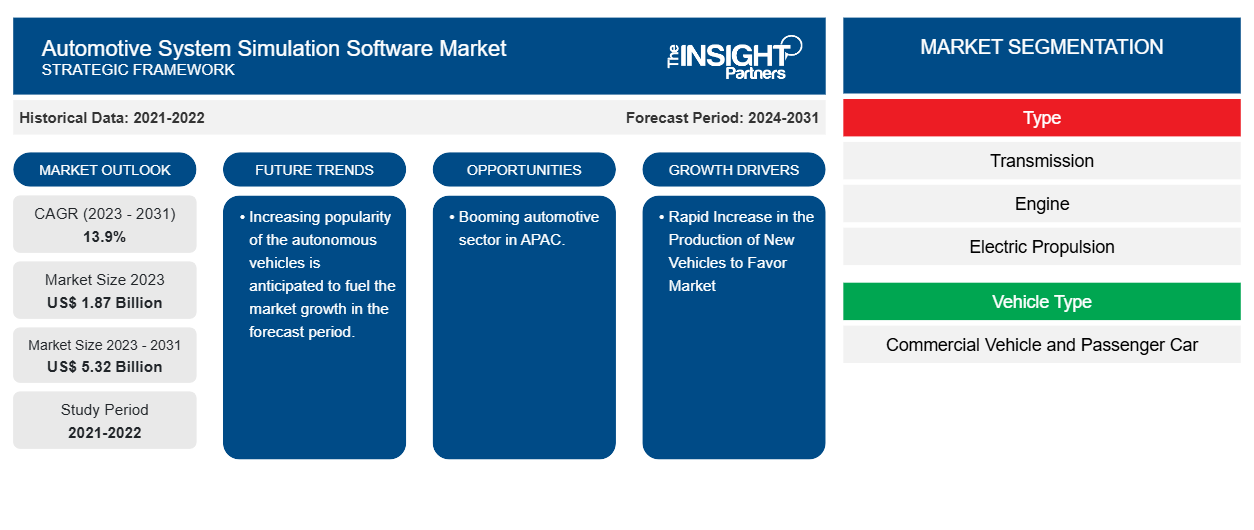

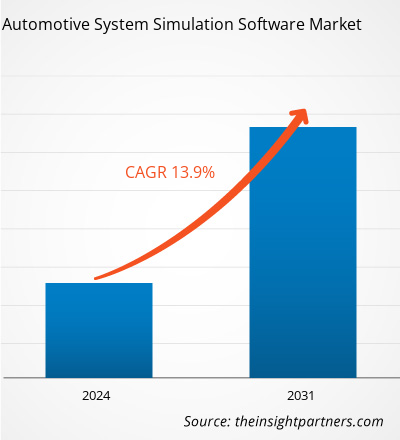

The automotive system simulation software market size is projected to reach US$ 5.32 billion by 2031 from US$ 1.87 billion in 2023. The market is expected to register a CAGR of 13.9% during 2023–2031. The upgrading of vehicle function and increase in the number of E/E components, growing production and sales of electric vehicles are likely to remain key trends and drivers in the market.

Automotive System Simulation Software Market Analysis

The demand for the automotive system simulation software market is anticipated to grow with the rapid increase in the production of new vehicles. OEMs are shifting their conventional prototyping methods towards automotive system simulation to develop new models and improve existing ones, which is fuelling the automotive system simulation software market.

Automotive System Simulation Software Market Overview

The automotive system simulation software (ASM) is a tool suite that comprises simulation models for automotive applications that can be merged as needed. The models support a wide spectrum of simulations, starting with individual components like combustion engines or electric motors, to vehicle dynamics systems, up to complex virtual traffic scenarios. The models can be handled easily and intuitively with ModelDesk, the graphical user interface.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive System Simulation Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automotive System Simulation Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automotive System Simulation Software Market Drivers and Opportunities

Rapid Increase in the Production of New Vehicles to Favor Market

The rapid increase in the production of new vehicles is driving the automotive system simulation software market growth. As the production of new vehicles is increasing, the demand for automotive system simulation software is also increasing. For instance, according to the Association des Constructeurs Européens d’Automobiles (ACEA), in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. Thus, increasing the production of new motor vehicles can drive the automotive system simulation software market growth.

Booming automotive sector in APAC.

APAC's automotive industry has been booming since recent few years. The growth is driven by rapid urbanization, economic prosperity, and a rising population; mobility needs in Asian countries have increased for people and goods. Further, automobiles are undergoing modernization over time. Moreover, companies such as KIA, Nio, and many more in the region are focused on product development.

Automotive System Simulation Software Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automotive system simulation software market analysis are type, vehicle type, and propulsion type.

- Based on type, the automotive system simulation software market is divided into transmission, engine, electric propulsion, fuel cell, driveline, chassis, and others. The transmission segment is anticipated to hold the largest share in the forecast period.

- Based on vehicle type, the automotive system simulation software market is divided into commercial vehicles and passenger cars. The commercial vehicle segment is anticipated to hold the largest share in the forecast period.

- Based on propulsion type, the automotive system simulation software market is divided into ICE and electric. The ICE segment is anticipated to hold the largest share in the forecast period.

