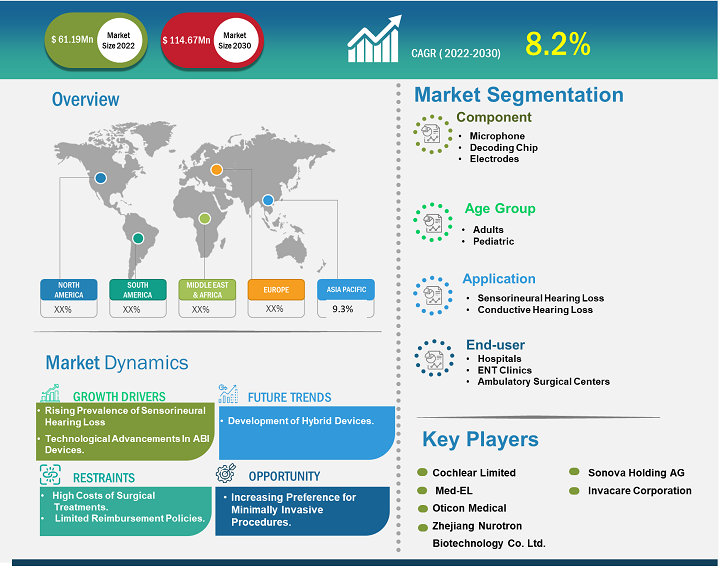

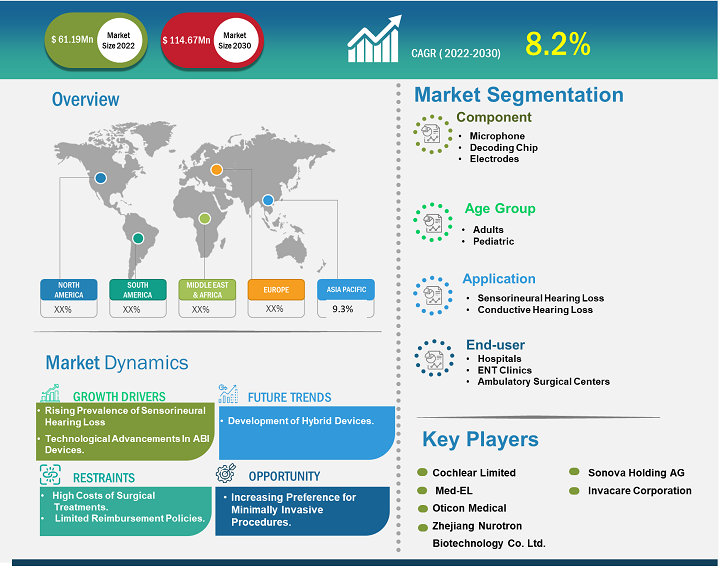

The auditory brainstem implant market is expected to grow from US$ 61.19 million in 2022 to US$ 114.67 million by 2030; it is estimated to register a CAGR of 8.2% from 2022 to 2030.

Analyst’s Viewpoint

The auditory brainstem implant (ABI) is a device that helps patients suffering from hearing disabilities and who cannot receive a cochlear implant (CI) due to anatomic constraints. This neuroprosthetic device bypasses the cochlear nerve and electrically stimulates second order neurons in the cochlear nucleus (CN) using a multichannel surface array. It is usually recommended for patients who have cochlear and retrocochlear pathologies.

The auditory brainstem implant market analysis explains growth drivers such as rising prevalence of sensorineural hearing loss and technological advancements in ABI devices. However, the high costs of surgical treatments and limited reimbursement policies hamper the market growth. Further, development of hybrid devices is expected to emerge as the future trends in the auditory brainstem implants market during 2022–2030.

Market Insights

Growing Prevalence of Sensorineural Hearing Loss to Drive Auditory Brainstem Implant Market Growth

According to an article published by StatPearls in 2023, the US reports 5 to 27 cases of sudden sensorineural hearing loss (SNHL) per 100,000 people every year, resulting in ~66,000 new cases annually. In addition, ~16% of adults worldwide with disabling hearing loss have noise-induced hearing loss (NIHL), another significant cause of hearing loss in adults that is related to occupational noise. It remains a common occupational disease despite legislation in place in most developed countries to prevent NIHL. Many studies have found that ABIs are successful in restoring hearing for Neurofibromatosis type 2 (NF2) patients with bilateral deafness. In an article published by Wolters Kluwer in February 2021, a study was carried out to assess auditory brainstem implantation in a case of a 65-year-old male diagnosed with bilateral cochlear otosclerosis and profound sensorineural hearing loss. The study concluded that extensive otosclerosis of the cochlea may lead to a poor outcome of cochlear implantation. In such cases, an Auditory Brainstem Implant (ABI) could be considered as an alternative treatment for profound sensorineural hearing loss in deaf children and adults who receive little or no benefit from hearing aids and aren’t suitable candidates for cochlear implants.

