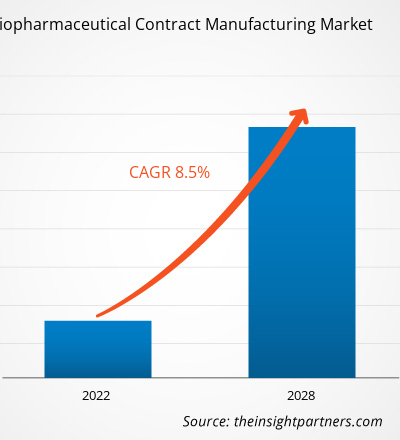

The biopharmaceutical contract manufacturing market size is projected to reach US$ 101.05 billion by 2031 from US$ 40.99 billion in 2024. The market is expected to register a CAGR of 13.8% during 2025–2031. Advanced manufacturing technologies are emerging as a significant trend in the biopharmaceutical contract manufacturing market.

Biopharmaceutical Contract Manufacturing Market Analysis

The biopharmaceutical contract manufacturing market is witnessing substantial growth due to increasing demand for biologics, including monoclonal antibodies, gene therapies, and vaccines, which necessitates specialized manufacturing capabilities, prompting pharmaceutical companies to outsource production to contract manufacturing organizations (CMOs). Advancements in manufacturing technologies, such as continuous processing, single-use systems, and automation, enhance production efficiency and scalability, enabling CMOs to meet the complex demands of biological production. The rising inclination toward outsourcing allows companies to focus on core competencies while reducing operational costs and capital expenditures. In addition, the expansion of healthcare access in emerging markets, coupled with favorable regulatory environments, presents new opportunities for contract manufacturers to serve a broader customer base. Strategic partnerships and alliances between biopharmaceutical companies and CMOs facilitate technology transfer and process optimization, accelerating product development and commercialization timelines. These factors together contribute to the growth of the biopharmaceutical contract manufacturing market globally.

Biopharmaceutical Contract Manufacturing Market Overview

The global biopharmaceutical contract manufacturing market is accelerating owing to the rising demand for biologics, biosimilars, and complex therapies. North America leads the market with a strong presence of biopharmaceutical companies and regulatory support. Technological advancements, such as continuous manufacturing and robotics, are enhancing efficiency and scalability in production processes. Furthermore, geopolitical shifts are prompting companies to diversify supply chains, with Indian firms such as Syngene International expanding operations in the US to mitigate risks associated with reliance on Chinese manufacturing. Similarly, European CMOs are expanding capabilities in high-growth areas such as biologics, cell and gene therapies, and high-potency APIs. Countries such as Germany, France, and Switzerland continue to lead with their established infrastructure and innovation-driven ecosystems, while emerging hubs in Central and Eastern Europe, including Poland and Hungary, are gaining traction due to cost advantages and growing technical expertise. Strategic partnerships, regulatory harmonization, and supportive government policies position Europe as a diverse and competitive region for end-to-end biopharmaceutical manufacturing services.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Biopharmaceutical Contract Manufacturing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Biopharmaceutical Contract Manufacturing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Biopharmaceutical Contract Manufacturing Market Drivers and Opportunities

Rising Demand for Biologics Bolster Market

Biologics are the basis of modern medicine due to their increased efficacy in treating complex and chronic diseases such as cancer, autoimmune disorders, and genetic conditions. Monoclonal antibodies, vaccines, cell and gene therapies, and recombinant proteins are some of the major biologics used prominently in medical services. As per the National Cancer Institute, ~20 million new cancer cases and 9.7 million cancer-related mortality were reported in 2022. The rising number of such chronic conditions creates the demand for biologics, leading to the increased collaboration of pharmaceutical manufacturers with contract manufacturing organizations (CMOs) specialized in biologics manufacturing capabilities.

