Cleanroom Technology Market Key Players and Forecast by 2031

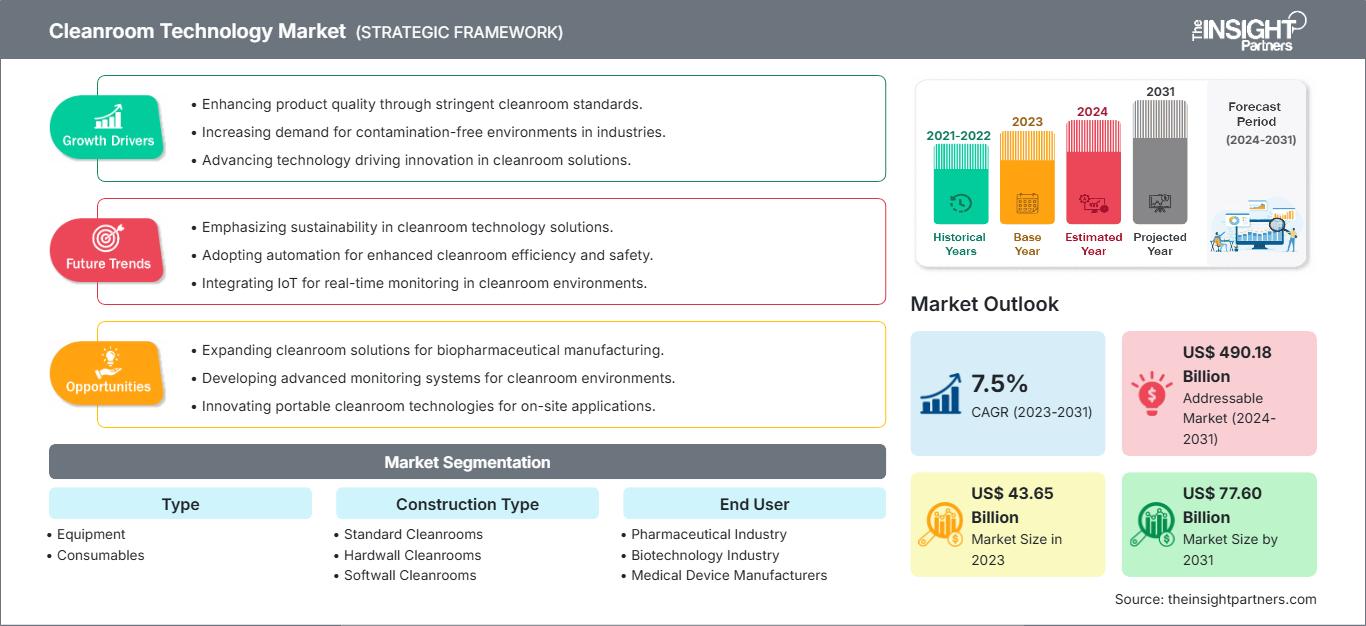

Cleanroom Technology Market Size and Forecast (2021-2031), Global and Regional Growth Opportunity Analysis Report Coverage: by Type {Equipment [Cleanroom Air showers, HVAC Systems, Laminar Air Flow Systems, High Efficiency Filters, Desiccator Cabinets, Fan Filter Units, Isolators, RABS, Dry Box, and Others] and Consumables [Apparels, Gloves, Wipes, Vacuum Systems, Cleaning Utensils (Mopping, ATFT, Trolley, and Automated Cleaning), Disinfectants, and Others]}, Construction Type (Standard Cleanrooms, Hardwall Cleanrooms, Softwall Cleanrooms, Pass-Through Cabinets), End User (Pharmaceutical Industry, Biotechnology Industry, Medical Device Manufacturers, Hospitals, Microelectronics, and Other End Users), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Dec 2024

- Report Code : TIPRE00004183

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 321

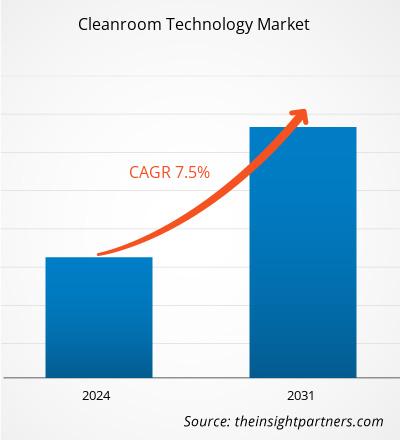

The cleanroom technology market size is projected to reach US$ 77.60 billion by 2031 from US$ 43.65 billion in 2023. The market is estimated to record a CAGR of 7.5% during 2023–2031. The integration of smart technologies with cleanroom technology is likely to bring new trends to the market in the coming years.

Cleanroom Technology Market Analysis

The cleanroom technology market is experiencing significant growth, driven by the increasing demand for contamination-free environments across various industries, particularly pharmaceuticals, biotechnology, and electronics. The pharmaceutical sector, in particular, is a key driver as the need for sterile environments to produce medications and vaccines becomes more critical, especially after the onset of the COVID-19 pandemic. Additionally, advancements in cleanroom design and technology, such as modular cleanrooms and improved filtration systems, present substantial opportunities for innovation and investment. Companies increasingly focus on integrating digital solutions to enhance cleanroom management and monitoring, propelling the market growth. As industries continue to prioritize safety and efficiency, the cleanroom technology market is poised for substantial expansion, offering lucrative opportunities for stakeholders involved in developing and implementing cleanroom solutions.

