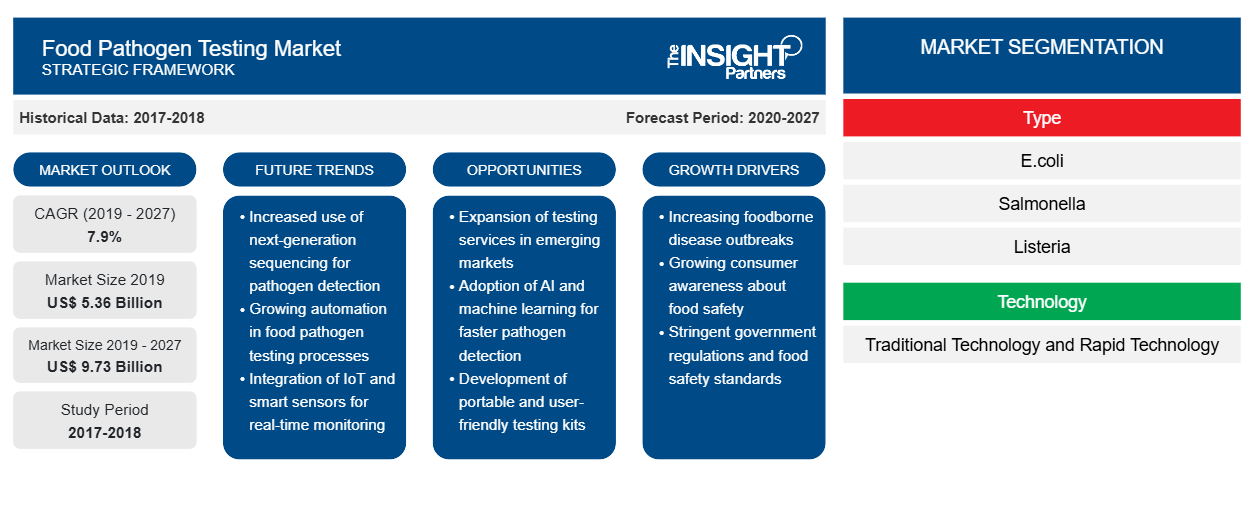

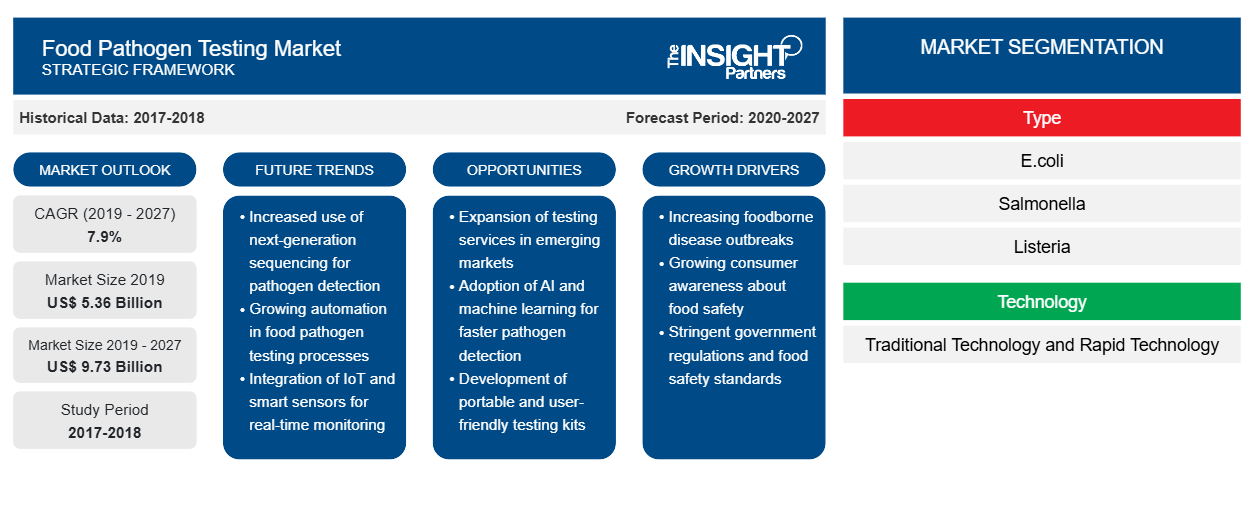

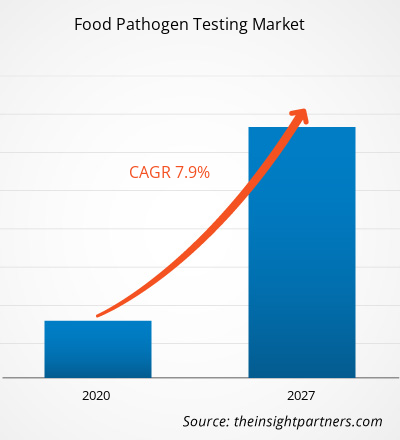

The food pathogen testing market was valued at US$ 5,360.94 million in 2019 and is projected to reach US$ 9,731.91 million by 2027; it is expected to grow at a CAGR of 7.9% from 2020 to 2027.

Food pathogen testing is defined as the process that helps in monitoring the presence of any life threatening bacteria or microbes in food. The food pathogen testing is mainly crucial for the food industry as there are about 31 known viruses and bacteria causing pathogens that can lead to harmful foodborne diseases. This method of testing is employed in every step of food production to ensure food safety. The rise in safety concerns and regulations due to the number of cases of food poisoning drives the growth of the market for food pathogen testing. Also, advancements in various food pathogen testing methods like polymerase chain reaction and immunomagnetic separation and limited detection time favors the adoption of food pathogen testing by various participants in the food industry.

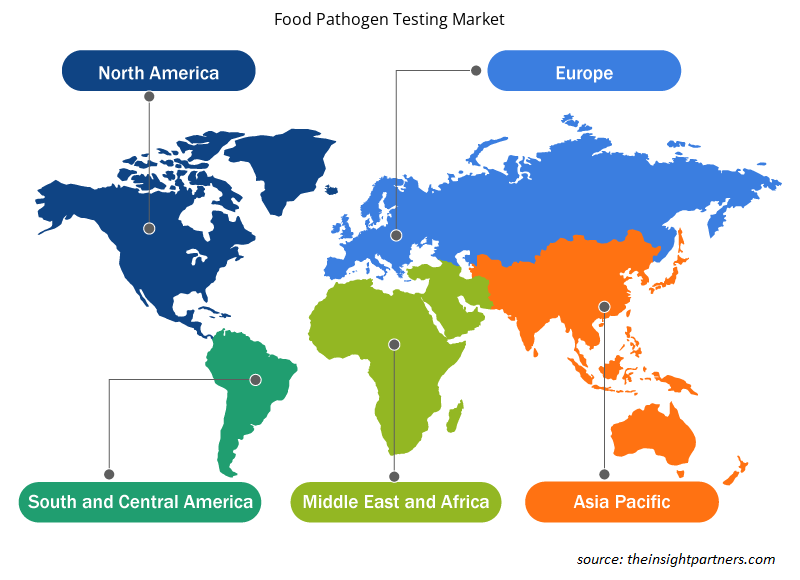

The food pathogen testing market in Europe is expected to grow at the highest CAGR during the forecast period. The growth of the market in this region is mainly attributed to The rise in the incidence of foodborne diseases and thus the rising awareness towards food safety drives the demand for food pathogen testing in North America. Development in pathogen testing methods coupled with nano-biotechnology also supports the growth of the market. Increments in medical expenses and the application of genetically modified organisms in food & beverages industry also fuels the market for the same. Globalization in food trade and economic development contributes to the expansion of food pathogen testing market in the region. Rising awareness about the benefits of the employment of food pathogen testing amongst the consumers and manufactures of food provide lucrative opportunities for the development of the food pathogen testing market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Food Pathogen Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Food Pathogen Testing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Food Pathogen Testing Market

The COVID-19 outbreak adversely affects economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. Food and beverages are among the significant industries suffering from severe disruptions such as restrictions on the supply chain and shutdown of production plants. The shutdown of different plants and factories in various countries disrupts the global supply chains and negatively impacts the manufacturing activities, delivery schedules, and multiple goods sales. Various companies have already announced possible delays in product deliveries and slump in future sales of their products. In addition, the global travel bans imposed by countries in Europe, Asia, and North America are hindering business collaboration and partnership opportunities. Thus, these factors are restraining the growth of the food pathogen testing market in the food and beverage industry.

