Organoids Market Size, Share, Growth and Forecast to 2031

Organoids Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Intestine, Liver, Stomach, Pancreas, Lung, Brain, Kidney, and Others), Application (Developmental Biology Disease, Pathology of Infectious Disease, Regenerative Medicine, Drug Toxicity & Efficacy Testing, Drug Discovery & Personalized Medicine, and Others), Source (Pluripotent Stem Cells and Organ Specific Adult Stem Cell), Offering [Instruments (Devices and Equipment), Consumables (Sensors and Others), and Services], Method (Micropatterned Plates, Ultralow Attachment Plates, Hanging Drop, Microdroplet or Emulsion, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

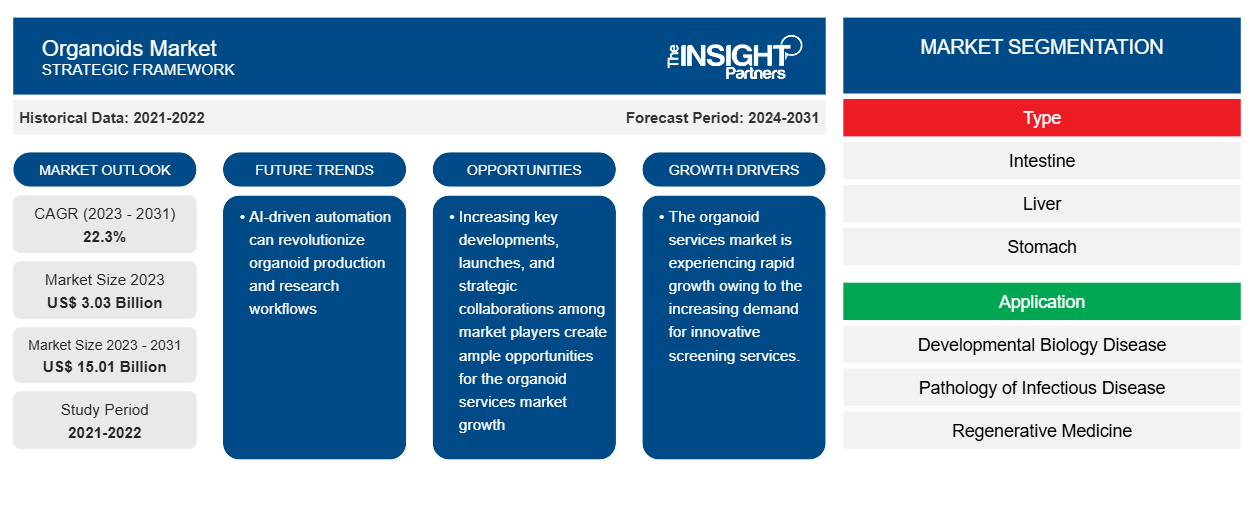

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Nov 2024

- Report Code : TIPRE00017616

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 297

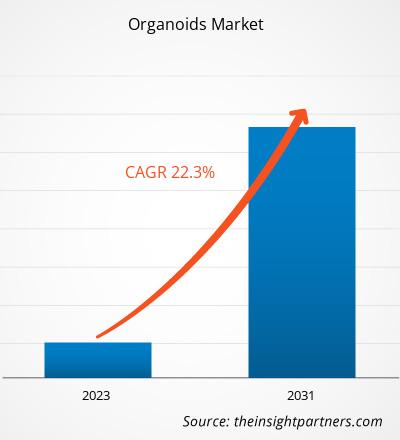

The organoids market size is projected to reach US$ 15.01 billion by 2031 from US$ 3.03 billion in 2023. The market is expected to register a CAGR of 22.3% during 2023–2031. The integration of artificial intelligence is likely to act as one of the key trends in the organoids market in the future.

Organoids Market Analysis

Factors contributing to the organoids market growth include the rising demand for novel drug screening services and an upsurge in the popularity of customized medications. However, the dearth of skilled professionals and stringent safety regulations hamper the market growth.

Organoids Market Overview

Organoids are emerging as a powerful asset for researchers and drug developers as they seek more efficient and accurate methods to identify promising drug candidates and predict their efficacy. The ability to generate patient-derived organoids (PDOs) opens up exciting possibilities for personalized drug screening. Organoids serve as realistic and relevant models for drug screening compared to traditional 2D cell cultures. They mimic the complexity of human organs, including their cellular composition, structure, and function, providing a more accurate representation of drug responses in the human body. This enables researchers to identify potential drug candidates more confidently, and avoid costly and time-consuming setbacks in clinical trials. The organoid market is experiencing rapid growth owing to the increasing demand for innovative screening services.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONOrganoids Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Organoids Market Drivers and Opportunities

