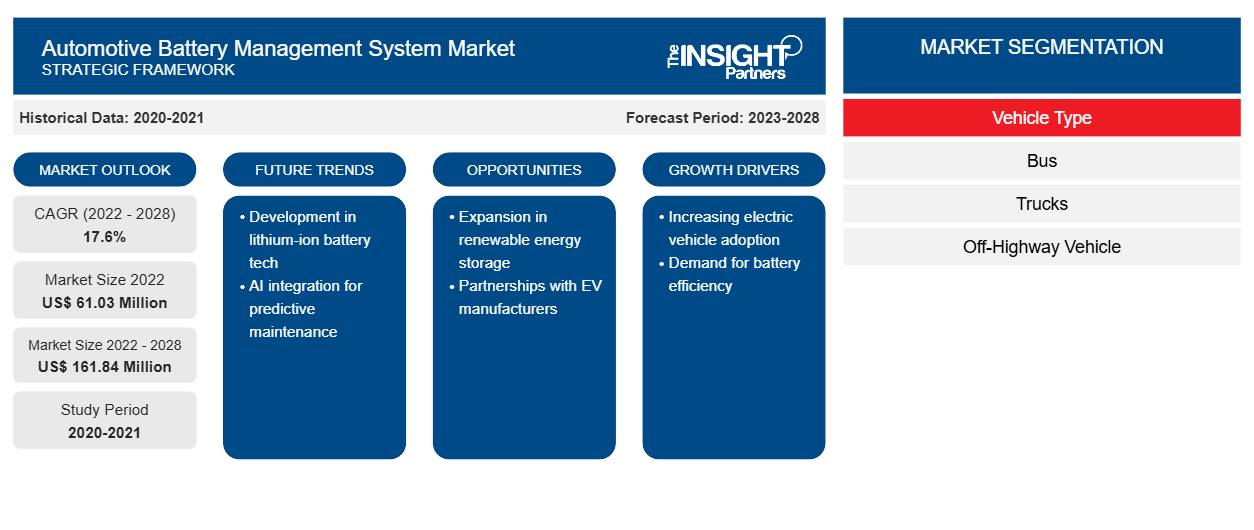

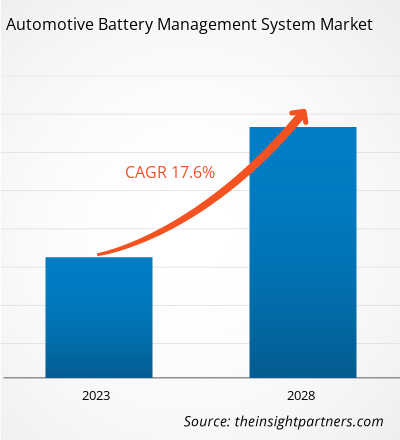

The automotive battery management system market is expected to grow from US$ 61.03 million in 2022; it is estimated to grow at a CAGR of 17.6% from 2022 to 2028.

A battery management system manages batteries used in high-voltage hybrid and electric vehicles. Electric vehicle manufacturers and battery pack manufacturers integrate a battery management system into Li-ion batteries to protect the battery pack. The overall battery system in an electric vehicle is a combination of multiple components such as battery modules, sensors, controllers, thermal management systems, and battery management systems. With the rise in concerns regarding environmental protection and positive initiatives taken by governments to reduce emissions, the demand for electric and hybrid vehicles is anticipated to grow at an impressive pace during the forecast period of 2022 to 2028. This, in turn, will fuel the automotive battery management system market growth.

The global electric vehicle and battery pack industry is characterized by the presence of a few very well-known and financially strong companies such as Mitsubishi, Nissan, and Tesla. Owing to this, the bargaining power of buyers in the automotive battery management system market size is quite high. Owing to the continuous research and development in the electric vehicles coupled with fast automotive battery management system market growth, the bargaining power of buyers is estimated to remain high during 2019–2027. The major companies in the automotive battery management system market size use different strategies while planning battery systems for their vehicles. Continuous advancements in the technology sector are anticipated to put pressure on battery management system providers to adapt the changes to sustain their market position. Owing to this fact, buyers also have a high tendency to switch BMS providers over a period of time depending on their specific requirements and technology portfolio of BMS providers.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Battery Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Battery Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Automotive Battery Management System Market share

