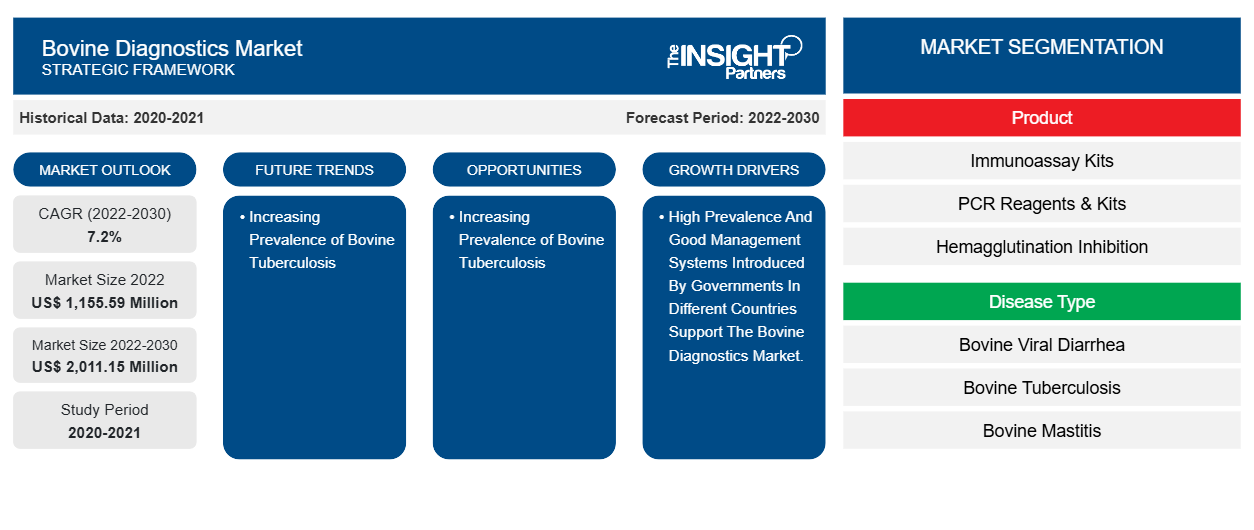

Bovine Diagnostics Market Developments and Forecast by 2030

Bovine Diagnostics Market Size and Forecast (2020-2030), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Immunoassay Kits, PCR Reagents & Kits, Hemagglutination Inhibition (HI) Assay, and Other Products), Disease Type [Bovine Viral Diarrhea (BVD), Bovine Tuberculosis (TB), Bovine Mastitis, Foot and Mouth Disease (FMD), and Other Disease Types], End User (Veterinary Hospitals, Veterinary Clinics, and Other End Users) and Geography

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2022-2030- Report Date : Sep 2023

- Report Code : TIPRE00030034

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 152

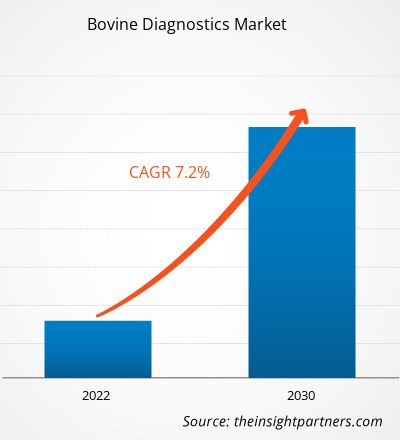

The bovine diagnostics market was valued at US$ 1,155.59 million in 2022 and is expected to reach US$ 2,011.15 million by 2030. It is estimated to register a CAGR of 7.2% during 2022–2030. The upsurge in research funding to develop modern diagnostic approaches is likely to remain a key bovine diagnostics market trend.

Bovine Diagnostics Market Analysis

Bovine refers to a domestic animal such as cattle, buffalo, goat, and sheep. The growth of the market is attributed to the increasing prevalence and economic impact of bovine mastitis and increasing number of product launches by major manufacturers. However, lack of skilled professionals in animal research sector may hinders the market growth.

Bovine Diagnostics Market Overview

Bovine mastitis is a major concern that incurs economic losses to the global agriculture sector. Mastitis diseases to the bovine species animals results in lowered milk production that inlead resulting in reduced profitability for dairy farmers. According to the study published “Global and countrywide prevalence of clinical mastitis and subclinical in dairy cattle and buffaloes by systematic review and meta-analysis,” published in April 2021, the worldwide prevalence of subclinical mastitis and clinical mastitis were about 42% and 15%, respectively, during the year 2011–2019. In India, the prevalence of subclinical mastitis and clinical mastitis were 45% and 18%, respectively, during the forecast period. The study also reported that North America and Europe had a higher prevalence of subclinical mastitis, while countries such as the Uganda and UK had a higher prevalence of clinical mastitis. The prevalence of overall mastitis is expected to increase due to the prolonged history of the diseases in the dairy industry. Moreover, surveillance programs and proper management systems introduced by governments in different countries support the growth of the bovine diagnostics market. The factors mentioned above are influences the growth of the bovine diagnostics market.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONBovine Diagnostics Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Bovine Diagnostics Market Drivers and Opportunities