Biologics manufacturing is a complex process and requires highly specialized equipment, expertise, and facilities. The long production timelines and high costs associated with setting up in-house manufacturing facilities for biologics make outsourcing more crucial. CMOs provide the necessary infrastructure and expertise to scale production, allowing drug developers to meet market demand without any significant capital investment. Manufacturers such as Roche and Bristol-Myers Squibb have developed monoclonal antibody-based biologics, Herceptin and Opdivo, with the help of CMOs, which have transformed cancer treatments. These therapies have significantly increased the demand for contract manufacturing services as companies look for specialized facilities capable of producing these highly complex biologics on a large scale. Therefore, the rising demand for biologics has created the need for specialized, cost-effective, and scalable production solutions, fueling the growth of the biopharmaceutical contract manufacturing market.

Increasing Demand for Personalized Medicine to Create Growth Opportunities

Personalized medicine offers a significant opportunity by offering tailored treatments that are designed to meet the unique genetic profiles, environments, and lifestyles of individual patients. This approach is experiencing increased adoption owing to advancements in genomics, biotechnology, and diagnostics, allowing for more precise and effective treatments. The constant developments in personalized medicine are creating demand for specialized, flexible, and scalable manufacturing solutions. These developments have increased the collaborations with CMOs to bring these therapies to market. Personalized therapies often require tailored approaches that involve more flexible manufacturing processes, which include gene therapies, cell therapies, and precision oncology treatments. As a result, biopharmaceutical companies are increasingly turning to CMOs that offer the expertise and capacity to handle these specialized manufacturing needs.

The growing demand for personalized medicine emphasizes the need for efficient, scalable manufacturing processes that can adapt to the production of highly individualized treatments. For instance, gene therapies such as Kymriah (developed by Novartis) and Yescarta (from Gilead) are personalized medicines that have been successfully developed and commercialized. CMOs with the right infrastructure provide these treatments, as they require unique manufacturing processes. Moreover, CMOs that can offer specialized services for the production of cell-based therapies or gene-editing technologies, such as CRISPR-based treatments, are well-positioned to benefit from the personalized medicine trend. As companies move toward smaller batch sizes, flexibility, and customization, CMOs play a vital role in ensuring that these treatments are efficiently and cost-effectively produced, thereby creating lucrative opportunities for the market during the forecast period.

Biopharmaceutical Contract Manufacturing Market Report Segmentation Analysis

Key segments that are the foundation of biopharmaceutical contract manufacturing market analysis are product type, source, application, and therapeutic area.

- Based on product type, the biopharmaceutical contract manufacturing market is bifurcated into biologics and biosimilar. The biologics segment held a larger share of the market in 2024.

- In terms of source, the biopharmaceutical contract manufacturing market is categorized into microbial and mammalian. The microbial segment dominated the market in 2024.

- By application, the biopharmaceutical contract manufacturing market is segmented into commercial and clinical. The commercial segment held a larger share of the market in 2024.

- Per therapeutic area, the market is classified into oncology, autoimmune disorders, respiratory disorders, metabolic disorders, neurology, infectious diseases, and others. The oncology segment dominated the biopharmaceutical contract manufacturing market share in 2024.

Biopharmaceutical Contract Manufacturing Market Share Analysis by Geography

The geographic scope of the biopharmaceutical contract manufacturing market report is divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America.

North America held a significant share of the market in 2024. The growth of the global biopharmaceutical contract manufacturing market in North America can be attributed to the well-established pharmaceutical industry, advanced technological infrastructure, and a strong regulatory framework that supports innovation and quality manufacturing. The US remains a dominant player due to its large pharmaceutical base, a high R&D investment, and the presence of significant contract development and manufacturing organizations (CDMOs). Canada is also expanding its capabilities, especially in niche biologics and sterile manufacturing. The growth in outsourcing trends among pharmaceutical companies reduces costs and accelerates time-to-market, further boosting the biopharmaceutical contract manufacturing market in the region.

