Emission Monitoring System Market Key Players and Opportunities by 2031

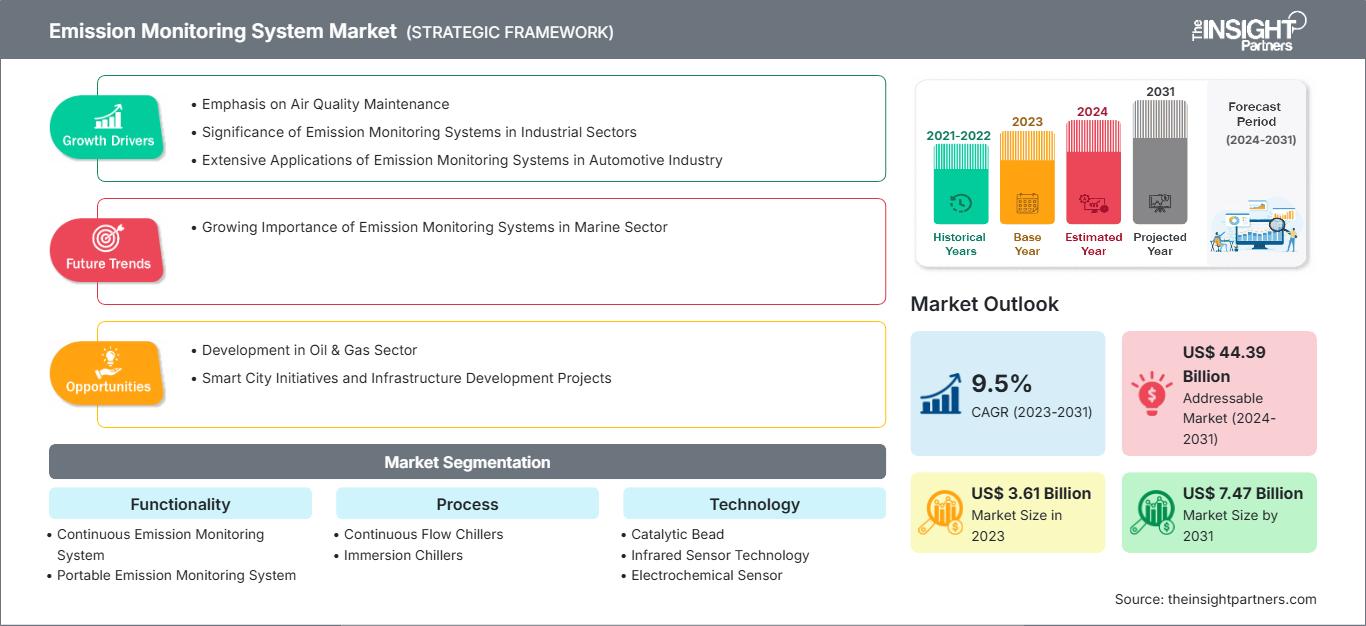

Emission Monitoring System Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Functionality [Continuous Emission Monitoring System (CEMS) and Portable Emission Monitoring System (PEMS)], Technology (Catalytic Bead, Infrared Sensor Technology, Electrochemical Sensor, Photoionization Detectors (PID), and Others), Type (Methane Gas Detectors, CO2 Gas Detectors, Oxygen Gas Detectors, and Others), End User (Marine Vessels, Oil and Gas, Chemicals, Automotive, Power Generation, and Others), and Geography

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Report Date : Nov 2024

- Report Code : TIPTE100001316

- Category : Electronics and Semiconductor

- Status : Published

- Available Report Formats :

- No. of Pages : 256

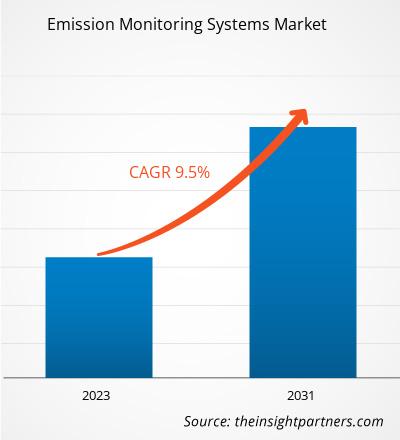

The Emission Monitoring System market size is expected to reach US$ 7.47 billion by 2031 from US$ 3.61 billion in 2023. The market is estimated to record a CAGR of 9.5% from 2023 to 2031. The growing importance of Emission Monitoring System in the marine sector is likely to remain a key market trend.

