Europe End Mills Market Analysis and Forecast by Size, Share, Growth, Trends 2031

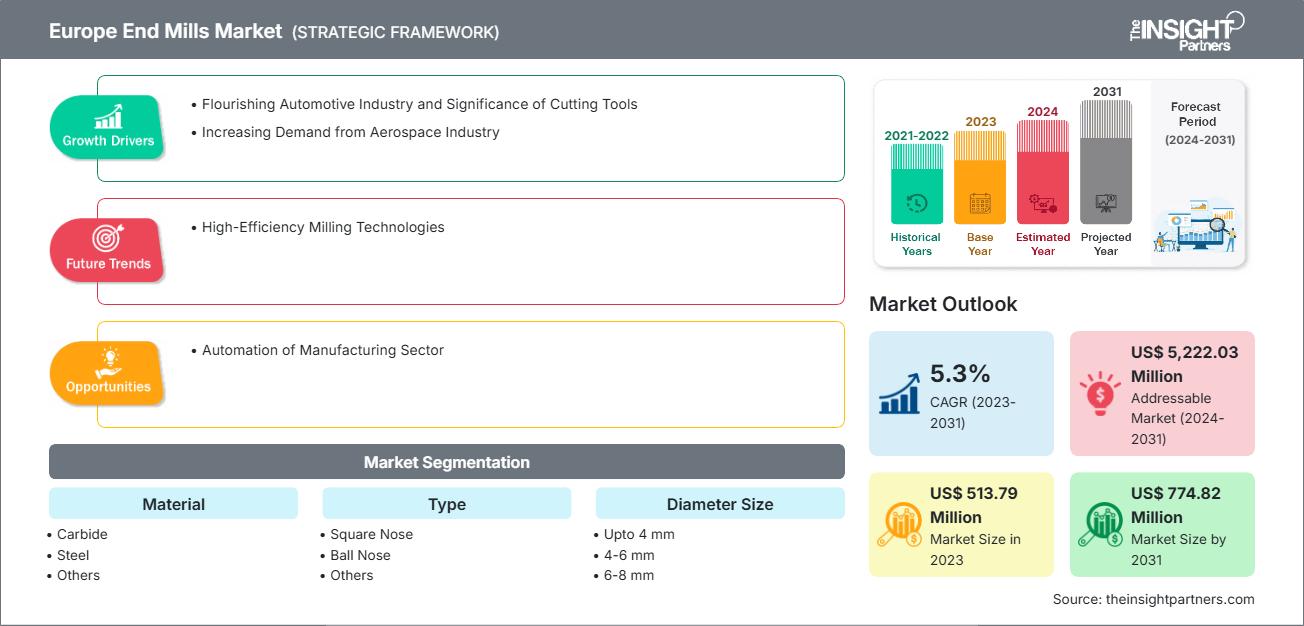

Europe End Mills Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material (Carbide, Steel, and Other Materials), Type (Square Nose, Ball Nose, and Other Types), Diameter Size (Up to 4 mm, 4-6 mm, 6-8 mm, 8-12 mm, and Above 12 mm), and End-Use Industry (Automotive, Heavy Machinery, Semiconductor and Electronics, Medical and Healthcare, Energy, Aerospace, and Other End-Use Industries)

Historic Data: 2021-2022 | Base Year: 2023 | Forecast Period: 2024-2031- Status : Published

- Report Code : TIPRE00041284

- Category : Manufacturing and Construction

- No. of Pages : 188

- Available Report Formats :

