Commercial Vehicle Wiring Harness Market Segments and Growth by 2031

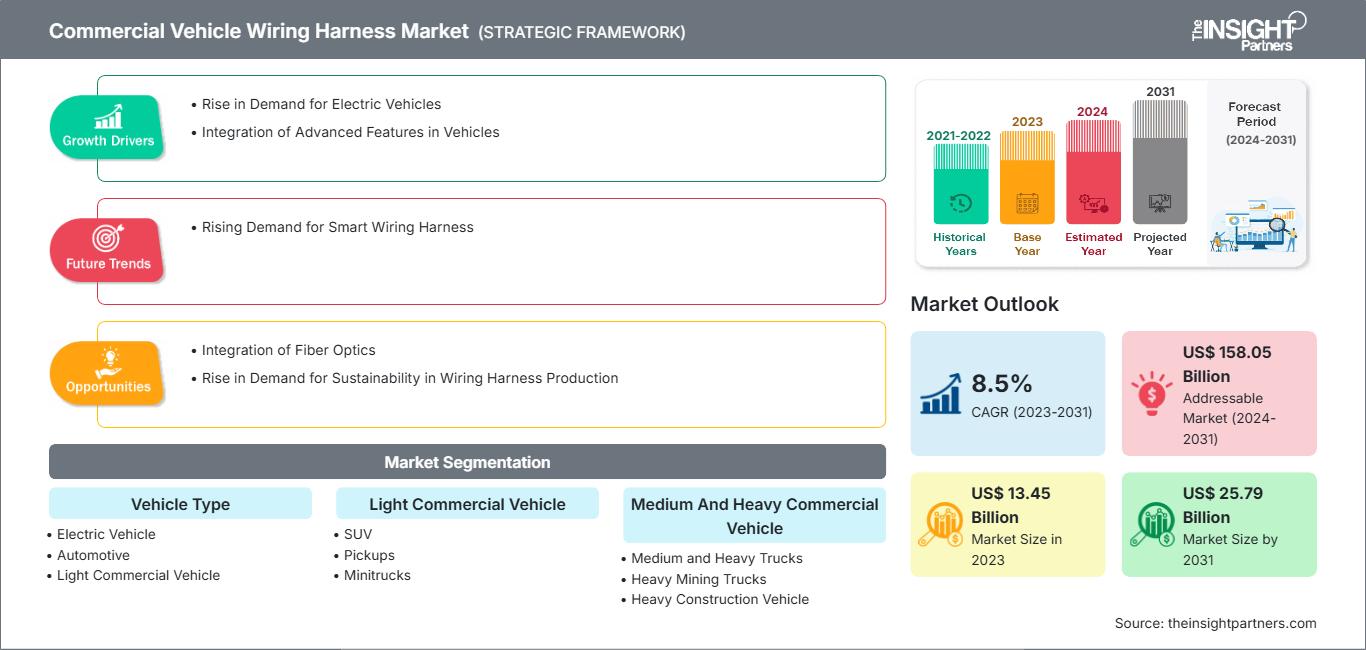

Commercial Vehicle Wiring Harness Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Vehicle Type (Electric Vehicle, Automotive, Light Commercial Vehicle, and Medium and Heavy Commercial Vehicle), Light Commercial Vehicle (SUV, Pickups, Minitrucks, and Minivans), Medium and Heavy Commercial Vehicle (Medium and Heavy Trucks, Heavy Mining Trucks, Heavy Construction Vehicle, Heavy Agriculture Vehicle, and Medium Agriculture Vehicle/Tractor), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Code : TIPRE00003274

- Category : Electronics and Semiconductor

- No. of Pages : 176

- Available Report Formats :

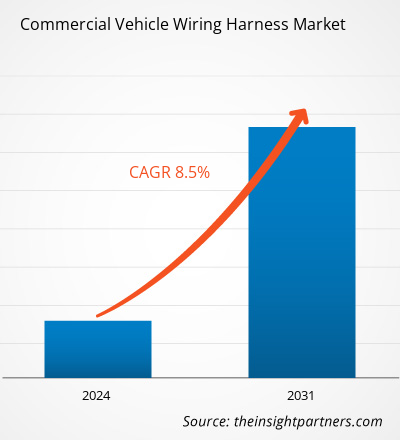

The commercial vehicle wiring harness market size is expected to reach US$ 25.79 billion by 2031 from US$ 13.45 billion in 2023. The market is estimated to record a CAGR of 8.5% from 2023 to 2031. The emergence of smart wiring harnesses is likely to bring in new trends in the market.

