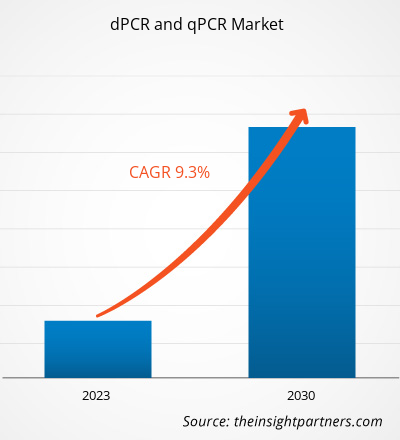

The dPCR and qPCR market size is projected to reach US$ 18,230.74 million by 2030 from US$ 8,976.99 million in 2022. The market is expected to register a CAGR of 9.30% during 2022–2030. The development of droplet digital PCR will likely remain a key trend in the market.

dPCR and qPCR Market Analysis

Nucleic acid quantification in molecular biology is facilitated by two essential technologies: quantitative PCR (qPCR) and digital PCR (dPCR). The market is expected to grow due to ongoing innovations that improve PCR technologies' accuracy, efficiency, and affordability and the integration of AI and machine learning for improved data analysis and interpretation. The leading companies in the market are Agilent Technologies Inc., QIAGEN N.V., Roche Diagnostics, Thermo Fisher Scientific Inc., and Bio-Rad Laboratories, Inc. The demand for dPCR and qPCR is expected to grow significantly due to rising disease prevalence, technological advancements, and increased research and development. Nevertheless, despite obstacles like exorbitant expenses and technological constraints, the market offers profitable prospects for advancement and growth, especially in developing nations.

dPCR and qPCR Market Overview

In the domains of recombinant DNA technology, which encompasses recombinant protein synthesis and PCR technology for amplification and quantification goals, gene synthesis is the most widely recognized instrument. In 2021, Mercia led a US$10 million Series A funding round for Camena Bioscience, a synthetic biology startup that supplies genes to the biotechnology and pharmaceutical industries. With the extra cash, the business will grow and continue to develop its revolutionary DNA synthesis platform, gSynth. The technology platform and other relevant resources accelerate the company's development of gene synthesis. Additionally, businesses have expanded the funds allocated to research and development to improve gene synthesis. The completion of its Series B funding round was announced in 2020 by EVONETIX LTD, a synthetic biology startup developing a desktop platform for high-fidelity, quick, and scalable gene synthesis. In this round, the business raised US$ 30 million (£23 million) under the direction of new investor Foresite Capital. Along with Rising Tide Fund and Civilization Ventures, other investors who took part in the round included Draper Esprit, DCVC (Data Collective), the Morningside group, Providence Investment Company, and Cambridge Consultants Ltd. Thus, growing government company investments support the expansion of the global gene synthesis market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

dPCR and qPCR Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

dPCR and qPCR Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

dPCR and qPCR Market Drivers and Opportunities

Technological Advancements in PCR Technologies Favor Market Growth

In most molecular biology labs, the polymerase chain reaction (PCR) is a robust, nearly universal technology used to amplify specific DNA stretches for genotyping, cloning, and analyzing single nucleotide variations. It is also the foundation for most next-generation sequencing (NGS) preparations. Technological advancements are producing different kinds of PCR techniques. Currently, PCR technology is being investigated for several unconventional uses, which will facilitate and expedite molecular diagnosis. Specifically, digital and real-time PCR improvements are utilized to support forensic investigations, identify viruses and bacteria, and diagnose illnesses.

Additionally, the researchers are attempting to use some nanomaterials to shorten test times. Announcing the development of ultrafast PCR technology in March 2023 was the Center for Augmented Safety System with Intelligence, Sensing of the Korea Institute of Science and Technology (KIST, President: Seok Jin Yoon). The research team led by Dr. Sang Kyung Kim and Dr. Seungwon Jung made this announcement. Using photothermal nanomaterials, the ultrafast PCR cuts the test duration in half compared to the previous test. The new method takes five minutes to complete and has diagnostic performance comparable to the current test method. Therefore, the growth of the dPCR and qPCR markets is driven by technological advancements in PCR technologies.

Rising Adoption of PCR Methods in Emerging Countries Creates Significant Opportunities in the Market

Molecular techniques like PCR have advanced as diagnostic tools in recent years. The technique is regarded as an essential research and diagnostic tool because it allows medical professionals to accurately diagnose a wide range of infectious diseases. With PCR, a single DNA strand can produce millions of copies of itself. It also makes early disease diagnosis possible, which makes it crucial for disease control. It is widely accepted because PCR produces consistent results that can be compared across labs. PCR methods are becoming more popular in developing nations. The World Health Organization is offering the required technical assistance to establish PCR laboratories in each of the 11 WHO South East Asia member states, according to the World Health Organization Report on Establishment of PCR Laboratory in Developing Countries (2016). The labs will support the delivery of top-notch healthcare. Depending on their needs, these PCR labs have embraced various PCR technologies, including digital PCR (dPCR), multiplex PCR, real-time PCR, in-situ PCR, and reverse transcriptase PCR (RT-PCR). As a result of its ease of use, speed, and high specificity in disease screening, as well as its growing applications in clinical microbiology, virology, parasitology, biotechnology, and related fields, the dPCR and qPCR market in developing nations is anticipated to grow significantly over the following years.

dPCR and qPCR Market Report Segmentation Analysis

Key segments that contributed to the derivation of the dPCR and qPCR market analysis are treatment, product, application, and end user.