Emission Monitoring System Market Analysis

Emission monitoring technology is currently witnessing a period of robust growth and development across multiple industries, including automotive, oil & gas, power generation, and chemicals. These industries are witnessing substantial investments from the private and public sectors, with many planned projects in the development stages. In specific, the automotive industry is undergoing substantial growth. This will continue, specifically with the government initiatives and funding for infrastructure development to incorporate autonomous vehicle technology. The emission monitoring system market outlook continues to be positive since this technology is well-positioned to serve the growing requirements for managing emissions of end users, such as oil & gas, utilities, construction, and manufacturing. The marine vessel and mining sectors are two prominent application areas of Emission Monitoring System. Aviation, pharmaceuticals, waste processing, and pulp & paper industries have also contributed a significant share of carbon emissions across the globe in every past decade. Most of these industries mandate government regulations that are associated with the reduction of carbon emissions from the respective industries' operations. Such factors are contributing to the demand for Emission Monitoring System worldwide.

Emission Monitoring System Market Overview

The Emission Monitoring System market growth is attributed to the growing concern for rising environmental pollution levels from toxic gases from oil & gas, utility, automotive, mining, construction, marine, and manufacturing industries. In addition, the increasing urbanization boosts the demand for Emission Monitoring System. The increase in substantial investments in the automotive sector boosts the emission monitoring market growth. Additionally, the growing adoption of Emission Monitoring System across the mining and chemicals sectors is projected to fuel the growth of the emission monitoring system market across the globe.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEmission Monitoring System Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Emission Monitoring System Market Drivers and Opportunities

Emphasis on Air Quality Maintenance

Airborne pollution is considered a health concern globally. The emphasis on air quality maintenance across different nations fuels the demand for Emission Monitoring System worldwide. The Environmental Protection Agency (EPA) phased out lead in motor vehicle gasoline under Clean Air Act authority in order to meet the US air quality standards, excluding areas near certain large lead-emitting industrial facilities. The harmful impact of lead emissions is linked with neurological consequences in children, such as behavioral problems, lowered IQ, and learning deficits, and high blood pressure and heart disease in adults.

The rising concern about the harmful environmental impact of toxic gases drives the application of Emission Monitoring System worldwide. The EPA promotes and supports area-wide air toxics strategies of state, tribal, and local agencies through national, regional, and community-based initiatives across the US. In India, the government has adopted several measures to improve air quality, foster green cover, and improve citizens' quality of life. Thus, the growing government focus on mitigating the environmental impact of harmful gases and reducing air pollution is acting as a major driver for the emission monitoring system market globally.

Development in Oil & Gas Sector

The demand for oil and gas has grown substantially across the globe. Countries such as the US, China, India, Vietnam, and South Korea are showcasing huge demand for crude oil owing to the continuous development in their manufacturing sectors, supported by favorable financial conditions and government policies and a surge in investments in the oil & gas sector. In November 2021, Equinor, a petroleum refining company, announced an investment of US$ 8.8 billion for the development of Wisting petroleum discovery in the Arctic Barents Sea, the northernmost oilfield of the world. Also, Petróleo Brasileiro S.A. has initiated an investment of US$ 68 billion for managing production at the offshore fields in the subsea pre-salt area from 2022 to 2026. The Qatar government has announced its plans to increase its LNG production by ~40% to ~110 million metric tons per annum by 2026. The government of Russia has also announced its strategy to escalate the LNG production capacity to ~140 million tons per year by 2035. Moreover, with the ever-increasing emphasis on reducing carbon emissions, governments of several nations are supporting gas-powered power plants over coal-powered power plants, as natural gas emits less carbon than coal. The emission monitoring system plays a crucial role in the oil & gas industry to monitor and manage the emissions from the oil & gas exploration and production operations. Thus, the increase in demand for natural gas and the evolution in the oil & gas sector are expected to provide growth opportunities to the emission monitoring system market.

