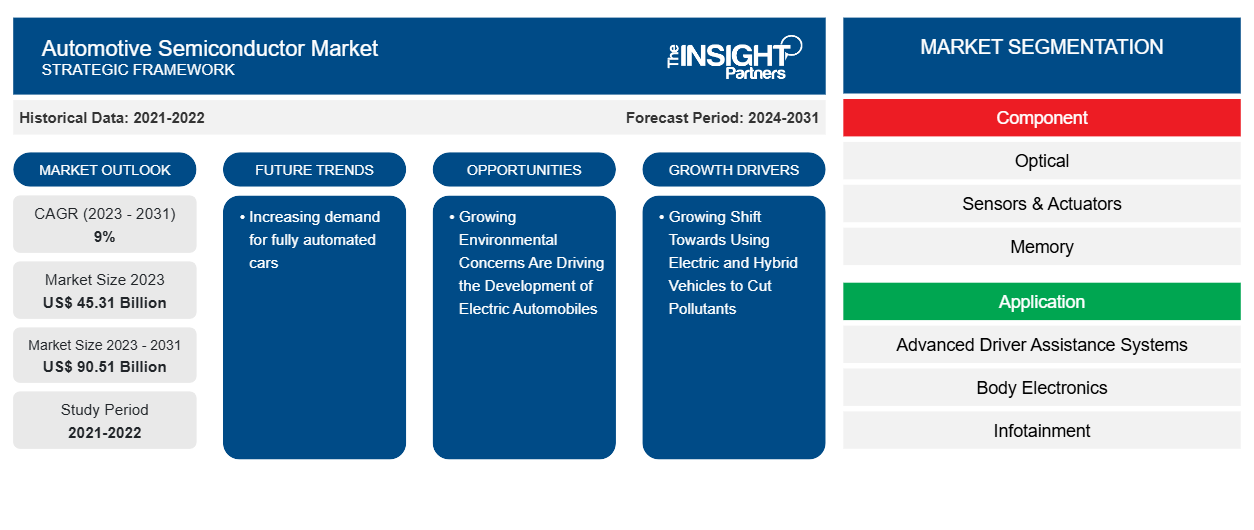

The automotive semiconductor market size is projected to reach US$ 90.51 billion by 2031 from US$ 45.31 billion in 2023. The market is expected to register a CAGR of 9% in 2023–2031 Rising penetration of electronic components in luxury to mass-produced cars, rising acceptance of electronic control units (ECUs) in modern vehicles, and growing emphasis on safety systems

Automotive Semiconductor Market Analysis

The growing demand for electric and hybrid vehicles creates a tremendous opportunity for the automotive semiconductor business. These vehicles necessitate semiconductors for devices such as ADAS and ECUs that regulate the battery, motor, and other components. This results in a demand for complex and specialized semiconductors in the automotive semiconductor market. These market developments are expected to have an impact on the supply chain, aftermarket, and semiconductor component manufacturers. As a result, onboard diagnostic systems may replace conventional diagnostic systems, allowing for continuous monitoring of a vehicle's mechanical and electrical components.

Automotive Semiconductor Market Overview

The market is predicted to increase steadily over the next few years due to the rising use of electronic components in luxury to mass-produced cars, growing acceptance of electronic control units (ECUs) in modern vehicles, and a growing focus on vehicle safety systems. Other factors driving market expansion include the proliferation of linked cars, entertainment systems, automotive safety systems, and fuel efficiency rules. A rising number of cheap vehicles offer improved infotainment, safety, performance, and fuel efficiency. Such features result in the incorporation of many components, which raises the entire vehicle's price. Thousands of semiconductor chips are now at the heart of automobiles, serving as the vehicle's eyes, hearing, and brain, monitoring the environment, making decisions, and controlling actions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Semiconductor Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Semiconductor Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Semiconductor Market Drivers and Opportunities

Growing Shift Towards Using Electric and Hybrid Vehicles to Cut Pollutants to Favor Market

Electric and hybrid vehicles, as well as solar-powered automobiles, are the principal alternatives to petroleum-based engines. Using electric and hybrid vehicles can reduce fuel costs, reduce greenhouse gas emissions, enhance urban air quality, and lessen reliance on fossil fuels. The introduction of electric vehicles will increase demand for new automotive ICs, microprocessors, and sensors.

