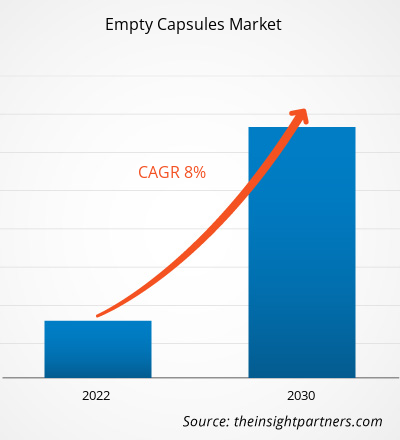

[Research Report] The empty capsules market size is projected to surge from US$ 6.75 billion in 2022 to US$ 12.52 billion by 2030; the market is estimated to grow at a CAGR of 8.0% during 2022–2030.

Analyst Perspective:

The report includes growth prospects owing to the current empty capsules market trends and their foreseeable impact during the forecast period. The major factors contributing to the market growth include the increasing geriatric population; an elevated demand for empty capsules in the pharmaceutical, nutraceutical, and cosmetic industries; and a growing consumer preference for capsules over tablets. The geriatric population, suffering from various chronic diseases, is a prime target of medicinal drug manufacturers. Elderly people primarily prefer capsules over tablets/pills as they are easy to swallow, dissolve more quickly, and reduce gastrointestinal irritation. However, the rising raw material prices and the cultural and religious issues associated with materials used to produce capsules (especially the inactive ingredients derived from animals) hinder the empty capsules market growth. The limited accessibility of raw materials, stringent regulatory regimes for gelatin manufacturers, and racial and dietary restrictions also hamper the market growth.

Market Overview:

Key factors driving the empty capsules market growth include the increasing acceptance of capsules over other forms of drug delivery, and strategic collaborations between empty capsule suppliers and gelatin manufacturers. Additionally, an upsurge in R&D activities and clinical trials, new product launches and key developments, and rapid advancements in capsule delivery technologies are other factors expected to have a significant impact on the empty capsules market forecast in the coming years. For instance, in November 2019, Qualicaps, Inc. launched the hard capsule dosage form at the CPHI WORLDWIDE 2019 conference.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Empty Capsules Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Empty Capsules Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Flourishing Nutraceutical and Dietary Supplement Industries Propel Market Growth

According to a research study titled “The Nutraceutical Nexus: Unveiling The Complete Nutrient Solution In One Place,” the global nutraceuticals market size was valued at US$ 454.55 billion in 2021 and is expected to grow by 9.0% from 2021 CAGR increase until 2030. Further, according to the US International Trade Administration, India is expected to account for ~3.5% of the global nutraceutical industry value by 2023; the nutraceutical industry in India is expected to grow from ~US$ 4 billion in 2020 to US$ 18 billion by the end of 2025. The nutraceutical and supplement industries offer vitamins, minerals, herbal extracts, probiotics, and other bioactive compounds. These substances often need to be encapsulated to facilitate convenient consumption. Empty capsules provide an efficient and versatile delivery system for such ingredients, enabling manufacturers to produce diverse products. Empty capsules allow manufacturers to tailor their formulations to specific ingredients, dosages, and target groups. This flexibility is critical in the nutraceutical and dietary supplement industries, as different products require different dosages and combinations of ingredients. Thus, capsules filled with nutraceuticals or dietary supplements help manufacturers meet consumer expectations in terms of quality, convenience, and effectiveness, which is a major factor driving the demand for empty capsules.

Segmental Analysis:

The empty capsules market analysis has been carried out by considering the following segments: product, functionality, application, and end user.

Based on product, the empty capsules market is segmented into gelatin capsules and non-gelatin capsules. The gelatin capsules segment held a larger market share in 2022. The non-gelatin capsules segment is estimated to register a higher CAGR of 9.0% during 2022–2030. The popularity of gelatin among capsule manufacturers is attributed to the ability of gelatin capsules to allow rapid drug release and uniform drug mixing, thereby preventing the oxidation of drug molecules. However, the growing concerns about allergies to animal products have also fueled demand for gelatin-free/non-gelatin capsules. Furthermore, the growing vegan and vegetarian population prefers plant-based alternatives. As a result, the market for this segment is anticipated to grow at a greater pace in the coming years.

