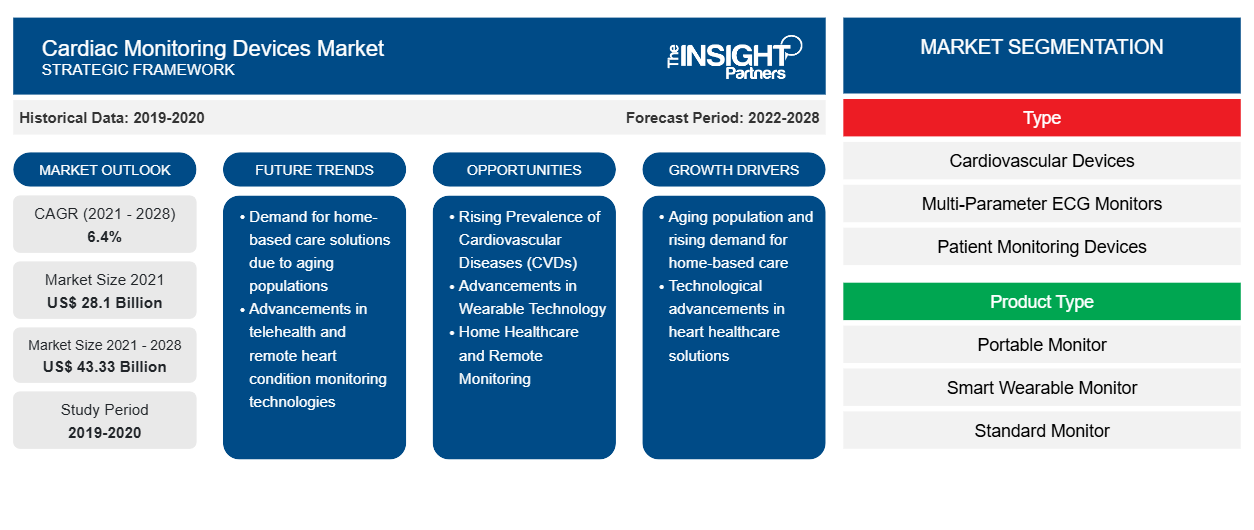

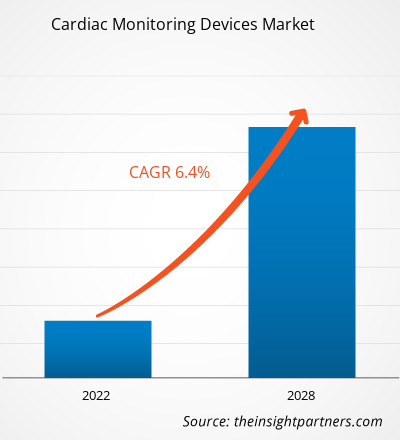

[Research Report] The cardiac monitoring devices market is projected to reach US$ 43,334.36 million by 2028 from US$ 28,098.08 million in 2021; it is expected to grow at a CAGR of 6.4% from 2021 to 2028.

A cardiac event monitor is a device used to record the heart's electrical activity (ECG) and keeps track of the heartbeat and rhythm., Cardiac event monitors are used when there is a need for long-term monitoring of symptoms that do not happen daily. Important heart health data can be tracked, recorded, and sent to patients’ doctors using a cardiac monitoring gadget, which reduces the need for frequent visits to the doctor's office, allowing the care team to monitor patients’ heart health from a distance.

