Managed Pressure Drilling Market Growth and Recent Trends by 2031

Managed Pressure Drilling Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology (Constant Bottom Hole Pressure, Mud Cap Drilling, Dual Gradient Drilling, and Return Flow Control Drilling), Application (Onshore and Offshore), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Dec 2024

- Report Code : TIPRE00002998

- Category : Energy and Power

- Status : Published

- Available Report Formats :

- No. of Pages : 152

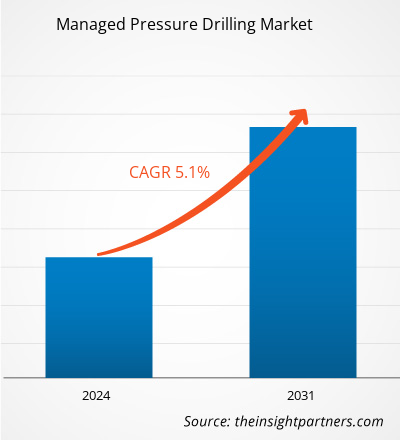

The managed pressure drilling market size is expected to reach US$ 7.22 billion by 2031 from US$ 4.85 billion in 2023. The market is estimated to record a CAGR of 5.1% during 2023–2031. The growing adoption of modern drilling equipment for high-pressure and high-temperature wells is likely to bring new trends to the market in the coming years.

Managed Pressure Drilling Market Analysis

The key stakeholders in the managed pressure drilling market ecosystem include raw material suppliers, managed pressure drilling equipment and machinery manufacturers, service providers, and end users. The raw material providers supply various types of materials, including steel and aluminum, to managed pressure drilling equipment and machinery manufacturers for manufacturing managed pressure drillings integrated with different technologies. Constant bottom hole pressure (CBHP), mud cap drilling (MCD), dual gradient drilling (DGD), and return flow control drilling (RFCD) are a few technologies for managed pressure drilling.

Service providers offer managed pressure drilling services to the end users, such as onshore and offshore oil extraction companies. Managed pressure drilling services are being adopted by many companies owing to rising drilling activities and significant investments in oil and gas projects. For instance, in 2024, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) announced that Nigeria has been offered 12 oil blocks in a new licensing round. In 2023, the Nigerian Oil Ministry announced that the award of licenses for seven offshore blocks offered in a 2022 licensing round is likely to be commissioned entirely with the round held in 2024, reserving the combined licenses of 19 oil blocks for capable investors. Similarly, in April 2023, the Oil and Natural Gas Corporation (ONGC) collected US$ 7 billion in investments for the next 3–4 years to support oil and gas production. A few managed pressure drilling equipment and machinery manufacturers are Ensign Energy Services, ADS Services LLC, Archer, Blade Energy Partners, Nabors Industries Ltd, Air Drilling Associates Inc, Halliburton Co, SLB Weatherford International Plc, and NOV Inc.

Managed Pressure Drilling Market Overview

The managed pressure drilling process is used to control the annular pressure levels precisely across the wellbore length by managing the downhole pressure environment. It is an essential technique for drilling wells with narrow pore-pressure and fracture-gradient windows. Ranging from automated to intelligent, the managed pressure drilling systems help enhance safety, lower well construction costs, reduce well control risks, and increase the production of oil and gas. The major application of managed pressure drilling systems is in deep offshore gas and oil wells. The oil and gas extraction process requires cautionary measures as these substances are highly volatile. With a rise in onshore and offshore drilling activities across the globe, the demand for managed pressure drilling equipment is also increasing. For instance, in April 2023, BP commenced oil production at its Argos platform located in the Gulf of Mexico. The Argos platform is a deepwater facility situated ~200 miles south of New Orleans, Louisiana.

The global managed pressure drilling market is segmented into North America, Europe, the Middle East and Africa, and South & Central America. North America is expected to dominate the managed pressure drilling market during the forecast period. This is owing to a rise in oil and gas drilling activities. U.S. Energy Development Corporation (U.S. Energy) aims to expand its operations in the prolific Permian basin, one of the most productive oil and gas areas in the US. Over the next 12 months in 2024, the corporation expects to deploy a capital of US$ 750 million, with the majority of this fund dedicated to projects in the Permian. Furthermore, U.S. Energy has invested, operated, and drilled ~4,000 wells in 13 US states and Canada. Such increasing investment in the oil and gas sector across the US, Canada, and Mexico drives the demand for managed pressure drilling products.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONManaged Pressure Drilling Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Managed Pressure Drilling Market Drivers and Opportunities

Growing Use of Modern Drilling Equipment for High-Pressure and High-Temperature Wells

Many countries are increasingly drilling high-pressure, high-temperature (HPHT) wells. Loss of circulation, stuck pipe, twisting off, kick, or loss scenarios are a few issues associated with drilling activities. A managed pressure drilling system is usually used in the HPHT well drilling activities as the equipment helps resolve these issues by improving penetration rate, avoiding kick or loss, narrowing passage window drilling, managing mud programs, allowing early identification of wellbore ballooning, ensuring high efficiency, and reducing non-productive time. Thus, the growing use of managed pressure drilling techniques for high-pressure, high temperature (HPHT) well drilling is expected to provide significant growth opportunities for managed pressure drilling equipment providers during the forecast period.

