ATM Market Dynamics, Size, and Trends by 2027

ATM Market to 2027 - Industry Analysis and Forecasts by Deployment (Brown Label ATM, White Label ATM, and Bank Owned ATM); Type (Cash Deposit, Cash Dispenser, Smart ATM, Others)

Historic Data: 2016-2017 | Base Year: 2018 | Forecast Period: 2019-2027- Status : Published

- Report Code : TIPTE100000664

- Category : Banking, Financial Services, and Insurance

- No. of Pages : 153

- Available Report Formats :

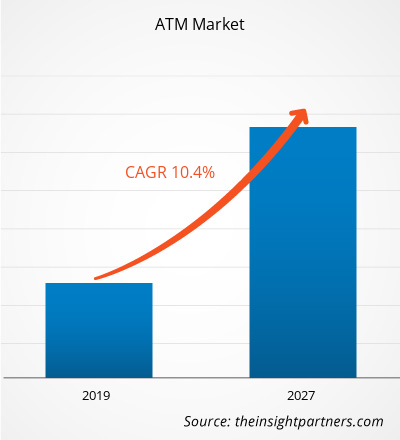

The ATM market is expected to grow from US$ 18.44 billion in 2018 to US$ 44.18 billion by 2027 at a CAGR of 10.4%.

The ATM market is growing due to an increase in the demand for automation in the banking sector in both emerging and developed nations such as the US, Canada, Italy, and China. Furthermore, during the last few decades, the global banking industry has seen significant technical developments such as the integration of IoT data analysis, digital convergence, and biometrics & cyber security, all of which have fueled ATM market expansion. Aside from cash withdrawal and checking account opening, ATMs allow consumers to open or withdraw FDs, recharge phone bills, pay income tax, and apply for personal loans, increasing convenience.

The ATM market is expected to develop as a result of technological improvements such as digital convergence, IoT data analytic integration, biometrics, and cybersecurity. The inclusion of increased security methods such as fingerprint, biometrics, and double authentication to technologically sophisticated ATMs gives an extra degree of protection, which is expected to assist in preventing fraud and promoting acceptance of ATM. A significant aspect driving the North American ATM industry is the growing desire for cardless ATM transactions. Long-term relationships with business partners are expected to boost income, while new innovation techniques are expected to help ATM suppliers reach new levels in the market. The growing banking infrastructure and increasing number of onsite ATMs to improve client satisfaction are likely to propel the ATM market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONATM Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Simple flow of cash, growing number of transactional benefits, speedy withdrawals, and practicality of both online and offline purchasing have all driven ATM usage throughout the world. Due to the abundance of undiscovered prospects, Asia Pacific, the Middle East, and Africa are now exhibiting a robust development potential. The ATM market in Asia Pacific and the Middle East is expected to benefit from economic growth and rising demand for innovative interactive machines in these areas.

ATM Market Insights

Expected Boom in Video Banking Technology

Video banking is an emerging technology in the banking industry where financial institutions such as banks and credit unions can engage their members or customers in face-to-face transactions via remote video collaboration sessions. Customers or members can join the online video sessions by using a personal device, such as a smartphone, from anywhere at any time. Various banks around the world are involved in implementing video technology for ATM, where customers can use high-definition video chat technology to connect with full-service bankers. The video banking technology is user-friendly and easy to operate; the customers can touch ATM screen to select the live teller option. The live teller will appear on the screen to assist the customer regarding cash or check deposits, account withdrawals, loan payments, and transfers. The machines enabled with the video banking technologies do not require debit card or PIN; one can securely withdraw money from a video teller machine (VTM). As it connects the customer face-to-face with a banking representative, it can implement the method of security questions and photo identification for personal verification.

Deployment-Based Market Insights

The automated teller machine (ATM) enables customer to complete transactions without any help from bank representatives. ATMs today are used for multiple banking purposes, such as cash withdrawal, cash deposits, bill payments, and bank statements procurement. Various types of ATMs deployed in the world include brown label ATM, white label ATM, and bank-owned ATM. The ATM market, by deployment, was led by the brown label segment in 2018.

ATM Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 18.44 Billion |

| Market Size by 2027 | US$ 44.18 Billion |

| Global CAGR (2018 - 2027) | 10.4% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

ATM Market Players Density: Understanding Its Impact on Business Dynamics

The ATM Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Type-Based Market Insights

An automated teller machine allows consumers to perform basic transactions using debit or credit cards. It is a system that handles money and performs functions such as cash deposit, cash withdrawal, and fund transfer. The machine involves a card reader, cash dispenser, and a display screen through which relevant account balance information is sent to the user. As compared to traditional bank tellers, today’s ATM, such as smart ATMs, serves as a quick, convenient, and self-serving alternative for a smooth financial transaction. The ATM market, by type, was led by the cash dispenser segment .

The players operating in the ATM market adopt strategies such as mergers, acquisitions, and market initiatives to maintain their positions in the market. A few developments by key players are listed below:

- In October 2020, NCR Corporation announced the launch of the NCR Activate Enterprise NextGen, NCR’s next-generation ATM software platform that enables banks to deploy customer experiences such as contactless technology and video teller collaboration in a simple manner.

- In 2020, Diebold Nixdorf signed a contract to provide 1,800 ATMs to the largest bank in Saudi Arabia and 500 ATMs to a new customer in Egypt. The companies are also paying attention to fortifying their machines against any possible threat of fraud or break-ins.

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For