Surge in Popularity of Personalized Drugs Favors Organoids Market

The growing demand for personalized medicine, also known as precision medicine, is playing a pivotal role in driving the global organoids market. Personalized medicine involves tailoring medical treatment and drug therapies to individual patients based on their genetic profile, lifestyle, and predicted disease response. This approach offers a more targeted and effective alternative to traditional one-size-fits-all treatments, thereby significantly improving clinical outcomes. According to the Personalized Medicine Coalition (PMC), personalized medicine has steadily gained traction in the pharmaceutical landscape. The proportion of personalized drugs in total FDA approvals for new molecular entities increased from just 5% in 2005 to more than 25% by 2016. Furthermore, over 73% of compounds in development pipelines are oncology-focused, with 42% showing potential to be applied as personalized therapies. Biopharmaceutical companies have recognized this opportunity and have nearly doubled their research and development investments in personalized treatments. Projections indicate that this investment will increase by an additional 33% in the coming years. The use of organoids—miniaturized, simplified versions of organs derived from stem cells—is emerging as a key enabler in this transformation. Organoids allow researchers to simulate patient-specific responses to drugs, thus offering a powerful tool for creating personalized treatment regimens. Their application in drug screening, disease modeling, and toxicity testing makes them indispensable for developing customized therapeutic strategies. The trend is further evidenced by data from PMC, which noted that the number of personalized therapies available in the US market more than doubled—from 132 in 2016 to 286 by 2020. This significant rise demonstrates not only increasing innovation but also a rapidly growing acceptance of precision medicine among healthcare providers and regulatory bodies. In addition, pharmacists are playing an increasingly important role in facilitating access to personalized treatments. Their efforts in patient education and medication management contribute to the broader adoption of these therapies. A 2021 study published in a journal indexed by the National Center for Biotechnology Information (NCBI) revealed that over 50% of consumers expressed a preference for personalized products or services, a trend extending beyond healthcare into lifestyle and consumer behavior. This convergence of consumer demand, pharmaceutical innovation, and clinical necessity has created a favorable environment for the organoids market. As the healthcare sector continues to shift toward individualized care models, the integration of organoid-based research and development will be essential in delivering next-generation therapies. Companies that invest in organoid technology stand to gain a competitive edge in the rapidly evolving precision medicine ecosystem.

Key Developments by Companies to Create Opportunities for Organoids Market Growth

The progress of the healthcare sector has led to a rise in the demand for organoids across the world. This increased demand contributes to new product developments, acquisitions, partnerships, product launches, and approvals on a global level. Major market players are involved in activities to ensure the innovation and development of efficient services and products. A few of the recent key developments are listed below:

- In June 2024, Molecular Devices, LLC. formally opened its purpose-built facility in Cardiff, UK. The multimillion-pound facility was designed to accommodate the exclusive bioprocess workflow and innovative bioreactor technology of the business, allowing for the large-scale, quality-controlled production of PDOs. Substantial amounts of repeatable PDOs that are 3D-ready are available as a custom service and are cryopreserved in a manner that is ready for analysis. Researchers can defrost, plate, and use these products when needed.

- In January 2024, HUB Organoids (HUB) launched IntegriGut Screen services for the global market. This screening service employs IBD PDO monolayers to aid in the development of novel IBD therapies by ensuring the availability of high-quality human data on epithelial barrier function.

- In July 2023, Molecular Devices launched a custom organoid line expansion service with unique bioprocess technology for high-throughput applications.

- In February 2023, Molecular Devices, LLC., and HUB Organoids (HUB) announced a strategic collaboration to contribute to the continued development of next-generation 3D biology technologies that enable step-change reduction in preclinical to clinical drug attrition.

Such key developments, launches, and strategic collaborations create ample opportunities for the organoid market growth.

Organoids Market Report Segmentation Analysis

Key segments that contributed to the derivation of the organoids market analysis are type, application, source, offering, and method.

- Based on type, the organoids market is classified into intestine, liver, stomach, pancreas, lung, brain, kidney, and others. The intestine segment held the largest share of the market in 2023, and it is further anticipated to register the highest CAGR during the forecast period.

- By application, the market is segmented into developmental biology, infectious disease pathology, regenerative medicine, drug toxicity & efficacy testing, drug discovery & personalized medicine, and others. The developmental biology disease segment held the largest share of the market in 2023; it is further anticipated to register the highest CAGR during 2023–2031.

- Based on source, the organoids market is divided into pluripotent stem cells and organ-specific adult stem cells. The pluripotent stem cells segment held a larger share of the market in 2023. The pluripotent stem cells segment is anticipated to register a higher CAGR during the forecast period.

- The organoids market, by offering, is segregated into instruments, consumables, and services. The instruments segment is further divided into devices and equipment. On the other hand, the consumables segment is divided into sensors and others. The consumables segment held the largest share of the market in 2023.

- The organoids market, by method, is segregated into hanging drop, micropatterned plates, ultralow attachment plates, microdroplet/emulsion, and others. The hanging drop segment held the largest share of the market in 2023.

Organoids Market Share Analysis by Geography

The geographic scope of the organoids market report is mainly divided into five regions: North America, Asia Pacific, Europe, and the Middle East & Africa.

North America dominates the organoids market. Market players in the US are focusing on organic growth strategies to strengthen their foothold. In February 2023, Molecular Devices, LLC. and HUB Organoids (HUB) announced a strategic collaboration to continue the development of next-generation 3D biology technologies that drive step-change reduction in preclinical to clinical drug attrition. Further, increasing research and development activities, rising demand for tissue engineering and organ transplantation, and a high rate of organoid adoption are driving the organoid market in the country. Organoids have the potential to overcome several previous limitations associated with biomedical research studies, with a high focus on making mechanistic insights on human development available for researchers, producing accurate models of human disease, and generating patient-matched tissue sources for regenerative medicine. Asia Pacific is anticipated to record the highest CAGR during 2023–2031.

Organoids

Organoids Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.03 Billion |

| Market Size by 2031 | US$ 15.01 Billion |

| Global CAGR (2023 - 2031) | 22.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Organoids Market Players Density: Understanding Its Impact on Business Dynamics

The Organoids Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Organoids Market News and Recent Developments

The organoids market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. One of the recent developments in the market is listed below:

- InSphero, a biotech company, signed a partnership agreement with Genome Biologics, Frankfurt. In this partnership, InSphero will receive the exclusive global rights to commercialize Genome Biologics' 3D Cardiac Organoid Platform. The platform provides accurate, scalable, and disease-specific organoid models for creating novel treatments, placing it at the forefront of heart disease research. (InSphero, Press Release, May 2024)

Organoids Market Report Coverage and Deliverables

The "Organoids Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Organoids market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Organoids market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Organoids market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the organoids market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For