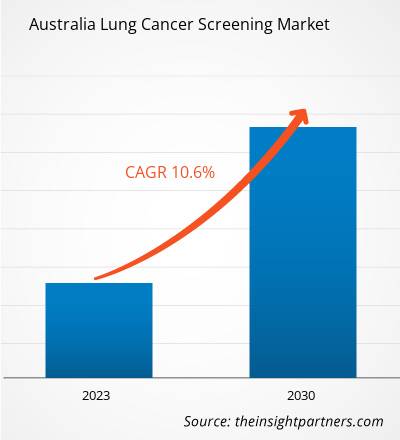

The Australia lung cancer screening market is projected to reach US$ 6.12 million by 2030 from US$ 2.74 million in 2022. It is expected to register a CAGR of 10.6% from 2022 to 2030.

Analyst Perspective:

The rising incidence of lung cancer and increasing government support drive the Australia lung cancer screening market expansion. With the high pervasiveness of lung cancer, the awareness of the disease and the associated treatment are also rising. Additionally, government initiatives provide better and more affordable screening and favorable reimbursement policies, which are expected to boost the Australia lung cancer screening market growth. The Australia lung cancer screening market key players are focusing on strategic initiatives by collaborations to expand their geographic reach and enhance capacities to cater to a large customer base. For instance, in November 2021, GE Healthcare and Optellum collaborated to advance precision diagnosis and treatment of lung cancer. Together, the companies are seeking to address one of the largest challenges in diagnosing lung cancer, helping providers determine the malignancy of a lung nodule: a suspicious lesion that may be benign or cancerous.

Australia Lung Cancer Screening Market - Market Overview:

Lung cancer screening is a process used to detect lung cancer in otherwise healthy people with a high risk of lung cancer. Lung cancer screening is recommended for older adults who are long time smokers and who do not have any signs or symptoms of lung cancer. Doctors use a LDCT scan of the lungs to look for lung cancer. If lung cancer is detected early, it is more likely to be cured with treatment.

The Australia lung cancer screening market is segmented into technology, cancer type, age group, and end user. The report offers insights and in-depth analysis of the Australia lung cancer screening emphasizing on parameters such as market trends, technological advancements, market dynamics, and competitive landscape analysis of leading market players.

Market Driver:

Increasing Incidence of Lung Cancer Drives Global Australia Lung Cancer Screening Market

According to the Cancer Australia 2023 report, ~14,529 new lung cancer cases were diagnosed in 2022; among these 7,707 were males and 6,822 were females. Additionally, nearly 9% of registered new cancer cases were diagnosed in 2022, with an estimated 8,664 total deaths due to lung cancer. According to the International Association for the Study of Lung Cancer report, in Australia, the majority of lung cancer cases are related to NSCLC, recording incidence rates of 64% and 61% among the male and female population, respectively. Hence, SCLC incidence has been decreasing, accounting for 11–13% of new diagnoses. Further, the Cancer Council SA 2023 report states that the most commonly diagnosed cancers among South Australian males in 2020 were prostate cancer, colorectal cancer, and lung cancer, and the most commonly reported cancer cause of death for females in South Australia while accounting for 17.4% of mortality is due to lung cancer.

With the growing prevalence of lung cancer, there is huge scope for lung cancer screening services in Australia. According to the Commonwealth of Australia report, in May 2023, the Minister of Health and Aged Care announced to invest US$ 263.8 million between 2023 and 2024 to implement a National Lung Cancer Screening Program and its commencement by July 2025. This program is co-designed with the First National Health Sector and is expected to maximize the prevention and early detection of lung cancer; thus, preventing over 500 lung cancer deaths annually. Lung cancer is the main cause of mortality among Australians, with the First National Communities recording a heavy burden of both smoking and cancer—which is a leading cause of disease-related deaths. For instance, according to the Commonwealth of Australia report, the National Tobacco Strategy 2023–2030, US$ 264 million will be invested in a new national lung cancer screening program and is expected to prevent 4,080 deaths associated with lung cancer during the mentioned period.

Thus, the rising prevalence and incidence of lung cancer in Australia is contributing to government support and initiatives for lung cancer screening programs, which is driving the australia lung cancer screening market growth.

Australia Lung Cancer Screening Market - Segmental Analysis:

Based on cancer type, the Australia lung cancer screening market is bifurcated into non-small cell lung cancer (NSCLC) and small cell lung cancer. The NSCLC segment accounted for a larger market share in 2022 and is expected to grow at a CAGR of 10.3% during the forecast period. The market position of this segment is due to the rising cases of NSCLC in Australia. NSCLC develops more slowly than small cell lung cancer. It usually spreads to other parts of the patient's body by the time it is diagnosed. Therefore, early diagnosis and treatment are crucial. According to National Foundation for Cancer Research, NSCLC accounts for nearly 9 out of every 10 diagnoses. As per the same source, large-cell undifferentiated carcinoma lung cancer accounts for ~10–15% of all NSCLC diagnoses.

