Military Rugged Display Market Size, Share, Trends & Forecast 2034

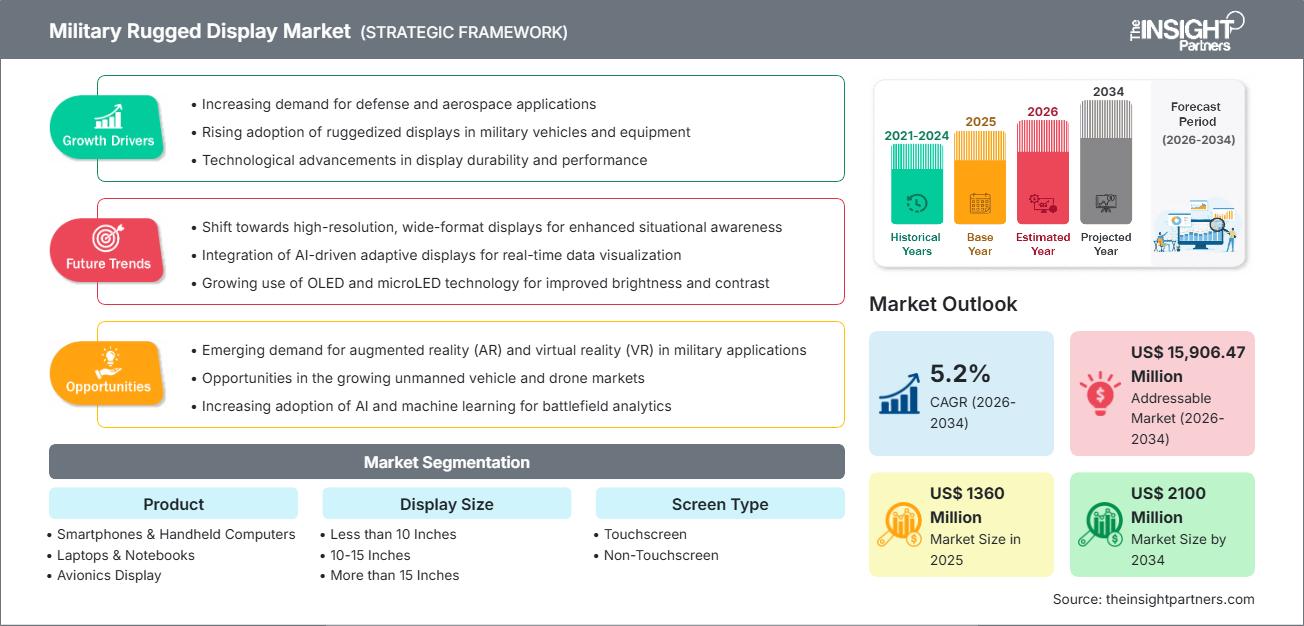

Military Rugged Display Market Size and Forecast (2021 - 2034), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product (Smartphones & Handheld Computers, Laptops & Notebooks, Avionics Display, Vehicle Mounted Computer, and Panel PC & Mission Critical Computer), Display Size (Less than 10 Inches, 10-15 Inches, and More than 15 Inches), Screen Type (Touchscreen and Non-Touchscreen), Resolution (High Definition and Full High Definition), and Users (Air Forces, Naval Forces, and Land Forces)

Historic Data: 2021-2024 | Base Year: 2025 | Forecast Period: 2026-2034- Status : Data Released

- Report Code : TIPRE00016080

- Category : Electronics and Semiconductor

- No. of Pages : 150

- Available Report Formats :

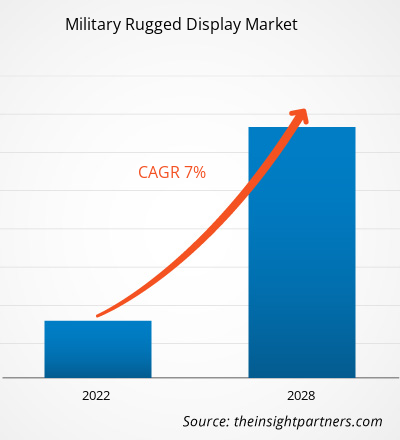

The military rugged display market size is expected to grow from US$1360 Million in 2025 to US$2100Million in 2034, registering a CAGR of 5.2% during the forecast period (2026–2034).

