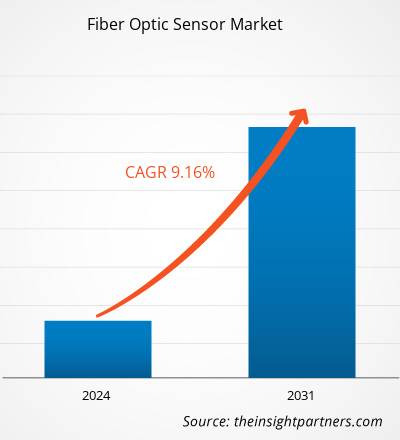

The fiber optic sensors market size is projected to reach US$ 6.76 billion by 2031 from US$ 3.61 billion in 2024. The market is expected to register a CAGR of 9.7% during 2025–2031. Miniaturization and portability are likely to bring new trends into the market in the coming years.

Fiber Optic Sensors Market Analysis

Optical fiber sensing is a technology used to measure chemical changes, strain, temperature, electric and magnetic fields, pressure, displacement, rotation, radiation, liquid level, flow, light intensity, and vibrations. A fiber-optic sensor is a device that uses optical fiber either to detect changes in the environment (called intrinsic sensors) or to carry signals from a remote sensor to processing equipment (called extrinsic sensors). These tiny sensors are commonly used in remote sensing because of several advantages. They don’t require electrical power at the sensing point, and a single fiber can support multiple sensors. These advantages make them cost-effective and efficient for monitoring operations over long distances. Fiber-optic sensors are durable and can operate in extreme temperatures. Since they don’t carry electricity, they also work well in areas with high electrical interference, high voltage, or flammable materials; this makes them ideal for use in industries such as oil and gas, construction, aerospace, and healthcare.

Fiber Optic Sensors Market Overview

Surging applications in the oil and gas sector and the burgeoning demand for structural health monitoring (SHM) in different sectors are the key factors bolstering the fiber optic sensor market. These sensors play a crucial role in improving safety and efficiency in buildings, pipelines, and transportation systems. Industries such as oil and gas, power, and telecommunications are also adopting these sensing technologies to enhance performance and reliability. As more industries move toward automation and smarter systems, the global fiber optic sensor market is expected to grow steadily in the coming years. The development of smart cities and growth in the renewable sector will create lucrative opportunities in the market in the near future.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