Commercial Vehicle Wiring Harness Market Analysis

The demand for electric vehicles (EVs) is increasing worldwide, particularly due to the strong government policies that support its adoption and growing environmental concerns. This rise in the demand for EVs is fueling the growth of the commercial vehicle wiring harness market, as wire harnesses play a vital role in handling the energy and information flow in vehicles. In addition, the growing integration of advanced features such as self-driving cars and advanced driver assistance systems (ADAS) is fueling the growth of the market. Furthermore, the growing integration of fiber optics for high connectivity and increasing demand for sustainability in wiring harness production is anticipated to create an opportunity for the growth of the commercial vehicle wiring harness market. Moreover, the increasing demand for smart wire harnesses, which can be compatible with any vehicle, is expected to further propel the growth of the market during the forecast period.

Commercial Vehicle Wiring Harness Market Overview

The wiring harness is a collection of electrical cables or wire assemblies that connect all of the electrical and electronic components in an automobile, such as sensors, electronic control units, batteries, and actuators. The wiring harness manages the flow of energy and information inside the electrical system to enable main automotive tasks, such as steering and braking, as well as secondary car functions, such as ventilation and infotainment. Wire harnesses link several wires into non-flexible bundles, making them safer than loose wires and reducing the chance of shorts in electrical circuits. In addition, wiring harnesses are composed of durable materials. They are built such that these bundles may function well in harsh conditions while carrying huge power loads. Furthermore, wiring harnesses help improve the fuel efficiency of any car, which is further raising their demand in the automotive industry.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONCommercial Vehicle Wiring Harness Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Commercial Vehicle Wiring Harness Market Drivers and Opportunities

Rise in Demand for Electric Vehicles

Electric vehicle (EV) sales are increasing due to concerns regarding environmental protection and government policies favoring the adoption of low-emission or zero-emission vehicles. Also, governments of different countries are offering subsidies and tax rebates to citizens to increase the adoption of EVs. The government authorities are taking various initiatives to promote EVs globally. Several US states are taking initiatives by providing financial incentives, including rebates, tax credits, and registration fee reductions, thereby promoting EV adoption in the country. For instance, in 2021, the government of Colorado offered a tax credit of US$ 4,000 on the purchase of a light-duty EV. Similarly, the government of Connecticut accepts a reduced biyearly vehicle registration fee of US$ 38 for EVs. Such government initiatives are leading to increased EV sales worldwide. According to IEA’s annual Global EV Outlook 2024, ~14 million new electric cars were registered in 2023 worldwide.

In 2023, the sales of electric cars were 3.5 million higher than in 2022, an increase of 35% year-on-year. As per the same source, electric cars accounted for ~18% of all cars sold in 2023, which was an increase from 14% in 2022. Also, in 2023, of the total number of new electric cars registered globally, China registered ~60% of new electric cars, Europe registered 25% of new electric cars, and the US registered 10% of new electric cars. The number of new electric car registrations reached 8.1 million in China in 2023, increasing by 35% compared to 2022. China is the world’s largest EV producer, producing 64% of global EV volume. Thus, the rise in sales of EVs boosts the demand for wire harnesses as they play a vital role in handling the energy and information flow within EVs.

Integration of Fiber Optics

The growing reliance on fiber optic cables is becoming a cornerstone of innovation and efficiency in the rapidly changing automobile industry. As automobiles become more connected with new technology, the use of automotive fiber optic cables becomes critical in addressing the increased need for quicker data transmission and better performance. Fiber optic cables boost in-car entertainment and information systems, providing passengers and drivers with an unrivaled audio-visual experience that dramatically increases user happiness and overall driving experience. In addition, fiber optics can provide real-time vehicle diagnostics, enhanced driver assistance systems, and autonomous driving capabilities by allowing for quick data transfer, which is critical for split-second decision-making. Its application in automobile design reduces vehicle weight, resulting in more fuel-efficient and environmentally friendly vehicles.