The empty capsules market, based on functionality, is segmented into immediate-release capsules, delayed-release capsules, and sustained-release capsules. The immediate-release capsules segment held the largest market share in 2022. It is further expected to register the highest CAGR of 8.5% during the forecast period. The demand for immediate-release capsules is high in antacids and antibacterial antibiotic manufacturing and packaging facilities. According to an article published by Nitta Gelatin India in June 2022, therapeutics filled in immediate-release capsules are most commonly prescribed to treat various common diseases and disorders.

The empty capsules market, based on application, is divided into antibiotics and antibacterial drugs, vitamins and dietary supplements, antacids and antiflatulent preparations, and others. The antibiotics and antibacterial drugs segment held the largest empty capsules market share in 2022. The market for the vitamins and dietary supplements segment is expected to grow at the fastest CAGR of 8.9% during 2022–2030. Antibiotics and antibacterial drugs are administered to prevent or treat some microbial infections. The increasing cases of infectious diseases, growing demand for antibiotics in low- and middle-income countries, and surging investments in research and development by major pharmaceutical companies are the key factors bolstering the demand for empty capsules in antibiotics and antibacterial manufacturing and packaging facilities. The growth of the vitamins and supplements segment is attributed to the growing geriatric population worldwide and increasing demand for therapeutic drugs, and the rising popularity of nutritional supplements for better health outcomes.

Based on the end user, the empty capsules market is divided into the pharmaceutical industry, nutraceutical industry, cosmetics industry, and research laboratories. The pharmaceutical industry segment held the largest empty capsules market share in 2022 and the same is anticipated to register the highest CAGR of 8.4% during 2022–2030. Due to various motives such as improved palatability and faster absorption, the capsules are the most common solid dosage forms. These empty capsules meet the pharmaceutical industry's highest needs for treating various chronic and infectious diseases. Furthermore, there are advancements in the pharmaceutical industry with increasing use of R&D, clinical research activities, and technological developments in capsule administration. Thus, the expansion of the pharmaceutical industry with the burgeoning demand for medication among people is expected to support the market growth of this segment during the forecast period.

Regional Analysis:

The scope of the empty capsules market report includes North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America was valued at US$ 1.83 billion in 2022 and is projected to reach US$ 3.45 billion by 2030; it is expected to register a CAGR of 8.3% during 2022–2030. The North America empty capsules market is segmented into the US, Canada, and Mexico. The market growth in North America is attributed to the increasing preference for capsule-based nutraceutical formulations, which help prevent serious health problems such as cancer, obesity, and arthritis. The rising cases of chronic diseases and diseases that are common in the geriatric population, especially in the US, can also be associated with the market growth in this region. As per the Population Reference Bureau's Population Bulletin: Aging in the US, the number of Americans aged 65 and above is anticipated to nearly double from 52 million in 2018 to 95 million in 2060. The US and Canada have well-developed, structured healthcare systems that encourage global market companies to enter these countries. As a result, these countries have the presence of numerous global market participants. The high demand for empty capsules is met by the global players present in the region.

Europe accounts for the third largest share of the empty capsules market. The market growth in this region is ascribed to the increasing prevalence of diseases and high drug accessibility, and an upsurge in research and development. The UK held the largest share of the empty capsule market in Europe. Further, the market in Germany is expected to grow at the fastest CAGR during the forecast period.

Asia Pacific is expected to register the highest CAGR in the global empty capsules market during 2022–2030. The market growth in this region is ascribed to a surge in disposable income and an inclination toward nutritional supplements. Due to the changing climatic conditions and growing working population, people are more conscious about skincare, empty HPMC capsules are used for encapsulating effective ingredients such as essential oils, vitamins and antioxidants, which thereby promotes the growth of the empty capsule industry across the region. According to the Indian Brand Equity Fund, the Indian beauty and personal care market rose to US$ 15.1 billion in 2021 compared to US$ 9.98 billion in 2019. Therefore, the proliferating cosmetics and pharmaceutical industry, especially in South Korea, India, Japan, and China, is expected to catalyze the growth of the empty capsules market in Asia Pacific during the forecast period.

Empty Capsules Market Regional Insights

The regional trends and factors influencing the Empty Capsules Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Empty Capsules Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Empty Capsules Market

Empty Capsules Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 6.75 Billion |

| Market Size by 2030 | US$ 12.52 Billion |

| Global CAGR (2022 - 2030) | 8.0% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Empty Capsules Market Players Density: Understanding Its Impact on Business Dynamics

The Empty Capsules Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Empty Capsules Market are:

- Erawat Pharma Limited

- Sunil Healthcare

- ACG Worldwide

- Medi-Caps Ltd

- LonzaGroup (Capsugel)

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Empty Capsules Market top key players overview

Key Player Analysis:

Erawat Pharma Limited, Sunil Healthcare, ACG Worldwide, Medi-Caps Ltd, LonzaGroup (Capsugel), Capscanada Corporation, Bright Pharma Caps Inc, Farmacapsulas, Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.), and Roxlor LLC are among the key players profiled in the empty capsules market report.

