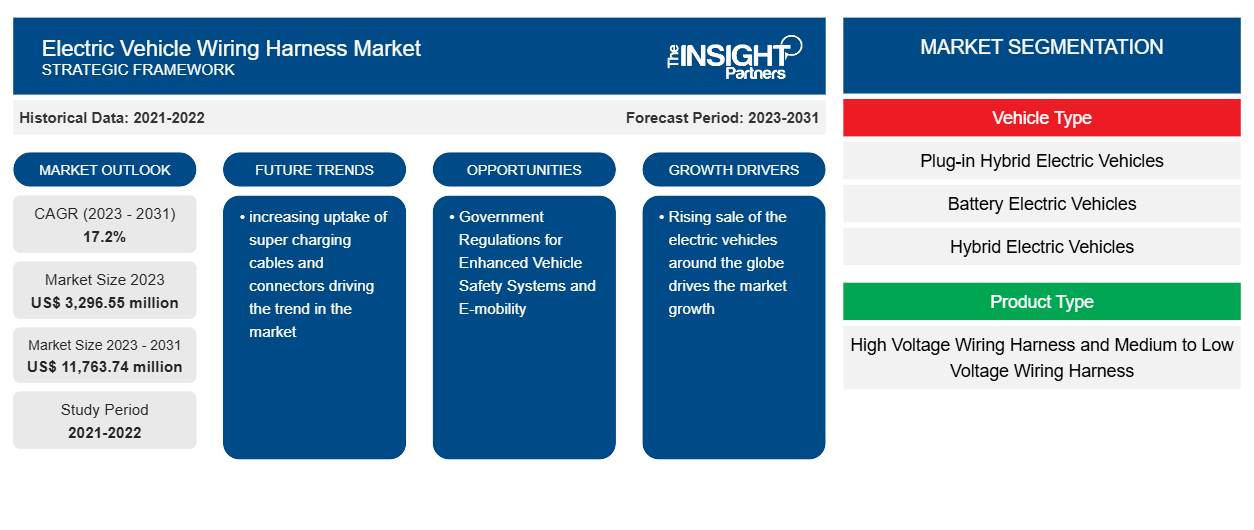

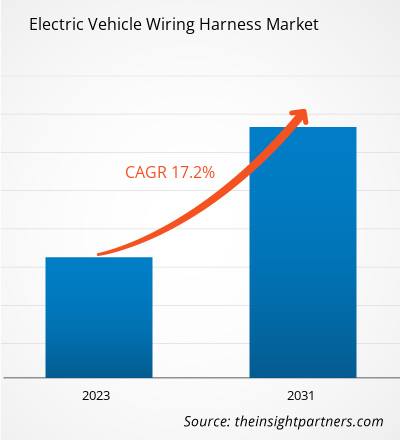

The electric vehicle wiring harness market size is projected to reach US$ 11,763.74 million by 2031 from US$ 3,296.55 million in 2023. The market is expected to register a CAGR of 17.2% during 2023–2031. The increasing uptake of super charging cables and connectors driving the trend in the market.

Electric Vehicle Wiring Harness Market Analysis

Manufacturers in the global electric vehicle wiring harness market carry out various processes, such as designing, assembling, and transformation of raw material into finished products. Coroplast Fritz Müller GmbH & Co. KG; Cypress Industries; Fujikura Ltd.; and Furukawa Electric Co., Ltd.; among others, are some of the leading players in the electric vehicle wiring harness market. The companies are offering a wide range of products for plug-in hybrid electric vehicles, battery electric vehicle, hybrid electric vehicles, and fuel cell electric vehicles OEMs. The end-users hold a large number of customers, from personal use vehicle buyers to fleet operators. Growing focus on improving the fuel economy of vehicles, increase in EV production, and high demand for lightweight wiring harness are anticipated to present significant opportunities for the companies planning to enter this market.

Electric Vehicle Wiring Harness Market Overview

The electric vehicle wiring harness market ecosystem comprises the following stakeholders – raw material providers, wiring harness manufacturers, OEMs, and end users. Major players occupy significant places in the various nodes of the electric vehicle wiring harness market ecosystem. The raw material providers supply the components such as aluminium, and copper among others to build the wiring harness. An electric vehicle wiring harness components includes connectors, terminals, locks, wires, cables, and outer coverings.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric Vehicle Wiring Harness Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Electric Vehicle Wiring Harness Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electric Vehicle Wiring Harness Market Drivers and Opportunities

Growing Demand for Lightweight Harness

Technological advancements and the rising manufacturing of electric vehicles (EV) lead to the growing demands of lightweight wiring harnesses to achieve weight reduction and improved vehicle packaging. The integration of advanced features in autonomous passenger cars and light commercial vehicles is projected to further aid in the market's growth during the forecast period.

