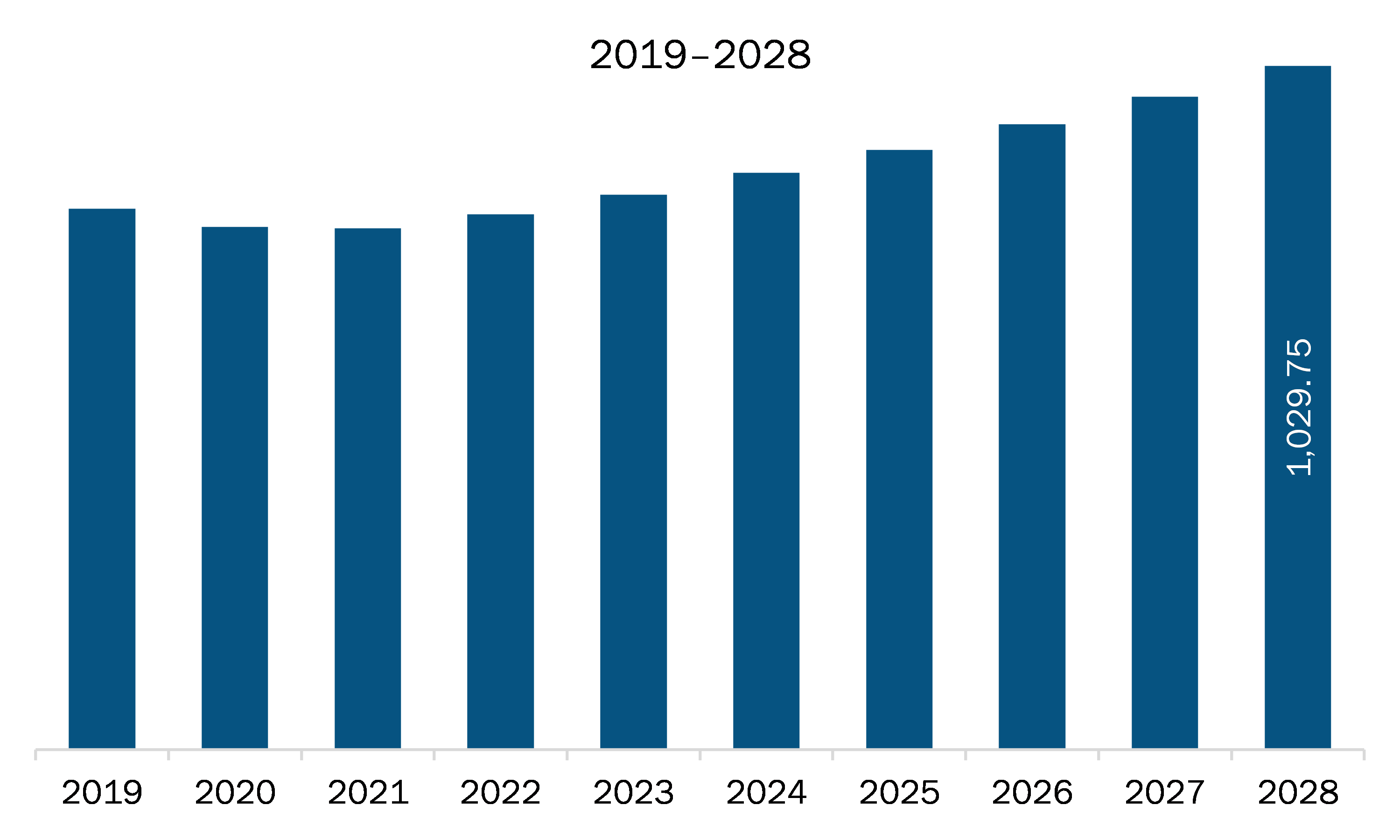

The Europe ultra-low alpha metals market is expected to grow from US$ 627.68 million in 2021 to US$ 1,029.75 million by 2028; it is estimated to grow at a CAGR of 7.3% from 2021 to 2028.

