EGR Valves Market Analysis, Size, and Share by 2028

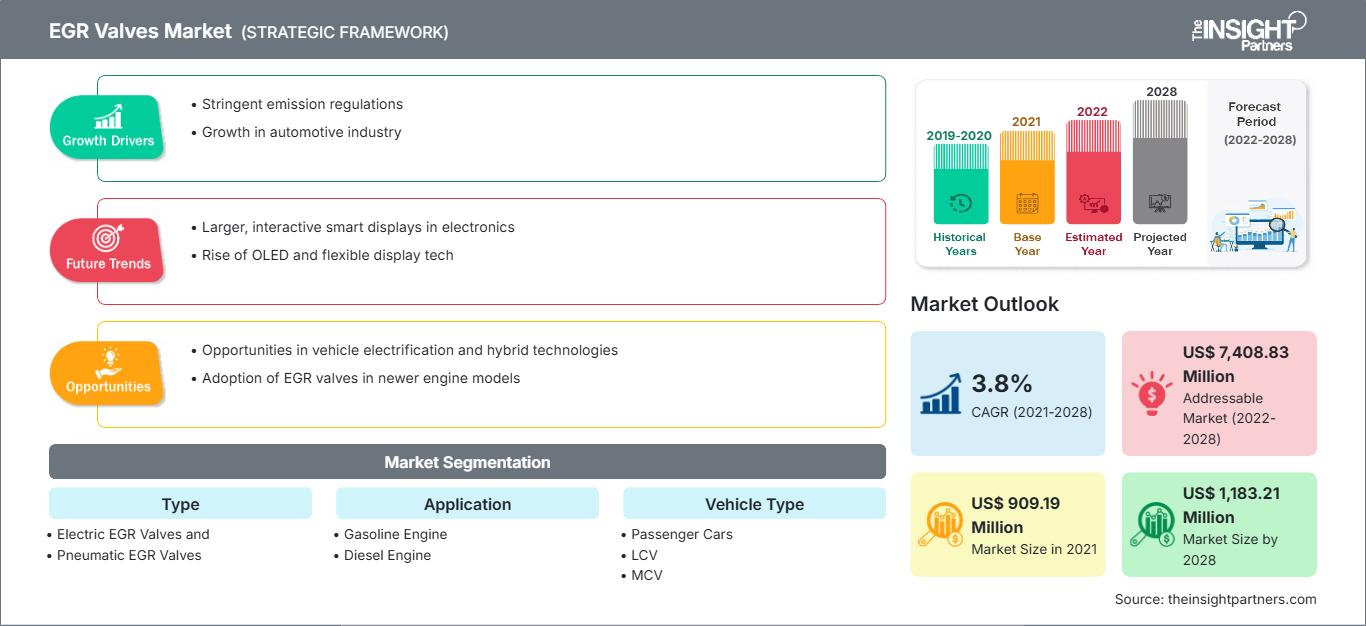

EGR Valves Market Forecast to 2028 - Analysis By Type (Electric EGR Valves and, Pneumatic EGR Valves), Application (Gasoline Engine, and Diesel Engine), and Vehicle Type (Passenger Cars, LCV, MCV, and HCV)

Historic Data: 2019-2020 | Base Year: 2021 | Forecast Period: 2022-2028- Report Date : Feb 2022

- Report Code : TIPTE100000613

- Category : Automotive and Transportation

- Status : Published

- Available Report Formats :

- No. of Pages : 160

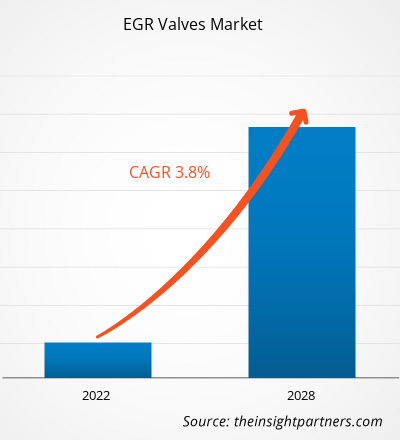

The EGR valves market is projected to reach US$ 1,183.21 million by 2028 from US$ 909.19 million in 2021; it is expected to grow at a CAGR of 3.8% from 2021 to 2028.

The accelerated pace of industrialization and commercialization in developing countries such as India, China, and Brazil owing to the rising number of infrastructural and industrial projects has led to a huge market for ICE-based commercial vehicles such as heavy-duty trucks, bulldozers, and trailers. Since commercial vehicles are a major source of emissions from the automotive industry, their remarkable sales create a high demand for components such as EGR valves to control the quality and volume of emissions, and increase the fuel efficiency of these vehicles. Therefore, the widespread use of internal combustion engines in commercial vehicles and the huge market for these vehicles in developing regions are further creating prospects for the growth of the EGR valves market.

