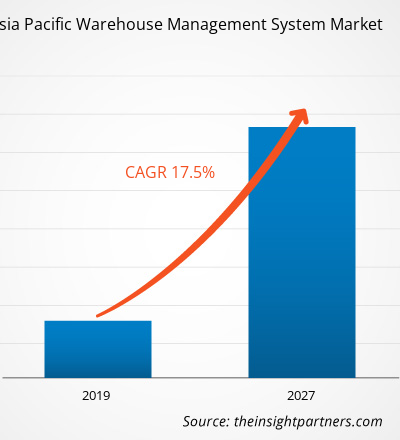

Warehouse Management System market in APAC is expected to grow from US$ 575.2 Mn in 2018 to US$ 2,332.3 Mn by the year 2027. This represents a CAGR of 17.5% from the year 2019 to 2027.

The boosting e-commerce industry is bolstering the growth of warehouse management system market. For example, many online retailers have found themselves needing to accelerate order fulfillment and shipping to maintain their competitive place in the industry. As a result, organizations must work to gain a greater degree of control and transparency across their supply chains so they can not only keep up with demand, but move items into and out of the warehouse at the rapid pace required within the industry. All of this must be done without sacrificing key performance metrics, such as inventory shrinkage and customer satisfaction rates. All these factors fuels the growth of Warehouse Management System market in the future. Similarly, the adoption of artificial intelligence have increased at a noticeable rate in the developing countries of Asia Pacific. This has led to competition between various technologies based industries. Owing to this the technology players in region are putting significant efforts to build a sustainable business in the warehouse management system market.The global economic warehouse management system market scenario has begun to stabilize and grow, the warehouse operations are also gaining the momentum with respect to their growth, which is expected to go beyond simple increase in throughput and volume. Furthermore, as the economy perceives to recover, the warehousing industry is also expected to consider the areas that would be witnessing greater growth in the coming years. This in response would have enormous ramifications for IT as well as operations of warehouses which demand advanced solution to bolster warehouse management system market. Apart from global recession, the warehouse management system market might also face certain challenges due to trade tensions between U.S and China. This trade tension has added up to the economic volatility, which in response has noted investors, occupiers and developers in opposition. Because of the trade tensions between the two countries not only the trading cost of the important goods will increase steadily, but the market would also foresee certain APAC realignment as both the individual economies explore newer trading partners. The stir caused by this trade tension has also generated an understandable fear among the industries regarding the impact of increased tariffs on consumer goods that will have the domino effect on the need for warehouse space. The aforementioned factors would have a direct impact on the global warehouse management system market. However, some of the advanced distributors have in warehouse management system market been already noticed to look into foreign-trade zones and bonded warehouses as innovation solution to this lag. Furthermore, as the unemployment rate in China remain to be at their lowest, the labor costs are project to increase. This in response is expected to disrupt the supply chain industry as managing the overhead cost would become difficult for the coming years. These factors are contributing to a good competition in the various companies in the warehouse management system market across APAC.

This rise in the labor cost in turn would increase the demand for cost efficient automation solutions that would reduce the operation cost and allow the supply chain and logistic companies focus upon improving their end-customer services. The trend is expected to benefit the warehouse management system market in the forthcoming years across all the major countries in the regions.

India is anticipated to leads the warehouse management system market across the APAC region through the forecast period. Many retailers call on real-time data from these software programs to better control stocking, picking, packaging and shipping - basically all the tasks of fulfilling a customer order. For instance In Singapore, for example, third-party logistic firms like LF Logistics and DHL are opening high-tech spaces to help retailers cope with growing volumes of online orders. DHL's US$160 million Advanced Regional Centre, for example, includes a specialized automation system with robotic shuttles to pick and store products from 72,000 locations, over 26 levels. Similarly, warehouses in Sydney's suburbs are being refitted to enable them to keep pace. For instance, Synnex uses fully automated technology in its western Sydney warehouse for picking, labelling, dispatch and back-end operations to speed up the selling process for its clients and thus enhance its foothold in warehouse management system market. The figure given below highlights the revenue share of India for warehouse management system market in the forecast period:

India Warehouse Management System Market Revenue and Forecasts to 2027 (US$ Mn)

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

APAC WAREHOUSE MANAGEMENT SYSTEM - MARKET SEGMENTATION

By Component

- Software

- Services

By Implementation

- On-Premises

- Cloud Based

By Tier Type

- Tier 1

- Tier 2

- Tier 3

By Industry

- Manufacturing

- Automotive

- Food & Beverage

- Healthcare

- Retail & Ecommerce

By Country

- Australia

- India

- China

- Japan

- Rest of APAC

Companies Mentioned

- IBM Corporation

- PSI Software AG

- SAP SE

- Epicor Software Corporation

- Oracle Corporation

- JDA Software Group, Inc.

- Infor Inc.

- Manhattan Associates

- PTC Inc.

- TECSYS

Asia Pacific Warehouse Management System Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 575.2 Million |

| Market Size by 2027 | US$ 2,332.3 Million |

| Global CAGR (2019 - 2027) | 17.5% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Medical and Research Grade Collagen Market

- Antibiotics Market

- Airport Runway FOD Detection Systems Market

- Enzymatic DNA Synthesis Market

- Customer Care BPO Market

- Adaptive Traffic Control System Market

- Space Situational Awareness (SSA) Market

- Organoids Market

- Medical Collagen Market

- Medical Second Opinion Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Implementation, Tier Type, Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Australia, China, Japan, South Korea

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Asia Pacific Warehouse Management System Market

1. IBM Corporation2. PSI Software AG

3. SAP SE

4. Epicor Software Corporation

5. Oracle Corporation

6. JDA Software Group, Inc.

7. Infor Inc.

8. Manhattan Associates

9. PTC Inc.

10. TECSYS

Get Free Sample For

Get Free Sample For