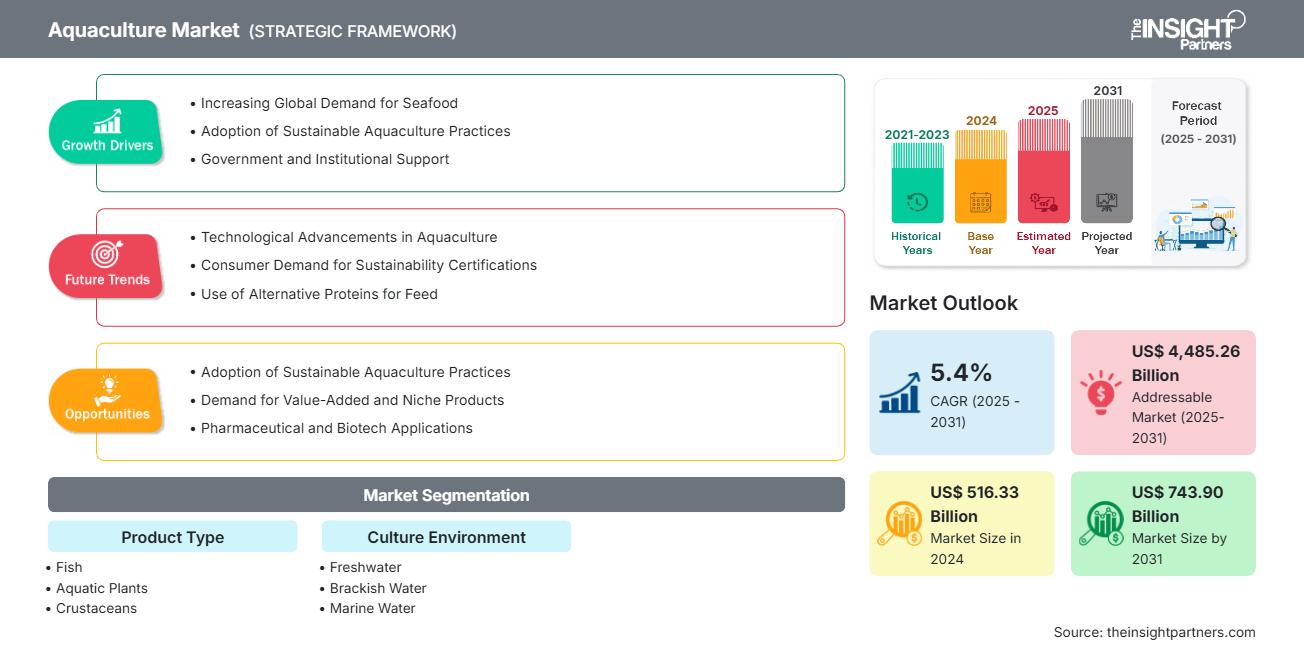

Global Aquaculture Market Forecast and Key Trends (2025-2031)

Aquaculture Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type [Fish (Salmon, Tuna, Cod, and Others), Aquatic Plants, Crustaceans, Mollusca, and Others] and Culture Environment (Fresh Water, Brackish Water, and Marine Water)

Historic Data: 2021-2023 | Base Year: 2024 | Forecast Period: 2025-2031- Report Date : Aug 2025

- Report Code : TIPRE00005135

- Category : Food and Beverages

- Status : Published

- Available Report Formats :

- No. of Pages : 281

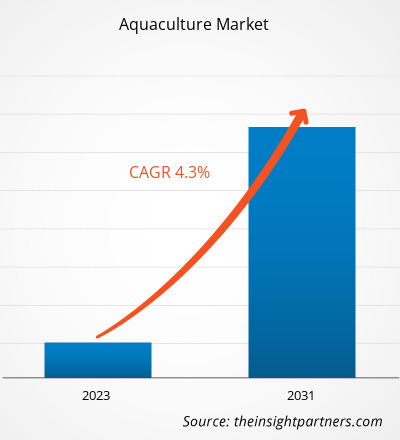

The Global Aquaculture Market size is projected to reach US$ 743.90 billion by 2031 from US$ 516.33 billion in 2024. The market is expected to register a CAGR of 5.4% during 2025–2031.

Global Aquaculture Market Analysis

The aquaculture market is driven by the rising global demand for protein-rich food, overfishing wild stocks, and advancements in aquaculture technology. As sustainability becomes a key focus, aquaculture presents an opportunity to meet seafood demand with a lower environmental impact. Innovations such as recirculating aquaculture systems (RAS) and improved breeding techniques enhance yield and efficiency. Additionally, increasing investments and favorable government policies in emerging economies create a promising landscape for expansion, positioning aquaculture as a vital contributor to future food security.