Key players in the market are focusing on the development of conductor materials, such as CuAg (copper/silver), CuSn (copper/tin), and CuMg (copper/magnesium), for the optimization of the current wiring system design. Copper conductors are the mainstream in the industry due to their excellent electrical conductivity and safety, and advantages for light-weighting. The increasing R&D to decrease the metal content helps achieve reduced weight and raise the overall vehicle fuel efficiency. In addition to this, lightweight, eco-friendly wire harness solutions, such as high-voltage wire harness systems for hybrid and plug-in vehicles, are also gaining rapid traction.

Government Regulations for Enhanced Vehicle Safety Systems and E-mobility

In North America, initiatives by the government, federal policies, and programs for various industries are expected to drive the electric vehicle wire harness market The US, Canada, and Mexico signed the trade deal NAFTA. The trade deal helping automakers with the increased number of manufacturing facilities and enhanced supply chain of auto parts. The expanding demand for hybrid and electric vehicles and increasing electrification of vehicles are the primary factors, driving the global electric vehicle wiring harness market. Stringent emission norms for vehicles are forcing OEMs to manufacture hybrid and electric vehicles to reduce the emission of harmful gases. The US Department of Transportation has set the Corporate Average Fuel Economy (CAFE) standards for vehicles. The Canadian National Safety Code (NSC) standards regulate commercial vehicles, drivers, and motor carriers in Canada. The NSC is a code of minimum performance standards for the safe operation of commercial vehicles.

Electric Vehicle Wiring Harness Market Report Segmentation Analysis

Key segments that contributed to the derivation of the electric vehicle wiring harness market analysis are vehicle type, Product Type, Material Type and geography.

- Based on vehicle type, the market is divided into plug-in hybrid electric vehicles (PHEV), battery electric vehicles (BEV), hybrid electric vehicles (HEV), and fuel cell battery electric vehicles (FCBEV). Among these, battery electric vehicles (BEV) have a largest share in 2023, this is owing to increased electric vehicles sale across the globe.

- Depending upon the product type, the market is divided into high voltage wiring harness and medium to low voltage wiring harness. Among these, medium to low voltage wiring harness has a larger share in 2023.

- Based on material type, the market is divided into copper-clad wire, aluminium alloy wire, glass optical fibre, plastic optical fibre, and others. Among these, aluminium alloy wire is growing with rapid pace during the forecast period.

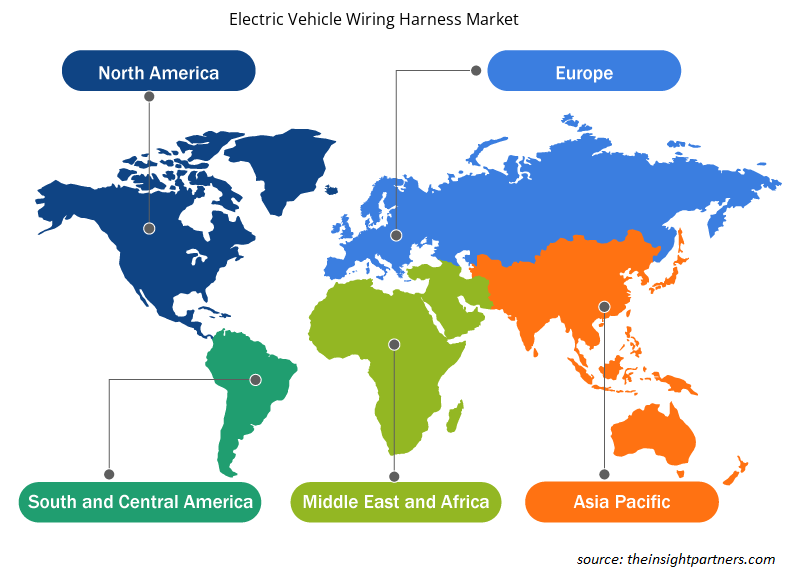

Electric Vehicle Wiring Harness Market Share Analysis by Geography

The geographic scope of the Electric Vehicle Wiring Harness market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific has largest share in the electric vehicle wiring harness market owing to increased sale of EVs in this region. Rise in consumer demand for expensive features in automobiles is encouraging manufacturers to invest in high-end technological solutions. The car industry was the first economic victim of COVID-19 in China with the shutdown of major automotive production sites and manufacturing plants. The automotive market in Asia Pacific region continued to rebound strongly in 2021. Industry experts expect the automakers' margins to improve in FY22. The market rebound is encouraging the growth of electric vehicle wiring harness solutions. In most countries, subsidies are a critical tool for maintaining the EV policy due to higher vehicle costs. The Japanese government arranged for US $77.1 million of EV subsidies in January 2021 to boost BEV sales. A number of new venture firms are emerging in the electric vehicle market in China, Japan and South Korea which is estimated to provide lucrative growth opportunities for the electric vehicle wiring harness market.

