Europe Organic Fertilizers Market Analysis and Forecast by Size, Share, Growth, Trends 2031

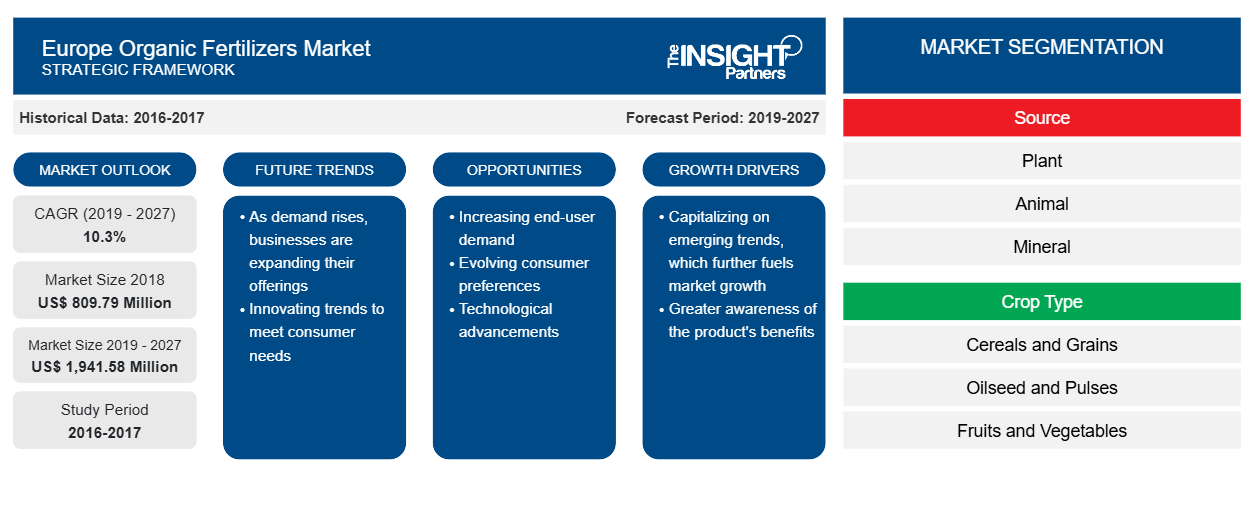

Europe Organic Fertilizers Market Size and Forecast (2021 - 2031), Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Source (Plant, Animal, and Mineral), Form (Dry and Liquid), Crop Type (Fruits and Vegetables, Cereals and Grains, Turf and Ornamental, Flower and Nursery, Tree Crop, Legumes, Herbs and Spices, Oilseeds, and Others), and Country

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : May 2025

- Report Code : TIPRE00016319

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 144

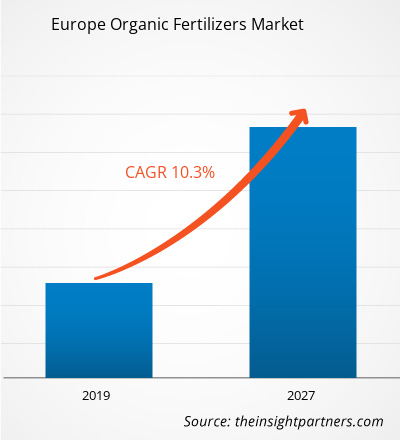

The Europe organic fertilizers market is projected to reach US$ 4.01 billion by 2031 from US$ 2.58 billion in 2024. The market is expected to register a CAGR of 6.6% during 2025–2031. The precision agriculture is likely to bring new trends into the market during the forecast period.

Europe Organic Fertilizers Market Analysis

The organic fertilizers market in Europe is driven by strong environmental policies, growing consumer demand for organic food, and increasing adoption of sustainable agricultural practices. As per the World of Organic Agriculture 2024 report by the Research Institute of Organic Agriculture, in 2022, nearly 18.5 million hectares of agricultural land were in use for organic farming in Europe. From 2004 to 2022, global organic citrus acreage increased by over 86,000 hectares; Europe was one of the most significant contributors, with Italy and Spain being the top producers of organic citrus fruits. Initiatives by the European Commission such as the European Green Deal, Farm to Fork, and Biodiversity Strategies aim to achieve sustainable food systems by 2030.

Europe Organic Fertilizers Market Overview

Germany, France, Italy, and the UK are leading the markets for organic fertilizers. As per the World of Organic Agriculture 2024 report, the retail sales of organic products in 2022 amounted to US$ 55 billion in Europe. According to the Benefert BV, France leads the EU with 2.9 million organic hectares, followed by Spain, Italy, and Germany. Austria, Estonia, and Sweden have the largest shares of organic farmland. Germany is a significant consumer of organic fertilizers in the region. According to the Institute of Farm Economics, as of 2023, 36,680 farms in Germany, occupying ~1.89 million hectares, were operating according to organic farming standards. Thus, the government policies for sustainable agriculture and a shift toward organic farming practices bolster the organic fertilizers market growth in Europe.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONEurope Organic Fertilizers Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Organic Fertilizers Market Drivers and Opportunities

