Europe Investor ESG Software Market Analysis and Forecast by Size, Share, Growth, Trends 2031

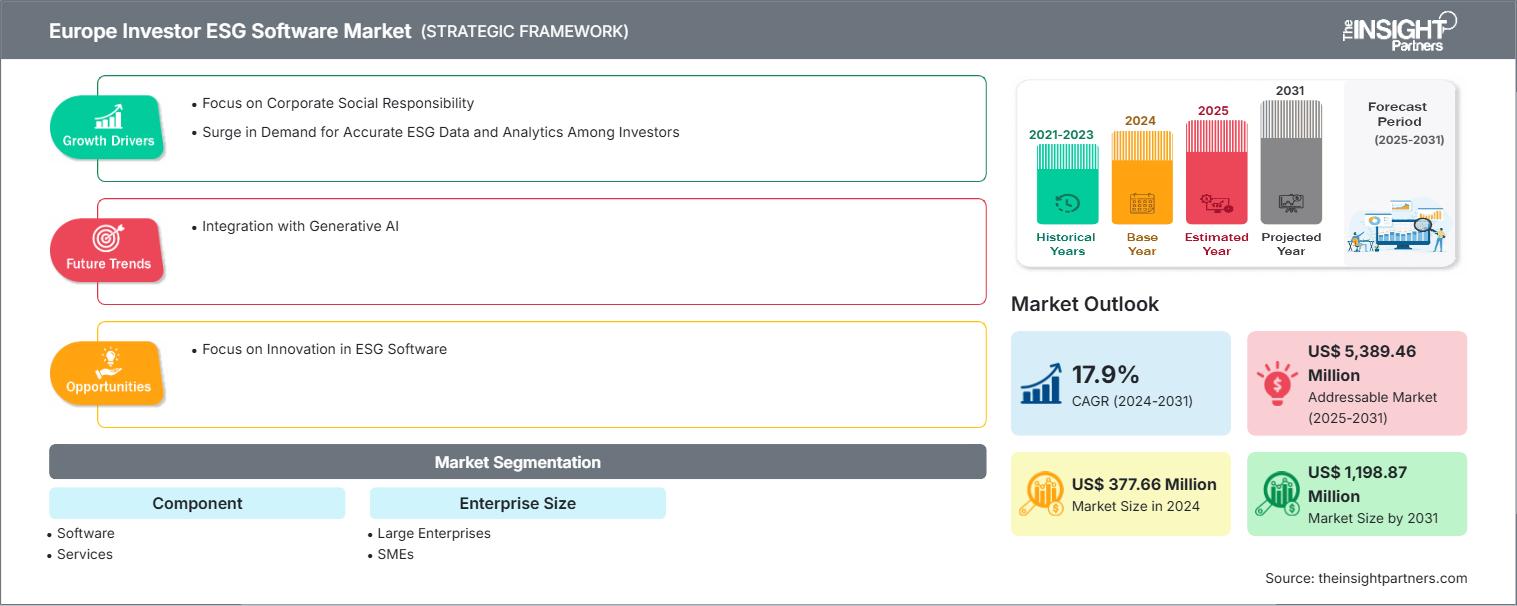

Europe Investor ESG Software Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component [Software and Services (Training, Integration, and Other Services)] and Enterprise Size (Large Enterprises and SMEs)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Oct 2025

- Report Code : TIPRE00023472

- Category : Technology, Media and Telecommunications

- Status : Published

- Available Report Formats :

- No. of Pages : 127

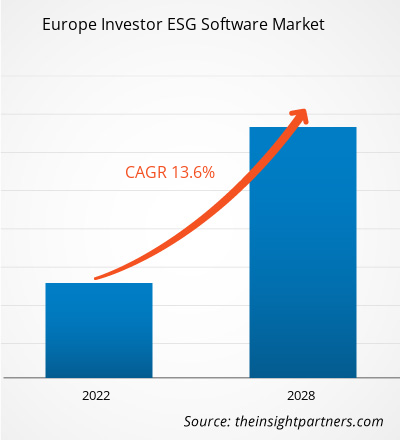

The Europe investor ESG software market size is expected to reach US$ 1,198.87 million by 2031 from US$ 377.66 million in 2024. The market is estimated to record a CAGR of 17.9% from 2024 to 2031.