Furthermore, the availability of advanced hearing implants equipped with innovative technologies has improved their effectiveness in treating hearing impairments. This, combined with minimally invasive surgical approaches, has played a significant role in the growth and prominence of the auditory brainstem implant market.

Future Trend

Development of Hybrid Devices to Emerge as Future Trends in Auditory Brainstem Implant Market During Forecast Period

The development of hybrid devices combining cochlear and brainstem implants is aimed to provide better hearing outcomes for patients suffering from hearing loss and who are ineligible for cochlear implantation due to anomalies of the cochlea and cochlear nerve. According to an article published by International Journal of Audiology in October 2022, a study aimed to assess impedance development following the implantation of Hybrid-L electrodes was carried out. In the study, 137 adult patients were implanted with a Hybrid-L electrode and followed up for at least one year. The study suggested reduced tissue growth with the Hybrid-L electrode array despite smaller contacts.

Therefore, the development of hybrid implants to reduce surgical risks, complications, and recovery time for patients is expected to boost the auditory brainstem implant market growth during 2022-2030.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Auditory Brainstem Implant Market: Strategic Insights

Market Size Value in US$ 61.19 million in 2022 Market Size Value by US$ 114.67 million by 2030 Growth rate CAGR of 8.2% from 2022 to 2030 Forecast Period 2022-2030 Base Year 2022

Akshay

Have a question?

Akshay will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Auditory Brainstem Implant Market: Strategic Insights

| Market Size Value in | US$ 61.19 million in 2022 |

| Market Size Value by | US$ 114.67 million by 2030 |

| Growth rate | CAGR of 8.2% from 2022 to 2030 |

| Forecast Period | 2022-2030 |

| Base Year | 2022 |

Akshay

Have a question?

Akshay will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Report Segmentation and Scope

The auditory brainstem implant market is segmented on the basis of component, age group, application, end-user. Based on component, the auditory brainstem implant market is segmented into microphone, decoding chip and electrodes.

Based on age group, the auditory brainstem implant market is bifurcated into adults and pediatrics. Based on application the market is bifurcated into sensorineural hearing loss and conductive hearing loss. In terms of end user, the auditory brainstem implant market is categorized into hospitals, ENT clinics, and ambulatory surgical centers.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Segmental Analysis:

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Component – Based Insights

The auditory brainstem implant market, by component is segmente d into microphone, decoding chip and electrodes. Electrodes segment held the highest market share in 2022.

Age Group-Based Insights

The auditory brainstem implant market, by age group, is segmented into adults and pediatrics. The adults segment held a larger market share in 2022 and is anticipated to hold the larger revenue share in the global market during 2022-2030. This is due to the increasing incidence of congenital profound hearing loss with anomalies in adult population worldwide, which results in rising auditory brainstem implantation surgery. Patients with severe Sensorineural Hearing Loss (SNHL) who are ineligible for auditory nerve surgery or have scarring of the inner ear caused by trauma or infection have found auditory brainstem implant surgery to be extremely effective.

Application-Based Insights

The market, by application is bifurcated into sensorineural hearing loss and conductive hearing loss. The sensorineural hearing loss segment held the larger market share in 2022.

Auditory Brainstem Implants Market, by Application – 2022 and 2030

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

End User-Based Insights

The auditory brainstem implant market, based on end-user is categorized into hospitals, ENT clinics, and ambulatory surgical centers. The hospitals segment will grow with the highest CAGR in the market during 2022–2030. Auditory brainstem implants involve complicated surgeries that needs specialized medical attention, including diagnosis, treatment, and ongoing monitoring. Hospitals play an essential role in delivering complete healthcare services to patients.

Regional Analysis

The auditory brainstem implant market, based on geography, is segmented into five major regions-North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. The market in North America is expected to grow at a significant rate during the 2022-2030 owing to factors such as the high availability and adoption of advanced treatment options and the concentration of key manufacturers in the region. The US, in particular, records a high adoption rate of auditory brainstem implants owing to various factors such as increasing incidence of hearing loss and growing awareness about these implants.

Cochlear Limited, Med-EL, Oticon Medical, Zhejiang Nurotron Biotechnology Co. Ltd., and Sonova Holding AG are among the key market players analyzed in the report. These leading players focus on expanding and diversifying their market presence and clientele, thereby tapping business opportunities prevailing in the auditory brainstem implant market.