Cleanroom Technology Market Overview

In the pharmaceutical industry, cleanrooms are critically important in preventing airborne particles from affecting the microbiological and physical properties of drugs. The need for pharmaceuticals and biologics development and manufacturing processes to comply with several local and international standards for product approvals and the demand for therapeutic drugs and vaccines across the globe is growing. As a result, biopharmaceutical and pharmaceutical companies are adopting cleanroom technology to ensure maximum cleanliness and minimal contamination in the products, production sites, and equipment. In May 2022, Termovent, a Serbia-based cleanroom technology company, completed cleanroom expansion for Bionika, a pharmaceutical company in North Macedonia. In November 2022, INCOG BioPharma partnered with AES Clean Technology for its modular cleanroom technology. Under this partnership, INCOG BioPharma leveraged the AES Compass and AES Faciliflex modular cleanroom solutions offered by AES Clean Technology, facilitating the quick and safe construction of production facilities. In December 2020, WHP, a multi-disciplinary engineering company, built a new viral vector manufacturing center for Oxford Biomedica. Furthermore, Phase 1 of the expansion of this new manufacturing site includes the renovation of the building into four GMP cleanroom suites and fill and finish production areas, offices, warehousing, and quality-controlled laboratories. The new GMP facility is suitable for the production of vaccines, such as the large-scale manufacturing of COVID-19 vaccine and gene therapy products. The facility design comprises cleanroom architecture; heating, ventilation, and air conditioning (HVAC) system; and other process and critical utility systems. Thus, the rising adoption of cleanroom technology among key pharmaceutical manufacturers fuels the cleanroom technology market growth.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCleanroom Technology Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cleanroom Technology Market Drivers and Opportunities

Rising Advancements in Cleanroom Technology

Advancements in cleanroom technology range from the incorporation of high-efficiency particulate absorption (HEPA) filters to unidirectional airflow systems and modular cleanrooms. The use of softwalled modular materials in cleanroom construction eliminates the need to rebuild the facilities. For instance, as per the article published by cleanroom technology in June 2024, Total Clean Air (TCA), an expert in cleanroom construction and containment specialist, launched its new portable cleanroom product—The Airelab. The product features an advanced filtration system equipped with the TCA Pulse 1000 for superior air quality and quiet operation. Unlike traditional inflatable cleanrooms, The Airelab is configured for vertical or horizontal HEPA FFU mounts. Its structural integrity is maintained upon inflation and does not require a continuous pump or any other support mechanisms. The Airelab offers rapid deployment as it can be delivered anywhere within 24 hours and 48 hours within the UK and Europe, respectively. It is designed to meet ISO Class 6, 7, and 8 standards, ensuring a controlled and contaminant-free environment. Moreover, in September 2024, Nortek Air Solutions CleanSpace published a press article to announce the relaunch of its modular cleanroom solution, SERVICOR, to address the increasing demand for adaptable and scalable cleanrooms that achieve necessary filtration levels. The product meets ANNEX 1 requirements and recommendations, including a flush wall system, a coving system, upgraded interlocks, improved gaskets, and ceiling modifications.

Cleanroom technology-based products are increasingly focusing on sustainability and energy efficiency to reduce environmental impact and operational costs, using LED lighting, advanced HVAC systems, and other technologies. LED lighting is more energy-efficient and has a longer service life than traditional options. Additionally, smart HVAC control optimizes the environment by minimizing energy usage and enhancing overall efficiency. In January 2022, Clean Rooms International published a press article to announce the launch of its Flow-Thru Light Troffer, specifically designed for cleanroom applications. This troffer is ideal for cleanrooms with limited ceiling space or lighting, where cleanliness is crucial. It is suitable for environments from Class 10 to Class 100,000. Thus, the rising advancements in cleanroom technology boost the growth of the cleanroom technology market.

Escalating Development of Cleanroom Technology-Based Products in Developing Economies

Countries in Asia Pacific, Latin America, and the Middle East are providing affordable and efficient cleanroom solutions tailored to local needs. The rising number of government initiatives, the increasing number of pharmaceutical companies, and favorable regulatory policies are a few factors boosting local manufacturing in countries such as India, Brazil, Argentina, and South Africa. In March 2021, Sai Life Sciences, one of India’s fastest-growing CDMOs, announced the opening of a new cleanroom block at its cGMP API & Intermediate Manufacturing campus in Bidar, India. In addition, investments by international players to support technological advancements in pharmaceuticals are rapidly increasing in Asia Pacific. In March 2023, Lindström India, a subsidiary of Finnish Lindström Oy, expanded its presence in South India by opening its second cleanroom facility and relocating to a larger workwear facility in Hyderabad, Telangana. This expansion doubled its workwear capacity, reflecting the company's rapid growth and increased investments in India. Lindström operated 11 workwear and 2 cleanroom business units in India, managing 2.3 million garments locally and nearly 13 million worldwide, for a total of 21 million products across all service lines.

