Electronic Article Surveillance Market Growth and Analysis by 2028

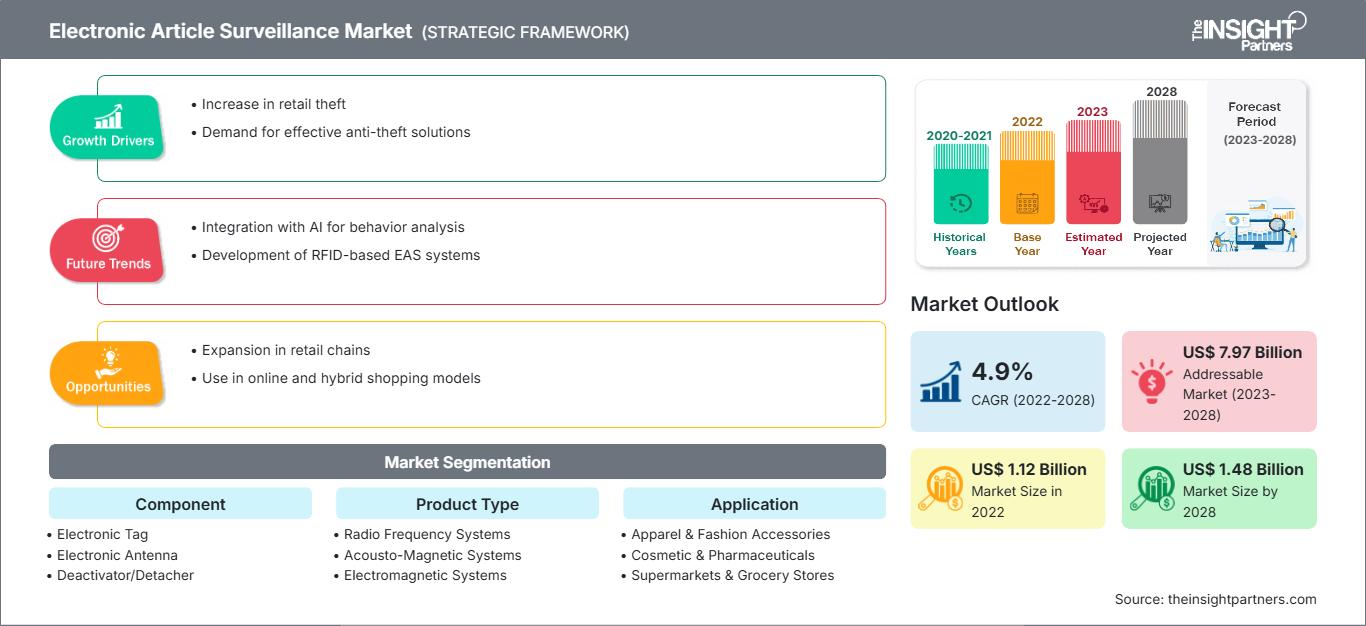

Electronic Article Surveillance Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Component (Electronic Tag, Electronic Antenna, Deactivator/Detacher, and Others), Product Type (Radio Frequency Systems, Acousto-Magnetic Systems, Electromagnetic Systems, and Microwave Systems), and Application (Apparel & Fashion Accessories, Cosmetic & Pharmaceuticals, and Supermarkets & Grocery Stores)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2028- Report Date : Feb 2023

- Report Code : TIPRE00003038

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 170

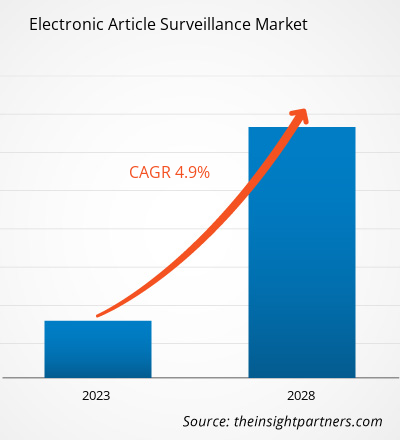

The electronic article surveillance market is expected to grow from US$ 1,116.07 million in 2022 to US$ 1,484.00 million by 2028; it is estimated to register a CAGR of 4.9% from 2022 to 2028.

The significant presence of the retail industry in North America is one of the major factors driving the electronic article surveillance (EAS) market. Major retail brands across the region include The Kroger Co., Costco, Best Buy, Carvana, The Home Depot, Target, eBay, and Walmart. Many expansion strategies, including the opening of several new retail stores across the region, have been adopted by the abovementioned brands. For example, in 2022, Target opened 23 new stores across different locations, such as New York, Texas, Pittsburgh, and South Carolina. Thus, the increase in the number of retail stores is further increasing the demand for electronic article surveillance solutions across the region.

In addition, the increasing number of shoplifting cases across North America is driving the demand for electronic article surveillance. According to the Retail Council of Canada, the retail sector in the country experienced theft of ~US$ 200 million a year before the onset of the COVID-19 pandemic. Furthermore, the rising cost of living is one of the factors catalyzing the increasing number of shoplifting cases across the country. These factors are propelling the demand for advanced security solutions across retail stores, thereby contributing to the electronic article surveillance market growth. In addition, several stringent government regulations and certifications, such as UCODE 9 IC, are launched to standardize security products across retail checkpoints and exit points, which is further influencing the North America electronic article surveillance market players to develop enhanced products.