Australia Lung Cancer Screening Market - Country Analysis:

According to the Cancer Council Victoria report, in 2020, 3,233 Victorians were diagnosed with lung cancer. Among these, 1,685 males and 1,548 females represent 52.1% and 47.9% of the total lung cancer diagnoses, respectively. In 2022, lung cancer is diagnosed at a rate of 26 per 100,000 males and 22.4 per 100,000 females, with a median age of diagnosis of 71 years in males and 71 in females. Further, in 2020, lung cancer was the fourth-most commonly diagnosed cancer and a major cause of cancer-related deaths in Victoria; it accounted for 9.3% of all cancers diagnosed and 18.3% of all cancer-related deaths.

To control the high prevalence of lung cancer in Australia, the Lung Cancer Policy Network claimed that the Australian Government provided funding of more than US$ 343.39 million to reduce the burden of lung cancer. Out of which, US$ 181.17 million is committed to fund a national lung screening program. The program aims to increase the rate of early lung cancer detection and improve overall cancer outcomes across the country.

According to the Lung Foundation Australia, the Australian Government must adopt Cancer Australia's recommendation to implement a national targeted lung cancer screening program. This involves a specific recommendation to fund seven mobile screening units and ensure equitable access to early detection of cancer in Australians, along with citizens at remote locations. Further, the targeted lung cancer screening program aims to position Australia as a global leader in offering lung cancer treatments.

Australia Lung Cancer Screening Market - Key Player Analysis:

The Australia lung cancer screening market analysis consists of players such as Intelerad Medical Systems Incorporated; Nuance Communications Inc; GE HealthCare Technologies Inc; Medtronic Plc; Canon Medical Systems Corp; Koninklijke Philips NV; Siemens AG; Aetna Inc; bioAffinity Technologies, Inc.; LungLife AI, Inc.; and Lung Screen Australia Pty Ltd. Among the players in the Australia lung cancer screening market, Siemens AG and Medtronic Plc are the top two players owing to the diversified product portfolio offered.

Australia Lung Cancer Screening Market - Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the Australia lung cancer screening market. A few recent key market developments are listed below:

In June 2022, Royal Philips teamed up with Biodesix, Inc. to incorporate the results of Biodesix’s Nodify Lung blood-based lung nodule risk assessment testing into Philips Lung Cancer Orchestrator lung cancer patient management system. The incorporation of proteomics data along with the radiologic and patient history data currently used to determine treatment decisions can help create diagnostic efficiency for cancer care centers in the management of a growing number of lung nodule cases via the contextual launch of Biodesix Nodify Lung application within Lung Cancer Orchestrator.

- In August 2022, Intelerad Medical Systems acquired PenRad Technologies, Inc., a software provider for enhancing breast imaging and lung screening productivity. The acquisition has expanded Intelerad’s product offerings for mammography and lung analytics, optimizing workflow for radiologists and boosting patient health outcomes.

- In May 2021, Genetron Holdings Limited partnered with Siemens Healthineers at the China Medical Equipment Fair. This partnership promoted the large-scale application of Genetron’s S5 platform and lung cancer 8-gene IVD assay in Chinese hospitals and provided NSCLC patients with efficient and accurate personalized diagnosis and treatment guidance.

Australia Lung Cancer Screening Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2.74 Million |

| Market Size by 2030 | US$ 6.12 Million |

| Global CAGR (2022 - 2030) | 10.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Cancer Type

|

| Regions and Countries Covered | Australia

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Cancer Type, Technology, Age Group, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The Australia lung cancer screening market majorly consists of the players such as Intelerad Medical Systems Incorporated, Nuance Communications Inc, GE HealthCare Technologies Inc, Medtronic Plc, Canon Medical Systems Corp, Koninklijke Philips NV, Siemens AG, Aetna Inc, bioAffinity Technologies, Inc., LungLife AI, Inc., and Lung Screen Australia Pty Ltd. among others.

Mobile Lung Cancer Screening Truck in Australia lung cancer screening market is likely to trend the market growth in the coming years.

Lung cancer screening is a process used to detect lung cancer in otherwise healthy people with a high risk of lung cancer. Lung cancer screening is recommended for older adults who are long time smokers and who don't have any signs or symptoms of lung cancer. Doctors use a low-dose computerized tomography (LDCT) scan of the lungs to look for lung cancer. If lung cancer is detected early, it's more likely to be cured with treatment.

Structured lung cancer screening program is likely to fuel the market growth in the coming years.

Small cell lung cancer segment is growing in the Australia lung cancer screening market.

The factors such as increasing incidence of lung cancer and rising government support drive the market growth. However, uncertainties related to lung cancer screening trial with LDCT hinders the market growth.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Australia Lung Cancer Screenings Market

- Intelerad Medical Systems Incorporated

- Nuance Communications Inc

- GE HealthCare Technologies Inc

- Medtronic Plc

- Canon Medical Systems Corp

- Koninklijke Philips NV

- Siemens AG

- CVS Health

- bioAffinity Technologies, Inc.

- LungLife AI, Inc.

- Lung Screen Australia Pty Ltd

Get Free Sample For

Get Free Sample For