- Based on treatment, the dPCR and qPCR market is segmented into quantitative PCR (qPCR) and digital PCR (dPCR). The digital PCR (dPCR) segment held the most significant market share in 2022.

- By product, the market is categorized into instruments, software & services, and reagents & consumables. The reagents & consumables segment held the largest share of the market in 2022.

- Based on application, the dPCR and qPCR market is segmented into research applications, clinical applications, and forensic applications. The clinical application segment held the most significant market share in 2022.

- By end user, the market is segmented into pharmaceutical and biotechnology companies, hospitals and diagnostic centers, forensic laboratories, research laboratories and academic institutes, and clinical research organizations. The hospitals and diagnostic centers segment held a significant market share in 2022.

dPCR and qPCR Market Share Analysis by Geography

The geographic scope of the dPCR and qPCR market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

The US, Canada, and Mexico comprise the North American dPCR and qPCR market segments. The US and Canada have the most significant market shares in North America, the region's primary biotechnology market. The presence of key market players, a rise in demand for innovative products from bio-analytical instrument manufacturers and PCR companies, and extensive research and development across multiple academic and research institutes all contribute to the market growth in North America. The growing emphasis on using advanced techniques in healthcare, public and private efforts to advance precision medicine, and significant funding for genomic research from public and private sources are all anticipated to spur growth and significantly increase revenue generation for North America's dPCR and qPCR markets. Furthermore, the nation's research groups have made scientific advancements that align with the region's growth and dominance in the global market positioning.

dPCR and qPCR Market Regional Insights

The regional trends and factors influencing the dPCR and qPCR Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses dPCR and qPCR Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for dPCR and qPCR Market

dPCR and qPCR Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 8,976.99 Million |

| Market Size by 2030 | US$ 18,230.74 Million |

| Global CAGR (2022 - 2030) | 9.30% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Treatment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

dPCR and qPCR Market Players Density: Understanding Its Impact on Business Dynamics

The dPCR and qPCR Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the dPCR and qPCR Market are:

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Takara Bio Inc.

- Qiagen NV

- Standard Biotools Inc.

- Lepu Medical Technology Beijing Co Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the dPCR and qPCR Market top key players overview

dPCR and qPCR Market News and Recent Developments

The dPCR and qPCR market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the dPCR and qPCR market are listed below:

- QIAGEN NV announced the expansion of its digital PCR (dPCR) offering to develop cell and gene therapies in the biopharma industry. The company has partnered with Niba Labs to offer customized digital PCR assay design services to biopharma customers and also launched the new CGT Viral Vector Lysis Kit that enables a standardized workflow from cell lysates to absolute and precise quantification of viral titers for multiple serotypes. (Source: QIAGEN NV, Press Release, July 2023)

- Roche and its subsidiary TIB Molbiol have developed three unique LightMix Modular Virus kits in response to recent monkeypox virus concerns. Multiple clusters of the monkeypox virus have been reported within the past two weeks in several European countries and North America, regions where the virus is not commonly found. (Source: Roche, Press Release, May 2023)

dPCR and qPCR Market Report Coverage and Deliverables

The “dPCR and qPCR Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- dPCR and qPCR market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- dPCR and qPCR market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- dPCR and qPCR market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the dPCR and qPCR market

- Detailed company profiles

Frequently Asked Questions

What are the future trends of the dPCR and qPCR market?

The development of droplet digital PCR will likely remain a key trend in the market.

Which are the leading players operating in the dPCR and qPCR market?

Abbott Laboratories, Thermo Fisher Scientific Inc., Qiagen NV, Standard Biotools Inc., Takara Bio Inc., Lepu Medical Technology, F. Hoffmann-la Roche Ltd, Bio-rad Laboratories Inc, Beijing Co Ltd, Agilent Technologies Inc.

What is the expected CAGR of the dPCR and qPCR market?

The market is expected to register a CAGR of 9.30% during 2022–2030.

Which region dominated the dPCR and qPCR market in 2022?

North America dominated the dPCR and qPCR market in 2022

What are the driving factors impacting the dPCR and qPCR market?

Key factors driving the market are the increasing incidence of genetic and infectious diseases, rising investments and funds for gene synthesis, and technological advancements in PCR technologies.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - dPCR and qPCR Market

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Takara Bio Inc.

- Qiagen NV

- Standard Biotools Inc.

- Lepu Medical Technology Beijing Co Ltd

- F. Hoffmann-la Roche Ltd

- Bio-rad Laboratories Inc

- Agilent Technologies Inc

- Genome Diagnostics Pvt Ltd.

Get Free Sample For

Get Free Sample For