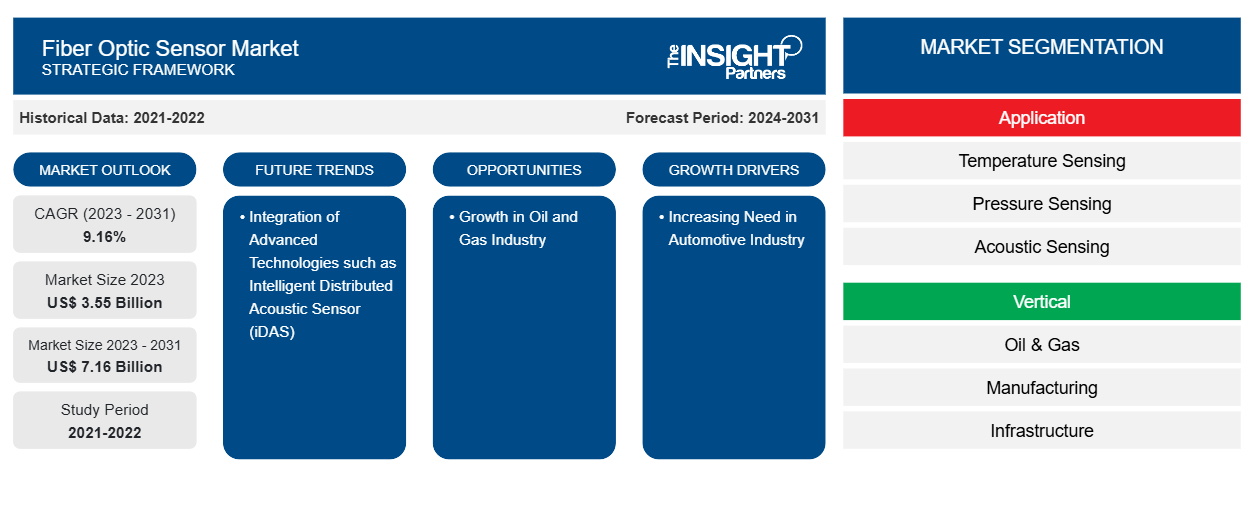

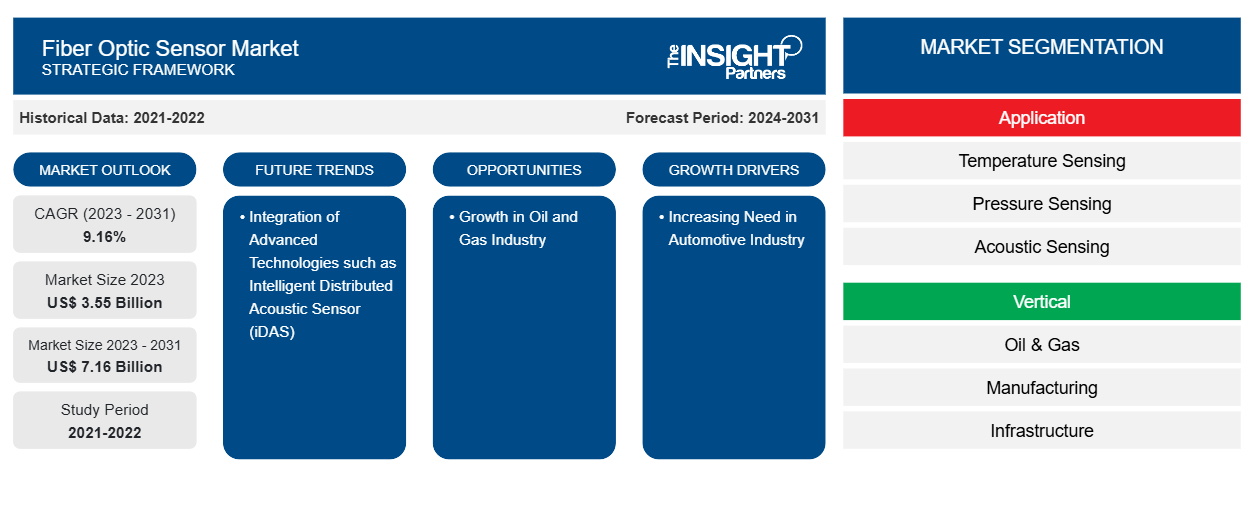

Fiber Optic Sensors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fiber Optic Sensors Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Fiber Optic Sensors Market Drivers and Opportunities

Burgeoning Demand for Structural Health Monitoring

There is a rising focus on infrastructure safety and real-time monitoring across the world, which drives the demand for advanced structural health monitoring (SHM) systems. With the expansion of modern cities and the aging of infrastructure, there is a constant need to detect early signs of damage or failure in structures such as bridges, tunnels, dams, and buildings. Traditional systems such as resistive strain gauges often fall short in terms of durability, long-term accuracy, and adaptability. Fiber optic sensors have risen as a superior alternative to traditional monitoring systems, offering benefits such as compact design, corrosion resistance, and electromagnetic interference tolerance. Moreover, their ability to be embedded directly into structures is adding to their popularity. These qualities make them ideal for long-term SHM, even in challenging environments. These sensors can accurately measure key physical parameters such as strain, temperature, vibration, and tilt, which are essential for maintaining the integrity and safety of infrastructure.

To address the elevating demand, companies in the fiber optic sensor market are securing investments to scale their technologies. For example, Sentea—a spin-off from imec and a supplier of read-out systems for fiber optic sensors—successfully raised ~US$ 2.6 million (EUR 2.3 million) in 2021 to expand its business. The announcement of this investment was made in October 2021. Backed by investors such as Finindus, PMV, QBIC II, and Fidimec, Sentea's expansion initiative focuses on advancing photonic integrated technology to enable large-scale fiber optic sensing across civil engineering, oil and gas, renewable energy, and medical applications. Such investments reflect the growing potential for the deployment of fiber optic sensing technology in SHM applications, thereby fueling the growth of the fiber optic sensor market.

Development of Smart Cities

The Indian government launched the 100 Smart Cities Mission on June 25, 2015, with an aim to develop 100 cities across the country with modern infrastructure, a clean and sustainable environment, and enhanced quality of life through the use of smart solutions. It promotes holistic urban development—social, economic, physical, and institutional—under a Centrally Sponsored Scheme with ~US$ 6,400 million (INR 48,000 crore) in central funding, matched by states and other sources, including Public Private Partnerships (PPPs). The mission seeks to create replicable models of sustainable and inclusive urban growth for other cities to follow. In the European Union (EU), NetZeroCities supports the "100 Climate-Neutral and Smart Cities by 2030" mission as part of the Horizon Europe program.

As smart cities expand, the need for advanced monitoring tools such as fiber optic sensors would continue to grow. These sensors can provide real-time data and work well in harsh environments, along with delivering long-lasting. They can be used to monitor bridges, roads, tunnels, buildings, water pipes, and energy systems. For example, they can detect cracks in bridges, leaks in pipelines, or changes in temperature in power networks, subsequently helping city authorities take action before problems become serious. These sensors can also be used in smart traffic systems, smart grids, and smart buildings, where they help improve performance and safety. Thus, the rise of smart cities offers a lucrative opportunity for the fiber optic sensor market, as these sensors help create connected, efficient systems.

Fiber Optic Sensors Market Report Segmentation Analysis

Key segments that contributed to the derivation of the fiber optic sensors market analysis are sensing type, end user, and application .

- Based on sensing type, the fiber optic sensor market is segmented into temperature sensing, pressure sensing, acoustic sensing, strain sensing, and others. The temperature sensing segment held the largest share of the market in 2024.