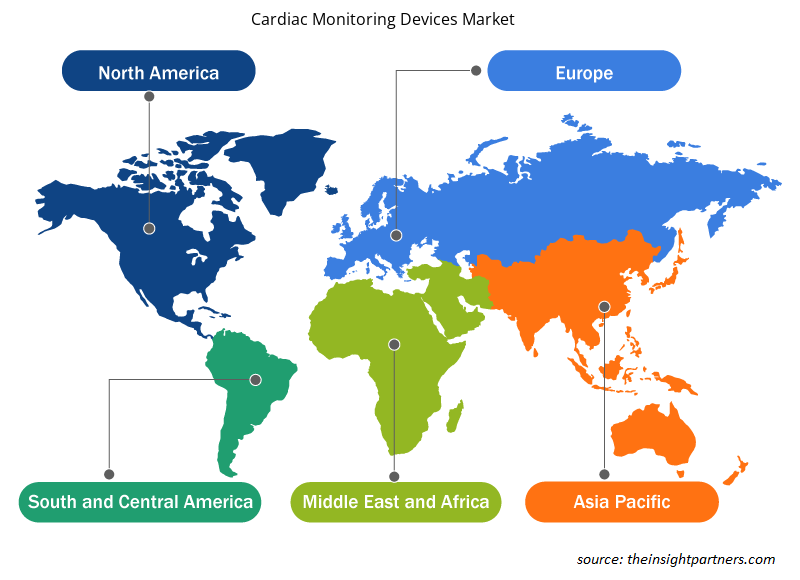

The global cardiac monitoring devices market is analyzed on the basis of type, product type, application, end user, and geography. Based geography, the cardiac monitoring devices market is broadly segmented into North America, Europe, Asia Pacific, the Middle East and Africa (MEA), and South and Central America. The report offers insights and in-depth analysis of the cardiac monitoring devices market, emphasizing parameters, such as market trends, technological advancements, and market dynamics, along with the analysis of the competitive landscape of the world's leading market players in the global cardiac monitoring devices market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cardiac Monitoring Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cardiac Monitoring Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Insights

Increase in Incidence of Cardiovascular Diseases Drives Global Cardiac Monitoring Devices Market Growth

In the last decade, the world witnessed notable developments in cardiac monitoring devices, offering physicians and patients new approaches to manage many diseases, including atrial arrhythmias, ventricular arrhythmias, and ventricular atrial fibrillation. The growing prevalence of cardiovascular diseases (CVDs) such as coronary heart diseases, sudden cardiac arrest, congenital heart diseases, heart failure, pulmonary hypertension, and pulmonary artery pressure (PA) encourages improved monitoring methods. The simplicity of use and the ability to detect cardiovascular diseases (CVDs) quickly are the factors adding to the popularity of cardiac monitoring devices. According to the World Health Organization (WHO), ~30 million people experience a stroke each year. Moreover, the American Heart Association states that more than 130 million people in the US are projected to have CVD by 2035.

The WHO estimates 17.9 million lives are lost due to CVDs every year, i.e., 32% of the total deaths reported globally. A few of the primary risk factors of CVDs include family history, ethnicity, and age; other risk factors include tobacco consumption, hypertension, obesity, high cholesterol, physical inactivity, diabetes, unhealthy diets, and alcohol consumption. Further, lifestyle changes lead to the rise in diabetes, hypertension, dyslipidemia, and obesity, contributing to a surge in CVD cases worldwide. Most CVD cases can be prevented through proactive monitoring and early diagnosis, which bolsters the need for cardiac monitoring devices. Thus, an increase in the incidence of cardiovascular diseases drives global cardiac monitoring devices market growth.

Rise in Number of Product Launches and Approvals Contributes Significantly to Global Cardiac Monitoring Devices Market Growth.

The global cardiac monitoring devices market is characterized by many small and big companies. To increase their market share, market players are taking up various strategies such as new product launches, regional expansion, and technological advancements. Cardiac monitoring devices are safer and more effective than ever with continued innovation and technological advances, leading to increased acceptance of cardiac monitoring devices. Leading players are investing in R&D to develop advanced technologies and gain more revenue share.

A few of the recent developments related to the global cardiac monitoring devices market are mentioned below:

- In May 2021, Medtronic plc announced the commercial launch of the SonarMed airway monitoring system in the US., The SonarMed airway monitoring system uses acoustic technology to check for endotracheal tube (ETT) obstruction and confirm position in real-time, giving physicians’ vital information make more informed and life-saving decisions for their patients.

- In July 2021, Medtronic plc announced US Food and Drug Administration (FDA) clearance for two AccuRhythm AI algorithms using the LINQ II insertable cardiac monitor (ICM). AccuRhythm AI applies artificial intelligence (AI) to cardiac rhythm event data collected by LINQ II to improve the accuracy of information received by physicians to diagnose better and treat abnormal cardiac rhythms.