The implementation of legislation such as RoHS and Waste Electrical and Electronic Equipment (WEEE) has led to the growing adoption of Pb-free ultra-low alpha metals in the production of electronic products. The primary alloys categorized as lead-free ultra-low alpha solders are Sn-Ag and Sn-Ag-Cu, as well as alloy systems composed of Bi, Sb, and others. The growing concern toward alpha emission, along with the rising focus on using environment-friendly materials, has led to the use of lead-free alloys. However, in the current scenario, several development activities have been oriented toward the development of Pb-free solders to meet up the manufacturability and reliability expectations from the industries. The electronification of car systems such as advanced driver assistance systems (ADAS) and the incorporation of multimedia systems in cars have driven the demand for advanced electronic components with miniaturized materials and sub-parts. All these requirements have motivated the solder manufacturers and researchers to come up with advanced alloys that can offer extended support for such advanced platforms. This implies the upgrade of conventional Pb-free solder alloys such as SnCu, silver-copper (SAC), and low SAC in fulfilling the demand from such platforms. The growing demand for advanced auto electronics and avionics, along with the growing implementation of a novel set of requirements in terms of solder joint reliability, is expected to fuel the need for advanced ultra-low alpha lead-free solders.

In Europe, the UK reported a huge number of COVID-19 cases, which led to the discontinuation of several business operations, including ultra-low alpha metals manufacturing activities. The disruption in the supply chain with volatility in raw material pricing and sourcing in the initial weeks of lockdown has impacted the industrial products and processes. However, as the economies are planning to revive their operations, the demand for ultra-low alpha metals is expected to rise in Europe. However, the focus on just-in-time production is another concerning factor hindering market growth. The increasing demand for advanced industrial materials backed by the growth of end-use industries such as electronics, aerospace & defense, automotive, medical, and telecommunication is expected to contribute to the market's growth. Further, significant investments by prominent manufacturers in advancing ultra-low alpha lead-free alloys are expected to drive the ultra-low alpha metals market.

With the new advancements and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Europe ultra-low alpha metals market. Alpha emission of the material involves decaying of one atom into another, along with the reduction in mass number by four times and atomic number by two. The rate of alpha emission helps to determine the grade of the metal to be used in different applications such as in the production of printed circuit boards (PCBs), circuit boards, semiconductor packaging, and plating. Apart from their use in the semiconductor and electronics industry, these metals are extensively used across medical and defense sectors. The ultra-low alpha metals are significantly used in the development of military equipment and medical devices attributable to their characteristics such as wetting behavior, mechanical properties, and soldering properties. These metals help minimize device malfunctions arising due to the occurrence of soft errors. This makes them suitable to be used in advanced clinical devices and military hardware and equipment. The expanding demand for clinical gadgets is expected to provide impetus to market growth. Moreover, the demand for ultra-low alpha metals is rising in 3D printing, consumer electronics, wearable devices, telecommunication, and aerospace equipment, which is expected to augment the growth of the ultra-low alpha metals market. Further, rapid industrialization and an increase in investment in advanced materials are expected to stimulate market growth. The implementation of the government regulations on use of the unsafe substances is boosting the market growth.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Ultra-Low Alpha Metals Market Segmentation

- Europe Ultra-Low Alpha Metals Market – By Type

- ULA Tin

- ULA Tin Alloys

- ULA Lead Alloys

- ULA Lead-Free Alloys and Others

- Europe Ultra-Low Alpha Metals Market – By Application

- Electronics

- Automotive

- Medical

- Telecommunication

- Others

- Europe Ultra-Low Alpha Metals Market – By Country

- Germany

- France

- Italy

- UK

- Russia

- Rest of Europe

Europe Ultra-Low Alpha Metals Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 627.68 Million |

| Market Size by 2028 | US$ 1,029.75 Million |

| CAGR (2021 - 2028) | 7.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For