- Based on end user, the fiber optic sensor market is segmented into oil and gas, manufacturing, infrastructure, aerospace and defense, power and utilities, and others. The oil and gas segment held the largest market share in 2024.

- Based on application, the fiber optic sensor market is segmented into high-voltage or high-power cable monitoring, pipeline monitoring, upstream application, fire detection in critical assets, CCS/CCUS application, and others. The others segment held the largest market share in 2024.

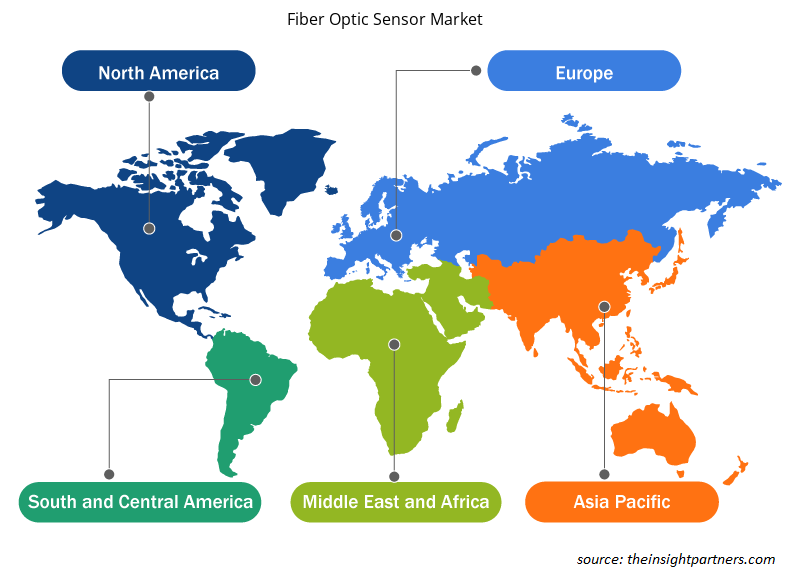

Fiber Optic Sensors Market Share Analysis by Geography

The geographic scope of the fiber optic sensors market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East and Africa, and South and Central America. Asia Pacific held a significant market share in 2024.

Fiber Optic Sensors Market Regional Insights

The regional trends and factors influencing the Fiber Optic Sensors Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Fiber Optic Sensors Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fiber Optic Sensors Market

Fiber Optic Sensors Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3.61 Billion |

| Market Size by 2031 | US$ 6.76 Billion |

| Global CAGR (2025 - 2031) | 9.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Sensing Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Fiber Optic Sensors Market Players Density: Understanding Its Impact on Business Dynamics

The Fiber Optic Sensors Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fiber Optic Sensors Market are:

- Baumer Holding AG

- Pepperl+Fuchs SE

- Wenglor Sensoric GmbH

- NEC Corp

- Proximion AB

- OMRON Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fiber Optic Sensors Market top key players overview

Fiber Optic Sensors Market News and Recent Developments

The fiber optic sensors market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the market is listed below:

Wenglor introduced the P1XD Fiber-Optic Amplifier, designed specifically for compact space applications. The P1XD2 series models provide flexible integration options, allowing the amplifier to function independently or as part of a networked system in either a master or subordinate role. (Source: Wenglor, Press Release, December 2024)

Honeywell (NASDAQ: HON) and Civitanavi Systems (EURONEXT MILAN: CNS) have launched a new inertial measurement unit for commercial and defense customers worldwide. The HG2800 family consists of low-noise, high-bandwidth, high-performance, tactical-grade inertial measurement units designed for pointing, stabilization and short-duration navigation on commercial and military aircraft, among other applications. (Source: Honeywell, Press Release, September 2023)

Fiber Optic Sensors Market Report Coverage and Deliverables

The "Fiber Optic Sensors Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Fiber optic sensors market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Fiber optic sensors market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Fiber optic sensors market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the fiber optic sensors market

- Detailed company profiles

Frequently Asked Questions

What is the expected CAGR of the fiber optic sensor market?

The market is anticipated to expand at a CAGR of 9.7% during 2025-2031.

What are the driving factors impacting the fiber optic sensor market?

Surging applications in oil and gas sector and burgeoning demand for structural health monitoring are driving the market growth.

What are the future trends of the fiber optic sensor market?

Miniaturization and portability is one of the key trends in the market.

Which are the leading players operating in the fiber optic sensor market?

OMRON Corporation, Yokogawa Electric Corporation, Honeywell International Inc., HALLIBURTON, and Keyence Corporation are major players in the market.

What would be the estimated value of the fiber optic sensor market by 2031?

The market is expected to reach a value of US$ 6.77 billion by 2031.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Fiber Optic Sensors Market

- Baumer Holding AG

- Pepperl+Fuchs SE

- Wenglor Sensoric GmbH

- NEC Corp

- Proximion AB

- OMRON Corp

- Sick AG

- Omnisens SA

- FISO Technologies

- Luna Innovations

- Honeywell International Inc

- Halliburton

- Schlumberger NV

- Yokogawa Electric Corp

- Keyence Corporation

Get Free Sample For

Get Free Sample For