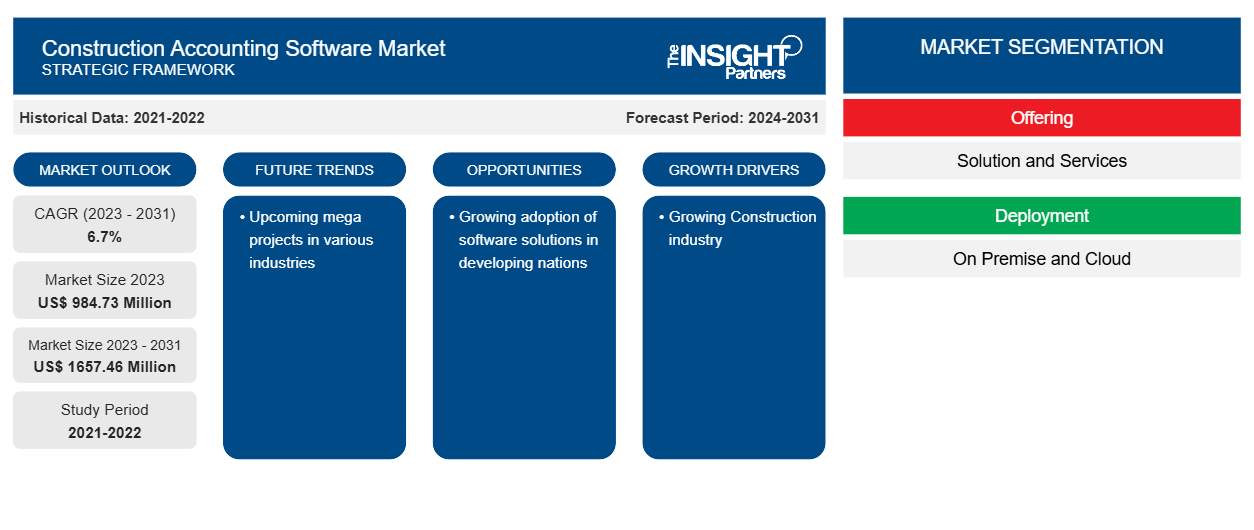

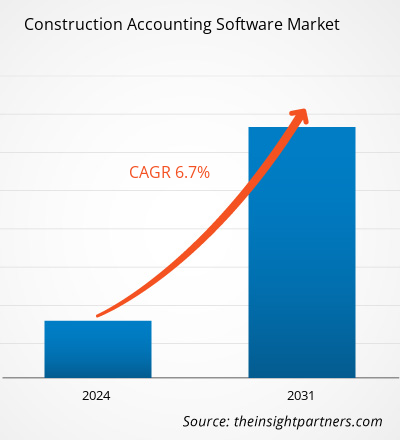

The construction accounting software market size is projected to reach US$ 1657.46 million by 2031 from US$ 984.73 million in 2023. The market is expected to register a CAGR of 6.7% during 2023–2031. The growing digitalization in the construction industry and the rising construction industry are likely to remain key trends in the market.

Construction Accounting Software Market Analysis

The rising demand from the residential and commercial sectors fuels the growing construction industry. This factor is leading to the adopting of construction accounting software by the construction companies' financial management. The software helps construction companies to accurately track money coming into and out of their businesses. The software handles aspects of the construction industry, such as job costing and retainage. Such features of construction accounting software lead to its adoption.

Construction Accounting Software Market Overview

Construction accounting software provides financial management tools to small and, mid-sized construction companies and large construction companies for construction projects and activities. This software solution offers features such as payroll, job costing, general ledger, accounts payable and receivable (AP/AR), audit reporting, and others. Some construction accounting solutions focus on specific financial information for projects, whereas others provide accounting insights into the entire company.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Construction Accounting Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Construction Accounting Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Construction Accounting Software Market Drivers and Opportunities

Growing Construction industry

The construction industry is at the forefront of developing and improving infrastructure such as roads, railways, airports, and ports. These infrastructure investments improve the connectivity, trade, and economic development of any country. Thus, the growing construction industry is fuelling the adoption of construction accounting software, which is used for accounting applications, including accounts payable, accounts receivable, payroll, and general ledger, as well as modules for job cost, estimating, equipment control, inventory control, purchase orders, work orders and AIA billings.

Growing adoption of software solutions in developing nations

Developing nations such as India and China are rapidly embracing digitalization, which is leading to the adoption of software solutions in various industries, including the construction industry. These countries are widely adopting construction accounting software to tackle challenges such as complex spreadsheets, lost receipts, and never-ending paperwork. The software adoption provides financial management functionality for construction firms.

Construction Accounting Software Market Report Segmentation Analysis

Key segments that contributed to the derivation of the construction accounting software market analysis are offering, deployment, and application.

- Based on the offering, the construction accounting software market is divided into solution and services. The solution segment has the largest market share in 2023.

- By deployment, the market is segmented into on premise and cloud. The cloud segment is expected to grow with the highest CAGR.

- By application, the market is segmented into small and mid-sized construction companies and large construction companies. The small and mid-sized construction companies segment is expected to grow with the highest CAGR.

