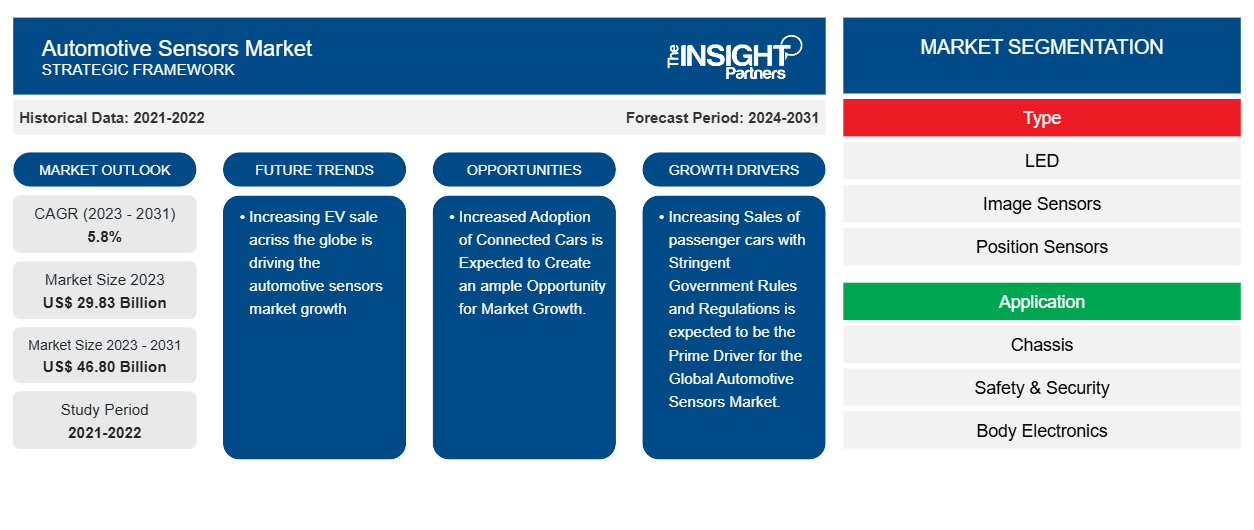

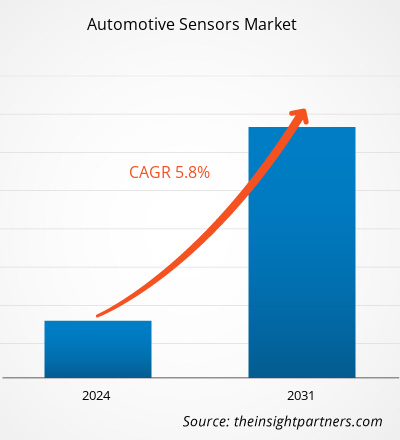

The automotive sensors market size is projected to reach US$ 46.80 billion by 2031 from US$ 29.83 billion in 2023. The market is expected to register a CAGR of 5.8% in 2023–2031. The automotive industry is increasing at a rapid pace with the emergence of connected vehicles and the adoption of electric vehicles around the globe. Automotive electronic sensors have a wide range of applications in commercial vehicles and passenger cars. Increasing continuous advancements in automotive technologies drive market growth. Rising focus on the adoption of advanced automotive technologies, such as the adoption of autonomous driving and rising electrification drives the market growth. Increased inclination towards adoption of the position sensors in the automotive sector drives the market growth during the forecast period.

Automotive Sensors Market Analysis

An automotive sensor is a semiconductor device that helps to detect sudden changes in a vehicle. Sensors are widely used for the detection of various types of physical changes in the automotive engine environment, such as fuel requirement, oil spillage, heat dissipation, heat, motion, moisture, pressure, and others. There are various types of sensors available in the automotive sensors market. The sensors include position sensors, temperature sensors, LED, Image Sensors, and among others.

Automotive Sensors Market Overview

Growing focus on the implementation of vehicle driver’s safety and comfort and increased adoption of advanced driver-assistance systems drive the automotive sensors market growth during the forecast period. Factors such as increased adoption and sale of electric vehicles to reduce carbon dioxide emissions and increased investments in the automotive sector drive the automotive sensors market growth around the globe.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Sensors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive Sensors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive Sensors Market Drivers and Opportunities

Increasing Sales of passenger cars with Stringent Government Rules and Regulations is expected to be the Prime Driver for the Global Automotive Sensors Market.

Global passenger car sales have increased at a rapid pace owing to increasing consumers' disposable income have created massive for the automotive sensors market growth. According to the International Organization of Motor Vehicle Manufacturers (OICA), passenger car sales in 2023 reached around 65.27 million units, increased by 11.3% compared to 2022. Such increases in passenger car sales across the globe have created massive demand for the automotive sensors market growth during the forecast period. Automotive sensors are essential for performing various functions of vehicles, including engine management, safety, and comfort features. Developing advanced sensor technologies for the automotive is driving the opportunity for autonomous driving cars.

Increased Adoption of Connected Cars is Expected to Create an ample Opportunity for Market Growth.

Connected car sales have increased at a rapid pace owing to the increased disposable income of people around the globe. Connected cars consist of a wide range of sensors and Bluetooth technology that can be connected to smartphones and tablets. The connected cars send the data to the electronic control unit using various advanced technology-based sensors. In recent years, automotive manufacturers have developed advanced connectivity solutions such as vehicle-to-infrastructure (V2I), vehicle 2 vehicle (V2V), and others to offer better connectivity for automotive systems. Vehicles that are connected to various devices use automotive sensors to enhance vehicle safety. The primary aim of connected cars is to avoid collisions, reduce fatalities, and make the vehicle more efficient.