Growing Environmental Concerns Are Driving the Development of Electric Automobiles

Environmental concerns and the need to preserve energy have fueled the development of HEVs and EVs. Hybrid vehicles are equipped with an engine, a motor, and a high-voltage, high-power battery to operate the motor. Hybrid vehicles meet high power needs while still providing environmental benefits. Global emission standards have led to developments in car technology to reduce dangerous exhaust emissions. The introduction of electric vehicles (EVs) is a significant step towards environmental sustainability in the automobile sector. These vehicles use no conventional gasoline and thus emit no hazardous gasses. Electric car sales have increased significantly in industrialized nations such as North America and Europe due to various factors. Because these vehicles are entirely powered by electricity, they make extensive use of technological gadgets.

Automotive Semiconductor Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive semiconductor market analysis are component, application, and vehicle type.

- Based on components, the automotive semiconductor market is segmented into optical, sensors & actuators, memory, microcontrollers, analog ICs, logic, and discrete power devices.

- By application, the market is segmented into advanced driver assistance systems, body electronics, infotainment, powertrain, and safety systems.

- In terms of vehicle type, the market is segmented into passenger, LCV, and HCV.

Automotive Semiconductor Market Share Analysis by Geography

The geographic scope of the automotive semiconductor market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. The fundamental cause for APAC automotive semiconductor market growing is the expanding Chinese car industry. As the world's largest vehicle producer, this industry also consumes the most automotive semiconductors globally. The region is known for small and affordable cars. The region has experienced higher growth in the past decade than mature markets in Europe and North America due to factors such as low production costs, easy availability of labor, lenient emission and safety norms, and government initiatives encouraging foreign direct investment (FDI). APAC is a suitable site for vehicle production due to its growing population, rising economies (both developed and developing), and government measures promoting industrial expansion.

Automotive Semiconductor Market Regional Insights

The regional trends and factors influencing the Automotive Semiconductor Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Semiconductor Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Semiconductor Market

Automotive Semiconductor Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 45.31 Billion |

| Market Size by 2031 | US$ 90.51 Billion |

| Global CAGR (2023 - 2031) | 9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Automotive Semiconductor Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Semiconductor Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Semiconductor Market are:

- Analog Devices, Inc.

- Infineon Technologies AG

- NXP Semiconductors

- Renesas Electronics Corporation

- Robert Bosch GmbH

- ROHM CO., LTD.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Semiconductor Market top key players overview

Automotive Semiconductor Market News and Recent Developments

The automotive semiconductor market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- In May 2022, Continental AG expanded its sensor offering for electrified vehicles in May 2022, introducing the Current Sensor Module (CSM) and Battery Impact Detection (BID) systems. Both new solutions aim to protect and retain battery parameters.

(Source: Continental, Company Website, 2021)

- In October 2021, Infineon Technologies offered the SL137 automotive security controller, a dependable trust anchor for securing safety-critical automotive applications like 5G eCall, V2X communication, car access, and SOTA software updates.

(Source: Infineon Technologies, Company Website, 2021)

Automotive Semiconductor Market Report Coverage and Deliverables

The "Automotive Semiconductor Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component ; Application ; Vehicle Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

What is the estimated market size for the global automotive semiconductor market in 2022?

The global automotive semiconductor market was estimated to be US$ 45.31 billion in 2023 and is expected to grow at a CAGR of 9 % during the forecast period 2023 - 2031.

What are the driving factors impacting the global automotive semiconductor market?

The growing shift towards using electric and hybrid vehicles to cut pollutants is the major factors that propel the global automotive semiconductor market.

What are the future trends of the global automotive semiconductor market?

Increasing demand for fully automated cars to play a significant role in the global automotive semiconductor market in the coming years.

Which are the key players holding the major market share of the automotive semiconductor market?

The key players holding the majority of shares in the global automotive semiconductor market are Analog Devices, Inc., Infineon Technologies AG, NXP Semiconductors, Renesas Electronics Corporation, and Robert Bosch GmbH.

What will be the market size of the global automotive semiconductor market by 2031?

The global automotive semiconductor market is expected to reach US$ 90.51 billion by 2031.

Get Free Sample For

Get Free Sample For