The COVID-19 outbreak dramatically impacted the global economy during its peak in 2020, hampering business activities in manufacturing industries. Before the outbreak, the automotive battery management system market share was experiencing substantial growth owing to increased sales of electric vehicles, surged disposable income, and easy availability of credit and financing. Further, significant investment initiatives in developing electric vehicles propel the demand for automotive battery management systems. As per the International Council on Clean Transportation, global EV sales reached a record-high of 6.9 million in 2021, a 107% increase from 2020. However, the onset of the COVID-19 pandemic slowed down the investment in and production of EVs. During the initial days of the pandemic, the crisis significantly restricted all business deals, collaborations, and partnerships that disrupted the automotive battery management system market. The emergence of the pandemic hampered the sales of vehicles in February 2020; furthermore, the sales dropped by 47% in the US and 80% in Europe by April. As per a report by Statista, global car sales dropped to 63.8 million in 2020 and registered a slow recovery in 2021 with 66 million sales.

Market Insight – Automotive Battery Management System Market

Increasing Sales of EVs and Expansion of EV Infrastructure

Electric vehicle (EV) sales are growing at a fast pace owing to increasing concerns about environmental protection and government policies favoring the adoption of low-emission and zero-emission vehicles. Subsidies and tax rebates offered by governments encourage manufacturers to scale up their processes. Per the Global Electric Vehicle Outlook, the sales of electric cars, including fully electric and plug-in hybrid vehicles, reached 6.6 million units in 2021. In the same year, sales in China surged to reach 3.3 million, accounting for about half of the global sales. Furthermore, EV sales grew by 65% in Europe to reach 2.3 million units, while sales in the US doubled to 630,000 units in 2021. Thus, an increase in investments in charging infrastructure and a rise in the number of favorable government policies are propelling battery manufacturing scales, thereby bolstering the demand for automotive battery management system market.

Vehicle Type Based Insights

Based on vehicle type, the automotive battery management system market is segmented into bus, trucks, and off-highway vehicle. In 2022, the bus segment accounted for the largest share of the automotive battery management system market owing to the increasing adoption of batteries in buses for mitigating carbon emissions. Moreover, the trucks segment is projected to register the highest CAGR during the forecast period. The demand for battery management systems is significantly increasing by the electric bus manufacturers owing to growing initiatives for optimal battery performance and monitoring of battery pack temperature. Additionally, the need for electric school buses is also growing in different countries to reduce carbonization, which is also enabling the electric school bus manufacturers to scale up their production lines. Several governments of different countries are adopting green technology buses, which is fueling the demand for electric coach buses, thus, bolstering the growth of the automotive battery management system market.

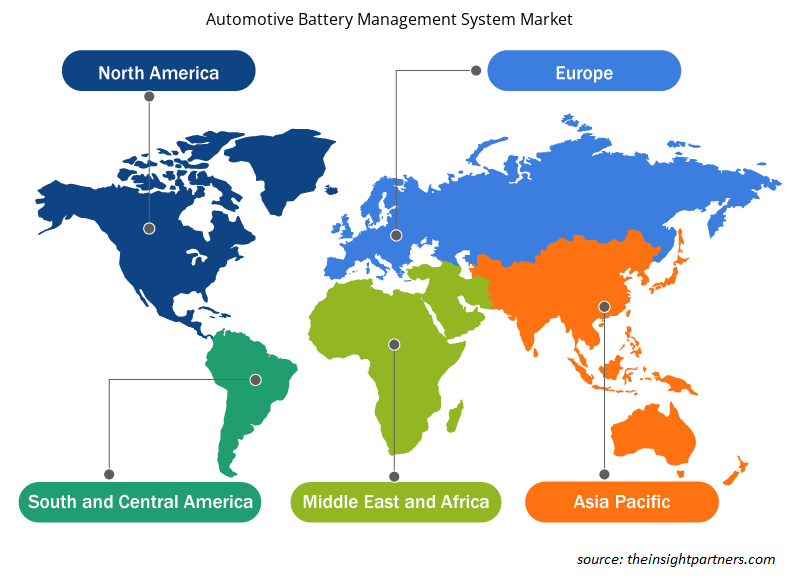

Automotive Battery Management System Market Regional Insights

The regional trends and factors influencing the Automotive Battery Management System Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Automotive Battery Management System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Battery Management System Market

