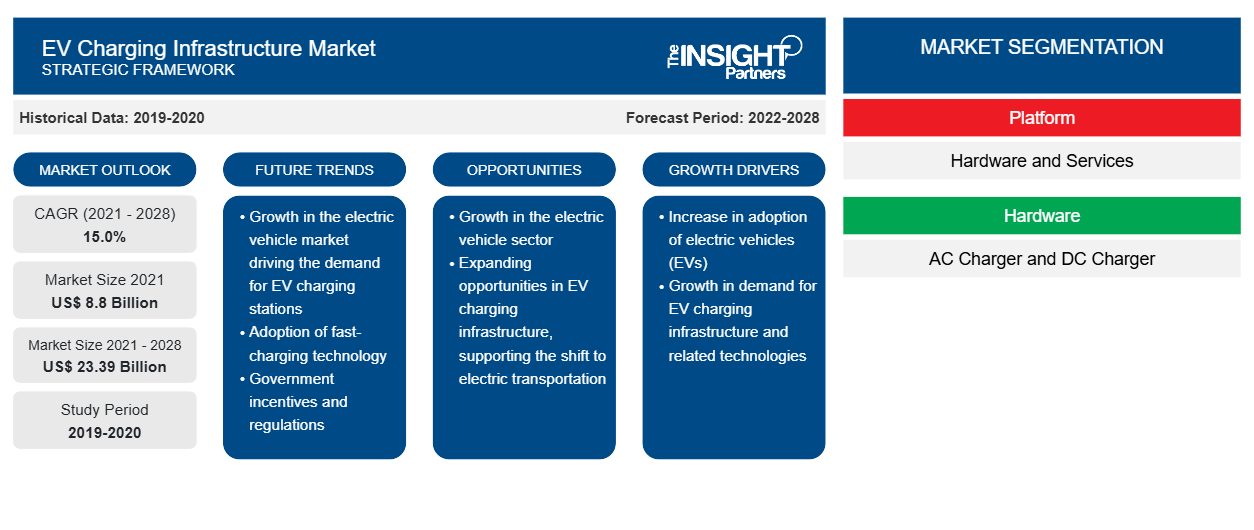

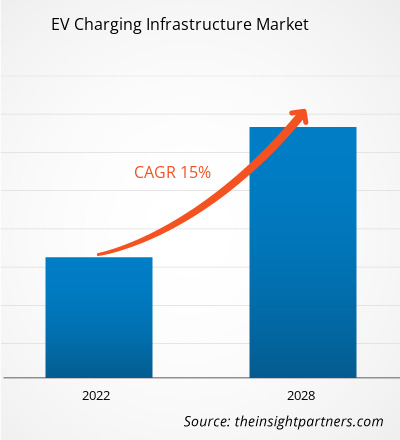

[Research Report] The EV charging infrastructure market was valued at US$ 8.80 billion in 2021 and is projected to reach US$ 23.39 billion by 2028; it is expected to grow at a CAGR of 15.0% from 2021 to 2028.

Analyst Perspective:

The electric vehicle (EV) charging infrastructure market has witnessed significant growth and development in recent years, driven by the global transition towards sustainable transportation. As more countries and governments prioritize adopting electric vehicles to lower greenhouse gas emissions and combat climate change, the demand for reliable and efficient charging infrastructure has surged. EV charging infrastructure refers to the network of charging stations and associated technologies that enable the recharging of electric vehicles. These charging stations come in various forms, including home, workplace, public, and fast-charging stations. They are designed to accommodate different charging needs and provide convenience for EV owners. One of the key drivers of the EV charging infrastructure market is the expanding EV market itself. As the sales of electric vehicles continue to grow, the need for a robust charging infrastructure becomes crucial to support the growing number of EVs on the road.

