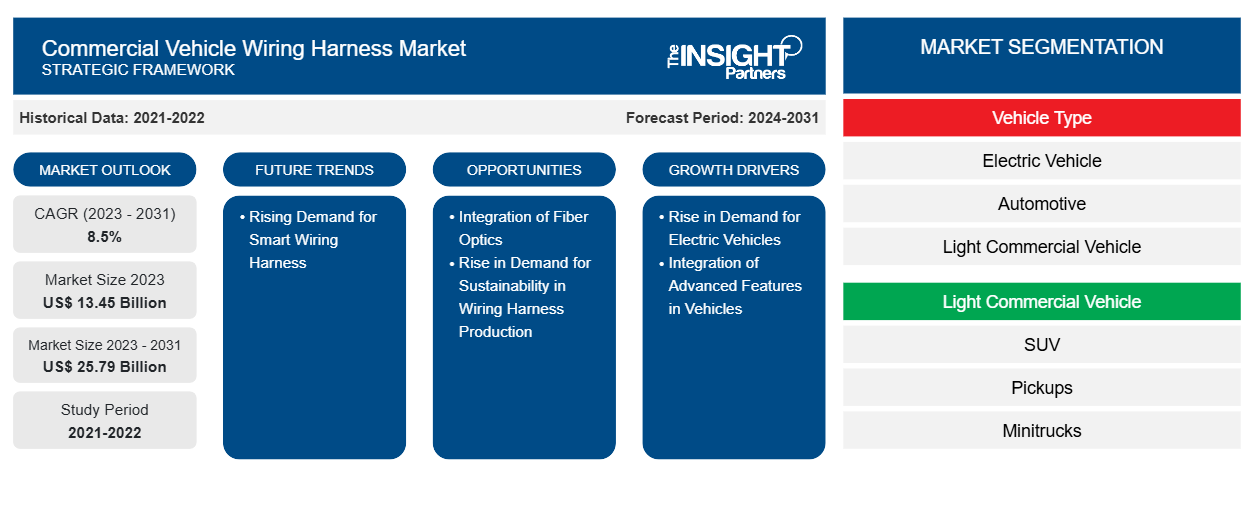

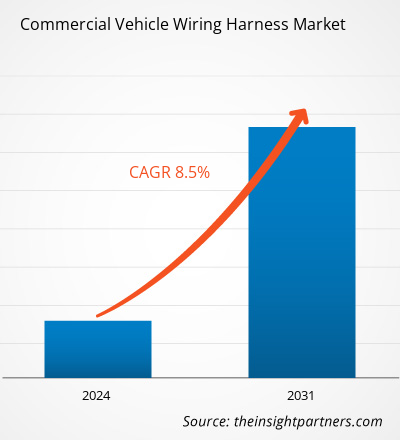

The commercial vehicle wiring harness market size is expected to reach US$ 25.79 billion by 2031 from US$ 13.45 billion in 2023. The market is estimated to record a CAGR of 8.5% from 2023 to 2031. The emergence of smart wiring harnesses is likely to bring in new trends in the market.

Commercial Vehicle Wiring Harness Market Analysis

The demand for electric vehicles (EVs) is increasing worldwide, particularly due to the strong government policies that support its adoption and growing environmental concerns. This rise in the demand for EVs is fueling the growth of the commercial vehicle wiring harness market, as wire harnesses play a vital role in handling the energy and information flow in vehicles. In addition, the growing integration of advanced features such as self-driving cars and advanced driver assistance systems (ADAS) is fueling the growth of the market. Furthermore, the growing integration of fiber optics for high connectivity and increasing demand for sustainability in wiring harness production is anticipated to create an opportunity for the growth of the commercial vehicle wiring harness market. Moreover, the increasing demand for smart wire harnesses, which can be compatible with any vehicle, is expected to further propel the growth of the market during the forecast period.

Commercial Vehicle Wiring Harness Market Overview

The wiring harness is a collection of electrical cables or wire assemblies that connect all of the electrical and electronic components in an automobile, such as sensors, electronic control units, batteries, and actuators. The wiring harness manages the flow of energy and information inside the electrical system to enable main automotive tasks, such as steering and braking, as well as secondary car functions, such as ventilation and infotainment. Wire harnesses link several wires into non-flexible bundles, making them safer than loose wires and reducing the chance of shorts in electrical circuits. In addition, wiring harnesses are composed of durable materials. They are built such that these bundles may function well in harsh conditions while carrying huge power loads. Furthermore, wiring harnesses help improve the fuel efficiency of any car, which is further raising their demand in the automotive industry.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Commercial Vehicle Wiring Harness Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Commercial Vehicle Wiring Harness Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Commercial Vehicle Wiring Harness Market Drivers and Opportunities

Rise in Demand for Electric Vehicles

Electric vehicle (EV) sales are increasing due to concerns regarding environmental protection and government policies favoring the adoption of low-emission or zero-emission vehicles. Also, governments of different countries are offering subsidies and tax rebates to citizens to increase the adoption of EVs. The government authorities are taking various initiatives to promote EVs globally. Several US states are taking initiatives by providing financial incentives, including rebates, tax credits, and registration fee reductions, thereby promoting EV adoption in the country. For instance, in 2021, the government of Colorado offered a tax credit of US$ 4,000 on the purchase of a light-duty EV. Similarly, the government of Connecticut accepts a reduced biyearly vehicle registration fee of US$ 38 for EVs. Such government initiatives are leading to increased EV sales worldwide. According to IEA’s annual Global EV Outlook 2024, ~14 million new electric cars were registered in 2023 worldwide.

