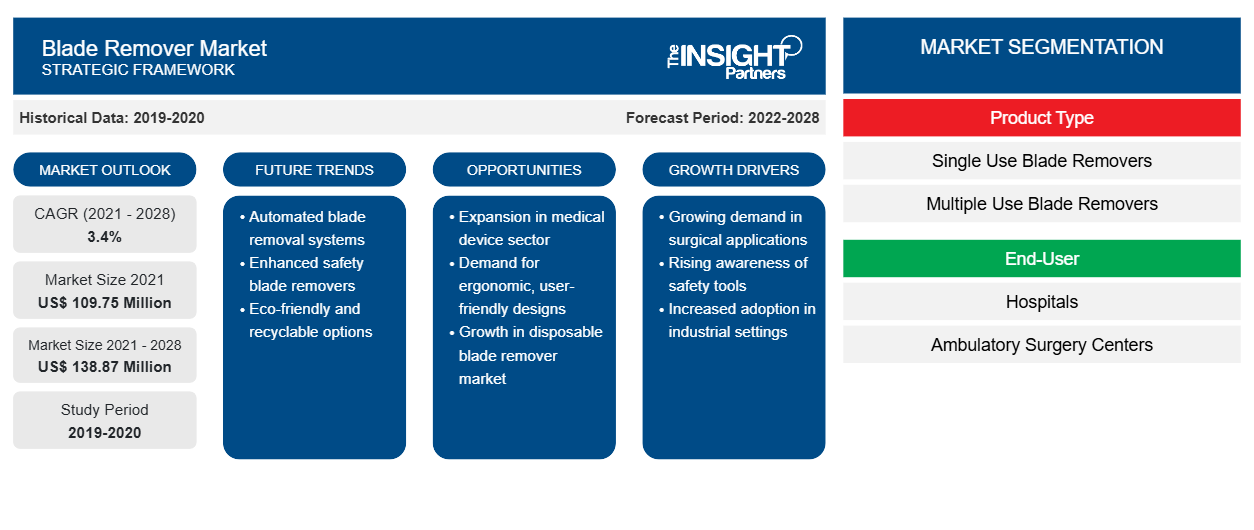

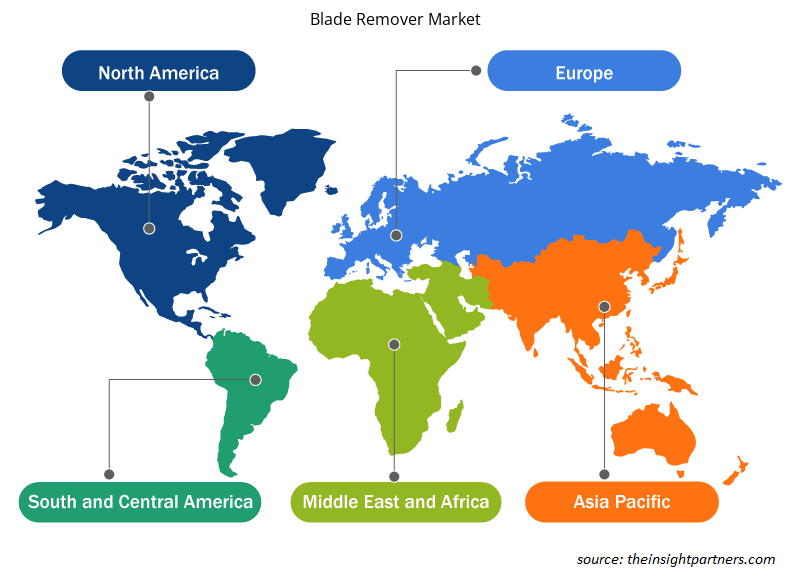

The blade remover market is projected to reach US$ 138,872.23 thousand by 2028 from US$ 109,750.48 thousand in 2021; it is estimated to grow at a CAGR of 3.4% during 2021 to 2028.

Blade remover withdraws the safe and simple removal of used disposable blades of any kind and size of scalpel handle. On the other hand, in the US alone, 20 injuries occur when loading or unloading blades, and 95% of these injuries are connected with sharp tools, and 90% of these injuries involve contaminated blades. Apart from that, the blade removal requires only straight-line in-out movement. Therefore, the remover is simple to use, and in the case of use by a surgeon or assistant, the blade removal operation does not distract the surgeon or assistant attention from the process that is in progress.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blade Remover Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blade Remover Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The growth of the blade remover market is attributed to the rise in single handed operations, and increase in incidence of injuries. However, the inherent problems associated with blade removers hampers the market growth.