Recent Developments:

Companies operating in the market adopt such as mergers and acquisitions. A few of the recent market developments are listed below:

- In March 2023, VANTAGE NUTRITION, an ACG company, acquired ComboCap, Inc. (US) and BioCap (South Africa) to expand its technology and footprint in North America and worldwide.

- In January 2022, Xi'an Le-Nutra Ingredients Inc. shipped 8.0 million HPMC capsules to Latvia, Europe. These capsules were devoid of titanium dioxide (TiO2), as the European Commission had banned the use of TiO2 in food additives. This highlights the company's efforts to meet demand for the product in the region.

- In July 2022, Akums Drug & Pharmaceuticals Ltd. approved its empty hard gelatin capsule manufacturing facilities in Haridwar, India. This European Union-based (EU-based) company is known to adopt Good Manufacturing Practices (GMP).

- In February 2022, CapsCanada, a Lyfe Group company, received approval for a liquid-filled aspirin capsule. This product is based on the PLxGuard drug delivery platform, aimed at delivering drugs into the targeted areas of the gastrointestinal tract.

Frequently Asked Questions

Which segment is dominating the empty capsules market?

The global empty capsules market, based on product is segmented into gelatin capsules and non-gelatin capsules. The gelatin capsules segment held a larger market share in 2022. The non-gelatin capsules segment is estimated to register a higher CAGR of 9.0% during 2022–2030. Based on functionality, the market is segmented into immediate-release capsules, delayed-release capsules, and sustained-release capsules. The immediate-release capsules segment held the largest market share in 2022. It is further expected to register the highest CAGR of 8.5% during the forecast period. Based on application, the empty capsules market is segmented into antibiotics and antibacterial drugs, vitamins and dietary supplements, antacids and antiflatulent preparations, and others. The antibiotics and antibacterial drugs segment held the largest empty capsules market share in 2022. The market for the vitamins and dietary supplements segment is expected to grow at the fastest CAGR of 8.9% during 2022–2030. In terms of end user, the empty capsules market is segmented into pharmaceutical industry, nutraceutical industry, cosmetics industry, and research laboratories. The pharmaceutical industry segment held the largest empty capsules market share in 2022 and the same is anticipated to register the highest CAGR of 8.4% during 2022–2030.

What are empty capsules?

Empty capsules are made of gelatin, hydroxypropyl methylcellulose (HPMC), pullulan, and starch. These capsules can also be used to fill formulations that are used to treat acute and chronic diseases, cancer, and common diseases such as cold and cough. They are also used to package nutritional supplement formulations, antacid and anti-flatulence medications, and personalized medicines.

What are the driving factors for the empty capsules market?

The factors driving the growth of the empty capsules market include the flourishing nutraceutical and dietary supplement industries and continuously growing pharmaceuticals industry.

Who are the major players in the empty capsules market?

The empty capsules market majorly consists of the players such as Erawat Pharma Limited, Sunil Healthcare, ACG Worldwide, Medi-Caps Ltd, LonzaGroup (Capsugel), Capscanada Corporation, Bright Pharma Caps Inc, Farmacapsulas, Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.), and Roxlor LLC.

What was the estimated empty capsules market size in 2022?

The empty capsules market was valued at US$ 6.7 billion in 2022.

What are the growth estimates for the empty capsules market till 2030?

The empty capsules market is expected to be valued at US$ 12.5 billion in 2030.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

I wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA, MANAGING DIRECTOR, PineCrest Healthcare Ltd.The Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

Yukihiko Adachi CEO, Deep Blue, LLC.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Strategic Planning

- Investment Justification

- Identifying Emerging Markets

- Enhancing Marketing Strategies

- Boosting Operational Efficiency

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Empty Capsules Market

- Erawat Pharma Limited

- Sunil Healthcare

- ACG Worldwide

- Medi-Caps Ltd

- LonzaGroup (Capsugel)

- Capscanada Corporation

- Bright Pharma Caps Inc

- Farmacapsulas

- Mitsubishi Chemical Holdings Corporation (Qualicaps, Inc.)

- Roxlor LLC

Get Free Sample For

Get Free Sample For