Automotive Break Shims Market Trends and Analysis by 2031

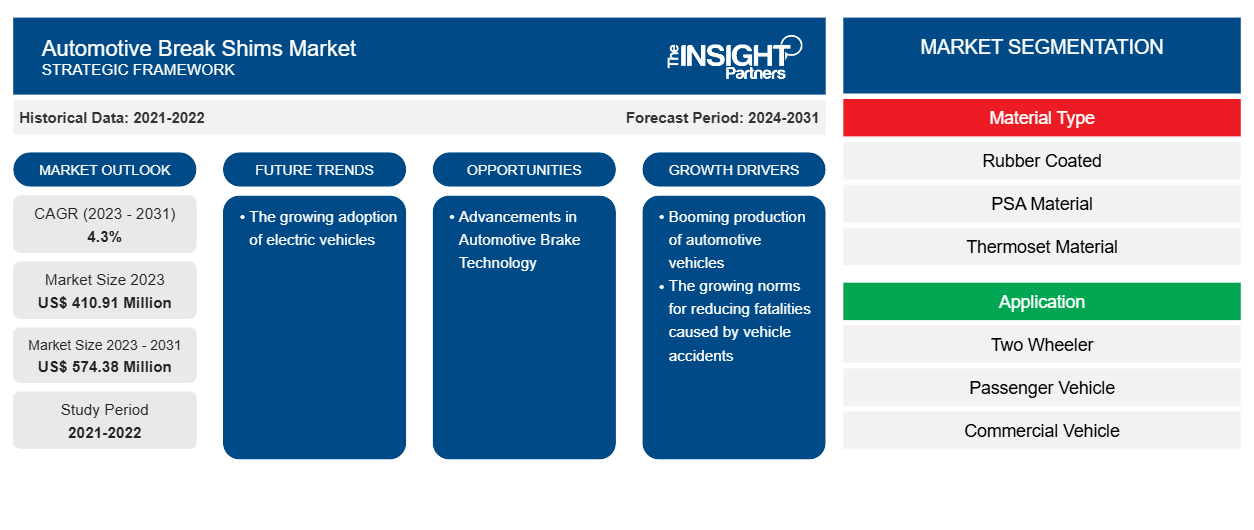

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031Automotive Break Shims Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material Type (Rubber Coated, PSA Material, Thermoset Material, and Others), Application (Two Wheeler, Passenger Vehicle, and Commercial Vehicle), and Geography

- Report Date : Mar 2026

- Report Code : TIPRE00017710

- Category : Automotive and Transportation

- Status : Data Released

- Available Report Formats :

- No. of Pages : 150

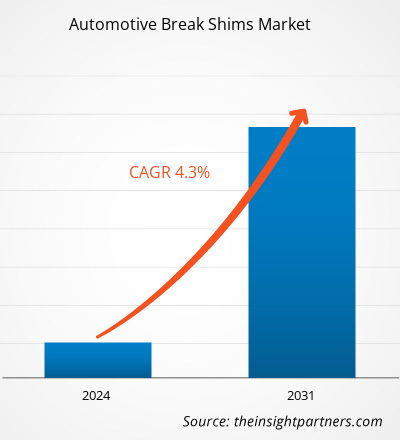

The automotive break shims market size is projected to reach US$ 574.38 million by 2031 from US$ 410.91 million in 2023. The market is expected to register a CAGR of 4.3% during 2023–2031. The rising adoption of electric vehicles is expected to drive the market is likely to remain a key trend in the market.

Automotive Break Shims Market Analysis

The major stakeholders in the global automotive brake shims market ecosystem include material providers, automotive brake shim manufacturers, standards & regulatory framing bodies, and end users. Material providers provide various materials to the automotive brake shims manufacturers, including rubber coated, PSA (Pressure Sensitive Adhesive) material, thermoset material, titanium, steel, iron, copper, and graphite. With the rising demand for automotive disc brakes across the globe, automotive brake shims manufacturers are also experiencing a rise in demand. Some of the major automotive brake shims manufacturers are Avery Dennison Corporation, Brembo S.p.A., BOSCH Auto Parts, Trelleborg Group, Meneta, Super Circle, NUCAP, Brake Performance, Delphi Technologies Plc, and TEXTAR Brake Technology.

Automotive Break Shims Market Overview

The major end users of the automotive brake shims market include passenger cars and commercial vehicles. The disc brakes are majorly utilized in passenger cars. However, owing to their stable performance at resistance to brake and higher speeds, they are getting spread into the commercial vehicle segment. Drum brakes are getting replaced with disc brakes in commercial vehicles as they provide higher quality and longer service life. Therefore, the demand for automotive brake shims is increasing.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Break Shims Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Break Shims Market Drivers and Opportunities

Growing Norms for Reducing Fatalities Caused by Vehicle Accidents

The rising passenger and commercial vehicles sales are fostering the global automotive brake shims market growth. The increasing demand for vehicles is positively impacting the global production cycle. As the demand for vehicles increases, the formation of regulatory mandates for making vehicles safer is rising. This leads to a surge in demand for disc brakes, penetration of anti-lock braking systems, and electronic stability control expansion. Therefore, government bodies of countries such as India have regulated safety-critical components within commercial and passenger vehicles, resulting in a rise in demand for automotive brake shims.

