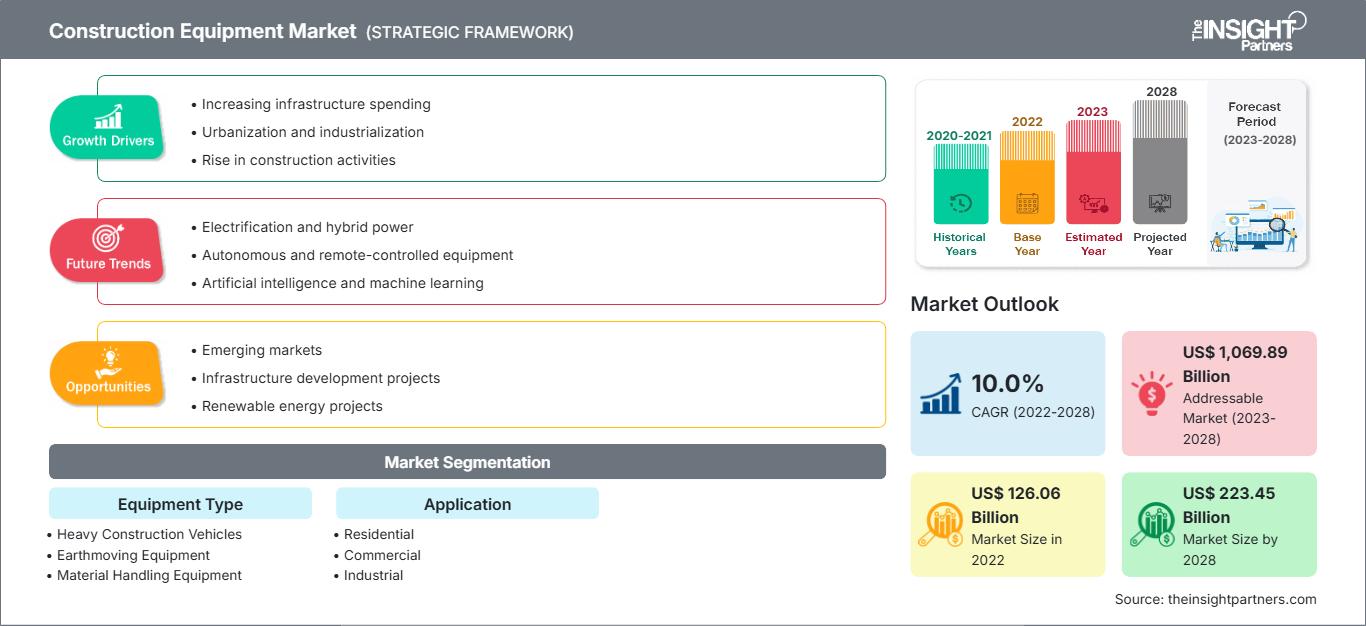

Construction Equipment Market Dynamics and Developments by 2028

Construction Equipment Market Forecast to 2028 - Analysis By Equipment Type (Heavy Construction Vehicles, Earthmoving Equipment, Material Handling Equipment, and Others) and Application (Residential, Commercial, and Industrial)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Report Date : Jun 2022

- Report Code : TIPRE00007469

- Category : Manufacturing and Construction

- Status : Published

- Available Report Formats :

- No. of Pages : 157

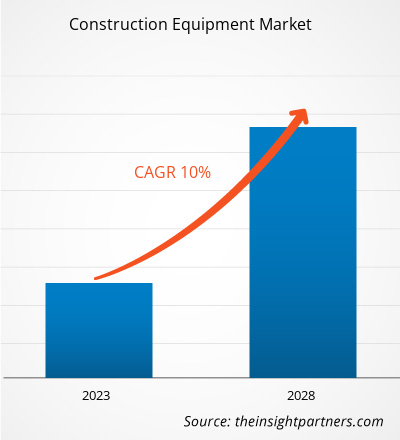

The construction equipment market is expected to grow from US$ 126,062.8 million in 2022 to US$ 223,451.1 million by 2028; it is estimated to grow at a CAGR of 10.0% from 2022 to 2028.

Heavy-duty vehicles developed specifically to carry out construction duties, most commonly earthwork operations, are referred to as construction equipment. The proper use of suitable equipment helps to the project's economy, quality, safety, speed, and timeliness. It is not always desired or feasible for the contractor to possess all of the construction equipment needed for the project. Excavating, digging dirt, moving it over great distances, placement, compacting, levelling, dozing, grading, and hauling are among the main processes involved in the building of any construction project.