The global EGR valves market is dominated by major players that collectively account for a huge share of the overall market. These companies are strategically focused on the introduction of innovative, high-efficiency products, as well as merger and acquisition activities. Enterprises are also engaging in strategic alliances and partnerships to gain a competitive edge in the market by expanding their technological competence while escalating their production capacities. Small, regional producers are focusing on introducing cost-effective, customized, and value-for-money products to extend their market reach.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEGR Valves Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on EGR Valves Market

The emergence and rapid spread of SARS-CoV-2 have paralyzed numerous countries, including developed as well as developing ones. A continuous surge in the count of infected patients has been hampering the progress of several industries worldwide. The COVID-19 pandemic has been affecting economies and industries in various countries as the government authorities had to enact lockdowns, travel bans, and business shutdowns in 2020 to contain the disease spread. The demand for EGR valves also decreased as the key countries purchasing EGR valves avoided investments in these components to be able to utilize a fair percentage of their budget to combat the economic consequences of the pandemic. The temporary shutdown of manufacturing facilities also hindered the EGR valves market growth in 2020. The automotive industry requires a significant number of human laborers; on the other hand, the mode of spread of SARS-CoV-2 through human gathering hampered the operations of the sector. Thus, the overall declining trajectory in the automotive sector reflects in the limited growth of the EGR valves market.

EGR valves: Market Insights

Growing Demand for Commercial Vehicles Fuels Growth of EGR Valves Market

Currently, 55% of the world's population lives in cities, which is anticipated to rise to 68% by 2050. According to a new United Nations data set released, urbanization or a gradual movement of humans from rural to urban areas, combined with the global population growth, could propel the urban population by 2.5 billion by 2050, and Asia and Africa would account for ~90% of this increase. Hence, growing urbanization has resulted in the flourishment of the industrial sector and infrastructural development, which is a fundamental factor driving the enormous increase in goods transport vehicles worldwide. The expansion of the industrial sector, particularly in developing countries, generated a large number of employment positions in various industries, including construction, mining, and tourism. The increase in job opportunities also leads to increased commuters, which significantly impacts public transportation demand and boosts vehicle manufacturing. These factors are fueling the growth of EGR valve providers.

Furthermore, rapid commercialization in developing countries such as China and India has fueled the demand for commercial cars in these countries. Commercial cars are used to make income, and these vehicles with superior fuel efficiency will increase vehicle owners' revenues. The demand for improved fuel efficiency and performance is expected to boost the EGR valves market growth during the forecast period.

Type-Based Market Insights

Based on type, the EGR valves market is segmented into electric EGR valves and pneumatic EGR valves. The pneumatic EGR segment accounted for a larger market share in 2020.

EGR Valves Market Regional InsightsThe regional trends and factors influencing the EGR Valves Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses EGR Valves Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

EGR Valves Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 909.19 Million |

| Market Size by 2028 | US$ 1,183.21 Million |

| Global CAGR (2021 - 2028) | 3.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

EGR Valves Market Players Density: Understanding Its Impact on Business Dynamics

The EGR Valves Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the EGR Valves Market top key players overview

Application-Based Market Insights

Based on application, the EGR valves market is bifurcated into gasoline engine and diesel engine. In 2020, the diesel engine segment led the market, in terms of a revenue share.

Players operating in the EGR valves market adopt strategies such as mergers and acquisitions to maintain their positions in the market. A few developments by key players are listed below:

- In October 2020, BorgWarner Inc. finalized the acquisition of Delphi Technologies. The merger of BorgWarner with Delphi Technologies is projected to boost BorgWarner's electronics and power electronics products, capabilities, and scale, establishing it as a leader in electrified propulsion systems.

- In October 2020, Continental Automotive and Powertrain Technologies was presented with the "Supplier of the Year" award for particularly exemplary performance among their 900 strategic series suppliers.

The EGR valves market is segmented on the basis of type, application, vehicle type, and geography. Based on type, the market is further segmented into electric EGR valves and pneumatic EGR valves. Based on application, the EGR valves market is subsegmented into gasoline engine and diesel engine. The EGR valves market, by vehicle type, is segmented into passenger cars, LCV, MCV, and HCV. By region, the market is segmented into five major regions North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and South America (SAM).

BorgWarner Inc; Continental AG; Nissens Automotive A/S; Denso Corporation; KORENS. Co., LTD.; Mahle GmbH; Mitsubishi Electric Corporation; Rheinmetall Automotive AG; Tenneco Inc.; and Valeo are a few major players operating in the global EGR valves market.

Frequently Asked Questions

Increasing Demand for Emission Reducing Technology

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For