Market Insights

Increased Rapid Pathogen Testing In Dairy production Is Expected to Fuel Food Pathogen Testing Market Growth

The food pathogen testing techniques are continuously being enhanced and employed, with the evolvement of food safety technologies. The dairy producers these days, have a variety of options to choose from for the accurate and rapid pathogen testing which are suitable for different categories of products, facilities and workflows. The rapid food pathogen testing technologies are based on different chemistries for the purpose of the detection of the targeted pathogens in the most effective & efficient manner. The Enzyme Linked Fluorescent Assay (ELFA) based technologies target the specific cell surface receptors on the pathogens for making an identification. The Polymerase Chain Reaction (PCR) based technologies target the DNA inside each of the pathogens.

The implementation of rapid testing technologies in a dairy plant provide many advantages such as faster time to get results which further allows higher testing throughout for the purpose of improving the production efficiency, decreasing the hold time and the increased shelf life of the products. The use of rapid testing technologies also favors the faster response to adverse events that allows the dairy production facilities to implement any required corrective actions that can prevent losses caused due to wastage and spoilage. Besides, these rapid food pathogen testing methods are easy to use and allow increased flexibility for personnel. Most of the dairy manufacturers have implemented in-house testing programs. With proper training and availability of proper instruments, an advanced microbiology degree no longer acts as a barrier for the implementation of a successful pathogen testing program. Also, the rise in the accessibility and affordability of the rapid testing methods, enable the dairy manufacturers to keep their data in-house, enhance the traceability and control of sample and results. The harnessing and housing of data further helps the manufacturers to employ analytics and make proactive decisions ranging from supply chain to the production line to the storage facilities. Owing to the advantages offered by the rapid pathogen testing, the dairy manufacturers implement it in their manufacturing units, which in turn foster the growth of the food pathogen testing market.

Type Insights

Based on type, the food pathogen testing market is bifurcated into blanched and natural. The salmonella segment accounted for a larger market share in 2018 and it is expected to register a higher CAGR in the market during the forecast period. Salmonella is the most common type of bacterial disease that affects the intestinal tract of a human body. It causes diarrhea, abdominal cramps and fever. It is mostly caused due to the consumption of raw or undercooked meat, poultry and egg products. Salmonella infection weakens the immune systems especially in infants, women and adults. Sometime it is life threatening and therefore food pathogen testing is mostly done for salmonella. The risk of being salmonella infection is very high and people are easily infected by it. Thus, in order to prevent this infection and loss of human life food pathogen testing plays a very important role in this segment, which in turn drives its growth in the food pathogen testing market.

Food Type Insights

Based on food type, the food pathogen testing market is segmented into meat and poultry, dairy, processed food, fruits and vegetables, and cereals and grains. The meat and poultry segment accounted for the largest market share in 2018. Global meat consumption has increased tremendously owing to its health benefits, such as improved protein intake coupled with a rise in spending on outdoor dinners. The necessity to improve or maintain the product quality due to growing consumer awareness and health consciousness drives the food pathogen testing demand. Developing regulations attributed to increasing food pathogen outbreaks through poultry, meat, and seafood products amplify the segment growth. The most important pathogens associated with meat and poultry are E. coli, campylobacter, and Salmonella. Unhygienic conditions and improper handling during skinning and de-feathering results in contamination anticipated supporting this segment growth.

Technology Insights

Based on technology, the food pathogen testing market is segmented into traditional technology and rapid technology. The rapid technology segment accounted for the largest market share in 2018. Simple steps and low initial cost associated with traditional technology supports the segment’s growth. It has various advantages, such as reduced cost and increased accuracy, which are likely to drive this segment growth. Even though traditional technology is highly precise, it requires a considerable amount of time for pathogen detection. Sometimes it takes days to weeks. Moreover, food microbiology laboratories have changed significantly during the last 30 years. During the early 1980s, the focus was on quality control testing, which was done in-house by manufacturers. However, as the industry started to adopt the HACCP approach to food safety management, quality control was substituted by quality assurance. Instead of detection, prevention became the goal of food safety control, and much of the remaining microbiological testing was outsourced. Traditional technologies continued to rely on culturing the microorganisms in a sample to produce sufficient cells for detection. That culture step took at least 24 hours, and for some pathogens, it is five days or more. Traditional methods were not able to provide results quickly enough to monitor critical control points in a HACCP system effectively and are currently used mainly to verify that the system is working correctly.