Global Aquaculture Market Overview

The global aquaculture market is experiencing robust growth, driven by rising seafood demand, overfishing concerns, and advancements in farming technologies. Valued at over US$ 300 billion in 2024, the market is expected to expand steadily due to increasing consumption of protein-rich diets and sustainable practices. Asia Pacific dominates the industry, with China as the leading producer. Key segments include freshwater, marine, and brackish water farming, focusing on species like salmon, shrimp, and tilapia. Innovations in feed, disease control, and aquaponics further enhance productivity, making aquaculture a vital component of global food security and economic development.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONAquaculture Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Global Aquaculture Market Drivers and Opportunities

Market Drivers:

- Rising Global Seafood Demand Increasing population and health-conscious diets are boosting seafood consumption.

- Overexploitation of Wild Fisheries Declining wild fish stocks are accelerating the global shift toward sustainable aquaculture.

- Technological Advancements Innovations in breeding, water quality management, and disease control improve yields.

- Government Support & Subsidies Many countries are promoting aquaculture through favorable policies and funding.

- Sustainable and Eco-Friendly Practices Growth in recirculating aquaculture systems (RAS) and integrated aquaponics.

- Expansion in Developing Regions Emerging markets in Africa, Latin America, and Southeast Asia offer untapped potential.

Market Opportunities:

- Expansion of Sustainable Aquaculture Systems Growth in eco-friendly methods like recirculating aquaculture systems (RAS) and integrated multi-trophic aquaculture (IMTA).

- Increased Demand for Plant-Based and Alternative Feeds Opportunity to reduce environmental impact and feed costs using algae, insects, or soy-based feeds

- Growth in Functional and Organic Seafood Rising consumer interest in organic, antibiotic-free, and value-added seafood products.

- Development in Emerging Markets Rising investments and infrastructure in Africa, Southeast Asia, and Latin America.

- Commercial & Hospitality Sector Growth Hotels, restaurants, and food-processing industries require strict pest control, offering growth avenues for service providers.

- Expansion into New Species and Products Farming of high-value or novel species (e.g., sea cucumbers, ornamental fish) and marine bioproducts (e.g., collagen, omega-3).

Global Aquaculture Market Report Segmentation Analysis

The global aquaculture market is divided into different segments to give a clearer view of how it works, its growth potential, and the latest trends. Below is the standard segmentation approach used in most industry reports:

By Product Type:

-

Fish

Farmed for human consumption, rich in protein and omega-3 fatty acids, using freshwater or marine systems.

-

Salmon

Raised in cold-water net pens or land-based systems, prized for their high market value and nutrients. - Salmon Mostly ranched or cultured in sea cages after being caught young, valued for sushi and export markets.

- Cod Cultivated in cold marine environments, it is known for its white, flaky meat and its use in fillets and processed foods.

- Others Species like tilapia and catfish are grown widely for affordable, sustainable protein.

-

- Aquatic Plants This includes seaweed and algae cultivated for food, cosmetics, biofuels, and pharmaceuticals.

- Crustaceans Shrimp and crabs are farmed in ponds or tanks; they are quite popular in global cuisine and export trade.

- Mollusca Oysters, mussels, and clams are often grown on ropes or seabeds for food and pearl production.

- Others They encompass eels, frogs, and ornamental fish; they are bred for niche markets and the aquarium trade.

By Culture Environment:

- Freshwater Farming of species like tilapia, carp, and catfish in rivers, ponds, and tanks is widely used due to low cost and accessibility.

- Brackish Water Utilizes slightly salty environments such as estuaries and coastal ponds to raise species like shrimp and milkfish, balancing freshwater and marine traits.

- Marine Water Cultivates saltwater species like salmon, tuna, and sea bass in ocean cages, net pens, or offshore farms, ideal for high-value seafood production.

By Geography:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South and Central America

The aquaculture market in the Asia Pacificis expected to witness the fastest growth. The key drivers of the aquaculture market in the Asia Pacific are the high production volume, strong seafood demand, and favorable farming conditions.

Aquaculture

Aquaculture Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 516.33 Billion |

| Market Size by 2031 | US$ 743.90 Billion |

| Global CAGR (2025 - 2031) | 5.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Aquaculture Market Players Density: Understanding Its Impact on Business Dynamics

The Aquaculture Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Global Aquaculture Market Share Analysis by Geography

Asia Pacific is expected to grow rapidly in the next few years. Emerging markets in the Asia Pacific also have many untapped opportunities for aquaculture providers to expand.