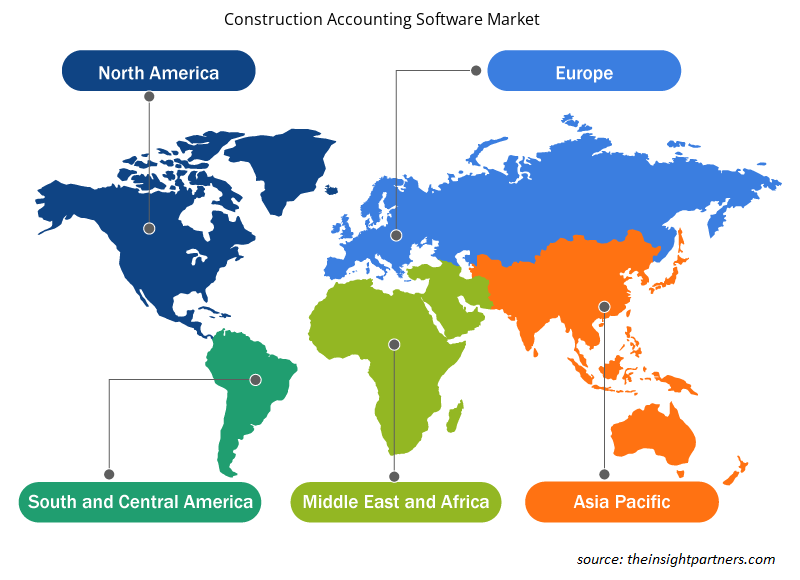

Construction Accounting Software Market Share Analysis by Geography

The geographic scope of the construction accounting software market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America region held a significant market share. The growing construction industry is the major factor driving the market in the region. The construction industry is one of the major contributors to the region's countries' economy, which has led to the adoption of software solutions for simplifying the tasks in construction accounting. The rising construction projects and growing residential sector are fueling the market growth.

Construction Accounting Software Market Regional Insights

The regional trends and factors influencing the Construction Accounting Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Construction Accounting Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Construction Accounting Software Market

Construction Accounting Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 984.73 Million |

| Market Size by 2031 | US$ 1657.46 Million |

| Global CAGR (2023 - 2031) | 6.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

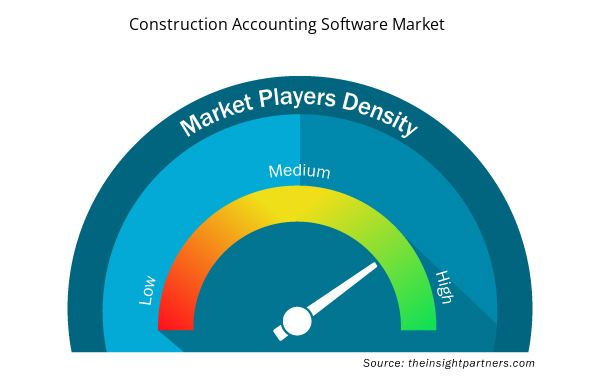

Construction Accounting Software Market Players Density: Understanding Its Impact on Business Dynamics

The Construction Accounting Software Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Construction Accounting Software Market are:

- Sage Group plc

- Chetu Inc

- Procore Technologies

- Deltek Inc

- Foundation Software, LLC

- Fresh book

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Construction Accounting Software Market top key players overview

Construction Accounting Software Market News and Recent Developments

The construction accounting software market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the construction accounting software market are listed below:

- Kojo, the construction industry's leading materials and inventory management platform, announced the launch of Kojo AP (accounts payable). Kojo AP is a suite of features built specifically for commercial construction accounting teams to address the final step in the material management workflow: payments. Kojo AP eliminates many of the manual data entry processes for contractors' accounting teams, automatically catching mistakes on invoices and enabling vendors to get paid directly in one system. (Source: Kojo, Press Release, May 2024)

Construction Accounting Software Market Report Coverage and Deliverables

The "Construction Accounting Software Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Construction accounting software market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Construction accounting software market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Construction accounting software market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the construction accounting software market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Bathroom Vanities Market

- Blood Collection Devices Market

- Occupational Health Market

- Nuclear Decommissioning Services Market

- Adaptive Traffic Control System Market

- Lymphedema Treatment Market

- Foot Orthotic Insoles Market

- Procedure Trays Market

- Photo Printing Market

- Employment Screening Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Offering, Deployment, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

What would be the estimated value of the construction accounting software market by 2031?

The estimated value of the construction accounting software market will be US$ 1657.46 million by 2031.

Which are the leading players operating in the construction accounting software market?

Sage Group plc; Chetu Inc.; Procore Technologies; Deltek Inc.; Foundation Software, LLC; Fresh book; Intuit Inc.; Buildertrend; Viewpoint Inc.; and Xero Limited are some of the key players operating in the construction accounting software market.

What is the future trend of the construction accounting software market?

Upcoming mega projects in various industries are considered a key trend in the construction accounting software market.

What are the driving factors impacting the construction accounting software market?

The growing digitalization in the construction industry and the rising construction industry are the key driving factors impacting the construction accounting software market.

What is the expected CAGR of the construction accounting software market?

The global construction accounting software market is estimated to register a CAGR of 6.7% during the forecast period 2023–2031.

Get Free Sample For

Get Free Sample For