gearboxes, reduce friction and wear and tear by preventing overheating.

- Bearings: Lubricants are used in bearings to ensure precise movements by reducing resistance and overheating.

- Drive Chain and Belts: Lubricants prevent corrosion, wear, and misalignment of moving chains and belts in dynamic robotic systems.

- Reducers: Lubricants are applied to speed-reducing elements with high load-carrying capacity requirements.

- Others: These include actuators, seals, or linear guides, which need specific lubrication solutions to perform and last.

By Robot Type:

- Industrial Robots: Using high-performance lubricants supports continuous and high-speed operations in manufacturing and assembly facilities.

- Collaborative Robots: Clean and bio-based lubricants are needed that are safe in shared human-robot workspaces and provide mechanical precision.

- Service Robots: Use special lubricants that operate quietly, leave little residue, and are reliable in the public or commercial environment.

- Humanoid Robots: Lightweight, flexible lubrication solutions are required to enable complex and human-like movements and multiple-joint articulation.

- Others: Niche robots, such as medical, underwater, or defense robots, are also included, and each demands a specific lubrication to work within a particular environment.

By End Use Industry:

- Automotive: Applies robotic lubricants to high-speed assembly and welding robots to provide precision, reliability, and long service life.

- Food and Beverage: Needs food-grade, nontoxic lubricants on robots in hygienic and contamination-sensitive areas.

- Medical and Healthcare: Requires surgical robots and automated medical equipment lubricants that are cleanroom-compatible and low-emission.

- Electrical and Electronics: Uses specialty lubricants on cleanroom robots that deal with sensitive parts in a static and dust-sensitive environment.

- Metals: This industry uses heavy-duty lubricants in robots that cut, weld, forge, and handle abrasive materials under extreme work environments.

- Others: This includes industries such as logistics, aerospace, and the pharmaceutical sectors, which use automation.

By Geography:

- North America

- Europe

- Asia Pacific

- South and Central America

- Middle East & Africa

The robotics lubricants market in Asia Pacific is expected to grow fastest. A growing demand from end-use industries in the region powers this surge.

Robotics Lubricants

Robotics Lubricants Market Regional InsightsThe regional trends and factors influencing the Robotics Lubricants Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Robotics Lubricants Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Robotics Lubricants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 6.92 Billion |

| Market Size by 2031 | US$ 14.24 Billion |

| Global CAGR (2025 - 2031) | 11.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Robotics Lubricants Market Players Density: Understanding Its Impact on Business Dynamics

The Robotics Lubricants Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Robotics Lubricants Market Share Analysis by Geography

Asia Pacific is expected to grow the fastest in the next few years. Emerging markets in South and Central America, the Middle East, and Africa also have many untapped opportunities for robotics lubricants providers to expand.

The robotics lubricants market grows differently in each region. The demand for smart manufacturing continues to grow, positioning robotics lubricants as a favored treat globally, in an evolving consumer landscape. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a significant portion of the global market

-

Key Drivers:

- Increasing adoption of smart manufacturing in various industries.

- Strong focus on predictive maintenance and performance optimization.

- Trends: Growing demand for smart lubricants integrated with condition-monitoring technologies to support data-driven maintenance strategies.

2. Europe

- Market Share: Holds a significant market share

-

Key Drivers:

- Stringent environmental regulations encourage the use of eco-friendly, low-emission lubricants.

- Advanced manufacturing infrastructure.

- Trends: Shift toward bio-based and biodegradable lubricants driven by EU sustainability goals.

3. Asia Pacific

- Market Share: Dominated the market and is also the fastest-growing region, with a rising market share every year

-

Key Drivers:

- Large-scale industrial manufacturing.

- Government-led initiatives across the region.

- Trends: Rising domestic production of robots is fuelling local demand for region-specific lubricants.

4. Middle East and Africa

- Market Share: A growing market with significant progress

-

Key Drivers:

- Increasing investment in industrial diversification.

- Rising infrastructure development.

- Trends: Growing automation in manufacturing across industries.

5. South and Central America

- Market Share: Although small, it is growing quickly

-

Key Drivers:

- Expansion of the automotive assembly and food processing industries.

- Cost-driven automation adoption.

- Trends: Emerging interest in sustainable and low-maintenance lubricant products.

Robotics Lubricants Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to established players such as Petrelplus Inc., Shell Plc., Fuchs SE, BP Plc., TotalEnergies SE, and Idemitsu Kosan Co Ltd, adding to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Innovative product offering

- Sustainable and ethical sourcing

- Competitive pricing models

- Strong customer support and easy integration

Opportunities and Strategic Moves

- Focusing on research and development activities to distinguish themselves in the market.

- Expanding global footprint and capabilities through acquisitions of value-added confectionery brands.

- Expanding product portfolio with the launch of several baked goods and confectionery products.

Major Companies operating in the Robotics Lubricants Market are:

- Petrelplus Inc

- Shell Plc

- Fuchs SE

- BP Plc

- TotalEnergies SE

- Idemitsu Kosan Co Ltd

- Matrix Specialty Lubricants B

- Chemie-Technik GmbH

- Quaker Chemical Corp (Quaker Houghton)

- Chevron Corp

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Citgo Petroleum Corp

- The Chemours Co

- Valvoline Inc

- Miller-Stephenson Inc

- Petroliam Nasional Bhd

- Castrol Limited

- Molygraph

- Powermaxx Lube India

- Nabtesco Precision Europe GmbH

- GreaseDivision

Robotics Lubricants Market News and Recent Developments

- METALUBE. – Product Launch In 2024, METALUBE launched the next-generation food-safe NSF-registered high-performance chain oils. The new products are designed to increase overall equipment effectiveness due to higher thermal stability, reduced carbon and varnish deposits, and optimized performance-enhancing additives.

- Shell plc. – Product Launch In 2024, Shell Lubricants introduced three new products in its market-leading Shell Helix Ultra passenger car motor oil brand to meet higher industry specifications and original automotive manufacturer (OEM) specifications to allow customers to unlock more engine power.

- PETRONAS Lubricants International (PLI). – Product Launch In 2024, ETRONAS Lubricants International (PLI), in partnership with Stellantis N.V., launched its new line of lubricants, the co-branded Selenia SUSTAINera engine oils.

Robotics Lubricants Market Report Coverage and Deliverables

The "Robotics Lubricants Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- Robotics Lubricants Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Robotics Lubricants Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's five forces and SWOT analysis

- Robotics Lubricants Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Robotics Lubricants Market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For