The aquaculture market grows differently in each region. This is because of factors like increasing global demand for seafood, depletion of wild fish stocks, technological advancements in farming methods, government policies and subsidies, rising health consciousness and protein consumption, expansion in developing regions, and adoption of sustainable and eco-friendly practices. Below is a summary of market share and trends by region:

1. North America

- Market Share: Moderate share with increasing investments in sustainable practices

-

Key Drivers:

- Demand for high-quality, traceable seafood

- Technological innovation in recirculating aquaculture systems (RAS)

- Supportive government regulations and certifications

- Trends: Growth in land-based salmon farming and plant-based feed alternatives

2. Europe

- Market Share: Growing market with steady progress

-

Key Drivers:

- Invasive Species Threats

- Public Health Concerns

- Climate Change Impact

- Trends: Rise in eco-friendly biopesticides and intelligent pest control

3. Asia Pacific

- Market Share: Largest market with dominant global production

-

Key Drivers:

- High Seafood Consumption

- Government Subsidies and Investment in Aquaculture

- Coastal Aquaculture Development

- Trends: Intensification of fish farming, integration of digital technologies, and increased focus on export-oriented production

4. Middle East and Africa

- Market Share: Emerging market with high growth potential

-

Key Drivers:

- Water Scarcity Driving Sustainable Practices

- Food Security Initiatives

- Government Investments in Aquaculture Infrastructure

- Trends: Adoption of desert aquaculture and cage farming in marine environments

5. South and Central America

- Market Share: Substantial share due to health awareness

-

Key Drivers:

- Rising Demand for Protein-Rich Diets

- Expansion of Coastal and Inland Fish Farming

- Government Support for Export-Oriented Aquaculture

- Trends: Adoption of sustainable aquaculture practices, growth in tilapia and shrimp farming, and increased investment in disease-resistant species

Global Aquaculture Market Players Density: Understanding Its Impact on Business Dynamics

High Market Density and Competition

Competition is intense due to the presence of established players such as JBS SA, Mowi ASA, Blue Ridge Aquaculture Inc, and Thai Union Group PCL. Regional and niche providers like Bakkafrost, Danish Salmon, and Mowi ASA also add to the competitive landscape across different regions.

This high level of competition urges companies to stand out by offering:

- Use of Recirculating Aquaculture Systems (RAS)

- AI & IoT-based monitoring and automation

- Genetic improvements and breeding technologies

Opportunities and Strategic Moves

- Sustainable and Eco-Friendly Practices.

- High-Value Species Diversification.

- Focus on Recirculating Aquaculture Systems (RAS)

- Introduction of Ready-to-Eat or Value-Added Seafood

Major Companies operating in the Global Aquaculture Market are:

- JBS SA

- Mowi ASA

- Blue Ridge Aquaculture Inc

- Thai Union Group PCL

- Bakkafrost

- Cooke Aquaculture Inc

- Danish Salmon

- Leroy Seafood Group ASA

- Stolt-Nielsen Ltd

- Cermaq Group AS

Disclaimer: The companies listed above are not ranked in any particular order.

Other companies analyzed during the course of research:

- Grieg Seafood ASA

- SalMar ASA

- Nireus Aquaculture S.A.

- Cargill Aqua Nutrition

- Maruha Nichiro Corporation

- Nippon Suisan Kaisha (Nissui)

- Unima Group

- American Abalone Farms

- Farallon Aquaculture, SA

- Empresas AquaChile S.A.

- Multiexport Foods

- Sea Watch International Ltd.

- Selonda Aquaculture S.A.

- Trident Seafoods

- Nueva Pescanova Group

- Huon Aquaculture Group

- Ocean Aquafarms AS

- Aqua.cl

- Aquaculture of Texas Inc.

- International Fish Farming Holding (Asmak)

Global Aquaculture Market News and Recent Developments

- Commission launches EU-wide aquaculture campaign EU Commissioner Costas Kadis will launch an EU-wide campaign on aquaculture, focusing on raising awareness and understanding among Member States and the Aquaculture Advisory Council, aimed at promoting the farming of fish, shellfish, and algae in the EU.

- India and the Maldives ink MoU to strengthen fisheries and aquaculture cooperation India and the Maldives have signed a Memorandum of Understanding (MoU) to strengthen their bilateral ties in fisheries and aquaculture, marking a significant step toward sustainable marine resource development. The agreement was formalized during Prime Minister Narendra Modi's state visit to the Maldives.

- Brazilian Fish and CAT Introduce First Gene-Edited Tilapia in Brazil Brazilian Fish and the Center for Aquaculture Technologies (CAT) developed the first gene-edited tilapia in Brazil, aiming to improve productivity and yield by accelerating breeding efficiency from 20 years to just one year. The initiative involves reproductive induction and in vitro fertilization tests, thereby improving growth, yield, and feed efficiency. The first gene-edited fish are now ready for performance and genomic evaluations.

Global Aquaculture Market Report Coverage and Deliverables

The " Global Aquaculture Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering the following areas:

- Global Aquaculture Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Global Aquaculture Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter’s and SWOT analysis

- Global Aquaculture Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Global Aquaculture Market

- Detailed company profiles

Frequently Asked Questions

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For