Additionally, government initiatives, subsidies, and regulations promoting electric vehicle adoption have played a significant role in boosting the development of charging infrastructure. Several companies and stakeholders are actively involved in the EV charging infrastructure market. These include established automakers, energy companies, charging network operators, and technology providers. They collaborate to develop innovative charging solutions, enhance charging speeds, and improve user experience. Fast-charging infrastructure is essential for long-distance travel and reducing range anxiety, allowing EV owners to recharge their vehicles quickly during extended journeys. Moreover, integrating renewable energy sources into the charging infrastructure is gaining traction. Renewable energy-powered charging stations help reduce carbon emissions associated with charging, making the overall electric mobility ecosystem more sustainable and environmentally friendly.

Market Overview:

An electric car charging station is a piece of hardware used to connect plug-ins and electric vehicles to an electrical source to be recharged. Private businesses or electric utility providers place Charging stations in public areas like parking lots, shopping malls, and other places. Three-pin plugs, public charging stations, and residential wall box chargers are all simple ways to recharge electric vehicles from the grid. The vehicle-to-grid (V2G) technology is anticipated to enable owners of vehicles to resell their excess electricity to the grid during peak hours in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

EV Charging Infrastructure Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

EV Charging Infrastructure Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Expansion of Electric Vehicle Market to Drive Growth of EV Charging Infrastructure Market

The development of the electric vehicle (EV) market is a significant driver for the growth of the EV charging infrastructure market. As the need for electric vehicles rises, a robust and widespread charging infrastructure becomes paramount. Several factors drive the expanding EV market. There is growing awareness and concern about environmental issues, including climate change and air pollution. The advancements in EV technology, including improved battery capacities and longer driving ranges, have enhanced the appeal and practicality of electric vehicles. As battery technology continues to evolve, EVs are becoming more competitive in terms of performance and range, addressing the concerns of potential buyers regarding limited driving distances and charging availability. Additionally, automakers are investing heavily in the development of electric vehicle models. Major players in the automotive industry are introducing an increasing number of EV options across various vehicle segments, catering to different consumer preferences and needs. The need for a comprehensive charging infrastructure becomes crucial as the EV market expands. EV owners require convenient and reliable charging solutions to recharge their vehicles easily and efficiently. This demand extends beyond residential charging options, as EV owners need access to charging stations at workplaces, public locations, and highways to support their daily commutes and long-distance travel. Charging infrastructure providers, energy companies, and other stakeholders recognize the importance of investing in and expanding the charging network to satisfy the needs of a larger EV fleet. They are collaborating with governments, automakers, and other industry players to develop charging solutions that are scalable, reliable, and widely accessible.

Segmental Analysis:

Based on platform, the EV charging infrastructure market is segmented into hardware and services. The hardware segment held the largest share of the market in 2020. Due to several factors, the hardware segment is the largest shareholder in the EV charging infrastructure market. The deployment of charging stations across various locations contributes to its dominance. The segment encompasses the manufacturing, installation, and maintenance of charging stations, which form the backbone of the charging infrastructure. The diverse charging solutions, including Level 1, 2, and DC fast chargers, drive the hardware segment's market share. Technological advancements in charging hardware and the longer lifespan of physical infrastructure investments further solidify its position. The hardware segment's larger market share reflects its capital-intensive nature and pivotal role in establishing reliable and efficient charging networks.

Regional Analysis:

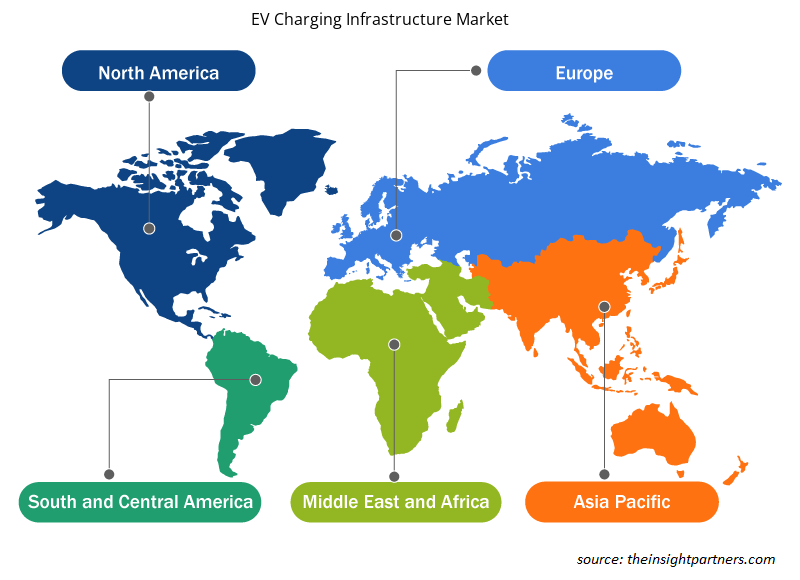

The Asia Pacific EV charging infrastructure market was valued at US$ 3.99 billion in 2021 and is projected to reach US$ 10.77 billion by 2028; it is expected to grow at a CAGR of 15.2% during the forecast period. The Asia Pacific region has established dominance in the EV charging infrastructure market through several key factors contributing to its growth and market share. The region has experienced a significant surge in electric vehicle adoption, making it the largest and fastest-growing market for electric vehicles globally. Countries like China, Japan, and South Korea have driven this adoption with strong government support, incentives, and ambitious emissions reduction targets. This growing electric vehicle market has created substantial demand for EV charging infrastructure, leading to the region's dominant position. The Asia Pacific region benefits from a well-developed manufacturing ecosystem, particularly in countries like China and South Korea. These nations have made significant investments in manufacturing charging stations, cables, and related components, resulting in a robust supply of charging infrastructure at competitive prices. This has facilitated the deployment of charging solutions and increased accessibility for consumers. Moreover, the region has strongly committed to building a comprehensive charging network. Governments and industry stakeholders have been actively expanding the charging infrastructure, including residential areas, commercial complexes, public spaces, and major transportation corridors. This widespread network ensures convenience and accessibility for electric vehicle owners, further solidifying the region's dominance. Technological advancements and innovation have also contributed to the Asia Pacific region's market dominance. Adopting high-power charging stations and smart charging solutions and exploring emerging technologies like wireless charging have improved the efficiency and user experience of EV charging. These advancements have attracted more consumers to electric vehicles and boosted the demand for charging infrastructure.

Additionally, leading companies and market players in the region have played a significant role. Asian manufacturers, including BYD, NIO, Hyundai, and LG Electronics, have invested substantially in charging infrastructure and expanded their market reach. Their expertise, technological advancements, and strong market presence have contributed to the growth of the EV charging infrastructure market in the Asia Pacific region.

Key Player Analysis:

The EV charging infrastructure market analysis consists of the players such as Tritium; Blink Charging Co.; ChargePoint, Inc.; BP p.l.c.; EVBox; EVgo Inc.; Tesla, Inc.; Webasto Group; RWE AG; and Delta Electronics, Inc. Among the players in the EV charging infrastructure Tritium and EVBox are the top two players owing to the diversified product portfolio offered.

EV Charging Infrastructure Market Regional Insights

EV Charging Infrastructure Market Regional Insights

The regional trends and factors influencing the EV Charging Infrastructure Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses EV Charging Infrastructure Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for EV Charging Infrastructure Market

EV Charging Infrastructure Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 8.8 Billion |

| Market Size by 2028 | US$ 23.39 Billion |

| Global CAGR (2021 - 2028) | 15.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Platform

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

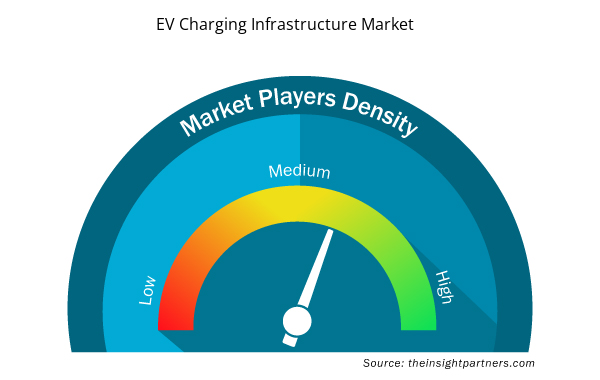

EV Charging Infrastructure Market Players Density: Understanding Its Impact on Business Dynamics