- In July 2021, Abbott announced the launch of its latest implantable cardiac monitor (ICM), the Jot Dx, in theUS. With Jot Dx ICM, doctors and hospitals can view all abnormal cardiac rhythm data or use the "Key Episodes" option to inform through a unique feature that simplifies recorded arrhythmia rhythms. This technology enables remote detection of patient cardiac arrhythmias and improved diagnostic accuracy. Jot Dx ICM utilizes SyncUP, a personalized service that provides customized education and training to help patients connect to and stay connected to the ICM.

- In January 2022, MicroPort CRM was approved by Japanese regulatory agency PMDA for Alizea, the latest implantable pacemaker. These devices feature Bluetooth technology for optimized remote monitoring when combined with MicroPort CRM's already approved SmartView Connect home monitor in Japan.

- June 2021, Shenzhen Carewell Electronics Co., Ltd. launched the new ECG tablets NeoEC GT180 and NeoECGS120. Neo ECG enables hospitals and medical centers to perform smart diagnostics by supporting connectivity with the AIECG platform.

The active participation of market players in product innovation and development and increase in approvals of products are fueling the growth of the global cardiac monitoring devices market in the coming years.

Type Insights

Based on type, the global cardiac monitoring devices market is segmented into cardiovascular devices, multi-parameter ECG monitors, patient monitoring devices, ambulatory cardiac monitoring, and cardiac monitors. In 2020, the cardiovascular devices segment held the largest share of the market. However, the market for the patient monitoring devices segment is expected to grow at the highest CAGR during the period from 2021 to 2028. Patient monitoring devices are increasing with a growing number of chronic disorders such as stroke, coronary heart disease, sudden cardiac arrest, congenital heart diseases, and other cardiovascular diseases. Temperature monitoring, continuous glucose monitoring, and pulsed oximetry blood pressure monitoring are several applications for wearable patient monitoring, biosensors, and smart implants. The surge in demand for the vital parameters monitors is bolstering this segment's market.

Product Type Insights

Based on product type, the global cardiac monitoring devices market is segmented into portable monitor, smart wearable monitor, and standard monitor. In 2020, the standard monitor segment held the largest share of the market. Moreover, the market for the smart wearable monitor segment is expected to grow at the highest CAGR during the period from 2021 to 2028. PMMA is a plastic with excellent mechanical properties and minimal toxicity. Technological advancements penetrate our daily lives, and a growing trend encourages the usage of commercial smart wearable monitors for health management. In the era of remote, increasingly personalized patient care catalyzed by the COVID-19 pandemic, the cardiovascular community is demanding wearable technologies for the need and their wide range of clinical applications. The surge in demand for the smart wearable monitor is bolstering this segment's growth.

Application Insights

Based on application, the global cardiac monitoring devices market is segmented into coronary heart diseases, sudden cardiac arrest, stroke, arrhythmia, congenital heart diseases, heart failure, pulmonary hypertension, heart function (HF/LVEDP), pulmonary artery pressure (PA), and others. The coronary heart diseases segment held the largest market share in 2020, and is further expected to be the largest shareholder in the market by 2028. The high prevalence and increased global mortality of chronic diseases such as diabetes, hypertension, and cholesterol levels, which increase the risk of suffering from cardiovascular disease, accelerate the number of coronary heart disease cases.

End-use Insights

Based on end user, the global cardiac monitoring devices market is segmented into hospitals, ambulatory surgery centers (ASCs), and clinics. The hospitals segment held the largest market share in 2020, and it is further expected to be the largest shareholder in the market by 2028. The growth of the segments is attributed to the growing number of cases of cardiovascular diseases. Hospitals are the primary healthcare centers where cardiovascular diseases such as coronary heart diseases, stroke, sudden cardiac arrest, arrhythmia are extensively treated, thereby bolstering the growth of this segment.

Product launches and mergers and acquisitions are the highly adopted strategies by the players operating in the global cardiac monitoring devices market. A few of the recent key product developments are listed below:

- In July 2021, Abbott launched the Jot Dx insertable cardiac monitor in the US market to detect irregular heart rhythms.

- In July 2021, Two AccuRhythm AI algorithms for use with the LINQ II insertable cardiac monitor (ICM) were approved by the US Food and Drug Administration (FDA) (ICM). AccuRhythm AI uses artificial intelligence (AI) to improve the accuracy of heart rhythm event data acquired by LINQ II, allowing physicians to diagnose better and treat aberrant heart rhythms.