Electric Vehicle Wiring Harness Market Regional Insights

The regional trends and factors influencing the Electric Vehicle Wiring Harness Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Electric Vehicle Wiring Harness Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Electric Vehicle Wiring Harness Market

Electric Vehicle Wiring Harness Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3,296.55 million |

| Market Size by 2031 | US$ 11,763.74 million |

| Global CAGR (2023 - 2031) | 17.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

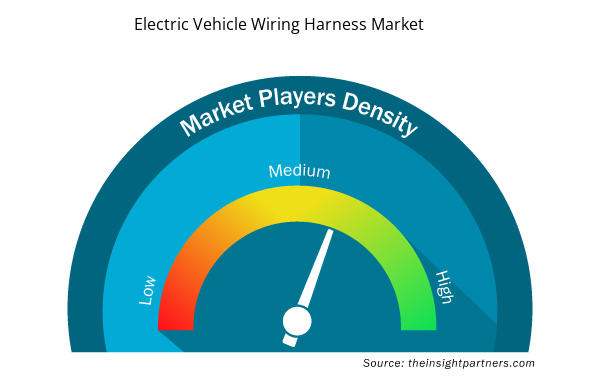

Electric Vehicle Wiring Harness Market Players Density: Understanding Its Impact on Business Dynamics

The Electric Vehicle Wiring Harness Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Electric Vehicle Wiring Harness Market are:

- Coroplast Fritz M?ller Gmbh & Co. Kg

- Fujikura Ltd.

- Furukawa Electric Co. Ltd.

- Motherson Sumi Systems Ltd.

- Nexans Autoelectric GmBh

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Electric Vehicle Wiring Harness Market top key players overview

Electric Vehicle Wiring Harness Market News and Recent Developments

The electric vehicle wiring harness market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Electric Vehicle Wiring Harness Market are listed below:

- Delphi announces the launch of its new range of BEV brake pads dedicated to the specific needs of BEV applications. Based on detailed comparisons, this range is amongst the most comprehensive in the world today covering the most popular models in the independent aftermarket. Vehicles include the Nissan Leaf and Tesla Model S/Model 3, in addition to the newest models such as BMW i4/iX, Mercedes EQC/EQEE/QS, and Porsche Taycan/Cross Turismo. Introducing 52-part numbers covering 2.7M Vehicles in Operation in Europe, Delphi is providing a substantial service opportunity for workshops. (Source: Company Website, February 2024)

- Allied Nippon launched EV+, an all-new, fully featured brake pad range for Electric Vehicles. (Source: Press Release, June 2023)

Electric Vehicle Wiring Harness Market Report Coverage and Deliverables

The “Electric Vehicle Wiring Harness Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Electric vehicle wiring harness market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Electric vehicle wiring harness market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Electric vehicle wiring harness market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the electric vehicle wiring harness market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Customer Care BPO Market

- EMC Testing Market

- Small Internal Combustion Engine Market

- Social Employee Recognition System Market

- Rugged Phones Market

- Semiconductor Metrology and Inspection Market

- Data Annotation Tools Market

- Artificial Intelligence in Defense Market

- Vertical Farming Crops Market

- Fixed-Base Operator Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Vehicle Type , Product Type, and Material Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, South Africa, South Korea, United Kingdom, United States

Frequently Asked Questions

Which region dominated the electric vehicle wiring harness market in 2023?

Asia Pacific is expected to dominate the electric vehicle wiring harness market in 2023.

What are the driving factors impacting the electric vehicle wiring harness market?

Rising sale of the electric vehicles around the globe drives the market growth.

What are the future trends of the electric vehicle wiring harness market?

The increasing uptake of super charging cables and connectors driving the trend in the market.

Which are the leading players operating in the electric vehicle wiring harness market?

Coroplast Fritz Müller GmbH & Co. KG; Cypress Industries; Fujikura Ltd.; and Furukawa Electric Co., Ltd and others.

What would be the estimated value of the electric vehicle wiring harness market by 2031?

The electric vehicle wiring harness market size is projected to reach US$ 11,763.74 million by 2031 from US$ 3,296.55 million in 2023.

What is the expected CAGR of the electric vehicle wiring harness market?

The market is expected to register a CAGR of 17.2% during 2023–2031.

Get Free Sample For

Get Free Sample For