In 2023, the sales of electric cars were 3.5 million higher than in 2022, an increase of 35% year-on-year. As per the same source, electric cars accounted for ~18% of all cars sold in 2023, which was an increase from 14% in 2022. Also, in 2023, of the total number of new electric cars registered globally, China registered ~60% of new electric cars, Europe registered 25% of new electric cars, and the US registered 10% of new electric cars. The number of new electric car registrations reached 8.1 million in China in 2023, increasing by 35% compared to 2022. China is the world’s largest EV producer, producing 64% of global EV volume. Thus, the rise in sales of EVs boosts the demand for wire harnesses as they play a vital role in handling the energy and information flow within EVs.

Integration of Fiber Optics

The growing reliance on fiber optic cables is becoming a cornerstone of innovation and efficiency in the rapidly changing automobile industry. As automobiles become more connected with new technology, the use of automotive fiber optic cables becomes critical in addressing the increased need for quicker data transmission and better performance. Fiber optic cables boost in-car entertainment and information systems, providing passengers and drivers with an unrivaled audio-visual experience that dramatically increases user happiness and overall driving experience. In addition, fiber optics can provide real-time vehicle diagnostics, enhanced driver assistance systems, and autonomous driving capabilities by allowing for quick data transfer, which is critical for split-second decision-making. Its application in automobile design reduces vehicle weight, resulting in more fuel-efficient and environmentally friendly vehicles.

Fiber optics are critical in systems such as adaptive cruise control, collision avoidance, and lane departure warnings, which require quick data transfer. Their application ensures that safety measures are not only more effective but also more reliable, giving drivers a greater sense of confidence. Moreover, using fiber optic cables in in-vehicle communication systems allows for a more seamless and efficient flow of information, which is critical for the proper functioning of modern safety measures. This real-time communication improves vehicle performance and marks a significant step in automotive safety innovation, paving the way for future vehicle technology advancements and moving the industry to greater levels of passenger protection. Thus, the growing integration of fiber optics in vehicles is expected to boost the demand for wire harnesses during the forecast period.

Commercial Vehicle Wiring Harness Market Report Segmentation Analysis

Key segments that contributed to the derivation of the commercial vehicle wiring harness market analysis are vehicle type, light commercial vehicle, and medium and heavy commercial vehicle.

- By vehicle type, the commercial vehicle wiring harness market is segmented into electric vehicles, automotive, light commercial vehicles (LCV), and medium and heavy commercial vehicles (MHCVs). The automotive segment held the largest share of the commercial vehicle wiring harness market in 2023.

- The commercial vehicle wiring harness market for light commercial vehicles (LCVs) is subsegmented into SUVs, pickups, mini-trucks, and minivans. The SUV segment held the largest share of the commercial vehicle wiring harness market in 2023.

- The commercial vehicle wiring harness market for medium and heavy commercial vehicles (MHCV) is subsegmented into medium and heavy trucks, heavy mining vehicles, heavy construction vehicles, heavy agriculture vehicles, and medium agriculture vehicles/tractors. The medium and heavy trucks segment dominated the commercial vehicle wiring harness market in 2023.

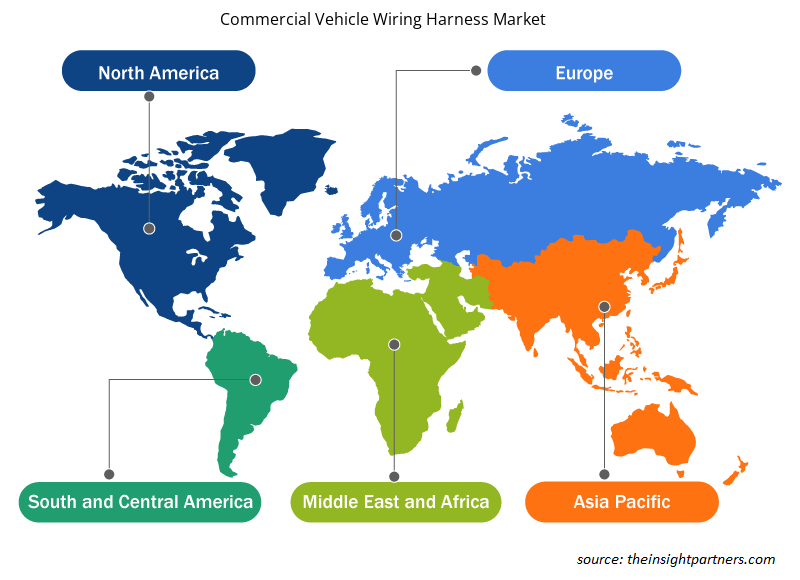

Commercial Vehicle Wiring Harness Market Share Analysis by Geography

- The commercial vehicle wiring harness market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific dominated the market in 2023, followed by North America and Europe.

