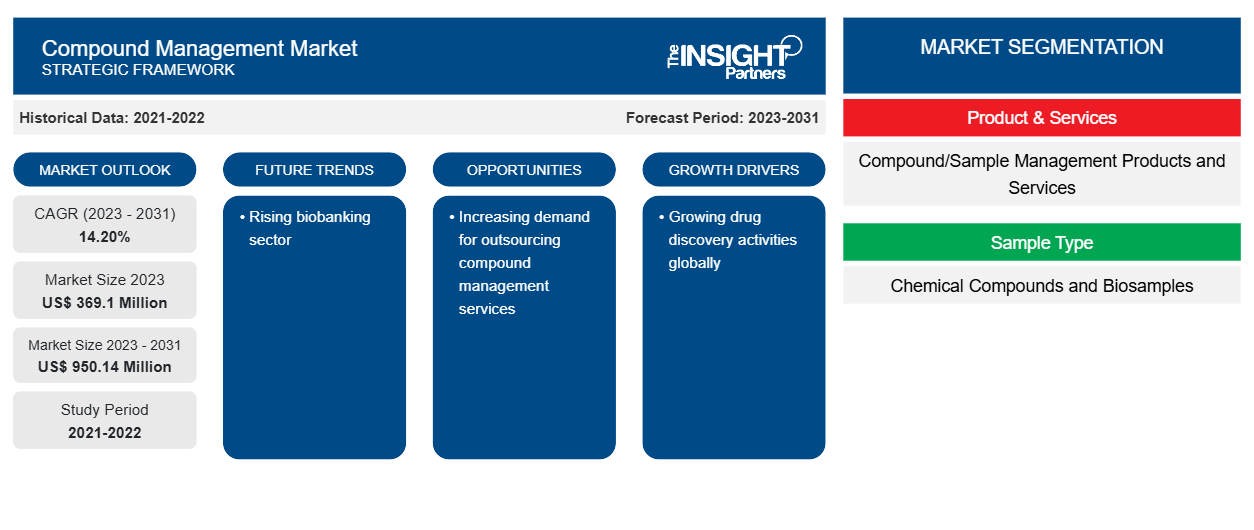

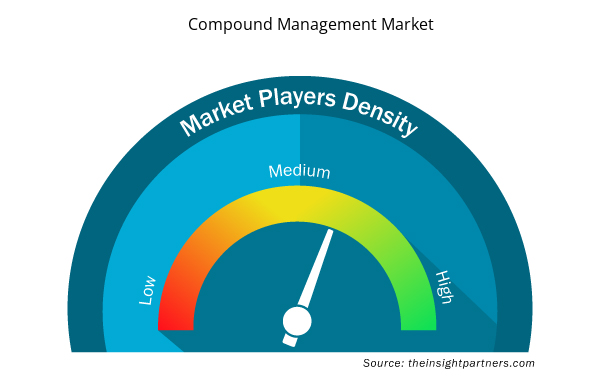

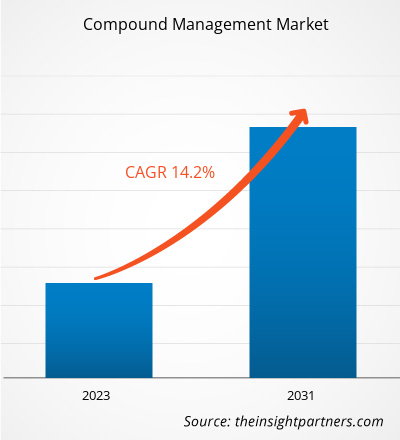

The Compound Management Market size is projected to reach US$ 950.14 million by 2031 from US$ 369.1 million in 2023. The market is expected to register a CAGR of 14.20% in 2023–2031. Increasing outsourcing activities related to compound management and the growing biobanking or biopharmaceutical industry are fueling the compound management market. The management of chemical libraries, includes databases and restoring outdated chemicals, updating chemical information etc is in high demand. Compound management also involves effectively maintaining chemical libraries and biological samples to improve the overall safety, purity, shelf life, and other critical aspects of samples which is a boosting factor for market growth.

Compound Management Market Analysis

Increasing R&D activities related to compound management is one of the major factors driving market growth. Rising research and development (R&D) efforts and increasing number of R&D pipeline is another key propelling factor. For instance, the R&D pipeline includes 22,000 drugs in 2023, while in 2022, the number of drugs in the pipeline was approximately 20,109 as per the data retrieved from Pharma Annual Review 2022. Additionally, compound libraries (collections of various chemical compounds) are in higher demand in the pharmaceutical and biotechnology industries due to rising R&D activities. These libraries offer tools for screening and identifying prospective drug candidates. Hence, with rising R&D and adoption of compound libraries market growth of compound management is further expected to augment in the near future.

Compound Management Market Overview

North America is the largest market for Compound Management market growth with the US holding the largest market share followed by Canada. The North American compound management market is driven by the large pharmaceutical and biopharma industry. North American pharmaceutical companies are engaged in drug discovery activities, and it need maintenance of huge chemical libraries. Therefore, to maintain the productivity of advanced drugs and biologics, major pharma and biopharma companies have started building compound management facilities. Thus, this factor is anticipated to fuel the overall market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Compound Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Compound Management Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Compound Management Market Drivers and Opportunities

Rising Demand for Biologics and Accelerating Drug Discovery Favors the Market

Robust pharmacovigilance systems are critical to address the complexity of safety data and challenges in detecting Adverse Drug Reaction (ADRs), for both innovator biologics and biosimilars. Additionally, drug discovery process and development of a compound is a costly, lengthy, and complicated process and requires various advanced techniques. Screening process such as High throughput screening is screens a large number of compounds with a biological target. Hence, rising drug discovery activities is further expected to boost the market growth of compound management.