Executive Summary and Europe Investor ESG Software Market Analysis:

Many European investors prioritize ESG factors in their decision-making processes, owing to the need to address climate change, governance practice challenges, and social inequalities. For instance, Deutsche Bank AG conducted the fourth annual CIO ESG survey across key European markets from April to June 2023. Germany accounted for the largest share of responses, followed by Belgium, Italy, and Spain. The survey revealed a strong level of engagement with ESG and sustainable investing topics and solutions, reflecting the growing focus on sustainability across the European Union (EU). The demand for ESG software rises among investors with a burgeoning focus on sustainability, as these solutions allow them to easily incorporate ESG principles into their portfolios. ESG software supports investors in assessing risks, opportunities, and overall alignment with sustainability goals.

Comprehensive ESG solutions help investors maintain transparency in their operations and work toward their sustainability goals; this encourages software development companies to advance their portfolios. For instance, in September 2023, Thomson Reuters announced the latest development in its strategic cooperation with SAP SE. The companies aimed at undertaking a product integration that will help their customers meet the surged needs for ESG reporting. This partnership will bring together Thomson Reuters ONESOURCE Statutory Reporting and SAP Sustainability Control Tower, allowing users to easily gather, manage, and report ESG data from a single platform. This significant product collaboration will unveil a best-in-class software solution, providing customers with the last mile report on top of SAP Sustainability Control Tower's foundational ESG management capabilities. Businesses operating in, or connected to, the EU ought to comply with the EU's Corporate Sustainability Reporting Directive (CSRD) obligations, beginning in January 2025; the scope and reach of this directive is expected to expand in subsequent years. This project further aims to make it easier for international enterprises to comply with evolving rules within the EU.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEurope Investor ESG Software Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Investor ESG Software Market Segmentation Analysis:

Key segments that contributed to the derivation of the Europe investor ESG software market analysis are component and enterprise size.

- Based on component, the Europe investor ESG software market is bifurcated into software and services. The software segment held a larger share of the market in 2024. The services segment is further sub segmented into training, integration, and other service.

- By enterprise size, the Europe investor ESG software market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger share of the market in 2024.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 377.66 Million |

| Market Size by 2031 | US$ 1,198.87 Million |

| CAGR (2024 - 2031) | 17.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Europe Investor ESG Software Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Investor ESG Software Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Europe Investor ESG Software Market top key players overview

Europe Investor ESG Software Market Outlook

The focus on innovation in ESG software is expected to create numerous opportunities for the investor ESG software market growth during the forecast period. As the demand for transparent, accurate, and actionable ESG data continues to rise, investors are increasingly relying on advanced ESG software solutions to make informed investment decisions. The evolving landscape of environmental, social, and governance (ESG) factors requires investors to access comprehensive, real-time insights that can only be provided by innovative software tools. Innovation in ESG software involves the integration of cutting-edge technologies such as artificial intelligence (AI), which are reshaping the way ESG data is collected, processed, and analyzed. A few instances are mentioned below:

- In December 2024, Microsoft introduced a suite of AI-powered tools that streamline environmental, social, and governance (ESG) data management, reporting, and analysis. These advanced tools simplify the complex process of gathering and organizing ESG information, ensuring companies can efficiently meet reporting requirements and gain actionable insights into their sustainability efforts. By leveraging AI, Microsoft enables organizations to automate data processing, improve the accuracy of their ESG reporting, and uncover trends or areas of improvement. This innovation enhances operational efficiency, helps businesses stay aligned with regulatory standards, and strengthens their ability to make data-driven decisions related to ESG initiatives.

