Electronic Health Record Market Share, Opportunities and Forecast to 2031

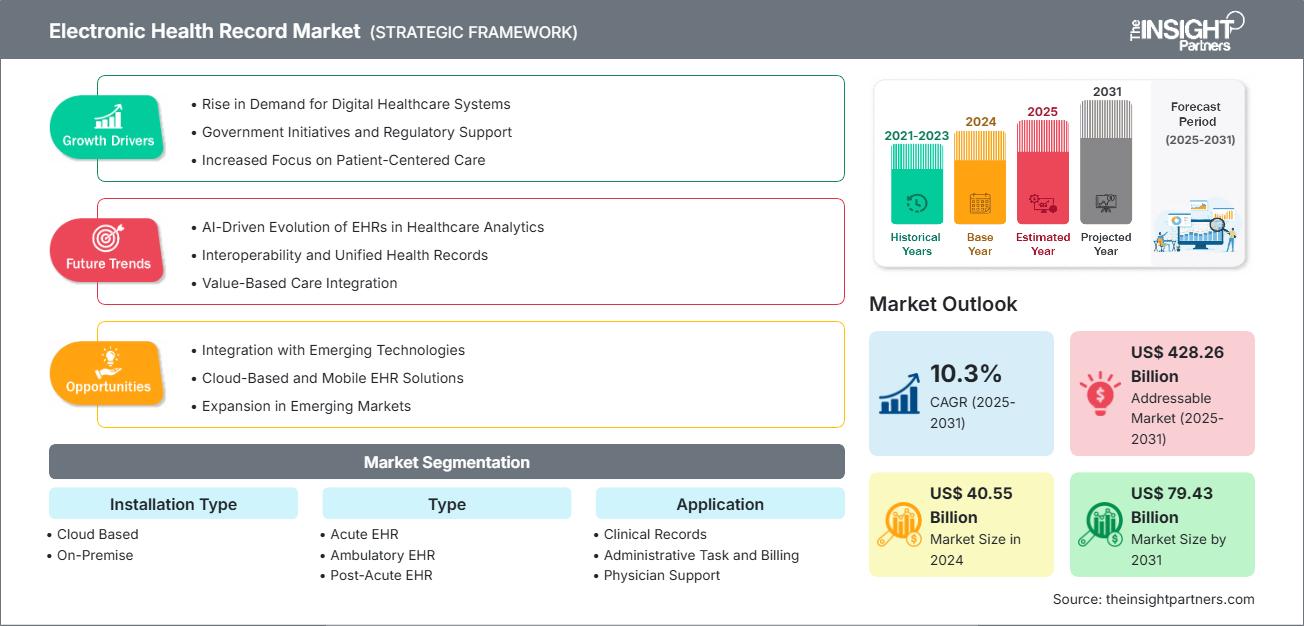

Electronic Health Record Market Size and Forecast (2021 - 2031) , Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage:By Installation Type (Cloud Based and On-Premise), Type (Acute EHR, Ambulatory EHR, and Post-Acute EHR), Application (Clinical Records, Administrative Task and Billing, Physician Support, and Patient Portal), Distribution Channel (Hospitals and Clinics, Ambulatory Care Centers and Physicians' Offices, or Specialty Care Centers), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, South and Central America)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Sep 2025

- Report Code : TIPHE100000822

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 248

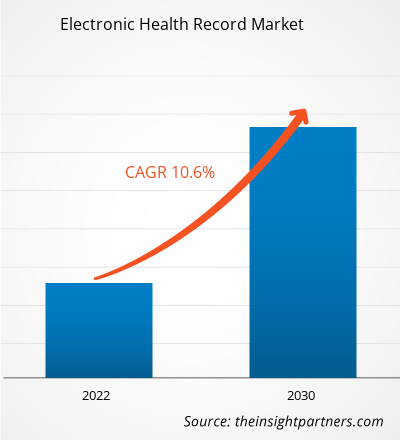

The electronic health record market size is expected to reach US$ 79.43 billion by 2031 from US$ 40.55 billion in 2024. The market is anticipated to register a CAGR of 10.3% during 2025–2031.