Various excavation duties, such as excavating and moving the ground, are carried out with earthmoving equipment. Earthmoving equipment are available in various shapes and sizes. They are mostly used for repairing, constructing, elevating, agricultural, and demolition purposes. Excavators are earth-moving machines with buckets, arms, rotating cabs, and moveable tracks. A backhoe, also known as a rear actor or back digger, is a kind of excavation equipment having a digging bucket attached to the end of a two-part articulated arm. Loader is a construction machine that moves or loads materials, including asphalt, demolition waste, dirt, snow, feed, gravel, logs, raw minerals, recycled material, rock, sand, and woodchips, into or onto another type of machinery.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONConstruction Equipment Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Key stakeholders in the construction equipment market are construction equipment raw materials, construction equipment manufacturers who operate at the supply side, and construction equipment end users who operate at the demand side. In the recent years, the demand for construction equipment especially in residential and commercial construction has increased, which is expected to drive the construction equipment market growth in the next five years. Caterpillar, John Deere, Komatsu, Volvo, and Liebherr are among the key construction equipment providers. In addition to these major ecosystem players, there are several other peripheral stakeholders who play a crucial role in enabling the advancements in technologies and the adoption of these products across several industries.

Impact of COVID-19 Pandemic on Construction Equipment Market

In 2020, the COVID-19 pandemic hampered construction activities. As a result, construction equipment sales have decreased across the world. Infrastructure investments; residential, commercial, and industrial construction; underground and well construction; and institutional expenditure affect construction equipment manufacturers. The US, the UK, China, and India are among the countries that have been disproportionately affected. According to the International Construction Group, the delivery of over one-quarter of all projects (22.7%) was delayed by more than 250 days, and more than one-tenth of all projects (13.4%) were delayed by more than a year in 2020. However, projects of hospitals and other medical facilities, labs, and shipping and logistics infrastructure are in limited supply. Furthermore, several nations have begun to gradually resume activities various industries, including the construction industry. India and China have started industrial and commercial construction projects. In April 2021, industrial output climbed for the first time since January 2021, as countries began to implement new projects. Therefore, the demand for excavators, backhoe loaders, compactors, dozers, and other construction equipment surged.

Market Insight

Increasing Infrastructure Investments Post COVID-19 Pandemic

Economic activities across the world were considerably stifled due to the COVID-19 pandemic. There were huge investments in infrastructure during 2020-21, which provided momentum to the infrastructure industry growth. Infrastructure investments in electricity generation, national highway construction, railways, and shipping cargo propel the demand for construction equipment. In emerging economies, a few core infrastructure industries including coal, crude oil, steel, and cement exhibited the growth index in 2021. These factors positively impacted the construction equipment market growth. Infrastructure investment has a long-term impact on product development, which can boost GDP in long run, albeit the scale of these effects is unknown. Most countries, specifically in Middle East, have established a quadrilateral economic forum to focus on infrastructure development projects in the region. To facilitate communication among employees and with consumers, businesses use digital solutions and channels. Governments and educational institutions have done so as well.

Equipment Type Segment Insights

A large number of construction equipment is used than ever, owing to the growing number of commercial, residential, and industrial projects requiring heavy-duty tools and machinery to get the job done. In huge projects, heavy construction equipment is employed for various tasks. The choice of heavy equipment types is based on the scope and cost of the project. These factors facilitate and speed up the construction process. Excavators are a vital and frequently used piece of equipment in the construction sector.

Application Segment Insights

Based on application, the construction equipment market is segmented into residential, commercial, and industrial. A construction tool known as an asphalt mixing plant is used to produce coated roadstone and other types of asphalt concrete for use in road construction projects. Road rollers are essentially compactor-style engineering machines that push down earth, gravel, concrete, or asphalt while building roads and foundations. For installing precast piles for skyscrapers and other enormous industrial complexes needing deep foundations, a pile boring machine is used to create vertical holes on a construction site, resulting in the growth of the construction equipment market.

The construction equipment market players focus on new product innovations and developments by integrating advanced technologies and features to compete with the competitors. In June 2022, Caterpillar Inc. announced that its worldwide headquarters will be relocated from Deerfield, Illinois to the company's existing facility in Irving, Texas. The company will begin transitioning its headquarters to Irving in 2022.

Based on equipment type, the construction equipment market is segmented into heavy construction vehicles, earthmoving equipment, material handling equipment, and others. The market, based on application, is segmented into residential, commercial, and industrial. Based on region, the global construction equipment market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Construction Equipment Market Regional Insights

The regional trends and factors influencing the Construction Equipment Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Construction Equipment Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Construction Equipment Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 126.06 Billion |

| Market Size by 2028 | US$ 223.45 Billion |

| Global CAGR (2022 - 2028) | 10.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Equipment Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Construction Equipment Market Players Density: Understanding Its Impact on Business Dynamics

The Construction Equipment Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Construction Equipment Market top key players overview

construction equipment market – Company Profiles

- Caterpillar Inc.

- CNH Industrial N.V.

- Hitachi Construction Machinery Co., Ltd

- J C Bamford Excavators Ltd.

- Deere & Company

- Komatsu Ltd.

- Liebherr-International Deutschland GmbH

- Terex Corporation

- Volvo CE

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

Frequently Asked Questions

I. Increasing Infrastructure Investments Post COVID-19 Pandemic

Growing Focus on Public-Private Partnerships (PPP)

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For