Moreover, fatalities caused due to vehicle accidents are one of the factors encouraging government bodies to introduce new norms for vehicles and road safety, which would help reduce fatalities. As a poor braking system is one of the causes of road accidents, establishing proper norms for using friction materials and braking systems is necessary. Below mentioned are some of the standards described by regional government bodies for braking systems:

- As per the LEGISLATIVE COUNSEL'S DIGEST article of January 2021, friction materials containing over 0.5% copper are prohibited from application in new vehicles commencing in 2025. Thus, companies such as Akebono have already begun following such laws. The company’s department engaged in producing and distributing friction materials and collaboratively working globally to comply with the new law. The company has already developed friction materials described by the new law.

- New rules have come into the market, directly impacting the braking system. Since November 2016, the replacement of brake discs on newly registered vehicles should follow compliance with the ECE R90 (ECE Regulation 90 or Economic Commission for Europe Regulation 90) quality standard. This quality standard is implemented across the European Union and in non-European countries. Since November 1, 2016, all passenger cars of every model have complied with ECE R90 brake discs and drums. Companies such as MEYLE provides brake discs that already comply with the new standard. Similarly, AF Aftermarket is also obeying with new ECE R90.

Such laws for friction materials and disc brakes support the growth of automotive brake shims.

Advancements in Automotive Brake Technology

The critical component of any vehicle braking system is the disc brake pad. For example, stopping a heavy car traveling at 100 km/hour in a few seconds generates over 100 kW (kilowatt) of heat. That heat is transferred into the brake pads; temperatures can reach approximately 600°C and higher within seconds. Despite this, braking must be safe and smooth, with an increasing focus on health, safety, and the environment. Disc brake pad manufacturers must look for alternatives to traditional raw materials such as copper.

New friction materials must perform well under extreme braking conditions. Brake pads must give the same pedal feel and deceleration during repeated braking and sudden emergency stop in weather conditions such as wet or dry, muddy, or icy. Braking advancements are increasingly affecting automotive car manufacturers; also, several standards are imposed to ensure friction materials reduce emissions. Fine particulate emissions are becoming increasingly unwelcome in cities. And even EVs, which use regenerative braking that reduces wear and emissions, place their own demands on braking systems.

Automotive Break Shims Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive break shims market analysis are material type and application.

- Based on material type, the automotive break shims market is segmented into rubber coated, PSA material, thermoset material, and others. The others segment held a larger market share in 2023.

- Based on application, the automotive break shims market is segmented into two wheeler, passenger vehicle, and commercial vehicle. The passenger vehicle segment held a larger market share in 2023.

Automotive Break Shims Market Share Analysis by Geography

The geographic scope of the automotive break shims market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific has dominated the market in 2023 followed by Europe and North America regions. Further, Asia Pacific is also likely to witness highest CAGR in the coming years. China accounted for the largest market share in Asia Pacific automotive break shims market in 2023. According to figures from the OICA, over 30 million vehicles (Cars and Commercial Vehicles) were produced in 2023 across the China region, with 26.12 million of them being passenger cars. As the Chinese automobile industry has grown, more carmakers have increased their understanding and auto part research and development. They not only identify tier-one braking system suppliers directly, but they also limit the number of brake pad suppliers and the friction material composition. As a result, China's demand for braking systems is increasing. The expansion of companies that create brake shims for vehicles and companies that supply brake shims for aftermarket services is influenced by the growing demand for braking systems. This has increased the demand for the automotive brake shims market in the region.

Automotive Break Shims Market Regional Insights

The regional trends and factors influencing the Automotive Break Shims Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Automotive Break Shims Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Automotive Break Shims Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 410.91 Million |

| Market Size by 2031 | US$ 574.38 Million |

| Global CAGR (2023 - 2031) | 4.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Automotive Break Shims Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Break Shims Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Automotive Break Shims Market top key players overview

Automotive Break Shims Market News and Recent Developments

The automotive break shims market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the automotive break shims market are listed below:

- Bosch and the Volkswagen Group subsidiary Cariad are entering into a partnership to enhance the automated driving functions across all vehicle classes. (Source: Bosch, Press Release, 2022)

- TMD Friction, parent company of Textar has released 825 new products to its whole product line. This step allows TMD Friction to offer largest coverage of all brake friction manufacturers. (Source: TMD Friction, Press Release, 2022)

Automotive Break Shims Market Report Coverage and Deliverables

The “Automotive Break Shims Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Automotive break shims market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automotive break shims market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST analysis

- Automotive break shims market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the automotive break shims market

- Detailed company profiles

Frequently Asked Questions

What would be the estimated value of the automotive break shims market by 2031?

What is the expected CAGR of the automotive break shims market ?

What are the driving factors impacting the automotive break shims market ?

Which are the leading players operating in the automotive break shims market ?

Which region dominated the automotive break shims market in 2023?

What are the future trends of the automotive break shims market ?

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For