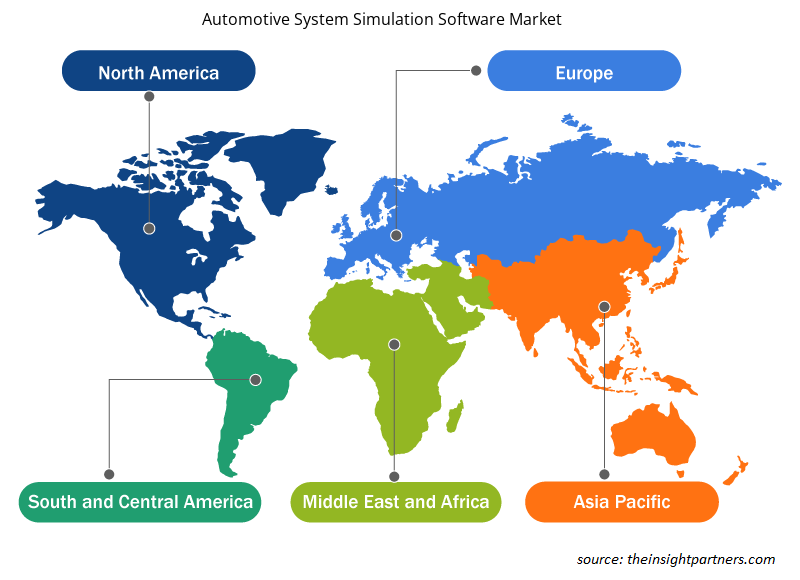

Automotive System Simulation Software Market Share Analysis by Geography

The geographic scope of the automotive system simulation software market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

APAC has dominated the market. The region is home to several manufacturers that focus on modern technological advancement. Also, the region consists of emerging economies, including China, Japan, and India. These countries have significant automotive industries. Moreover, urbanization and industrialization are increasing the demand for a large number of vehicle production, which fuels the automotive system simulation software market in the region.

Automotive System Simulation Software Market Regional Insights

The regional trends and factors influencing the Automotive System Simulation Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Automotive System Simulation Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Automotive System Simulation Software Market

Automotive System Simulation Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.87 Billion |

| Market Size by 2031 | US$ 5.32 Billion |

| Global CAGR (2023 - 2031) | 13.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

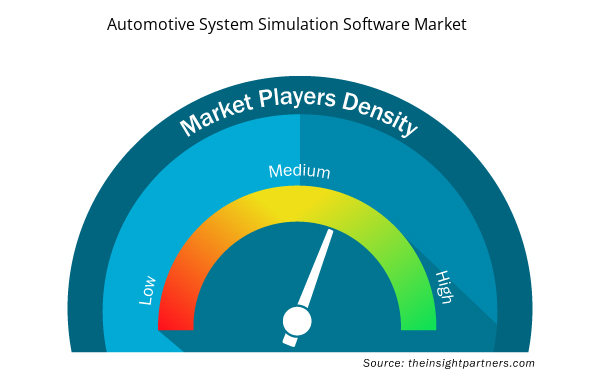

Automotive System Simulation Software Market Players Density: Understanding Its Impact on Business Dynamics

The Automotive System Simulation Software Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Automotive System Simulation Software Market are:

- ESI Group

- ANSYS, Inc

- Hexagon AB

- dSPACE GmbH

- Siemens

- Modelon

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Automotive System Simulation Software Market top key players overview

Automotive System Simulation Software Market News and Recent Developments

The automotive system simulation software market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the automotive system simulation software market are listed below:

- Altair, one of the global leaders in computational intelligence, announced it had acquired Research in Flight, maker of FlightStream, which provides computational fluid dynamics (CFD) software with a large footprint in the aerospace and defense sector and a growing presence in marine, energy, turbomachinery, and automotive applications. FlightStream is a user-friendly yet powerful flow solver that bridges the gap between high-fidelity CFD simulations and the needs of engineers and designers. (Source: Altair, Company Website, May 2024)

- Rohde & Schwarz teamed up with IPG Automotive, a pioneer in virtual test driving, to redefine automotive radar Hardware-in-the-Loop (HIL) integration testing, thereby reducing the cost by bringing Autonomous Driving (AD) testing from the proving ground to the development lab. Combining the CarMaker simulation software from IPG Automotive with the R&S AREG800A radar object simulator and the R&S QAT100 advanced antenna array provides vehicle manufacturers with the ability to simulate ADAS/AD scenarios like those defined in the Euro NCAP in a controlled, safe, time-efficient and cost-reducing way. (Source: Rohde & Schwarz Company Website, April 2024)

Automotive System Simulation Software Market Report Coverage and Deliverables

The “Automotive System Simulation Software Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Automotive system simulation software market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Automotive system simulation software market trends as well as market dynamics such as drivers, restraints, and key opportunities.

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Automotive system simulation software market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the automotive system simulation software market.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Vehicle Type, and Propulsion Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What is the expected CAGR of the automotive system simulation software market?

The expected CAGR of the bucket elevator market is 13.9%.

What would be the estimated value of the automotive system simulation software market by 2031?

The automotive system simulation software market is anticipated to reach US$ 5.23 billion by 2031.

Which are the leading players operating in the automotive system simulation software market?

The key players in the automotive system simulation software market are ESI Group, ANSYS, Inc, Hexagon AB, dSPACE GmbH, Siemens, Modelon, IPG Automotive GmbH, Realtime Technologies, Gamma Technologies, LLC, SimScale GmbH.

What are the future trends of the automotive system simulation software market?

The increasing popularity of autonomous vehicles is anticipated to fuel market growth in the forecast period.

What are the driving factors impacting the automotive system simulation software market?

The upgrading of vehicle function and increase in the number of E/E components, growing production and sales of electric vehicles are likely to remain key trends and drivers in the market.

Which region dominated the automotive system simulation software market in 2023?

APAC dominated the automotive system simulation software market in 2023.

Get Free Sample For

Get Free Sample For