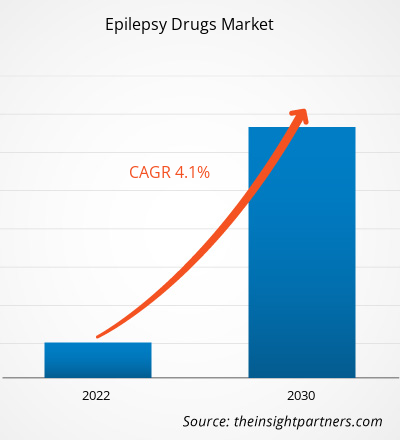

The epilepsy drugs market size is projected to grow from US$ 7.7 billion in 2022 to US$ 10.7 billion by 2030; it is estimated to record a CAGR of 4.1% during 2022–2030. Rising Research & Development (R&D) activities are likely to remain key trends in the market.

Epilepsy Drugs Market Analysis

Rising clinical trials for epilepsy drugs to develop innovative drugs will provide a lucrative opportunity for market growth in the coming years. For example, Mayo Clinic conducted a clinical trial to investigate the effectiveness and safety of "Fenfluramine Hydrochloride Oral Solution (ZX008) as an Adjuvant Therapy for children with Intractable Epilepsy with Myoclonic-Atonic Seizures. Further, rising incidence of epilepsy cases accelerates demand for antiepileptic drugs will drive market growth. For example, companies launching innovative products by the company is an influential factor responsible for accounting for considerable market growth during 2020-2030. Rising Research & Development (R&D) activities are likely to remain key trends in the market.

Epilepsy Drugs Market Overview

According to the WHO report, globally, an estimated 5 million people are diagnosed with epilepsy annually. For records, in high-income countries, there are an estimated 49 per 100000 people diagnosed with epilepsy, and in low-income countries, this figure is as high as 139 per 100000. The World Health Organization (WHO) report further reveals that epilepsy accounts for more than 0.5% of the global burden of disease, with out-of-pocket costs creating a substantial burden on households. Therefore, rising cases of epilepsy will accelerate demand for antiepileptic drugs in the coming decade.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Epilepsy Drugs Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Epilepsy Drugs Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Epilepsy Drugs Market Drivers and Opportunities

Rising Incidence of Epilepsy Cases Accelerate Demand for Antiepileptic Drugs to Favor Market

According to the WHO 2024 published report, around 50 million people globally have epilepsy, making it the most common neurological disease—the rising incidence of epilepsy results in a considerable burden of healthcare costs worldwide. For example, it has been estimated that the 6 million people with active epilepsy cost over US$21.5 billion annually, and despite this, very few European countries have national plans to manage epilepsy disorder. Therefore, demand for antiepileptic drugs is high in demand to prevent seizures. For example, upto 70% of people living with epilepsy could become seizure free with appropiate use of antiseizures medicines as per the WHO report. Furthermore, rising prevalence of epilepsy cases accelerate demand for antiepileptic drugs are the major drivers of global epilepsy drugs market share.

Rising Clinical Trials for Epilepsy Drugs Provide Lucrative Market Opportunity

For example, Équilibre Biopharmaceuticals’s "EQU-001" witness "Phase Transition Success Rate (PTSR)" as the company reported Phase 2 results for anti-epileptic drugs. Additionally, the SANAD clinical trial was design to identofy the most effective and cost-effective treatments for patients with epilepsy. Previosuly "Valproate" was approved to control the seizures and was more efficacious over "Lamotrigine" and was the first drug choice for many patients suffering from generalized and unclassified epilepsies. However, due to adverse effects of valproate during pregnancy the physicians stop prescribing the drug. Further, the Lamotrigine through clinical trials was clinially proven better than valproate with cost effective alternative for patients diagnosed with partial onset seizures. Further, in 2024, the results from the clinical trial SANAD-2 are yet to be announced for new antiepileptic drugs. Therefore, rising clinical trials for development of new antiepileptic drugs is seen to leave a positive impact on the market, as it has an opportunity for innovative drugs.

Epilepsy Drugs Market Report Segmentation Analysis

Key segments that contributed to the derivation of the epilepsy drugs market analysis are type, cause, disorder type, category, and end user.