COVID-19 pandemic created a demand to monitor patients treated in emergency departments (EDs) at home for clinical deterioration, such as hypoxemia, to help raise hospital capacity. Hospitalized patients were at increased risk for unrecognized clinical deterioration with the increased number of patients coupled with high staffing ratios for all doctors' workload. The pandemic accelerated monitoring and therapy based on patient needs and risks, and a combination of technological advances, medical urgency, and payment policy supported this change. The COVID-19 pandemic marks the beginning of a new era of cardiac management with remote patient monitoring (RPM). Real-time cardiovascular disease monitoring based on wearable medical devices can effectively reduce COVID 19 mortality. The COVID 19 pandemic accelerated the implementation of cardiac monitoring devices worldwide. The demand for cardiac monitoring devices is expected to grow continuously in the forecast period as there is a rise in the number of product approvals and launches by many market players. Thus, the COVID-19 pandemic has a significant positive impact on the cardiac monitoring devices market.

Cardiac Monitoring Devices Market Regional Insights

The regional trends and factors influencing the Cardiac Monitoring Devices Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Cardiac Monitoring Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cardiac Monitoring Devices Market

Cardiac Monitoring Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 28.1 Billion |

| Market Size by 2028 | US$ 43.33 Billion |

| Global CAGR (2021 - 2028) | 6.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Cardiac Monitoring Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Cardiac Monitoring Devices Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cardiac Monitoring Devices Market are:

- Medtronic

- Abbott

- Boston Scientific Corporation

- iRhythm Technologies, Inc.

- GE Healthcare

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cardiac Monitoring Devices Market top key players overview

Cardiac Monitoring Devices – Market Segmentation

Cardiac Monitoring Devices - By Type

- Cardiovascular Devices

- Event Monitors

- Electrocardiography (ECG)

- Cardiac Catheters

- Stents

- Defibrillators

- Guidewires

- Pacemakers

- Heart Valves

- Others

- Patient Monitoring Devices

- Cardio Monitoring Devices

- Anesthesia Monitoring Devices

- Haemodynamic Monitoring Devices

- Fetal and Neonatal Monitoring Devices

- Stress Management Devices

- Stress Echocardiography

- Treadmill Stress Tests

- Myocardial Perfusion PET Stress Test

- Nuclear Stress Test (SPECT)

- Others

- Multi-Parameter ECG Monitors

- Cardiac Monitors

- Cardiac Event Monitoring (CEM)

- Holter

- Extended Holter/AECG

- Others

- Ambulatory Cardiac Monitoring

- Event Recorders

- Implantable Loop Recorders

- Mobile Cardiac Telemetry

- Others

- Others

Cardiac Monitoring Devices -

By Product Type- Standard Monitor

- Portable Monitor

- Smart Wearable Monitor

Cardiac Monitoring Devices -

By Application- Coronary Heart Diseases

- Stroke

- Sudden Cardiac Arrest

- Arrhythmia

- Heart Failure

- Pulmonary Hypertension

- Congenital Heart Diseases

- Pulmonary Artery Pressure (PA)

- Heart Function (HF/LVEDP)

- Others

Cardiac Monitoring Devices -

By End User- Hospitals

- Clinics

- Ambulatory Surgery Centers

- Cardiac Centers

- Home Care

- Others

Cardiac Monitoring Devices -

By Geography- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- Italy

- Spain

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

- South and Central America (SCAM)

- Brazil

- Argentina

- Rest of South and Central America

Company Profiles

- Medtronic

- Abbott

- Boston Scientific Corporation

- iRhythm Technologies, Inc.

- GE Healthcare

- Biotronik, Inc.

- SCHILLER Healthcare India Pvt. Ltd

- Koninklijke Philips N.V.

- MicroPort Scientific Corporation

- Asahi Kasei Corporation

- Hill-Rom Holdings, Inc.

- Nihon Kohden Corporation

- AliveCor, Inc

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- ACS Diagnostics

- BTL

- Hemodynamics Company LLC

- Mortara Instruments

- LivaNova PLC

- TZ Medical

- Amiitalia

- RHYTHMEDIX

- Medi-Lynx Cardiac Monitoring, LLC

- Infinium Medical

- Bionet America, Inc.

