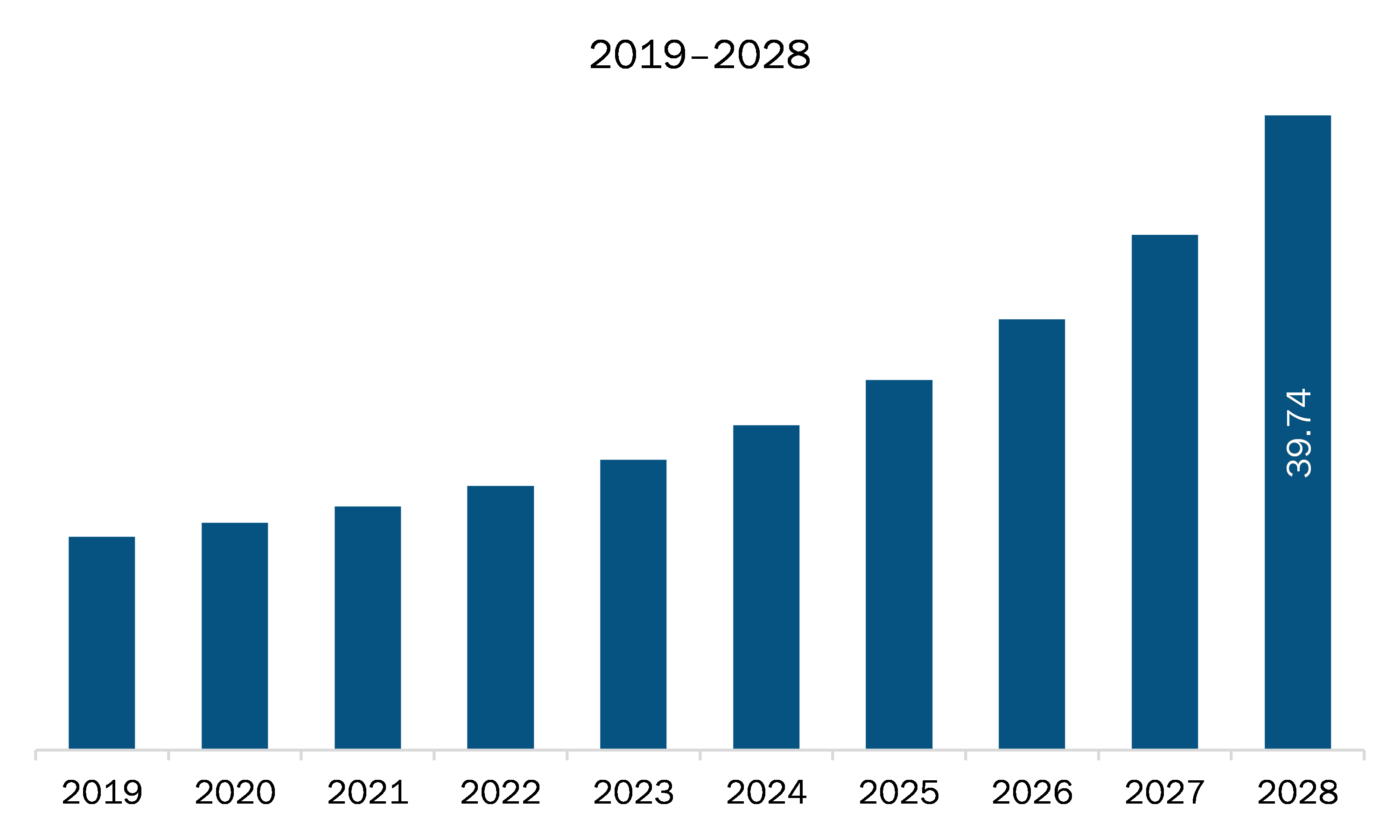

The wealthtech solution market in Europe is expected to grow from US$ 15.23 billion in 2021 to US$ 39.74 billion by 2028; it is estimated to grow at a CAGR of 14.7% from 2021 to 2028.

Artificial intelligence being used in various industry verticals is the major factor driving the growth of the Europe wealthtech solution market. Artificial intelligence (AI) is helping the financial industry to streamline and optimize different processes, ranging from credit decisions to quantitative trading and financial risk management. The AI solutions facilitate more accurate assessment of traditionally underserved borrowers, such as millennials, in the credit decision-making process, thereby helping banks and credit lenders in making smarter underwriting decisions. Further, the use of AI helps smoothen and automate the financing process in several banks, investment firms, and wealth management firms. aixigo AG uses AI-based wealthtech solutions for providing digital transformation, private banking, retail banking, robo advisor, and asset management services. The robo advisor software of aixigo AG uses AI as a replacement of human component at the point-of-sale during the financial investment process. Similarly, Synechron Inc. provides an AI-based solution named Neo for the financial services industry. Neo uniquely brings together Synechron’s digital, business, and technology consulting to guide financial institutions through the deployment of AI solutions to solve complex business challenges. Therefore, the growing popularity of AI-based assistance in banks, investment firms, and wealth management firms is driving the wealthtech solutions market growth.

In Europe, Switzerland is the hardest-hit country by the COVID-19 outbreak, followed by the UK and others. Majority of European countries are expected to suffer an economic hit due to a lack of revenue from various industries, as these countries record the highest number of COVID-19 cases and deaths in the past year. Due to business lockdowns, travel bans, and supply chain disruptions, the region is anticipated to face an economic slowdown in 2020 and most likely in 2021. European countries represent a major market for wealthtech solution owing to the financially stability of the region. As Europe is mega hub for the start hubs the demand for effective wealth management was till in progess However, the supply chain disruptions and demand decline from various end-user industries of wealthtech solution market have led to a decline in revenues of market players operating in the European region.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Europe wealthtech solution market. The Europe wealthtech solution market is expected to grow at a good CAGR during the forecast period.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe WealthTech Solution Market Segmentation

Europe WealthTech Solution Market – By Component

- Solution

- Services

Europe WealthTech Solution Market – By End User

- Banks

- Wealth Management Firms

- Others

Europe WealthTech Solution Market – By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

Europe WealthTech Solution Market – By Deployment Mode

- Cloud-Based

- On-Premises

Europe WealthTech Solution Market, by Country

- Austria

- BeNeLux

- France

- Germany

- Switzerland

- UK

- Rest of Europe

Europe WealthTech Solution Market - Companies Mentioned

- 3rd-eyes analytics AG

- aixigo AG

- BlackRock, Inc.

- FinMason, Inc.

- InvestCloud, Inc.

- InvestSuite

- Synechron

- Valuefy

- Wealthfront Inc.

Europe WealthTech Solution Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 15.23 Billion |

| Market Size by 2028 | US$ 39.74 Billion |

| CAGR (2021 - 2028) | 14.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For