Automotive Battery Management System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 61.03 Million |

| Market Size by 2028 | US$ 161.84 Million |

| Global CAGR (2022 - 2028) | 17.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Automotive Battery Management System Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Battery Management System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Battery Management System Market are:

- CONTINENTAL AG

- DANA LIMITED

- GENTHERM

- HANON SYSTEMS

- MAHLE GMBH

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Battery Management System Market top key players overview

Players operating in the automotive battery management system market are mainly focused on the development of advanced and efficient products.

- In August 2021, Varta, a battery expert, and Continental Engineering Services (CES), a provider of development and production services, announced collaboration. A replaceable 48-volt battery pack for electrically driven two-wheelers with a power of 10 kW and more has been collaboratively developed by the two partners as a part of a first pilot project.

- In June 2021, Carrar, an Israeli company that creates superior thermal management systems for the electric mobility sector, announced that Gentherm, a market leader and creator of cutting-edge thermal management solutions, is the lead investor in a Seed round of financing.

The automotive battery management system market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Rest of World. In 2022, Asia Pacific led the market with a substantial revenue share, followed by Europe. Further, Asia Pacific is expected to register the highest CAGR in the market from 2022 to 2028.

Continental AG; Dana Limited; GENTHERM; Hanon Systems; Mahle GmbH; NXP Semiconductors; Renesas Electronics Corporation; Robert Bosch GmbH; Valeo; and Marelli Holdings Co., Ltd. are among the key players operating in the automotive battery management system market. The market report provides detailed market insights, which helps the key players strategize the growth in coming years.

Frequently Asked Questions

What are the driving factors impacting the Automotive Battery Management System market?

Increasing Sales of EVs and Expansion of EV Infrastructure driving the need for Automotive Battery Management System market. Electric vehicle (EV) sales are growing at a fast pace owing to increasing concerns about environmental protection and government policies favoring the adoption of low-emission and zero-emission vehicles. Subsidies and tax rebates offered by governments encourage manufacturers to scale up their processes.

What are the future trends for Automotive Battery Management System market?

Wireless Automotive Battery Management System is propelling the market growth. A large amount of wiring goes into an EV to connect individual cells in a battery pack, and these wires are liable to safety failures. Wireless connectivity results in high reliability, reduced costs, and decreased weight in large multicell battery packs. Wireless connections are also allowing EV manufacturers to experiment with the placement of flexible battery modules and the installation of additional sensors in the place of wires. Wireless technologies such as Zigbee and point-to-point wireless topology are being used to enable wireless battery management systems.

Which is the fastest growing regional market?

Asia Pacific is the fastest growing regional market, followed by North America.

Which countries are registering a high growth rate during the forecast period?

Mexico and India are expected to register high growth rates during the forecast period.

Which are the key players holding the major market share of Automotive Battery Management System market?

The key players, holding majority shares, in Automotive Battery Management System market includes Continental AG; Dana Limited; GENTHERM; Hanon Systems; and Mahle GmbH.

Which country is holding the major market share of Automotive Battery Management System market?

The US held the largest market share in 2022, followed by China.

What is the incremental growth of the Automotive Battery Management System market during the forecast period?

The incremental growth, expected to be recorded for the Automotive Battery Management System market during the forecast period, is US$ 100.81 million.

What is the estimated global market size for the Automotive Battery Management System market in 2022?

The global Automotive Battery Management System market was estimated to be US$ 61.03 million in 2022 and is expected to grow at a CAGR of 17.6%, during the forecast period 2022 - 2028.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Automotive Battery Management System Market

- CONTINENTAL AG

- DANA LIMITED

- GENTHERM

- HANON SYSTEMS

- MAHLE GMBH

- NXP SEMICONDUCTORS

- RENESAS ELECTRONICS CORPORATION

- ROBERT BOSCH GMBH

- VALEO

- MARELLI HOLDINGS CO., LTD

Get Free Sample For

Get Free Sample For