Biopharmaceutical Contract Manufacturing Market Regional Insights

The regional trends and factors influencing the Biopharmaceutical Contract Manufacturing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Biopharmaceutical Contract Manufacturing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Biopharmaceutical Contract Manufacturing Market

Biopharmaceutical Contract Manufacturing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 40.99 Billion |

| Market Size by 2031 | US$ 101.05 Billion |

| Global CAGR (2025 - 2031) | 13.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

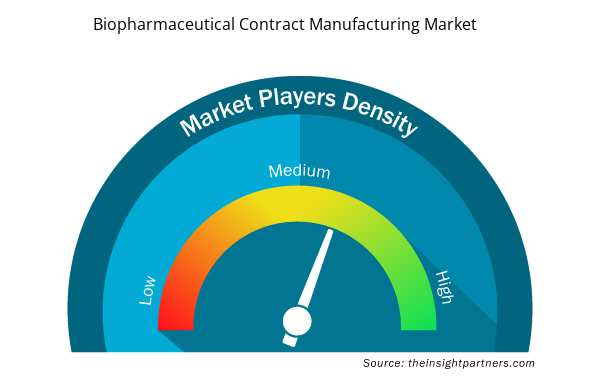

Biopharmaceutical Contract Manufacturing Market Players Density: Understanding Its Impact on Business Dynamics

The Biopharmaceutical Contract Manufacturing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Biopharmaceutical Contract Manufacturing Market are:

- Boehringer Ingelheim International GmbH

- Thermo Fisher Scientific Inc.

- Lonza Group AG

- Merck KGaA

- AbbVie Inc.

- General Electric Co

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Biopharmaceutical Contract Manufacturing Market top key players overview

Biopharmaceutical Contract Manufacturing Market News and Recent Developments

The biopharmaceutical contract manufacturing market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A key development in the market is listed below:

- Lonza Completes Acquisition of Large-Scale Biologics Site in Vacaville (US) from Roche. (Source: Lonza, Press Release, October 2024)

- Sutro Biopharma and Boehringer Ingelheim BioXcellence collaboration: Established first-in-class cell-free capabilities at a commercial scale. (Source: Sutro Biopharma, Inc.; Press Release, January 2025)

- Boehringer Ingelheim enhances biopharmaceutical contract manufacturing services in China. (Source: Boehringer Ingelheim International GmbH, Press Release, March 2025)

Biopharmaceutical Contract Manufacturing Market Report Coverage and Deliverables

The "Biopharmaceutical Contract Manufacturing Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Biopharmaceutical contract manufacturing market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Biopharmaceutical contract manufacturing market trends and market dynamics, such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Biopharmaceutical contract manufacturing market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the biopharmaceutical contract manufacturing market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product; Service, and Source, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Which region dominated the biopharmaceutical contract manufacturing market in 2024?

North America dominated the market in 2024.

What are the factors driving biopharmaceutical contract manufacturing market growth?

Rising demand for biologics and increasing demand for cost efficiency and flexibility contribute to market growth.

Which are the leading players operating in the biopharmaceutical contract manufacturing market?

Boehringer Ingelheim International GmbH, Thermo Fisher Scientific Inc., Lonza Group AG, Merck KGaA, AbbVie Inc., General Electric Co, Samsung Biologics Co Ltd, WuXi Biologics Inc., Inno Bio Ventures Sdn Bhd, and Ajinomoto Co Inc. are among the key players operating in the biopharmaceutical contract manufacturing market.

What is the expected CAGR of the biopharmaceutical contract manufacturing market?

The market is estimated to register a CAGR of 13.8% during the forecast period.

What would be the estimated value of the biopharmaceutical contract manufacturing market by 2031?

The market is expected to reach a value of US$ 101.05 billion by 2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Biopharmaceutical Contract Manufacturing Market

- Boehringer Ingelheim International GmbH

- Thermo Fisher Scientific Inc

- Lonza Group AG

- Merck KGaA

- AbbVie Inc.

- General Electric Co

- Samsung Biologics Co Ltd

- WuXi Biologics Inc

- Inno Bio Ventures Sdn Bhd

- Ajinomoto Co Inc.

Get Free Sample For

Get Free Sample For