Automotive Sensors Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive sensors market analysis are type, component, and application.

- Based on type, the market is divided into LED, Image Sensors, Position Sensors, Temperature Sensors, Pressure Sensors, MEMS, and Others. Among these, position sensors and pressure sensors have the largest share in 2023.

- Based on application, the market is divided into chassis, safety & security, body electronics, powertrain, ADAS, and others. Among these, ADAS application is growing at the highest CAGR during the forecast period owing to increased demand for connected cars.

- Based on the vehicle type, the market is divided into light commercial vehicles, heavy-duty commercial vehicles, and passenger cars. Among these, passenger cars have the largest share in 2023. This is owing to increased sales of passenger cars across the globe.

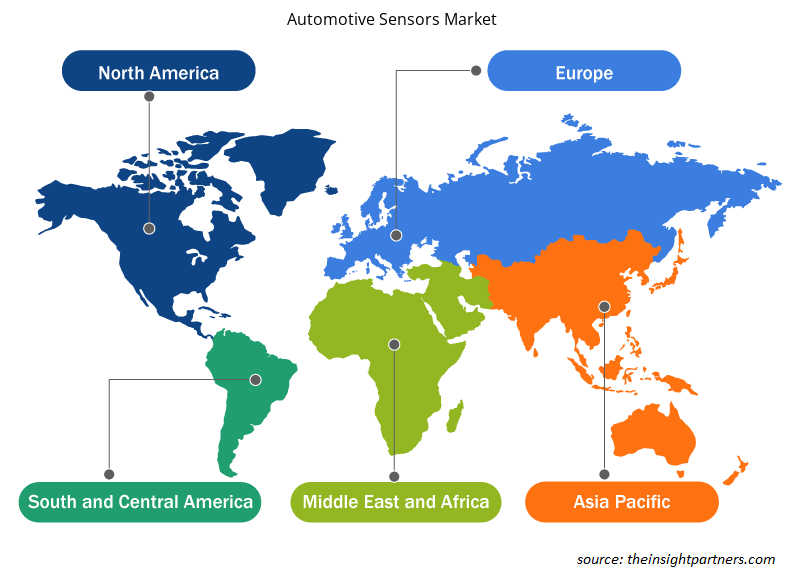

Automotive Sensors Market Share Analysis by Geography

The geographic scope of the Automotive Sensors Market report is mainly divided into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific is expected to have the largest share in 2023 in the global automotive sensors market during the forecast period. Increased automotive sales across countries such as Japan, India, South Korea, and China drive this automotive sensor market demand. Also, countries such as Indonesia, Taiwan, the Philippines, and other ASEAN countries are growing at a moderate pace, with increased automotive sales in 2023. In addition, the Asia Pacific region has several key market players, such as RoboSense, DENSO Corporation, LIVOX, Hesai, Huawei Technologies Co., Ltd. And among others. The presence of such companies is projected to fuel the automotive sensors market growth.

Automotive Sensors Market Regional Insights

The regional trends and factors influencing the Automotive Sensors Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive Sensors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive Sensors Market

Automotive Sensors Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 29.83 Billion |

| Market Size by 2031 | US$ 46.80 Billion |

| Global CAGR (2023 - 2031) | 5.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

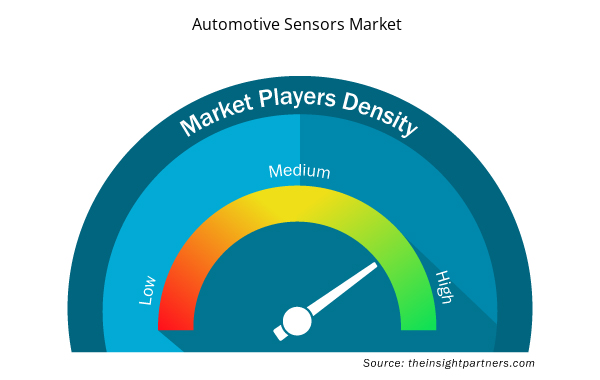

Automotive Sensors Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive Sensors Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive Sensors Market are:

- Continental AG

- Delphi Automotive

- First Sensor AG

- Denso Corporation

- Robert Bosch GmbH

- Infineon Technologies

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive Sensors Market top key players overview

Automotive Sensors Market News and Recent Developments

The automotive sensors market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for Automotive Sensors market and strategies:

- In December 2023, Panasonic Corporation launched an inertial 6-in-1 sensor to elevate automotive performance and safety. Panasonic Corporation’s Life Solutions business launched this 6-in-1, Degrees of Freedom Inertial Sensors. This sensor measures the vehicle’s acceleration and angular rates and provides critical information to enhance the vehicle’s safety and stability. These sensors follow ISO26262 Functional Safety norms, including the Automotive Safety Integrity Level and dependability for critical applications. (Source: Flyability, Press Release/Company Website/Newsletter)

Automotive Sensors Market Report Coverage and Deliverables

The “Automotive Sensors Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles with SWOT analysis

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- GMP Cytokines Market

- Asset Integrity Management Market

- Authentication and Brand Protection Market

- Digital Pathology Market

- Enteral Nutrition Market

- Animal Genetics Market

- Emergency Department Information System (EDIS) Market

- Hydrogen Compressors Market

- Enzymatic DNA Synthesis Market

- Identity Verification Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type ; Application ; Vehicle Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Get Free Sample For

Get Free Sample For