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONElectronic Article Surveillance Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Electronic Article Surveillance Market

Lockdowns imposed by governments of various countries in Europe due to the onset of the COVID-19 pandemic resulted in the shutdown of several stores of apparel, fashion accessories, and cosmetics. As a result, the adoption of electronic article surveillance across these stores witnessed a decline, severely affecting the market growth. With the shutdown of nonessential businesses in 2020, clothing and apparel retail stores recorded high losses in sales. For instance, several apparel markets witnessed a step-change in the proportion of online sales due to lockdowns and shutdowns of stores. According to the Retail Economics forecasts, the UK is the most highly penetrated market, with 60% of apparel sales projected to occur online by 2025. All these factors led to a decline in the demand for electronic article surveillance in fashion stores.

Market Insights – Electronic Article Surveillance Market

The global retail industry witnessed growth owing to the rise in the standard of living of people. Major companies operating in the global electronic article surveillance market include Agon Systems, Amersec, Feltron Security Systems LLC, Johnson Controls, and Tekno Electro Solutions Pvt Ltd. These companies have been engaged in new product development over the years. A list of such developments is mentioned below:

- In July 2022, Checkpoint Systems announced the launch of its new NS40 EAS antenna. The solution is easily integrated with retail solutions to control shoplifting incidents across retail stores.

- In April 2021, Prosegur Security announced the launch of its new DoubleLock EAS tag with two separate use cases, reducing the tag defeat by 40–60%.

- In March 2021, Prosegur Security announced the launch of its D-Arm Series EAS tags. The tags are integrated with a self-alarm, which is activated if removed with a magnet. The solution is designed to reduce retail loss due to shoplifting incidents.

Thus, the rising development of new electronic article surveillance systems such as electronic tags, antennae, and deactivators is driving the global electronic article surveillance market forecast.

Component-Based Insights

Based on component, the electronic article surveillance market is segmented into electronic tag, electronic antenna, deactivator/detacher, and others. The electronic tag segment accounted for the largest market share in 2021. An electronic article surveillance (EAS) tag is a crucial component of an EAS system. The tag is a small signal transmitter that gives the signal to the EAS antennas and generates an alarm when tried to take it out of the store without removing the same. Also, every store with a problem with shrinkage generally benefits from the quality tags as EAS antennas reduce shrinkage from 50 to 90%. Moreover, every store has different security needs, and electronic tags allow retailers to track inventory at the item level, so they are better prepared to make decisions about stocking and promotions. Also, many handheld devices contain internal RFID tags which are designed to set off electronic article surveillance sensors at store entrances. A clothing store has hard tags that are premium of all tags and have multiple lock mechanisms, making it extremely hard to remove by unauthorized individuals. Grocery stores face difficulties in tagging frozen items and items containing liquids or metal. Therefore, electronic tags or labels are attached to such products, and sensors are placed at store exits.

The global electronic article surveillance market size is segmented based on component, product type, application, and geography. Based on component, the electronic article surveillance market is segmented into electronic tag, electronic antenna, deactivator/detacher, and others. Based on product type, the electronic article surveillance market is categorized into radio-frequency, acoustic-magnetic, electromagnetic, and microwave systems. Based on application, the electronic article surveillance market is classified into apparel & fashion accessories, cosmetics & pharmaceuticals, and supermarkets & grocery stores. The electronic article surveillance market size, based on region, is segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

Sensormatic, Checkpoint Systems, ALL-TAG, Agon Systems, and Checkpoint Systems are among the key electronic article surveillance market players operating across the world.

Electronic Article Surveillance Market Regional InsightsThe regional trends and factors influencing the Electronic Article Surveillance Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Electronic Article Surveillance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Electronic Article Surveillance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.12 Billion |

| Market Size by 2028 | US$ 1.48 Billion |

| Global CAGR (2022 - 2028) | 4.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Electronic Article Surveillance Market Players Density: Understanding Its Impact on Business Dynamics

The Electronic Article Surveillance Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Electronic Article Surveillance Market top key players overview

The electronic article surveillance market players are mainly focused on the development of advanced and efficient products.

- In 2022, Noccela has a strategy for protecting our IPR, and we have been granted several patents already. This most recent patent, especially as it is a system-level patent, is another example of the continuous innovation of our team. It proves our solutions uniqueness and innovativeness and ability to develop end-to-end solutions with a product-market fit.

- In 2022, Checkpoint System is expanding its relationship with Polish fashion retail group LPP, with the deployment of a large scale Radio Frequency Identification program to improve merchandise availability, operational efficiency, and the consumer experience. The program will be deployed across LPP’s entire supply chain from manufacturing through LLP’s eCommerce platform and to over 1,700 outlets spanning 23 countries.

Frequently Asked Questions

1. Increasing Retail Outlets by Global Brands

2. Growing Product Development Initiatives by Global Players

3. Rising Number of Supermarkets

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For