With significant investments in the development of drugs and vaccines, the demand for cleanroom technology products, including equipment and consumables, is also increasing in developing economies. In February 2023, BioNTech launched its BioNTainer, a modular cleanroom aimed to provide end-to-end GMP vaccine manufacturing in Senegal and South Africa. The vaccines produced through this pan-African infrastructure were aimed at residents of African Union member states to improve access to innovative medicines. Therefore, the escalating demand for cleanroom technology-based products in developing economies is expected to offer lucrative opportunities for the cleanroom technology market growth during 2023–2031.

Cleanroom Technology Market Report Segmentation Analysis

Key segments that contributed to the derivation of the cleanroom technology market analysis are type, construction type, end user, and geography.

- The cleanroom technology market, based on type, is segmented into equipment and consumables. The equipment segment held a larger share in the cleanroom technology market in 2023, and it is expected to register a significant CAGR during 2023–2031.

- Based on construction type, the market is segmented into standard cleanrooms, hardwall cleanrooms, softwall cleanrooms, and pass-through cabinets. The standard cleanrooms segment held the largest share of the cleanroom technology market in 2023.

- The cleanroom technology market, based on end user, is segmented into pharmaceutical industry, biotechnology industry, medical device manufacturers, hospitals, microelectronics, and other end users. The microelectronics segment held the largest share of the cleanroom technology market in 2023, and it is expected to register a significant CAGR during 2023–2031.

Cleanroom Technology Market Share Analysis by Geography

The geographic scope of the cleanroom technology market report is mainly divided into five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. North America dominated the market in 2023. In the pharmaceutical and biotechnology sector, manufacturing involves strict norms that require the utilization of cleanrooms for the safety and effectiveness of products. To create a regulatory environment, companies are compelled to invest in modern cleanroom technologies for full compliance with these norms. Biologics development requires highly controlled environments to prevent contamination and ensure the integrity of sensitive products. For instance, biopharmaceutical companies spent approximately US$ 97 billion in research and development in the US in 2017, which is more than any other industry, as per the Pharmaceutical Research and Manufacturers Association (PhRMA).

According to the Advanced Medical Technology Association, more than 6,500 medtech companies in the US, mainly small- and medium-sized enterprises, are working toward their medical innovation every day. Increased investments into research and development in the pharmaceutical sectors are driving innovation, which further creates the need to establish cleanrooms for safe experiments and product development.

Cleanroom technologies in Canada have been developed mainly owing to the country’s strong and flourishing healthcare and pharmaceutical industries, coupled with an increasing awareness of regulatory compliance and quality assurance. Canada is promoting strategic developments by operating key players. For instance, in September 2024, BioTalent Canada launched a new cleanroom certification initiative that will fill the skills gap and improve workforce readiness for the biomanufacturing sector in the country.

The government of Canada has implemented major changes in regulating processes in pharmaceutical and biotechnology industries to achieve the highest level of cleanliness and minimize contamination using the most advanced cleanroom technology. An innovative regulatory frame boosts investment in cleanroom infrastructure, leading to a rise in state-of-the-art facilities for various activities in the pharmaceuticals, biotechnology, and medical devices industries.

The rise in research and development in the field of life sciences has accelerated the need for cleanroom technologies in Canada-based companies. Companies are investing in research and development projects to support the development of new therapeutics and medical devices, which require the use of safe and controlled environments to develop effective products. The production processes of biologics often necessitate controls over contamination levels with the help of cleanrooms. According to Statistics Canada, businesses across the country spent a record US$ 30.4 billion on in-house research and development in 2022, an increase of 9.4% from 2021. Also, the growing demand for personalized medicine and advanced therapies requires cleanroom solutions that can adapt to changing product and process requirements.

Cleanroom Technology Market Regional Insights

The regional trends and factors influencing the Cleanroom Technology Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Cleanroom Technology Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Cleanroom Technology Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 43.65 Billion |

| Market Size by 2031 | US$ 77.60 Billion |

| Global CAGR (2023 - 2031) | 7.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Cleanroom Technology Market Players Density: Understanding Its Impact on Business Dynamics

The Cleanroom Technology Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Cleanroom Technology Market top key players overview

Cleanroom Technology Market News and Recent Developments

The cleanroom technology market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the cleanroom technology market are listed below:

- Ansell acquired Kimberly-Clark's Personal Protective Equipment (KCPPE) business, bolstering its global leadership in personal protection solutions, expanding its product portfolio, and enhancing its service capabilities. (Source: Ansell, Company Website, February 2024).

- Cleanroom shop partnered with Kimberly Clark to expand their Cleanroom personal protective clothing and wipes range, offering solutions for healthier, safer, and more productive environments, including laboratories and cleanrooms, to maintain cleanliness and contamination control. (Source: Kimberly Clark, Company Website, November 2023)

Cleanroom Technology Market Report Coverage and Deliverables

The "Cleanroom Technology Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Cleanroom technology market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Cleanroom technology market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Cleanroom technology market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the cleanroom technology market

- Detailed company profiles

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For