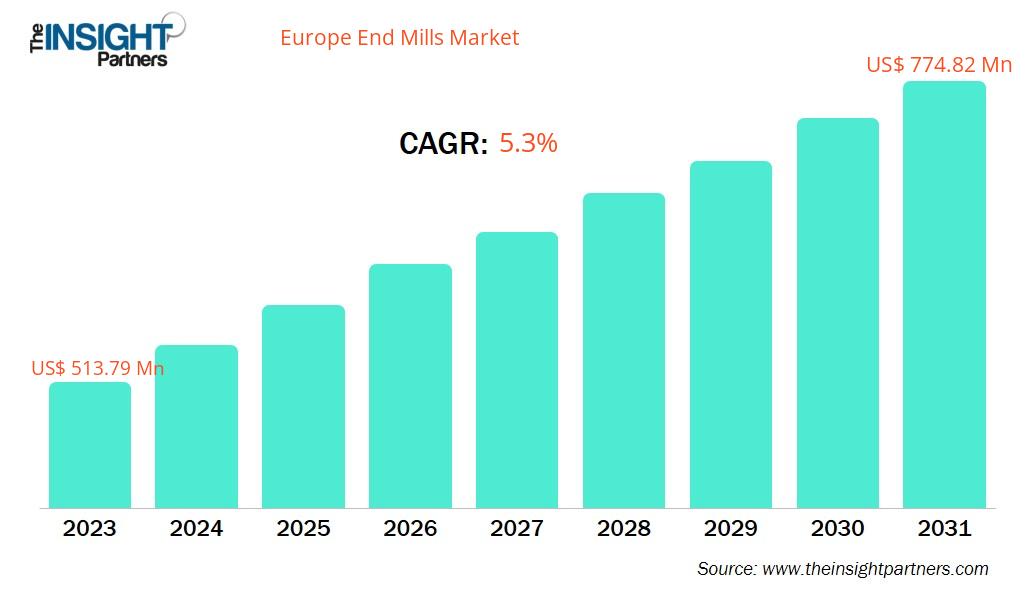

The Europe end mills market size is expected to reach US$ 774.82 million by 2031 from US$ 513.79 million in 2023. The market is estimated to record a CAGR of 5.3% from 2023 to 2031.

Executive Summary and Europe End Mills Market Analysis:

The growth of the metalworking machinery industry in Europe is determined by France, Germany, Italy, Russia, Spain, Poland, Switzerland, Slovenia, Serbia, the Czech Republic, Hungary, Portugal, and the UK, among other European countries. Europe has a well-established manufacturing sector using cutting-edge technologies aligned with the Internet of Things (IoT), the Industrial Internet of Things (IoT), and Industry 4.0. This region also thrives as a dominant automobile manufacturer in the world owing to the presence of world-leading automobile manufacturers such as Volkswagen AG, Stellantis NV, Mercedes-Benz Group AG, Bayerische Motoren Werke AG, and Renault SA. These players focus on delivering high-quality products in large volumes. Metalworking machines are becoming increasingly popular in the automotive manufacturing process, which is expected to fuel the demand for end mills in the region. These machines contribute to less waste and faster production by aiding in speed and precision, subsequently supporting cost-effective manufacturing processes. Therefore, the rapid-paced automotive industry is expected to provide promising opportunities for the end tools market growth in Europe in the future.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEurope End Mills Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe End Mills Market Segmentation Analysis:

Key segments that contributed to the derivation of the end mills market analysis are material, type, diameter size, and end-use industry.

- Based on material, the Europe end mills market is segmented into carbide, steel, and others. The carbide segment held the largest share of the market in 2023.

- In terms of type, the Europe end mills market is segmented into square nose, ball nose, and others. The square nose segment held the largest share of the market in 2023.

- By diameter size, the Europe end mills market is segmented into upto 4 mm, 4-6 mm, 6-8 mm, 8-12 mm, and Above 12 mm. The upto 4 mm segment held the largest share of the market in 2023.

- By end-use industry, the Europe end mills market is segmented into automotive, heavy machinery, semiconductor and electronics, medical and healthcare, energy, aerospace, and others. The automotive segment held the largest share of the market in 2023.

Europe End Mills Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 513.79 Million |

| Market Size by 2031 | US$ 774.82 Million |

| CAGR (2023 - 2031) | 5.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Europe End Mills Market Players Density: Understanding Its Impact on Business Dynamics

The Europe End Mills Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Europe End Mills Market Outlook

Cutting tools such as end mills are used for a variety of purposes in the aerospace industry. They are particularly used in milling operations that require high precision and smooth surfaces. End mills are commonly employed in this industry as they can cut through materials such as titanium, aluminum, steel alloy, and plastics. They are crucial in manufacturing aircraft components such as engines, wings, fuselage structures, and landing gears. The aerospace industry increasingly emphasizes lightweight materials and high-end manufacturing techniques to enhance the fuel efficiency and performance of aircraft. Airbus, a European plane manufacturer, inaugurated a production facility in Tianjin, China, for the A-320 narrow bodies in July 2023. The company takes such initiatives to expand its production capabilities in the country. With this development, Airbus would be able to fabricate ~75 new A-320 neo-family jets every month by 2026. In 2022, Collins Aerospace, a business of Raytheon Technologies (US), invested US$ 200 million in India and unveiled its Global Engineering and Technology Center (GETC) and Collins India operation center in Bengaluru. With this move, Collins Aerospace plans to scale up its manufacturing operations by acquiring digital technology and engineering capabilities.