- In November 2024, Mitratech, a global leader in compliance technology for legal, risk, and HR teams, unveiled new AI-driven features and improvements in its recently acquired third-party risk management (TPRM) platform, Prevalent. These latest updates aim to enhance the process of identifying, assessing, monitoring, managing, and mitigating risks associated with third-party vendors, suppliers, and partners. The enhancements are designed to boost operational efficiency, offer deeper insights into vendor ecosystems, and strengthen compliance across critical risk areas, including environmental, social, and governance (ESG) factors, throughout the entire third-party lifecycle.

- In April 2024, ESG data solutions provider ESGgo announced the launch of its One-Click Sustainability Report, an AI-powered tool designed to help companies effortlessly generate sustainability reports in line with regulatory frameworks and stakeholder expectations. ESGgo states that this new solution simplifies the sustainability reporting process for organizations, ensuring compliance with evolving standards. The platform's AI-driven data engine processes both numerical and text-based information, calculates emissions, and synthesizes datasets to create customized sustainability reports.

These advancements allow investors to monitor a company's sustainability performance more efficiently as well as predict future ESG risks and opportunities based on real-time data. The ability to process vast amounts of data, often coming from disparate sources, and synthesize it into actionable ESG metrics is a significant benefit for investors looking for transparency and reliability.

Europe Investor ESG Software Market Country Insights

Based on country, the Europe investor ESG software market comprises Germany, France, the UK, Italy, Russia, and the Rest of Europe. The Rest of Europe held the largest share in 2024.

Sweden, Poland, the Netherlands, Spain, Belgium, and Greece are among the major countries conisdered in the investor ESG software market in the Rest of European region. The investor ESG software market in the Rest of Europe is expected to grow with collaborations and partnership agreements between market players, along with the increasing focus on adherence to sustainability requirements in the Netherlands, Italy, and Belgium. For instance, Datamaran Ltd formed a strategic partnership with Deloitte to help businesses in three European markets-Italy, the Netherlands, and Belgium. Deloitte will use Datamaran's double-materiality analysis (DMA) software to help clients in these regions evaluate their sustainability risks and meet changing regulatory requirements. This agreement highlights the surging demand for sophisticated sustainability solutions, fueled partly by legal frameworks such as the CSRD, which require firms to include ESG factors in their corporate strategy. Moreover, the need for investor ESG software in the Rest of Europe would continue to surge in the coming years as more organizations seek tools to track, manage, and report on their sustainability initiatives in response to investor and regulatory demands.

Europe Investor ESG Software Market Company Profiles

Some of the key players operating in the market include MSCI Inc; Workiva, Inc.; London Stock Exchange Group Plc; Cority Software Inc; SAP SE; Sphera Solutions, Inc.; FactSet Research Systems Inc; Morningstar Inc; Bloomberg LP; and Prophix Software Inc., among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

Europe Investor ESG Software Market Research Methodology:

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

- Company websites, annual reports, financial statements, broker analyses, and investor presentations.

- Industry trade journals and other relevant publications.

- Government documents, statistical databases, and market reports.

- News articles, press releases, and webcasts specific to companies operating in the market.

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

- Validate and refine findings from secondary research.

- Enhance the expertise and market understanding of the analysis team.

- Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects.

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

- Industry stakeholders: Vice Presidents, business development managers, market intelligence managers, and national sales managers

- External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Ankita is a dynamic market research and consulting professional with over 8 years of experience across the technology, media, ICT, and electronics & semiconductor sectors. She has successfully led and delivered 100+ consulting and research assignments for global clients such as Microsoft, Oracle, NEC Corporation, SAP, KPMG, and Expeditors International. Her core competencies include market assessment, data analysis, forecasting, strategy formulation, competitive intelligence, and report writing.

Ankita is adept at handling complete project cycles—from pre-sales proposal design and client discussions to post-sales delivery of actionable insights. She is skilled in managing cross-functional teams, structuring complex research modules, and aligning solutions with client-specific business goals. Her excellent communication, leadership, and presentation abilities have enabled her to consistently deliver value-driven outcomes in fast-paced and evolving market environments.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For