Increasing Adoption of Strategic Initiatives to Develop Innovative Products

Several major players are adopting strategies such as mergers, acquisitions, partnerships, and collaboration to develop advanced managed pressure drilling equipment, which is expected to create ample opportunities for the managed pressure drilling market growth during the forecast period. For instance, in September 2024, Seadrill, a Bermuda-based offshore drilling contractor, collaborated with Oil States International, an offshore drilling company headquartered in Texas. This collaboration aims to transform offshore drilling efficiency by adopting managed pressure drilling (MPD) into its mainstream operations. Similarly, in July 2024, Archer signed an agreement with Air Drilling Associates, Inc. to acquire their Managed Pressure Drilling subsidiary, ADA Argentina. The subsidiary offers MPD services to Archer’s customers in the Vaca Muerta basin in Argentina. Managed pressure drilling is an adaptive drilling process that helps control the annular pressure profile precisely throughout the drilled wellbore. Further, ADA owns and operates three MPD systems.

Managed Pressure Drilling Market Report Segmentation Analysis

Key segments that contributed to the derivation of the managed pressure drilling market analysis are technology and application.

- In terms of technology, the market is categorized into constant bottom hole pressure, mud cap drilling, dual gradient drilling, and return flow control drilling. The constant bottom hole pressure segment dominated the market in 2023.

Based on application, the market is divided into onshore and offshore. The onshore segment dominated the market in 2023.

Managed Pressure Drilling Market Share Analysis by Geography

The managed pressure drilling market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2023, followed by Asia Pacific and the Middle East and Africa.

The managed pressure drilling market in the Middle East and Africa (MEA) market is projected to proliferate owing to increasing investments in the oil and gas sector. The oil & gas sector contributes a substantial share of the GDP of these countries. In 2024, Abu Dhabi National Oil Company (ADNOC) has planned to invest more than US$ 13 billion between 2024 and 2029 for the LNG gas exploration expansion. In 2023, Aramco’s, an oil and gas company in the Middle East, total capital investments totaled US$ 49.7 billion, an increase of 28% compared to 2022. In 2024, the company's capital investments are expected to reach between US$ 48 billion and US$ 58 billion. The boost in per capita income, recovering economic conditions, and government spending on infrastructure development are among the factors contributing to the demand for managed pressure drilling services. Oil and gas production is one of the prominent businesses in the region. Saudi Arabia, Libya, Iran, the UAE, and Qatar are a few countries that have witnessed growth in the oil business. Despite the slowdown in economic growth and substantial macroeconomic imbalances from lower oil prices in the last few years, oil and gas-producing countries in the MEA are focusing on achieving greater oil and gas production by partnering with foreign firms to scale up their activities at huge offshore and onshore oil and gas fields.

Managed Pressure Drilling

Managed Pressure Drilling Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.85 Billion |

| Market Size by 2031 | US$ 7.22 Billion |

| Global CAGR (2023 - 2031) | 5.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Managed Pressure Drilling Market Players Density: Understanding Its Impact on Business Dynamics

The Managed Pressure Drilling Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Managed Pressure Drilling Market News and Recent Developments

The managed pressure drilling market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the managed pressure drilling market are listed below:

- Nabors Industries Ltd and SLB announced a collaboration to scale the adoption of automated drilling solutions for oil and gas operators and drilling contractors. The agreement will enable customers to seamlessly integrate the companies’ drilling automation applications and rig operating systems to deliver improved well construction performance and efficiency.

(Source: Nabors Industries Ltd, Press Release, January 2024)

- Halliburton Company and Oil States Industries, Inc. announced a strategic collaboration that combines two award-winning technology sets to provide customers with innovative deepwater managed pressure drilling (MPD) solutions.

(Source: Halliburton, Press Release, November 2023)

Managed Pressure Drilling Market Report Coverage and Deliverables

The "Managed Pressure Drilling Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Managed pressure drilling market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Managed pressure drilling market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Managed pressure drilling market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the managed pressure drilling market

- Detailed company profiles

Frequently Asked Questions

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For