As per General Aviation Manufacturers Association (GAMA) data, 3,050 airplane and 962 helicopter deliveries were recorded across the world in 2023, signifying an increase of ~9% and ~9.8%, respectively, compared to 2022. In addition, an increase in backlogs for all segments of general aviation aircraft and helicopters is anticipated to further propel the number of deliveries during 2023-2031.

End mills are used in wing assembly, engine mounting, and fuel tank and landing gear production, among other aircraft manufacturing processes. Thus, fostering aerospace manufacturing activities worldwide with huge investments, coupled with a surge in the need for aircraft fleets, favors the progress of the end mills market, as these cutting tools are employed in a wide range of processes in the aerospace industry, including cutting, bending, and designing.

Europe End Mills Market Country Insights

Based on country, the Europe end mills market comprises Germany, France, Italy, Spain, the UK, Russia, Poland, Switzerland, Slovenia, Serbia, Czech Republic, Hungary, Portugal, and the Rest of Europe. Germany held the largest share in 2023.

Germany is the largest economy in Europe and houses several leading industry verticals. With the high rate of technology adoption, coupled with the presence of various multinational companies, the country presents a conducive environment for the expansion of the manufacturing sector. According to GTAI, the automotive sector generated nearly US$ 350 billion in revenue in 2021; the domestic market accounted for 33.32%, and the foreign market accounted for ~60.00% of the total revenue generated. Germany has the most prominent automotive sector in Europe, accounting for over 25% of the region's total passenger car production and ~20% of its total new vehicle registrations. In 2021, Germany was Europe's leading passenger vehicle producer, with 3.10 million units of production. Thus, data shows that Germany has a well-established ecosystem for automobile manufacturing, which in turn generates a significant demand for automotive components and metal-cutting tools. In addition to the automotive sector, an upsurge in the demand for precise and efficient metal cutting and milling in the manufacturing industry bolsters the end mills market growth in Germany. End mills offer precise cuts and shapes to materials such as metal, plastic, and wood, which can be used in various industrial applications.

Europe End Mills Market Company Profiles

Some of the key players operating in the market include NS TOOL USA, INC; TOWA Corporation; SDK Tool (China) Co., Limited; Karnasch Professional Tools GmbH; Hoffmann Group USA; Kodiak Cutting Tools; Harvey Tool Company; Fullerton Tool Company, Inc; PRECISION TECHNOLOGY CO.,LTD; UNION TOOL Co.; OSG USA, Inc; KYOCERA SGS Precision Tools, Inc.; and IZAR CUTTING TOOLS S.A.L., among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

Europe End Mills Market Research Methodology :

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

- Company websites, annual reports, financial statements, broker analyses, and investor presentations.

- Industry trade journals and other relevant publications.

- Government documents, statistical databases, and market reports.

- News articles, press releases, and webcasts specific to companies operating in the market.

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research

The Insight Partners' conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

- Validate and refine findings from secondary research.

- Enhance the expertise and market understanding of the analysis team.

- Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects.

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

- Industry stakeholders: Vice Presidents, business development managers, market intelligence managers, and national sales managers

- External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Nivedita is an accomplished research professional with over 9 years of experience in Market Research and Business Consulting. Currently serving as a Project Manager in the ICT domain at The Insight Partners, she brings deep expertise in managing and executing Syndicated, Custom, Subscription-based, and Consulting research assignments across diverse technology sectors.

With a proven track record of delivering data-driven analysis and actionable insights, Nivedita has been a key contributor to several critical projects. Her work involves end-to-end project execution—right from understanding client objectives, analyzing market trends, to deriving strategic recommendations. She has collaborated extensively with leading ICT companies, helping them identify market opportunities and navigate industry shifts.

Nivedita holds an MBA in Management from IMS, Dehradun. Prior to joining The Insight Partners, she gained valuable experience at MarketsandMarkets and Future Market Insights in Pune, where she held various research roles and built a strong foundation in industry analysis and client engagement.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For