Electronic Health Record Market Analysis

The global electronic health record market has experienced significant growth over the past few years driven by increased digital transformation efforts within healthcare systems, government initiatives, and increased demand for more advanced healthcare infrastructure. Growth is also supported by healthcare information workload and data volume increase, interoperability initiatives, emerging technologies, and overall therapeutic innovation. Investigative companies are investing in innovation to develop EHR solutions that are scalable, mobile, and analytics-based to meet changing clinical and administrative request for data and information. As healthcare agencies make substantial efforts to become more operationally efficient and better engage with patients/families, the electronic health record market is anticipated to grow strong moving into the future.

Electronic Health Record Market Overview

Electronic health records (EHRs) are computerized versions of patients' paper charts that contain a real-time, patient-centered record that is accessible all at once and securely to those who have the right access. EHR system exist that allow details for each patient, including a medical history, diagnosis, medications, treatment plans, immunisations dates, and allergies, as well as radiology images and laboratory test results, all to enable more efficient clinical workflows, better coordination of care, and higher quality, safer, and more efficient healthcare. EHRs are in use in hospitals, clinics, specialty care centers, laboratories, and even mobile care units. With increased focus on integrated, patient-centered healthcare experiences and greater pressure for EHRs to enable evidence-based decision-making, and lessen inappropriate medical errors, and ultimately, improve patient outcomes.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONElectronic Health Record Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Electronic Health Record Market Drivers and Opportunities

Market Drivers:

- Increase in Adoption of Digital Health Care Systems The medical field is increasingly using digital systems to improve the quality of patient interactions with the hope of better patient outcomes and processes. Electronic health records contain data that can be more efficiently managed, readily accessible to healthcare providers, and interoperability amongst care providers will become significantly easier, leading to wide-ranging adoption of systems with increased electronic health records (EHR) capabilities in both developed and developing countries.

- Government Incentives and Regulation Support Countries across the world are working to support their providers in the transition to electronic health records through various funding initiatives, regulations and other supportive actions. The regulatory environment in the US has kept pressure on providers to transition to electronic systems. Supporting regulation such as HIPAA protections for data and the HITECH Act, have all incentivized the growth of EHR solutions, while addressing security concerns.

- Patient-Centered Care Emphasis and Consumer Choice There is increasing emphasis on the delivery of care that is more individualized. EHR systems are critical to the delivery of patient-centered plans with personalized plans, promoting patient engagement, better communication between providers, and a better and more satisfying experience for the patient.

Market Opportunities:

- Integration with Emerging Technologies Integration of EHRs with artificial intelligence (AI), machine learning (ML) and Internet of Things (IoT) and blockchain is improving accuracy of documentation, predictive analytics, and security. These technologies will allow for automation, intelligent diagnosis, and real-time insight and for healthcare organizations this means significant opportunities to enhance clinical decision making and to improve administrative and operational processes.

- Cloud-Based and Mobile EHR Solutions Cloud and mobile-based EHRs are viable scalable and cost-effective solutions for easy access to patient records at any time. These solutions enable real time data syncing, remote consultations and improved collaboration among providers and meet healthcare organizations' needs to provide flexibility and mobility, especially in post-pandemic delivery of care and overall healthcare infrastructure.

- Growth Opportunities in Emerging Economies With digital healthcare rapidly developing in emerging economies, avenues are emerging for these markets to adopt EHR's. The demand for EHRs in the emerging markets is bolstered by increasing investments in health information technology infrastructure and increasing internet access, which facilitate the realization of national health goals through government digital health programs. Emerging economies present vendors and other market forces with significant growth opportunities to address the needs of their populations, many of whom are unserved by existing care systems.