Key development by major market player include:

- In January 2022, Cochlear Americas Corporation received FDA approval for its Nucleus 24 Cochlear Implant System. This approval broadens the usage of this device for individuals aged five years and above who have severe to profound hearing loss in one ear [also known as single-sided deafness/unilateral hearing loss (SSD/UHL)] and normal hearing or mild hearing loss in the other ear.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Age Group, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The auditory brainstem implant (ABI) is a device that helps patients suffering from hearing disabilities and who cannot receive a cochlear implant (CI) due to anatomic constraints. This neuroprosthetic device bypasses the cochlear nerve and electrically stimulates second order neurons in the cochlear nucleus (CN) using a multichannel surface array. It is usually recommended for patients who have cochlear and retrocochlear pathologies.

Rising prevalence of sensorineural hearing loss and technological advancements in ABI devices are driving the global auditory brainstem implant market.

The CAGR value of the auditory brainstem implant during the forecasted period of 2020-2030 is 8.2%.

The microphone segment dominated the global Auditory Brainstem Implant and held the largest market share of 61.76% in 2022.

Global Auditory Brainstem Implant is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. The market in North America held the largest market share of US$ 25.65 million in 2022 and is expected to grow at a significant rate during the forecast period. North America Auditory Brainstem Implant is segmented into the US, Canada, and Mexico.

The auditory brainstem implant majorly consists of the players including Cochlear Limited, Med-EL, Oticon Medical, Zhejiang Nurotron Biotechnology Co. Ltd., and Sonova Holding AG.

The List of Companies - Auditory Brainstem Implant Market

- Cochlear Limited

- Med-EL, Oticon Medical

- Zhejiang Nurotron Biotechnology Co. Ltd.

- Sonova Holding AG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Auditory Brainstem Implant Market

Dec 2023

Colonoscopes Market

Forecast to 2028 - COVID-19 Impact and Global Analysis By Product Type (Fiber Optic Colonoscopy Devices, Video Colonoscopy Devices); Application (Colorectal Cancer, Lynch Syndrome, Ulcerative Colitis, Crohn's Disease, Polyp); End User (Hospitals, Ambulatory Surgery Center, Others), and Geography

Dec 2023

Noninvasive Fat Reduction Market

Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Cryolipolysis, Laser Lipolysis, Ultrasound, and Others), End User (Hospitals, Dermatology Clinics & Cosmetic Clinics, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Dec 2023

Medical Ultrasound Flow Meter Market

Size and Forecast (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Implementation Type (Clamp-On, Inline, and Others), Technology (Doppler, Transit Time, and Hybrid), Application (Heart and Lung Machines, Extracorporeal Membrane Oxygenation, Perfusion, Organ Transportation Systems, and Others), End User (Hospitals and Clinics, Ambulatory Surgical Centers, Research Laboratories, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Dec 2023

Rapid Test Kits Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Rapid Antigen Testing, Rapid Antibody Testing, and Others), Product (Over-the-Counter Rapid Testing Kit and Professional Rapid Testing Kit), Technology (Lateral Flow Assay, Solid Phase, Agglutination, Immunospot Assay, and Cellular Component-Based), Application (Blood Glucose Testing, Infectious Disease Testing, Pregnancy and Fertility, Cardiometabolic Testing, and Others), End User (Hospital and Clinics, Home Care, Diagnostics Centers, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Dec 2023

Osteoarthritis Therapy Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Therapy Type [Transcutaneous Electrical Nerve Stimulation (TENS), Occupational Therapy, Physical Therapy, Platelet-Rich Plasma Therapy and Stromal Vascular Fraction, Prolotherapy, and Others], Disease Indication (Knee Osteoarthritis, Spine Osteoarthritis, Foot and Ankle Osteoarthritis, Shoulder Osteoarthritis, Hand Osteoarthritis, and Others), End User (Hospitals & Clinics, Specialty Clinics, Ambulatory Surgical Centers, Homecare, and Others), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Dec 2023

Bariatric Surgeries Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type [Adjustable Gastric Bands (AGB), Sleeve Gastrectomy, Gastric Bypass, Biliopancreatic Diversion with Duodenal Switch (BPD-DS), and Others], End User (Hospitals and Ambulatory Surgical Centers), and Geography (North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America)

Dec 2023

Post-Acute Care Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Service Type (Skilled Nursing Facilities, Inpatient Rehabilitation Facilities, Long-Term Care Hospitals, Home Health Agency, and Others), Age (Elderly, Adult, and Others), Disease Conditions (Amputations, Wound Management, Brain Injury and Spinal Cord Injury, Neurological Disorders, and Others), and Geography

Dec 2023

Lung Cancer Therapy Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Therapy Type (Noninvasive and Minimally Invasive), Indication (Non-Small Cell Lung Cancer and Small Cell Lung Cancer), End User (Hospitals, Oncology Clinics, Research Centers, and Others), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)