Increasing Number of Product Launches Favors Market

Rapid research and development activities allow veterinary diagnostics prominent companies to launch various innovative diagnostics products that provide rapid output for diagnosis. In addition, growing awareness among end users via the government’s educative and knowledge-sharing programs and initiatives has encouraged these companies to launch advanced diagnostics products. A few of the new product launches in the bovine diagnostics market are, for instance, in June 2023, Zoetis, Inc. company launched Vetscan Mastigram+, an on-farm mastitis diagnostic solution that offers results eight hours before the next milking cycle. The Vetsacn Mastigram+ uses a flow dipstick test for detection of Gram-positive mastitis in cattle. The product will also help in detecting the presence of Gram-positive pathogens in cow milk with 99% sensitivity as well as 100% specificity, along with differentiating between Gram-positive and Gram-negative bacteria.

High Prevalence of Bovine Tuberculosis – An Opportunity in Bovine Diagnostics Market

Bovine tuberculosis (bTB) is a type of chronic infectious disease that affects cattle and is later transferred to other animals and humans. The World Organization for Animal Health (WOAH) has listed bTB and must be detected and reported as soon as possible. As per the report shared by Thermo Fisher Scientific company in May 2023, bTB affects more than 50 million cattle globally, incurring annual economic losses of around US$ 3 billion. In the UK, bTB disease incurs financial losses of about US$ 145 million annually.

The diseases casing rate of bTB differs in different geographic areas. It is rare in Canada, Europe, , and the US. However, bovine tuberculosis is around 50% in Africa and some parts of Asian countries. Although ongoing technological and infrastructural developments, still many developing countries fail to effectively diagnose bTB due to the complexity as well as the lack of universal strategies for its diagnosis. This scenario provides opportunities for bovine diagnostics market players to enhance awareness in Africa and Asia and launch new products that suit the socioeconomic conditions in these countries.

Bovine Diagnostics Market Report Segmentation Analysis

Key segments that contributed to the derivation of the bovine diagnostics market analysis are product, disease type, and end user.

- Based on product, the bovine diagnostics market is divided into Immunoassay Kits, PCR Reagents & Kits, Hemagglutination Inhibition (HI) Assay, and Other Products. The Immunoassay Kits segment held a higher market share in 2022.

- Based on disease type, the market is segmented into Bovine Viral Diarrhea (BVD), Bovine Tuberculosis (TB), Bovine Mastitis, Foot and Mouth Disease (FMD), and Other Disease Types.

- In terms of end users, the market is segmented into Veterinary Hospitals, Veterinary Clinics, and Other End-Users.

Bovine Diagnostics Market Share Analysis by Geography

The geographic scope of the bovine diagnostics market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

In North America, the bovine diagnostics market is currently in exponential growth during the forecast years. The US dominated the market in 2022. The bovine diagnostics market in the US has benefitted from rising government initiatives to control mastitis, zoonotic diseases, and tuberculosis diseases. Continuous research and developments in veterinary diagnostics resulting in bovine diagnostics new product launches. For instance, in October 2022, the Kansas State Veterinary Diagnostic Laboratory of the State University College of Veterinary Medicine developed test kit to detect two major blood-borne diseases in cattle. Researcher team at Kansas State Veterinary Diagnostic Laboratory developed a PCR diagnosis technique to detect endemic anaplasmosis and emerging Theileriosis. The test will allow cattle farmers and veterinarians to diagnose herds with disease-causing microorganisms and also help them effectively prevent and manage the veterinary diseases.

Bovine Diagnostics Market Regional Insights

The regional trends and factors influencing the Bovine Diagnostics Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Bovine Diagnostics Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Bovine Diagnostics Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,155.59 Million |

| Market Size by 2030 | US$ 2,011.15 Million |

| Global CAGR (2022-2030) | 7.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Bovine Diagnostics Market Players Density: Understanding Its Impact on Business Dynamics

The Bovine Diagnostics Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Bovine Diagnostics Market top key players overview

Bovine Diagnostics Market News and Recent Developments

The bovine diagnostics market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for innovations, business expansion, and strategies:

- In July 2023, PBD Biotech and Actiphage TB entered its third clinical trial. A ground-breaking phage-based molecular diagnostic has been agreed between its developer, PBD Biotech, the NIHR Respiratory Biomedical Research Centre, Leicester (UK)and University of Leicester. The study aims to validate the test's utility as a tuberculosis diagnostic. The phage-based diagnostic has the potential to detect TB progression. (Source: PBD Biotech and Actiphage TB Press Release)

Bovine Diagnostics Market Report Coverage and Deliverables

The “Bovine Diagnostics Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering the following areas:

- Bovine Diagnostics Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Bovine Diagnostics Market trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Bovine Diagnostics market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Bovine Diagnostics Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For