Market Trends:

- AI-Driven Evolution of EHRs in Healthcare Analytics AI is enhancing EHR by customizing treatment recommendations, forecasting health outcomes, and identifying diseases much earlier than previously possible. By smarter EHR systems, AI can more seamlessly help with the transition to information-based and preventative healthcare by improving clinical processes, decreasing the administrative load, and aiding in clinical decision support.

- Interoperability and Integrated Health Records Healthcare systems are prioritizing interoperability across platforms and providers to facilitate seamless data exchange. Integrated health records enable full patient views, coordinated patient care, and minimize duplication. This trend is an important enabler of collaborative care models; it will also help the industry meet regulatory expectations for patient-accessible electronic health information.

- Value-Based Care Integration The shift from fee-for-service to value-based care is changing EHR systems from focusing solely on documentation of services to documentation focused on health outcomes, efficiency, and quality of care. EHR systems will need to evolve to support performance metric tracking, documenting patient care coordination, and provide insights that appropriately align with reimbursement models for patient health outcomes.

Electronic Health Record Market Report Segmentation Analysis

The electronic health record market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in industry reports:

By Installation Type:

- Cloud-Based: Remote inclusion, simplicity, and cost-effectiveness are the advantages of cloud-based EHR. These solutions work best for smaller and medium-sized clinics and ask for real-time data access.

- On-Premise: Larger healthcare organizations with established IT facilities and stringent compliance standards prefer these systems. EHR also allows a system and data protection along with better system and data protection.

By Type:

- Acute EHR : Acute EHR are designed for hospitals and inpatient settings. It support complex, high-acuity care with features such as real-time monitoring, medication management, and emergency interventions.

- Ambulatory EHR : It is used for outpatient care settings. It streamlines documentation, patient scheduling, and chronic disease management. It helps to improve workflow efficiency for clinics and physician practices.

- Post-Acute EHR: It is used for rehabilitation centers, nursing homes, and long-term care facilities. It helps to manage patient transitions, therapy progress, and extended care documentation.

By Application:

- Clinical Records

- Administrative Task and Billing

- Physician Support

- Patient Portal

This segment includes clinical records, administrative tasks and billing, physician support, and patient portals. Each segment helps with streamlining of healthcare delivery. It improves documentation, enhance billing accuracy, support clinical decisions, and helps to boost patient engagement via secure, real-time access to personal health data.

By Distribution Channel:

- Hospitals and Clinics

- Ambulatory Care Centers

- Physicians' office/Specialty Care Centers

By Geography:

- North America

- Europe

- Asia Pacific

- South & Central America

- Middle East & Africa

The regional trends and factors influencing the Electronic Health Record Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Electronic Health Record Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Electronic Health Record Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 40.55 Billion |

| Market Size by 2031 | US$ 79.43 Billion |

| Global CAGR (2025 - 2031) | 10.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Installation Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Electronic Health Record Market Players Density: Understanding Its Impact on Business Dynamics

The Electronic Health Record Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Electronic Health Record Market top key players overview

Electronic Health Record Market Share Analysis by Geography

The electronic health record (EHR) market in Asia Pacific is growing. This is mainly due to growing digital healthcare adoption, and growing government support of healthcare IT infrastructure development. Emerging markets in South and Central America, and the Middle East and Africa also provide untapped opportunities for EHR vendors to expand their growth.