- Based on treatment, the epilepsy drugs market is segmented as first-generation anti-epileptics, second generation anti-epileptics, third generation anti-epileptics. The second generation anti-epileptics segment held the largest market share in 2022.

- By distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and others. The hospital pharmacies segment held the largest share of the market in 2022.

Epilepsy Drugs Market Share Analysis by Geography

The geographic scope of the Epilepsy Drugs market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the market. In North America region, the US accounts largest share for epilepsy drugs market. Presence of top manufacturers in the region and their innovative antiepileptic drugs having effective pharmacological activity are the factors contributing to the dominance of the market. Asia Pacific is anticipated to grow with the highest CAGR in the coming years.

Epilepsy Drugs Market Regional Insights

The regional trends and factors influencing the Epilepsy Drugs Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Epilepsy Drugs Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Epilepsy Drugs Market

Epilepsy Drugs Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7.7 Billion |

| Market Size by 2030 | US$ 10.7 Billion |

| Global CAGR (2022 - 2030) | 4.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Treatment

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

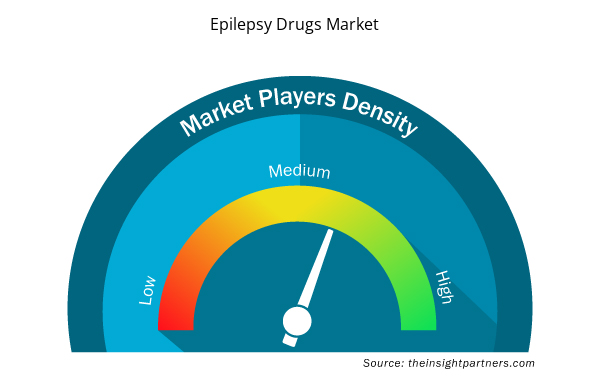

Epilepsy Drugs Market Players Density: Understanding Its Impact on Business Dynamics

The Epilepsy Drugs Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Epilepsy Drugs Market are:

- UCB SA

- Novartis AG

- Pfizer

- GSK

- Abbott

- Sanofi

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Epilepsy Drugs Market top key players overview

Epilepsy Drugs Market News and Recent Developments

The Epilepsy Drugs market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Epilepsy Drugs market are listed below:

- Eisai Co., Ltd. announced new product launch "Fycompa" intended for intravenous (IV) infusion. The injection formulation of Fycompa received manufacturing and marketing approval on January 2024 and this was included in the Japan's National Health Insurance (NHI) Drug Price list today. Fycompa is the first-in-class AED discovered at Eisai's Tsukuba Research Laboratories. (Source: Eisai Co., Ltd, Press Release, April 2024)

Epilepsy Drugs Market Report Coverage and Deliverables

The “Epilepsy Drugs Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Epilepsy Drugs market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Epilepsy Drugs market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Epilepsy Drugs market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Epilepsy Drugs market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Data Annotation Tools Market

- Rare Neurological Disease Treatment Market

- Arterial Blood Gas Kits Market

- Medical Audiometer Devices Market

- Hot Melt Adhesives Market

- Battery Testing Equipment Market

- Bioremediation Technology and Services Market

- Medical Enzyme Technology Market

- Cut Flowers Market

- Lymphedema Treatment Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Treatment, Distribution Channel, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

What would be the estimated value of the epilepsy drugs market by 2031?

The estimated value of epilepsy drugs market accounted US$ 11.9 billion in 2031.

Which are the leading players operating in the epilepsy drugs market?

UCB SA, Novartis AG, Pfizer, GSK, Abbott, Sanofi, Sumito Pharma Company, Teva Pharmaceuticals, Catalyst Pharmaceuticals, and Alkem Laboratories are the key players in the epilepsy drugs market.

What are the future trends of the epilepsy drugs market?

Rising Research & Development (R&D) activities to remain as a key trend for epilepsy drugs market.

What are the driving factors impacting the epilepsy drugs market?

Rising incidence of epilepsy cases accelerate demand for antiepileptic drugs is one of the most influential factors responsible for market growth.

Which region dominated the epilepsy drugs market in 2023?

North America region dominated the epilepsy drugs market in 2023.

What is the expected CAGR of the epilepsy drugs market?

The CAGR for epilepsy drugs accounted 4.5% during 2023-2031.

Get Free Sample For

Get Free Sample For