Fiber optics are critical in systems such as adaptive cruise control, collision avoidance, and lane departure warnings, which require quick data transfer. Their application ensures that safety measures are not only more effective but also more reliable, giving drivers a greater sense of confidence. Moreover, using fiber optic cables in in-vehicle communication systems allows for a more seamless and efficient flow of information, which is critical for the proper functioning of modern safety measures. This real-time communication improves vehicle performance and marks a significant step in automotive safety innovation, paving the way for future vehicle technology advancements and moving the industry to greater levels of passenger protection. Thus, the growing integration of fiber optics in vehicles is expected to boost the demand for wire harnesses during the forecast period.

Commercial Vehicle Wiring Harness Market Report Segmentation Analysis

Key segments that contributed to the derivation of the commercial vehicle wiring harness market analysis are vehicle type, light commercial vehicle, and medium and heavy commercial vehicle.

- By vehicle type, the commercial vehicle wiring harness market is segmented into electric vehicles, automotive, light commercial vehicles (LCV), and medium and heavy commercial vehicles (MHCVs). The automotive segment held the largest share of the commercial vehicle wiring harness market in 2023.

- The commercial vehicle wiring harness market for light commercial vehicles (LCVs) is subsegmented into SUVs, pickups, mini-trucks, and minivans. The SUV segment held the largest share of the commercial vehicle wiring harness market in 2023.

- The commercial vehicle wiring harness market for medium and heavy commercial vehicles (MHCV) is subsegmented into medium and heavy trucks, heavy mining vehicles, heavy construction vehicles, heavy agriculture vehicles, and medium agriculture vehicles/tractors. The medium and heavy trucks segment dominated the commercial vehicle wiring harness market in 2023.

Commercial Vehicle Wiring Harness Market Share Analysis by Geography

- The commercial vehicle wiring harness market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Asia Pacific dominated the market in 2023, followed by North America and Europe.

- North America witnessed tremendous growth in EV sales in 2023. According to the International Energy Agency’s (IEA) annual Global EV Outlook 2024, new electric car registrations in the US reached 1.4 million in 2023, accounting for a rise of more than 40% compared to 2022. Various commercial vehicle wiring harness market players in the region are taking various initiatives to build awareness about the benefits of these components. For instance, upon the success of conferences hosted in 2022 and 2023, Süddeutscher Verlag Events GmbH plans to host its third US Automotive Wire Harness & EDS Conference at Dearborn, Michigan, on October 28–29, 2024. These events are planned to educate and provide OEMs, wire harness developers, Tier1 and Tier2 suppliers, high-voltage specialists, and other innovative suppliers with knowledge on the manufacturing and designing of commercial vehicle wiring harnesses along with their benefits in harsh conditions.

Commercial Vehicle Wiring Harness Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 13.45 Billion |

| Market Size by 2031 | US$ 25.79 Billion |

| Global CAGR (2023 - 2031) | 8.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Commercial Vehicle Wiring Harness Market Players Density: Understanding Its Impact on Business Dynamics

The Commercial Vehicle Wiring Harness Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Commercial Vehicle Wiring Harness Market News and Recent Developments

The commercial vehicle wiring harness market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the commercial vehicle wiring harness market are listed below:

- Lear Corporation, one of the global automotive technology leaders in Seating and E-Systems, announced that it has acquired M&N Plastics, a privately owned, Michigan-based injection molding specialist and manufacturer of engineered plastic components for automotive electrical distribution applications.

(Source: Lear Corporation, Press Release, March 2024)

- Japanese company Sumitomo Electric Wiring Systems Inc. signed an initial agreement with Egypt's General Authority for Investment and Free Zones to establish the world's largest factory for electric vehicle wiring harnesses in Egypt. The factory will be set up in a free zone of the 10th of Ramadan City in an area of 150,000 square meters. The project involves investments of about US$ 100 million for exporting the products to global car manufacturers in Europe and the Middle East.

(Source: Sumitomo Electric Wiring Systems Inc., Press Release, April 2023)

Commercial Vehicle Wiring Harness Market Report Coverage and Deliverables

The "Commercial Vehicle Wiring Harness Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Commercial vehicle wiring harness market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Commercial vehicle wiring harness market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Commercial vehicle wiring harness market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the commercial vehicle wiring harness market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For