Market Insights

Increase in Incidence of Injuries

Removing the blades with tweezers or your fingers is not safe. They increase the likelihood of getting a cut and bloodborne injuries like HIV, Hep B, and C. Worse, if excessive force is used when removing the blade with tweezers, the blade can slip and eject beyond its normal range, stabbing a nearby colleague. This leads to injuries. The risks are increased if any person's blood has contaminated the tool. This can result in percutaneous exposure to bloodborne pathogens. In the European Union/European Economic Area (EU/EEA), approximately 9 million people are chronically infected with hepatitis B virus (HBV) or hepatitis C virus (HCV), with an additional unknown number of undiagnosed cases. This risk also affects patients. Percutaneous injuries to surgical personnel pose a mutual risk to patients, with the possibility of physician-to-patient transmission of infection. Removal devices are designed to protect the user and downstream personnel from accidental injury when removing a scalpel blade from a reusable handle.

Product Type-Based Insights

Based on product type, the global blade remover market has been segmented into single use blade removers and multiple use blade removers. The single use blade removers segment held the largest share of the market in 2021 and is anticipated to register the highest CAGR of 3.5% in the market during the forecast period. The blade remover allows safely removing blades from metal scalpel handles while storing them in a hinged plastic case that securely locks the blade in place for easy disposal in a sharps container. This disposable device works with all scalpel blades and handles to prevent sharp injuries.

Blade Remover Market Regional Insights

The regional trends and factors influencing the Blade Remover Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Blade Remover Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Blade Remover Market

Blade Remover Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 109.75 Million |

| Market Size by 2028 | US$ 138.87 Million |

| Global CAGR (2021 - 2028) | 3.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Blade Remover Market Players Density: Understanding Its Impact on Business Dynamics

The Blade Remover Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Blade Remover Market are:

- Swann Morton Limited

- Aspen Surgical

- Cincinnati Surgical Company Inc.

- Sklar Surgical Instruments

- Fine Science Tools, Inc.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Blade Remover Market top key players overview

End-User/ Application-Based Insights

Based on end-user/application, the global blade remover market is segmented into the global blade remover market is segmented into hospitals, ambulatory surgical centers and others. The hospital segment held the largest share of the market in 2021 and is estimated to register the highest CAGR of 3.9% in the market during the forecast period.

Product launches and approvals are commonly adopted strategies by companies to expand their global footprints and product portfolios. Moreover, the blade remover market players focus on the partnership strategy to expand their clientele, which, in turn, permits them to maintain their brand name across the world.

Company Profiles

- Swann-Morton Limited

- Aspen Surgical

- Cincinnati Surgical Company Inc

- Sklar Surgical Instruments

- Fine Science Tools Inc.

- Cancer Diagnostics Inc.

- Deroyal Industries, Inc.

- Mortech Manufacturing

- Hu-Friedy MFG. CO., LLC.

- Ribbel International Limited

Frequently Asked Questions

What is the market scenario of blade remover?

Blade remover market is segmented by geography into North America, Europe, Asia Pacific, Middle East & Africa, and South and Central America. North America held the largest market share for blade remover in 2021. The United States held the largest market in North America for blade remover, and the market is expected to grow due to rise in awareness among people about the importance and usage of blade remover, increasing adoption of technological advancements. Also, the regulatory scenario for the global blade remover market in North America has improved due to advancements in elective surgeries, increased awareness about sharp injuries. However, Asia Pacific registered as the fastest-growing region in the global blade remover market. The market is driven by growing investments from international players in China and India. The Asia Pacific, companies are focusing on widening product portfolio, diversified business operations, lower costs, and user satisfaction.

Who are the key players in the blade remover market?

The blade remover market majorly consists of the players such Swann-Morton Limited, Aspen Surgical, Cincinnati Surgical Company Inc, Sklar Surgical Instruments, Fine Science Tools Inc., Cancer Diagnostics Inc., Deroyal Industries, Inc., Mortech Manufacturing, Hu-Friedy MFG. CO., LLC., and Ribbel International Limited among others.

What is blade remover?

Blade remover withdraws the safe and simple removal of used disposable blades of any kind and size of scalpel handle. The blade removal requires only straight-line in-out movement. Therefore, the blade remover is simple to use, and in the case of use by a surgeon or an assistant, the blade removal operation does not distract them from the process that is in progress.

What are the driving factors for the blade remover market?

Key factors that are driving the growth of the blade remover market over years are the rising single-handed operations and increase in incidence of injuries.

Which product type led the market?

The single use blade remover segment dominated the blade remover market and held the largest market share of 87.17% in 2021.

Which end-user held the largest share in the market?

The hospitals segment dominated the blade remover market and accounted for the largest revenue share of 62.09% in 2021.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Blade Remover Market

- Swann Morton Limited

- Aspen Surgical

- Cincinnati Surgical Company Inc.

- Sklar Surgical Instruments

- Fine Science Tools, Inc.

- Cancer Diagnostics, Inc.

- DeRoyal Industries, Inc.

- Hu-Friedy Mfg. Co., LLC.

- Ribbel International Limited

- Mortech Manufacturing

Get Free Sample For

Get Free Sample For