Military Rugged Display Market Analysis

The forecast for the military rugged display market signals robust growth driven by the modernization of defense systems, enhanced situational awareness demands, and increasing investments in military digitization. Rugged displays are critical in mission environments; they provide high durability under extreme temperatures, shock, and vibration, while offering readability in bright sunlight and compatibility with night-vision systems.

Growth is further supported by a shift toward capacitive touchscreen technologies (away from traditional resistive touch), which enable more sensitive and responsive input, as well as greater brightness for outdoor readability.

Additionally, rising procurement of ruggedized devices (like tablets, panel PCs, and vehicle-mounted computers) for dismounted soldiers, aircraft, naval vessels, and land vehicles is pushing demand. High military spending, driven by ongoing vehicle and platform modernization, also underpins market expansion.

Military Rugged Display Market Overview

Military rugged displays are specialized display systems designed to operate reliably in hostile, mission-critical environments. These rugged displays are built for durability; they resist environmental stresses such as extreme temperature, vibration, shock, dust, and moisture. They support daylight readability, night-vision compatibility, and provide critical situational awareness to users in air, land, and naval operations. Their role spans onboard avionics, soldier-worn handhelds, vehicle consoles, and mission-critical control panels.

These display systems are a backbone of military human-machine interfaces (HMI), enabling real-time data visualization, command-and-control, navigation, targeting, and communication, all within ruggedized hardware built for battlefield reliability.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONMilitary Rugged Display Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Military Rugged Display Market Drivers and Opportunities

Drivers:

- Defense Modernization Programs: Governments globally are investing heavily in modernizing their military hardware, including digitization of ground vehicles, aircraft cockpits, and naval platforms, which drives demand for rugged displays.

- Situational Awareness Needs: Increased emphasis on real-time situational awareness among soldiers and vehicle crews necessitates rugged, bright, high-resolution displays.

Technological Innovation: Transition from resistive to capacitive touchscreens, adoption of high-definition (HD) and full-HD displays, and improved power consumption boost product appeal. - Operational Resilience: Displays that perform reliably under harsh environmental conditions (temperature extremes, vibration, moisture) are critical for mission success across domains.

Opportunities:

- Emerging Defense Markets: Rapid military modernization in Asia-Pacific, the Middle East, and Latin America opens up new market potential.

Integration with Other Systems: Rugged displays integrated with battlefield networks, IoT devices, and advanced HMI systems offer more value. - AI and Automation: Display platforms that support AI‑driven situational analytics or augmented reality (AR) overlays could become increasingly desirable.

Modular & Scalable Solutions: Demand for modular rugged display systems (e.g., panel PCs, vehicle mounts) offers room for product differentiation.

Military Rugged Display Market Report Segmentation Analysis

The military rugged display market is segmented using the following dimensions:

By Product:

- Smartphones & Handheld Computers

- Laptops & Notebooks

- Avionics Display

- Vehicle-Mounted Computer

- Panel PC & Mission-Critical Computer

By Display Size:

- Less than 10 Inches

- 10–15 Inches

- More than 15 Inches

By Screen Type:

- Touchscreen

- Non-Touchscreen

By Resolution:

- High Definition (HD)

- Full High Definition (FHD)

By Geography:

- North America

- Europe

- Asia Pacific

- Latin America (South & Central America)

- Middle East & Africa

Military Rugged Display Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 1360 Million |

| Market Size by 2034 | US$ 2100 Million |

| Global CAGR (2026 - 2034) | 5.2% |

| Historical Data | 2021-2024 |

| Forecast period | 2026-2034 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Military Rugged Display Market Players Density: Understanding Its Impact on Business Dynamics

The Military Rugged Display Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Military Rugged Display Market Share Analysis by Geography

- North America is expected to hold the largest market share, driven by extensive defense budgets, high adoption of rugged display technologies, and the presence of major market players.