- North America witnessed tremendous growth in EV sales in 2023. According to the International Energy Agency’s (IEA) annual Global EV Outlook 2024, new electric car registrations in the US reached 1.4 million in 2023, accounting for a rise of more than 40% compared to 2022. Various commercial vehicle wiring harness market players in the region are taking various initiatives to build awareness about the benefits of these components. For instance, upon the success of conferences hosted in 2022 and 2023, Süddeutscher Verlag Events GmbH plans to host its third US Automotive Wire Harness & EDS Conference at Dearborn, Michigan, on October 28–29, 2024. These events are planned to educate and provide OEMs, wire harness developers, Tier1 and Tier2 suppliers, high-voltage specialists, and other innovative suppliers with knowledge on the manufacturing and designing of commercial vehicle wiring harnesses along with their benefits in harsh conditions.

Commercial Vehicle Wiring Harness Market Regional Insights

The regional trends and factors influencing the Commercial Vehicle Wiring Harness Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Commercial Vehicle Wiring Harness Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Commercial Vehicle Wiring Harness Market

Commercial Vehicle Wiring Harness Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 13.45 Billion |

| Market Size by 2031 | US$ 25.79 Billion |

| Global CAGR (2023 - 2031) | 8.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Commercial Vehicle Wiring Harness Market Players Density: Understanding Its Impact on Business Dynamics

The Commercial Vehicle Wiring Harness Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Commercial Vehicle Wiring Harness Market are:

- Motherson Sumi Systems Ltd.

- AME Systems (VIC) Pty Ltd.

- Spark Minda

- Yazaki Corp

- Sumitomo Electric Industries Ltd

- Nexans SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Commercial Vehicle Wiring Harness Market top key players overview

Commercial Vehicle Wiring Harness Market News and Recent Developments

The commercial vehicle wiring harness market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the commercial vehicle wiring harness market are listed below:

- Lear Corporation, one of the global automotive technology leaders in Seating and E-Systems, announced that it has acquired M&N Plastics, a privately owned, Michigan-based injection molding specialist and manufacturer of engineered plastic components for automotive electrical distribution applications.

(Source: Lear Corporation, Press Release, March 2024)

- Japanese company Sumitomo Electric Wiring Systems Inc. signed an initial agreement with Egypt's General Authority for Investment and Free Zones to establish the world's largest factory for electric vehicle wiring harnesses in Egypt. The factory will be set up in a free zone of the 10th of Ramadan City in an area of 150,000 square meters. The project involves investments of about US$ 100 million for exporting the products to global car manufacturers in Europe and the Middle East.

(Source: Sumitomo Electric Wiring Systems Inc., Press Release, April 2023)

Commercial Vehicle Wiring Harness Market Report Coverage and Deliverables

The "Commercial Vehicle Wiring Harness Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Commercial vehicle wiring harness market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Commercial vehicle wiring harness market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Commercial vehicle wiring harness market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the commercial vehicle wiring harness market

- Detailed company profiles

Frequently Asked Questions

What are the future trends of the commercial vehicle wiring harness market?

Rising demand for smart wiring harness are expected to drive the growth of the commercial vehicle wiring harness market in the coming years.

Which key players hold the major market share of the commercial vehicle wiring harness market?

The key players holding majority shares in the commercial vehicle wiring harness market include Motherson Sumi Systems Ltd., AME Systems (VIC) Pty Ltd., Spark Minda, Yazaki Corp, Sumitomo Electric Industries Ltd, Nexans SA, Furukawa Electric Co Ltd, Lear Corp, DRÄXLMAIER Group, and ECOCABLES.

What are the driving factors impacting the commercial vehicle wiring harness market?

Rise in demand for electric vehicles and integration of advanced features in vehicles are driving factors in the commercial vehicle wiring harness market.

What is the estimated global market size for the commercial vehicle wiring harness market in 2023?

The commercial vehicle wiring harness market was estimated to be valued at US$ 13.45 billion in 2023 and is anticipated to grow at a CAGR of 8.5% over the forecast period.

Which is the leading vehicle type segment in the commercial vehicle wiring harness market?

The automotive segment led the commercial vehicle wiring harness market with a significant share in 2023.

What will the commercial vehicle wiring harness market size be by 2031?

The commercial vehicle wiring harness market is expected to reach US$ 25.79 Billion by 2031.

Which is the fastest-growing region in the commercial vehicle wiring harness market?

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Commercial Vehicle Wiring Harness Market

- Motherson Sumi Systems Ltd.

- AME Systems (VIC) Pty Ltd.

- Spark Minda

- Yazaki Corp

- Sumitomo Electric Industries Ltd

- Nexans SA

- Furukawa Electric Co Ltd

- Lear Corp

- DRÄXLMAIER Group

- ECOCABLES

Get Free Sample For

Get Free Sample For