Expanding Biopharma and Pharma Companies in Developing Countries– An Opportunity in the Compound Management Market

Developing countries serves as a key hub for Pharmaceutical and biotechnology companies as these countries offers low labor cost and raw material cost. There has been increasing demand for compound management in Asian countries due to the above mentioned factors. Moreover, rising funding and budgests from these companies focused on compound management. Low cost outsourcing compound management services in the developing countries coupled with rising prevalence of chronic and infectious diseases iis further creating an opportunity for market to grow over the forecast period.

Compound Management Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Compound Management market analysis are product and services, sample type, application, and end user.

- Product & Services (Compound/Sample Management Products and Services), Sample Type (Chemical Compounds and Biosamples), Application (Drug Discovery, Gene Synthesis, and Biobanking), and End User (Pharmaceutical Companies, Biopharmaceutical Companies, Contract Research Organizations (CROs), and Others)

- Based on the product and services, the Compound Management market is segmented into Services and Compound/Sample Management Products. The Compound/Sample Management Products held a larger market share in 2023.

- By application, the market is segmented into Drug Discovery, Gene Synthesis, and Biobanking. The drug discovery held the major market share in the year 2023.

- Based on end users, the market is segmented into Pharmaceutical Companies, Biopharmaceutical Companies, Contract Research Organizations (CROs), and Others. The pharmaceutical companies held the major market share in the year 2023.

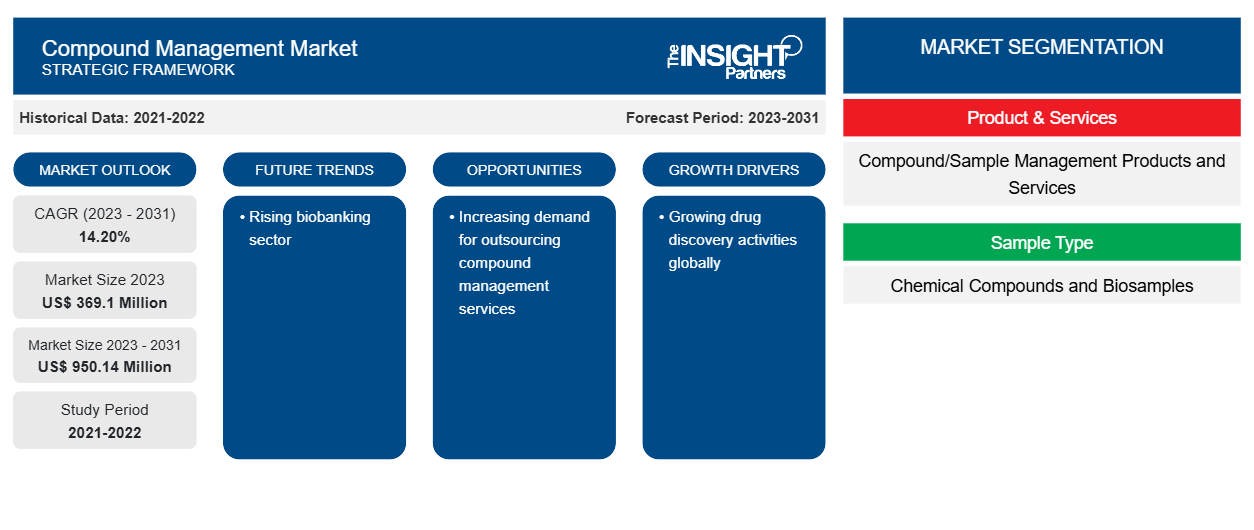

Compound Management Market Share Analysis by Geography

The geographic scope of the Compound Management Market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. North America dominated the Compound Management Market. The market growth of compound management can be attributed to increasing efforts in R&D activities by pharmaceutical companies as well as the presence of biopharma and pharmaceutical companies operating in the market. In addition, technological advancements in the drug discovery process are likely to be a major growth stimulator for the compound management market in North America.

Compound Management Compound Management Market Regional Insights

The regional trends and factors influencing the Compound Management Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Compound Management Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Compound Management Market

Compound Management Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 369.1 Million |

| Market Size by 2031 | US$ 950.14 Million |

| Global CAGR (2023 - 2031) | 14.20% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Product & Services

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Compound Management Market Players Density: Understanding Its Impact on Business Dynamics

The Compound Management Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Compound Management Market are:

- WuXiAppTec

- Evotec

- Icagen

- TCG Life Sciences

- TTP LabTech

- Hamilton Company

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Compound Management Market top key players overview

Compound Management Market News and Recent Developments

The Compound Management Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for Compound Management:

- SPT Labtech announced the acquisition of BioMicroLab, a robotics automation provider, to strengthen its capabilities in automatic sample management. (Source: SPT Labtech, Press Release/Company Website/Newsletter, February 2021)

- Ziath, a leading sample/compound management solutions provider, introduced a new software called Datapaq 3.18 that runs the Acoustix module on a Cube, Mirage, or Express tube, reader. The product is compatible with Labcyte Echo, the latest generation of acoustic dispensers. It offers higher speed and efficiency than many other tube readers available. (Source: Ziath, Press Release/Company Website/Newsletter, December 2020)

- A leading software company for automated processes and laboratory connection Biosero was acquired by BICO. BICO spends up to $20 million over three years to accelerate Biosero’s commercial agenda to expand into new geographical markets and fully maximize on current order pipeline. (Source: Bico, Press Release/Company Website/Newsletter, December 2020)

Compound Management Market Report Coverage and Deliverables

The “Compound Management Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product & Services, Sample Type, Application, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Get Free Sample For

Get Free Sample For