- Asia Pacific is projected to see fast growth due to increasing defense modernization in countries like China, India, and others.

- Europe, MEA, and Latin America will also contribute, with demand from both national defense forces and increasing imports of ruggedized technology.

Military Rugged Display Market Players Density: Understanding Its Impact on Business Dynamics

Competitive Strategies:

- Innovating with touchscreen technology (capacitive vs resistive) to enhance usability and readability.

- Developing high-brightness, full-HD rugged displays to improve situational awareness.

- Partnering with defense agencies to co-develop bespoke display solutions.

- Offering modular display units (panel PCs, vehicle mounts) to cater to different platforms (aircraft, land vehicles, naval).

- Emphasizing durability certification (temperature, vibration, shock) to maintain trust in critical-environment usage.

Opportunities and Strategic Moves

- Form strategic partnerships with defense OEMs (original equipment manufacturers) to embed rugged displays into new platforms (e.g., next-gen armored vehicles, aircraft).

- Invest in R&D for ultra-low-power rugged displays, enabling longer operation in the field.

- Expand in emerging markets, particularly in APAC and MEA, by localizing production or establishing supply chain presence.

- Leverage AI / AR features to add value: displays that support AR overlays (map, targeting) will be attractive to modern forces.

- Offer service contracts: maintenance, rugged testing, and upgrades could become a differentiator in a market with mission-critical SLAs.

Major Companies Operating in the Military Rugged Display Market

- Advanced Embedded Solutions Ltd

- Assured Systems Ltd

- Aydin Displays

- Crystal Group, Inc.

- General Digital Corporation

- Hatteland Technology AS

- Neuro Logic Systems, Inc.

- Winmate Inc.

- ZMicro, Inc.

- CP Technologies LLC

Other Companies Analyzed During the Course of Research

- Curtiss‑Wright Corporation

- Leonardo

- Elbit Systems Ltd.

- Saab AB

- BAE Systems plc

- Thales Group

- Kontron AG

- EIZO Rugged Solutions Inc.

- Getac Technology Corporation

- Panasonic Corporation

Military Rugged Display Market News and Recent Developments

- In 2021, Winmate launched the L140TG-4, a convertible rugged laptop specifically designed for military use, featuring a 14″ daylight-readable display with 1920×1080 resolution.

- Curtiss-Wright introduced a rugged multi-point PCAP touchscreen display for military aircraft and land vehicle applications

- Curtiss-Wright also released a 7″ vehicle-mount LCD rated for full HD resolution (1920×1080) for demanding military environments.

- In 2020, General Digital Corporation expanded its capacity by opening a 48,000 sq ft facility in East Hartford, Connecticut, to scale up rugged display production.

Military Rugged Display Market Report Coverage and Deliverables

The “Military Rugged Display Market Forecast (2021-2034)– COVID‑19 Impact and Global Analysis” report by The Insight Partners includes:

- Market size and forecast (global, regional, country-level) for all key segments

- Market trends, dynamics (drivers, restraints, opportunities)

- PEST (Political, Economic, Social, Technological) and SWOT analysis

- Competitive landscape with company profiles and ranking

- Recent developments, strategic initiatives

- Heat‑map analysis, market concentration

- Excel dataset for quantitative inputs

Frequently Asked Questions

2. Demand for enhanced situational awareness via rugged displays

3. Technological advancements in touchscreen and resolution

4. Need for displays that function reliably in harsh environments.

Naveen is an experienced market research and consulting professional with over 9 years of expertise across custom, syndicated, and consulting projects. Currently serving as Associate Vice President, he has successfully managed stakeholders across the project value chain and has authored over 100 research reports and 30+ consulting assignments. His work spans across industrial and government projects, contributing significantly to client success and data-driven decision-making.

Naveen holds an Engineering degree in Electronics & Communication from VTU, Karnataka, and an MBA in Marketing & Operations from Manipal University. He has been an active IEEE member for 9 years, participating in conferences, technical symposiums, and volunteering at both section and regional levels. Prior to his current role, he worked as an Associate Strategic Consultant at IndustryARC and as an Industrial Server Consultant at Hewlett Packard (HP Global).

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For