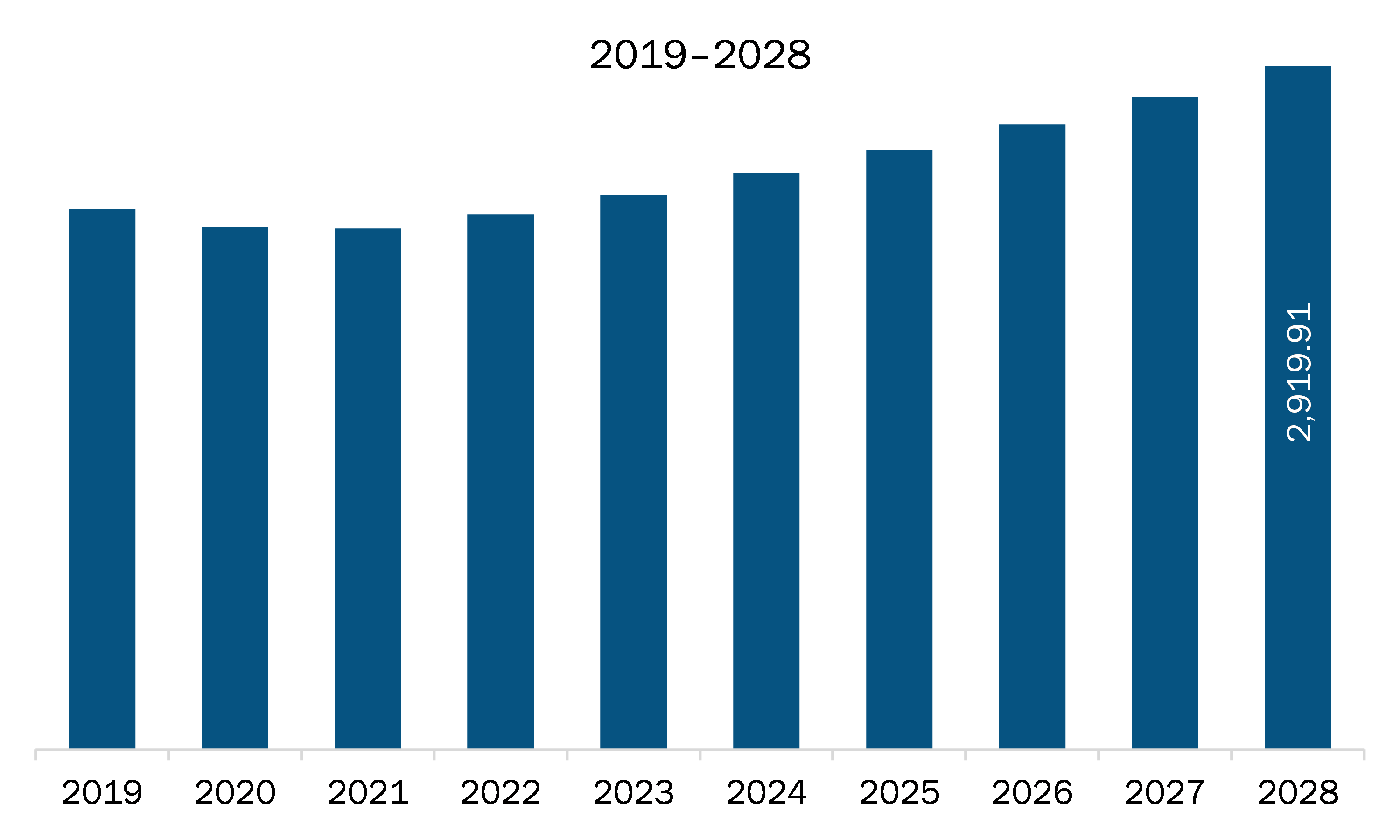

The Asia Pacific ultra-low alpha metals market is expected to grow from US$ 1,739.48 million in 2021 to US$ 2,919.91 million by 2028; it is estimated to grow at a CAGR of 7.7% from 2021 to 2028.

For the past few years, several metals such as lead (Pb), are being extensively used in the production of electronic devices to boost the functionality of such devices. However, the implementation of regulations by government bodies on the use of such unsafe metals in electronic devices has led to increased adoption of substitute metals. As a result, the companies involved in the production of electronic devices have focused their attention on the deployment of ultra-low alpha metals in their devices. Apart from government regulations on the use of toxic substances, the use of heavy metals in electronic products has also been prohibited under the Restriction on Hazardous Substances (RoHS) Directive. Such regulations and policies framed by governments are expected to boost the growth of the ultra-low alpha metals market. Ultra-low alpha metals offer the provision of production based on materials that are free from hazardous substances. Other than this, the availability of different types of ultra-low alpha solders is broadening the scope of choosing alloys depending on the specific purpose. Hence, strict government regulations on the use of hazardous substances in electronic equipment are expected to stimulate the growth of the ultra-low alpha metals market.

In Asia Pacific, India reported a huge number of COVID-19 cases, which led to the discontinuation of several business operations, including ultra-low alpha metals manufacturing activities. The disruption in the supply chain with volatility in raw material pricing and sourcing in the initial weeks of lockdown has impacted the industrial products and processes. However, as the economies are planning to revive their operations, the demand for ultra-low alpha metals is expected to rise in Asia Pacific. However, the focus on just-in-time production is another concerning factor hindering market growth. The increasing demand for advanced industrial materials backed by the growth of end-use industries such as electronics, aerospace & defense, automotive, medical, and telecommunication is expected to contribute to the market's growth. Further, significant investments by prominent manufacturers in advancing ultra-low alpha lead-free alloys are expected to drive the ultra-low alpha metals market.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Asia Pacific Ultra-Low Alpha Metals Market Segmentation

Asia Pacific Ultra-Low Alpha Metals Market – By Type

- ULA Tin

- ULA Tin Alloys

- ULA Lead Alloys

- ULA Lead-Free Alloys and Others

Asia Pacific Ultra-Low Alpha Metals Market – By Application

- Electronics

- Automotive

- Medical

- Telecommunication

- Others

Asia Pacific Ultra-Low Alpha Metals Market – By Country

- Australia

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

Asia Pacific Ultra-Low Alpha Metals Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 1,739.48 Million |

| Market Size by 2028 | US$ 2,919.91 Million |

| CAGR (2021 - 2028) | 7.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Asia-Pacific

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For