Frequently Asked Questions

What is the market CAGR value of the cardiac monitoring devices market during the forecast period?

The CAGR value of the cardiac monitoring devices market during the forecasted period of 2021-2028 is 6.4%.

Which application held the largest share in the cardiac monitoring devices market?

The coronary heart diseases segment dominated the North America cardiac monitoring devices market and accounted for the largest market share of 23.38% in 2021.

Which type led the cardiac monitoring devices market?

The cardiovascular devices segment held the largest share of the market in the global cardiac monitoring devices market and held the largest market share of 32.11% in 2021.

What are cardiac monitoring devices?

A cardiac event monitor is a device that is used to record the heart's electrical activity (ECG). It keeps track of the heartbeat and rhythm. When there is a need for long-term monitoring of symptoms that don't happen every day, cardiac event monitors are employed. Important heart health data can be tracked, recorded, and sent to the doctor in real-time using a cardiac monitoring gadget. This reduces the need for frequent visits to the doctor's office, allowing the care team to monitor heart health from a distance.

Which product type held the largest share in the cardiac monitoring devices market?

The standard monitor segment dominated the global cardiac monitoring devices market and accounted for the largest market share of 40.62% in 2021.

Which end user held the largest share in the cardiac monitoring devices market?

The hospital segment dominated the North America cardiac monitoring devices market and held the largest market share of 32.36% in 2021.

Who are the key players in the cardiac monitoring devices market?

The cardiac monitoring devices market majorly consists of players such as Medtronic; Abbott; Boston Scientific Corporation; iRhythm Technologies, Inc.; GE Healthcare; Biotronik, Inc.; SCHILLER Healthcare India Pvt. Ltd; Koninklijke Philips N.V.; MicroPort Scientific Corporation; Asahi Kasei Corporation; Hill-Rom Holdings, Inc.; Nihon Kohden Corporation; AliveCor, Inc; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; BPL Medical Technologies; ACS Diagnostics; BTL; Lepu Medical Technology Co. Ltd.; Hemodynamics Company LLC; Mortara Instruments; LivaNova PLC; TZ Medical and Amiitalia amongst others.

Which country is expected to witness significant demand for the cardiac monitoring devices market in the coming years?

Global cardiac monitoring devices market is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa and South & Central America. In North America, the U.S. is the largest market for acetaminophen reagents. The market is expected to grow as coronary heart disease is the main cause of death in the United States and is rapidly becoming the world's leading cause of death. In the United States, the growing senior population is driving up the use of patient monitoring equipment. According to US Bureau of Labor Statistics data, the number of Americans aged 65 and over is expected to more than double (from 46 million in 2016 to over 98 million by 2060), with the 65-and-older age group accounting for nearly 24% of the total population, up from 15%. According to the Centers for Disease Control and Prevention (CDC), in the United States, Heart disease is the leading cause of death for men, women, and people of most racial and ethnic groups.

Which are the top companies that hold the market share in cardiac monitoring devices market?

Boston Scientific Corporation and Abbott Laboratories are the top two companies that hold huge market shares in the cardiac monitoring devices market.

What are the driving factors for the cardiac monitoring devices market across the globe?

Key factors that are driving the growth of this market are the increase in the incidence of cardiovascular diseases, surge in geriatric population base and rise in the number of product launches and approvals are expected to boost the market growth for the cardiac monitoring devices over the years.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Cardiac Monitoring Devices Market

- Medtronic

- Abbott

- Boston Scientific Corporation

- iRhythm Technologies, Inc.

- GE Healthcare

- Biotronik, Inc.

- SCHILLER Healthcare India Pvt. Ltd

- Koninklijke Philips N.V.

- MicroPort Scientific Corporation

- Asahi Kasei Corporation

- Hill-Rom Holdings, Inc.

- Nihon Kohden Corporation

- AliveCor, Inc

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- BPL Medical Technologies

- ACS Diagnostics

- BTL

- Lepu Medical Technology Co. Ltd.

- Hemodynamics Company LLC

- Mortara Instruments

- LivaNova PLC

- TZ Medical

- Amiitalia

- RHYTHMEDIX

- Medi-Lynx Cardiac Monitoring, LLC

Get Free Sample For

Get Free Sample For