Market growth will vary by region due to varying healthcare digitization, regulatory mechanisms, and infrastructure development. Below is a summary of market share and trends by region:

1. North America

- Market Share: Holds a dominant share of the global EHR market due to early adoption and advanced healthcare infrastructure

-

Key Drivers:

- Strong presence of major EHR vendors and established healthcare IT systems

- Supportive regulations such as HIPAA

- High digital literacy and patient engagement in healthcare

- Trends: Increasing integration of AI and telehealth with EHR systems to improve care coordination and outcomes

2. Europe

- Market Share: Accounts for a substantial portion of the global EHR market, especially in Western Europe

-

Key Drivers:

- Government-led digital health initiatives and funding programs

- Rising demand for cross-border healthcare data sharing

- High focus on patient data privacy and GDPR compliance

- Trends: Expansion of cloud-based EHR systems and focus on interoperability across national health systems

3. Asia Pacific

- Market Share: Witnessing the fastest growth rate in the global electronic health record market

-

Key Drivers:

- Growing investments in healthcare infrastructure and IT in countries such as India, China, and Japan

- Increasing population and chronic disease burden

- Government programs promoting digital health transformation

- Trends: Mobile and cloud EHR adoption in rural and urban areas; rise of telemedicine integration

4. South and Central America

- Market Share: Although small, it is moderately growing

-

Key Drivers:

- Expanding public healthcare systems and regional digitization initiatives

- Need for efficient record-keeping in underserved and remote areas

- Local EHR vendors offering affordable solutions

- Trends: Gradual transition from paper to digital records with growing interest in cloud EHR platforms

5. Middle East and Africa

- Market Share: Holds a smaller share but shows significant potential for future growth

-

Key Drivers:

- Government healthcare modernization plans in the Gulf countries

- Rising demand for efficient health data management in emerging economies

- Increasing investment in hospital infrastructure and smart health systems

- Trends: Adoption of interoperable and multilingual EHR systems to cater to diverse populations

Electronic Health Record Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to established players such as Oracle Corp, Veradigm Inc, and Infor-Med Inc. Regional and niche providers such as eClinicalWorks LLC (US) and PracticeSuite Inc (US) add to the competitive landscape across regions.

This high level of competition urges companies to stand out by offering:

- Advanced AI-powered analytics and decision support tools

- Secure, interoperable, and patient-centric EHR solutions

Opportunities and Strategic Moves

- Integration of telehealth and mobile health applications with EHRs

- Increasing focus on data privacy, security, and compliance with regulations

Major companies operating in the electronic health record market are:

- Veradigm Inc – Durham, North Carolina, US

- Greenway Health LLC – Tampa, Florida, US

- eClinicalWorks LLC – Westborough, Massachusetts, US

- Infor-Med Inc – Petach Tikva, Israel

- Microwize Technology Inc – New Delhi, India

- Athenahealth Inc – Watertown, Massachusetts, US

- ChipSoft.com Inc – Amsterdam, Netherlands

- AdvancedMD Inc – South Jordan, Utah, US

- PracticeSuite Inc – New Jersey, US

- Oracle Corp – Austin, Texas, US

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Cerner Corporation

- Allscripts Healthcare Solutions

- MEDITECH

- NextGen Healthcare

- Epic Systems Corporation

- McKesson Corporation

- GE Healthcare

- e-MDs

- Netsmart Technologies

- Kareo

- Practice Fusion

- drchrono

- Advanced Data Systems Corporation (ADSC)

- Medhost

- Sevocity

Electronic Health Record Market News and Recent Developments

- Oracle Brings EHR into the 21st Century - Oracle has launched its all-new, modern Oracle Health EHR for ambulatory providers in the US. This AI-powered, voice-first solution enables clinicians to access patient information effortlessly using voice commands, reducing administrative burden and streamlining workflows. Designed with frontline providers, it enhances care quality. The company plans to include acute care features in this solution by 2026.

- Campbell County Health Implements Epic EHR - Campbell County Health (CCH) went live with Epic, a leading Electronic Health Record system, on July 19, 2025. This implementation marks a major advancement in improving patient care, communication, and operational efficiency for the health system.

Electronic Health Record Market Report Coverage and Deliverables

The "Electronic Health Record Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- Electronic health record market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Electronic health record market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Electronic health record market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the electronic health record market

- Detailed company profiles

Frequently Asked Questions

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For