Emission Monitoring System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Emission Monitoring System market analysis are functionality, technology, type, and end user.

- Based on functionality, the emission monitoring system market has been segmented into continuous emission monitoring system (CEMS) and portable emission monitoring system (PEMS). The continuous emission monitoring system (CEMS) segment held a larger Emission Monitoring System market share in 2023.

- Based on technology, the emission monitoring system market has been segmented into catalytic bead, infrared sensor technology, electrochemical sensors, photoionization detectors (PID), and others. The electrochemical sensor segment held the largest Emission Monitoring System market share in 2023.

- Based on type, the emission monitoring system market has been segmented into methane gas detectors, CO2 gas detectors, oxygen gas detectors, and others. The CO2 gas detectors segment held the largest Emission Monitoring System market share in 2023.

- Based on end user, the emission monitoring system market is segmented into marine vessels, oil & gas, chemicals, automotive, power generation, and others. The oil and gas segment held the largest Emission Monitoring System market share in 2023.

Emission Monitoring System Market Share Analysis by Geography

The Emission Monitoring System market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. North America dominated the market in 2023, followed by Europe and Asia Pacific.

The Environmental Protection Agency (EPA) has set strict regulations and standards in regard to greenhouse gases, particularly programs such as the Greenhouse Gas Reporting Program. Companies operating in the petroleum sector will need monitoring systems to adhere to the required standards, avoiding sanctions. In December 2023, The US EPA announced a final rule to lower methane and other harmful air pollutants generated by the oil and natural gas industry nationwide. The rule aims to promote the use of advanced methane detection technologies; it is expected to prevent approximately 58 million tons of methane emissions from 2024 to 2038, or 1.5 billion metric tons of carbon dioxide. By 2030, the reductions are anticipated to reach 130 million metric tons of carbon dioxide. The rule is projected to achieve a ~80% reduction in methane emissions by 2038.

China and Japan are major contributors to the Asia Pacific Emission Monitoring System market. These countries record significant amounts of emissions. With the growing awareness initiatives to combat climate change and promote sustainability, the governments of various countries in Asia Pacific are implementing strict laws aimed at lowering greenhouse gas emissions, including methane and carbon dioxide.

Emission Monitoring System Market Regional Insights

The regional trends and factors influencing the Emission Monitoring System Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Emission Monitoring System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Emission Monitoring System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3.61 Billion |

| Market Size by 2031 | US$ 7.47 Billion |

| Global CAGR (2023 - 2031) | 9.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Functionality

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Emission Monitoring System Market Players Density: Understanding Its Impact on Business Dynamics

The Emission Monitoring System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Emission Monitoring System Market top key players overview

Emission Monitoring System Market News and Recent Developments

The Emission Monitoring System market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Emission Monitoring System market are listed below:

- Caerus Oil and Gas announced its collaboration with Qube Technologies, which is a milestone in its commitment to sustainable energy development. After a comprehensive pilot, Caerus has decided to deploy Qube's advanced continuous monitoring technology across 50 sites in Colorado's Piceance basin. This initiative highlights Caerus's dedication to environmental leadership and marks a significant step forward in the adoption of cleaner energy practices.

(Source: Qube Technologies, Press Release, May 2024)

- HORIBA, Ltd., a global leader in analytical and measurement technologies, proudly announces the launch of its groundbreaking AP-380 series of analyzers, catering to diverse air quality monitoring needs. The AP-380 series offers a comprehensive lineup of five models, each tailored to address specific trace gas monitoring requirements. These cutting-edge models include APMA-380 for carbon monoxide, APSA-380 for sulfur dioxide, APOA-380 for ozone, APNA-380 for nitrogen oxides, and APHA-380 for hydrocarbon trace gas monitoring.

(Source: HORIBA, Ltd., Press Release, January 2024)

Emission Monitoring System Market Report Coverage and Deliverables

The "Emission Monitoring System Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Emission Monitoring System market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Emission Monitoring System market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Emission Monitoring System market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Emission Monitoring System market

- Detailed company profiles

Frequently Asked Questions

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For