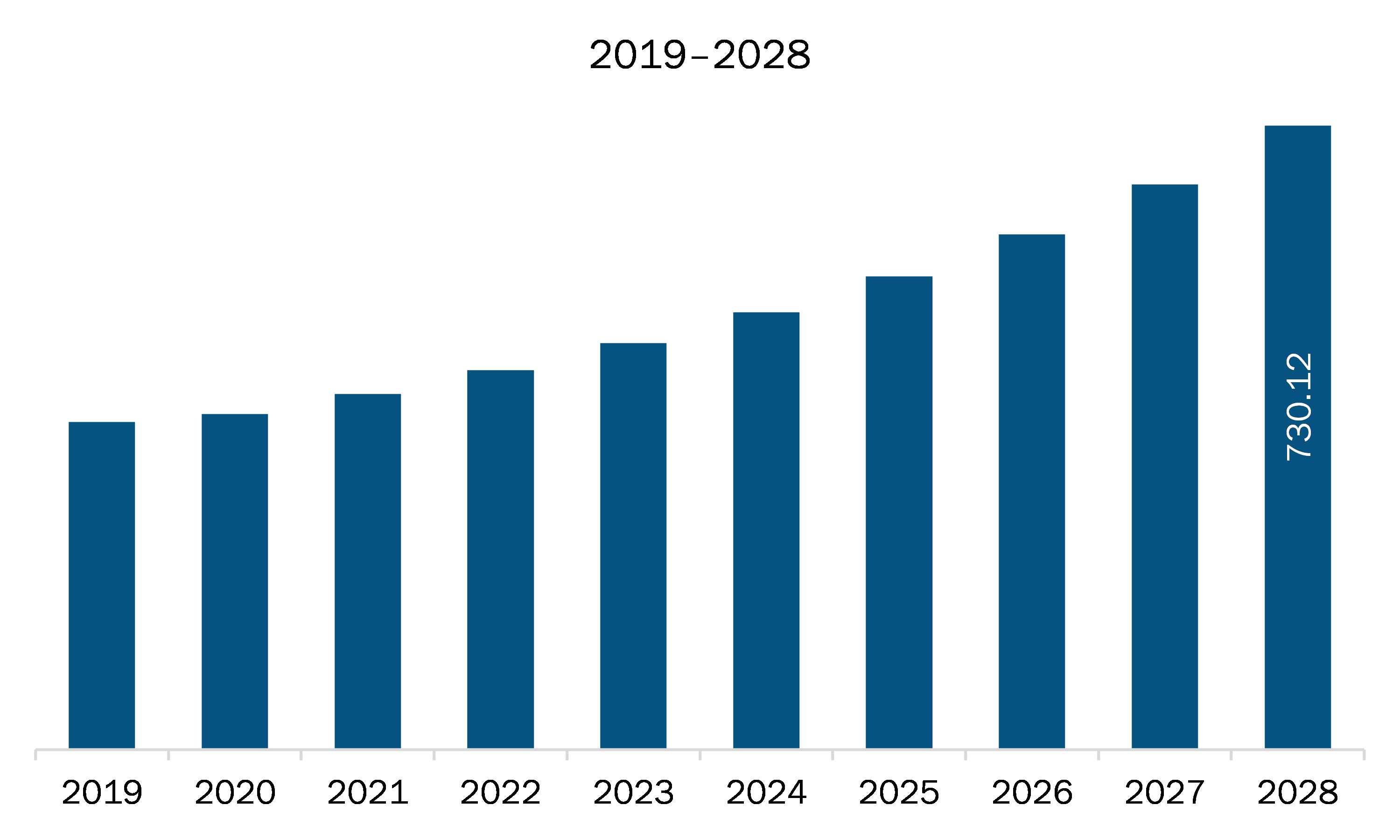

The Europe system on module (SoM) market is expected to grow from US$ 425.95 million in 2021 to US$ 730.12 million by 2028; it is estimated to grow at a CAGR of 8.0% from 2021 to 2028.

The flourishing trends of deploying industrial robots in the manufacturing sector is significantly driving the adoption of system on module in industrial automation. System on modules improve the industrial control processes as well as operations of factory equipment and industrial robots. Further, the continuous advancements in communication systems and sensors are also accelerating the demand for system on modules to deliver high productivity. Industry 4.0 has bolstered the adoption of service robots as robotics helps achieve high manufacturing productivity. The growing use of embedded systems in robots to reduce their reliance on external computing systems is also bolstering the market growth. Further, the demands for robots that are affordable and user friendly is on rise in the industrial, residential, and healthcare applications, which is fueling the need of controller microchips and eventually boosting the adoption of system on modules.

Significant initiatives from the governments and leading market players are enabling the Europe system on module market to recover from the adverse effects of the COVID-19 pandemic. The European Union is seeking to launch itself into the Europe premier league of semiconductor manufacturing by 2030. Intel aims to build a US$ 20 billion semiconductor factory on the continent. Europe has established itself significantly in the semiconductor industry supply chain. However, it lags far behind Asia in the manufacturing of highest-end chips. Thus, the governments of the UK, Germany, and France are making significant investments in the semiconductor technology and focusing on partnerships and collaborations to boost the regional market. Establishments of key production centers in the EU and European Free Trade Association (EFTA) that include Austria, France, Germany, Italy, Ireland, and the Netherlands, all of which are home to several leading manufacturers, are projected to boost the Europe system on module market growth during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe System on Module (SoM) Market Segmentation

- Europe System on Module (SoM) Market – By Processor Type

- ARM

- X86

- POWER

- FPGA

- GPU

- DSP

- Europe System on Module (SoM) Market – By Application

- Industrial Automation

- Entertainment

- Medical

- Transportation

- Test and Measurement

- Others

- Europe System on Module (SoM) Market – By Standard

- Qseven

- SMARC

- COMExpress

- Europe System on module (SoM) Market – By Country

- Germany

- France

- Italy

- UK

- Russia

- Rest of Europe

Europe System on Module (SoM) Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 425.95 Million |

| Market Size by 2028 | US$ 730.12 Million |

| CAGR (2021 - 2028) | 8.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Processor Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For