The EV Charging Infrastructure Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the EV Charging Infrastructure Market are:

- De

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the EV Charging Infrastructure Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the EV charging infrastructure market. A few recent key market developments are listed below:

- In November 2022, Yulu signed an MoU (memorandum of understanding) with the Karnataka government and announced its plans to invest INR 12 billion in deploying a fleet of 100,000 electric vehicles (EV) and operationalizing the state's largest EV battery charging and swapping infrastructure over the next five years.

- In October 2022, the Luxembourg government announced that 29 projects were chosen following the first call for projects granting financial aid to companies investing in charging infrastructure projects for electric vehicles. The companies involved will receive a subsidy of up to 50% on investments related to the deployment of charging stations with a charging capacity of at least 175 kilowatts.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Platform, Hardware, Charger Type, and IEC Mode

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Argetina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Asia Pacific dominated the EV charging infrastructure market in 2020 with a share of 45.2% and is expected to continue its dominance by 2028. Europe is the second-largest contributor to the global EV charging infrastructure market in 2020, followed by North America.

The major companies in EV charging infrastructure market are Tritium; Blink Charging Co; ChargePoint, Inc.; BP p.l.c.; EVBox; EVgo Inc.; Tesla, Inc.; Webasto Group; RWE AG; and Delta Electronics, Inc.

The IEC Mode in EV charging infrastructure includes 2, 3, and 4. In terms of market share, the market was dominated by the 3 segment in 2020.

Based on platform, the global EV charging infrastructure market is segmented into hardware, and services. The EV charging infrastructure market was dominated by the hardware segment in 2020.

The rising concern of the transportation sector's impact on the environment has led to an unprecedented global requirement of decarbonizing transportation to meet climate goals and limit global warming, thereby increasing the adoption of low carbon technology in the transportation sector. The rising concerns for the adverse impact of transportation-related emissions and shift of consumer behavior toward zero-emission vehicles have resulted in a significant increase in the adoption of light-duty passenger vehicles across the globe, especially in strong economies, such as the US, China, and the European Union. The global share of new passenger EVs has risen at an average of nearly 50% per year since 2015. In 2021, the sales of electric vehicles surged by 160% in these top three markets. Notably, China has the largest fleet of electric vehicles globally, with 4.5 million electric cars, and Europe witnessed the largest annual increase to reach a total of 3.2 million electric passenger vehicles.

Presently, EV charging stations are more common in private residences. However, the rising consumer demand has led to an active adoption of on-site commercial charging as a standard building feature. China, the EU-27 plus the UK, and the US, are expected to implement charging in residential and commercial buildings to scale up the EV charging infrastructure in the near future, which requires upgrading buildings' electrical infrastructure to satisfy the rising demand for EV charging. Additionally, EV charging at scale is subject to the careful planning of a building's electrical distribution system, along with the local electric-grid infrastructure. To enhance the accessibility and affordability of electric chargers, a large number of building developers, urban planners, and electrical-equipment suppliers are actively integrating the EV charging infrastructure into standard building design plans.

Trends and growth analysis reports related to Automotive and Transportation : READ MORE..

The List of Companies - EV Charging Infrastructure Market

- De’Longhi Appliances S.r.l.

- The Whirlpool Corporation

- Koninklijke Philips N.V.

- Breville

- SMEG S.p.A.

- Hobart

- Ankarsrum Kitchen AB

- Wonderchef Home Appliances Pvt. Ltd.

- Kenwood Limited

- Hamilton Beach Brands, Inc.

Get Free Sample For

Get Free Sample For