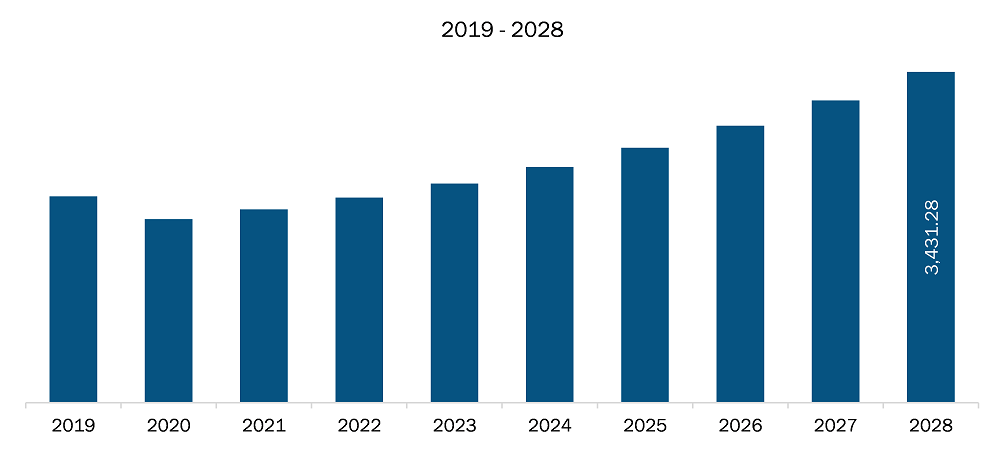

The aircraft wheels and brakes market in Europe is expected to grow from US$ 2,003.82 million in 2021 to US$ 3,431.28 million by 2028; it is estimated to grow at a CAGR of 8.0% from 2021 to 2028.

The UK, Germany, and Russia are major economies in Europe. Escalating demand for passenger airline services is the major factor driving the growth of the Europe aircraft wheels and brakes market. Commercial airline traffic has increased at a noteworthy rate in the past few months, after a notable decrease in COVID-19 cases in many parts of the world. Further, a rise in passenger airline operations highlights the need for additional aircraft to reduce the operational burden of existing fleets, thus compelling the airline companies to procure new aircraft fleets. In June 2021, United Airlines, Inc. rolled out its purchase order of 200 Boeing 737 (including 50 B737 Max 8s and 150 737 Max 10s) and 70 Airbus 321 Neo fleet. Similarly, Indigo Airlines received 44 A320 Neo aircraft in January 2020, and it is yet to receive more than 250 aircraft models. Hence, the rising production and procurement of new aircraft fleets, in response to the growing demand for passenger airline services, is boosting the adoption of aircraft wheels and brakes, thereby driving the market growth, which is further anticipated to drive the market in Europe.

The air transport sector plays an important role in economic growth and employment in many European countries. With the COVID-19 outbreak, the production and sales of aircraft wheels and brake came to a sudden halt in the most part of Europe. The collapse of demand side severely impacted the EU aerospace sector and reduced international trade, thereby putting the economies in deep crisis. The European aerospace industry began to witness airspace inefficiencies, activity delays, and declining flight counts with the initial spread of COVID-19. The global passenger volume contracted by 60.5%, and total cost of infrastructure declined by 45.4% in 2020, increasing unit costs. This reduced demand has severely impacted the regional aircraft wheels and brake market. The EU aerospace industry is anticipated to recover gradually due to a slower economic recovery and the importance of international services. As per the IATA estimates, Europe faced net loss of ~US$ 26.9 billion in 2020. In 2021, net losses are estimated to lower down to US$ 11.9 billion.However, the European aircraft manufacturing giant, Airbus, foresees faster recovery of the aviation industry and aircraft manufacturing. According to the company, the global and European aviation industry is expected to reach pre-COVID levels during 2023–2025. Owing to this, the company has been ramping up its production volumes to be capable of delivering a large number of orders. Airbus plans to produce 900 Airbus A320 family aircraft models per year by 2025, with 64 per month by 2023 and 75 units per month by 2025. The announcement of such strategies indicates a promising scenario for the growth of the manufacturers of aircraft components, including wheels and brakes.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Aircraft Wheels and Brakes Market Segmentation

Europe Aircraft Wheels and Brakes Market – By Component

- Braking System

- Wheels

- Brakes

Europe Aircraft Wheels and Brakes Market – By Fit Type

- Line Fit

- Retro Fit

Europe Aircraft Wheels and Brakes Market – By End User

- Defense

- Commercial

Europe Aircraft Wheels and Brakes Market – By Country

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

Europe Aircraft Wheels and Brakes Market – Companies Mentioned

- BERINGER AERO

- Collins Aerospace

- Crane Aerospace & Electronics

- Honeywell International Inc.

- Meggitt PLC

- Parker Hannifin Corporation

- Safran

Europe Aircraft Wheels and Brakes Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2,003.82 Million |

| Market Size by 2028 | US$ 3,431.28 Million |

| CAGR (2021 - 2028) | 8.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For