Strategic Initiatives by Fertilizer Companies Fuel Europe Organic Fertilizers Market Growth

Key companies in the Europe organic fertilizer market are implementing several strategic initiatives to expand their market presence, enhance crop sustainability, and meet surging consumer demands. These initiatives focus on supply chain improvements, technological advancements, certification programs, partnerships, and research and development investments. Organic food producers, retailers, agribusiness firms, etc., play a crucial role in shaping the organic farming ecosystem. Organic fertilizer companies are investing in agricultural research and biotechnology to address the challenges of organic farming, including yield limitations and pest control. For instance, Bayer AG and Syngenta, two well-known synthetic fertilizer producers, are exploring organic fertilizers and soil health solutions. In addition, in March 2023, Benefert B.V. announced the launch of BeneSOL 3-3-6 organic fertilizer designed for the enhancement of fruit cultivation outputs.

Companies in the Europe organic fertilizers market focus on product launches to meet the growing consumer demand and contribute to the shift toward a circular economy. In 2024, Yara launched the YaraSuna portfolio of organic-based fertilizers designed for regenerative agriculture. The product range is a complementary offering for all farmers to support soil health and promote crop resilience. It comprises six organic and organo-mineral products permitted in biological agriculture, with a specific micropellet formulation and a high organic carbon content of ~30%. In January 2024, Miven launched a vegan and organic granulated liquid fertilizer made from plant-based materials; the product is partly sourced from agricultural waste to improve soil properties and soil structure.

Government Regulations and Policies Supporting Organic Farming to Generate Market Growth Opportunities

Several European governments are implementing regulations and policies to promote organic farming as a part of their broader sustainability and food security strategies. These policies focus on financial incentives, certification standards, and research support to aid in overall market development to encourage the transition from conventional to organic agriculture. Almost all EU member states support organic farming through EU-wide legal definition, agri-environmental conversion and maintenance payments, rural development marketing and processing grants, promotion funding initiatives, and public procurement and research & information initiatives. In 2020, the European Commission launched the Farm to Fork Strategy, which set out a series of targets to enhance sustainability in food production in the EU. These targets include a 50% reduction in pesticide usage and a 20% decrease in fertilizer usage; it also aims to boost the share of organic farming to 25% of the total agricultural land. Several European countries have set targets and goals to expand their organic farmland to align with this target. For instance, the government of Germany aims to bring 30% of the agricultural land under organic farming by 2030.

Europe Organic Fertilizers Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Europe organic fertilizers market analysis are source, form, and crop type.

- Based on source, the market is segmented into plant, animal, and mineral. The plant segment held the largest share of the market in 2024.

- By form, the market is segmented into dry and liquid. The dry segment held a larger market share in 2024.

- In terms of crop type, the market is segmented into fruits and vegetables, cereals and grains, turf and ornamental, flower and nursery, tree crop, legumes, herbs and spices, oilseeds, and others. The oilseeds segment dominated the market in 2024.

Europe Organic Fertilizers Market Share Analysis by Geography

The geographical scope of the Europe organic fertilizers market is mainly divided into Germany, France, Italy, Spain, the UK, and the Rest of Europe.

Italy held a significant share of the Europe organic fertilizers market in 2024. As per the report published by the Italian Institute of Services for the Agricultural and Food Market in 2024, the agricultural land utilized for organic farming recorded significant growth, reaching 2.45 million hectares in 2023, reporting an increase of 4.5% compared to 2022. In 2022, the Italian government encouraged organic farming with its US$ 3 billion investment, aimed at converting conventional practices in 25% of its agricultural land to organic by 2027. The report also revealed that ~279,766 hectares of olive groves were organically cultivated in the country in 2023. Most of the organic olive production occurred in Southern Italy in 2023. Thus, a rise in organic farming with supportive government policies is expected to boost the organic fertilizers market growth in Italy in the near future.

Europe Organic Fertilizers

Europe Organic Fertilizers Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 2.58 Billion |

| Market Size by 2031 | US$ 4.01 Billion |

| CAGR (2025 - 2031) | 6.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Source

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Europe Organic Fertilizers Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Organic Fertilizers Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Europe Organic Fertilizers Market News and Recent Developments

The Europe organic fertilizers market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A recent key development in the market is mentioned below:

- Yara acquired Agribios Italiana, a business specializing in high-quality organic fertilizers. The acquisition aims to expand its offerings, promote regenerative agriculture, and improve soil health. Agribios, with 60,000 Kilo tons produced by 2022, holds a 10% market share in Italy's organic fertilizer market. (Source: Yara International, Press Release, April 2024)

- Miven launched a vegan and organic granulated liquid fertilizer made from plant-based materials and is partly sourced from agricultural waste to improve soil properties and soil structure. (Source: Miven, News Letter, January 2024)

Europe Organic Fertilizers Market Report Coverage and Deliverables

The "Europe Organic Fertilizers Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Europe organic fertilizers market share and forecast at regional and country levels for all the key market segments covered under the scope

- Europe organic fertilizers market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Europe organic fertilizers market covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Europe organic fertilizers market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For