A few players operating in the food pathogen testing market are SGS SA, Bureau Veritas, Intertek Group Plc, Eurofins Scientific, Mérieux NutriSciences., ifp Institut für Produktqualität GmbH, ALS Limited, AsureQuality, Microbac Laboratories, and FoodChain ID Group Inc among many others. The key companies implement the mergers and acquisitions, and research and development strategies to expand customer base and gain significant share in the global market, which also allows them to maintain their brand name globally.

Food Pathogen Testing Market Regional Insights

The regional trends and factors influencing the Food Pathogen Testing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Food Pathogen Testing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Food Pathogen Testing Market

Food Pathogen Testing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 5.36 Billion |

| Market Size by 2027 | US$ 9.73 Billion |

| Global CAGR (2019 - 2027) | 7.9% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

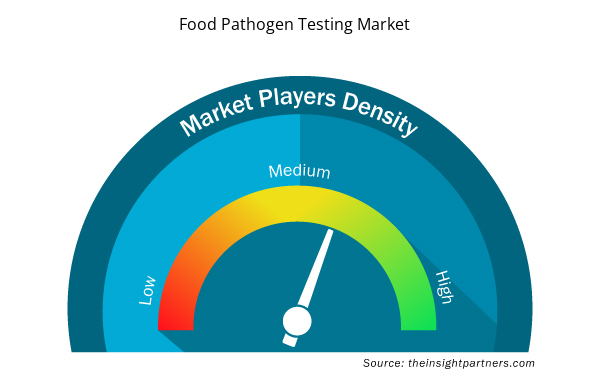

Food Pathogen Testing Market Players Density: Understanding Its Impact on Business Dynamics

The Food Pathogen Testing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Food Pathogen Testing Market are:

- SGS SA

- Bureau Veritas

- Intertek Group Plc

- Eurofins Scientific

- Mérieux NutriSciences.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Food Pathogen Testing Market top key players overview

Report Spotlights

- Progressive industry trends in the food pathogen testing market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the food pathogen testing market from 2019 to 2027

- Estimation of global demand for food pathogen testing

- PEST analysis to illustrate the efficacy of buyers and suppliers operating in the industry

- Recent developments to understand the competitive market scenario

- Market trends and outlook as well as factors driving and restraining the growth of the food pathogen testing market

- Assistance in decision-making process by highlighting market strategies that underpin commercial interest, leading to the market growth

- The size of the food pathogen testing market size at various nodes

- Detailed overview and segmentation of the market, as well as the food pathogen testing industry dynamics

- Size of the food pathogen testing market in various regions with promising growth opportunities

Food Pathogen Testing Market- by Type

- E. coli

- Salmonella

- Listeria

- Campylobacter

- Others

Food Pathogen Testing Market – by Technology

- Traditional Technology

- Rapid Technology

Food Pathogen Testing Market – by Food Type

- Meat And Poultry

- Dairy

- Processed Food

- Fruits And Vegetables

- Cereals And Grains

Company Profiles

- SGS SA

- Bureau Veritas

- Intertek Group Plc

- Eurofins Scientific

- Mérieux NutriSciences.

- ifp Institut für Produktqualität GmbH

- ALS Limited

- AsureQuality

- Microbac Laboratories

- FoodChain ID Group Inc

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type ; Technology ; Food Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Based on application, why the meat and poultry segment accounted for the largest share in the global pathogen testing market?

Global meat consumption has increased tremendously owing to its health benefits, such as improved protein intake coupled with a rise in spending on outdoor dinners. The necessity to improve or maintain the product quality due to growing consumer awareness and health consciousness drives the food pathogen testing demand. Developing regulations attributed to increasing food pathogen outbreaks through poultry, meat, and seafood products amplify the segment growth. The most important pathogens associated with meat and poultry are E. coli, campylobacter, and Salmonella. Unhygienic conditions and improper handling during skinning and de-feathering results in contamination anticipated supporting this segment growth.

Can you list some of the major players operating in the global pathogen testing market?

The major players operating in the global pathogen testing market are SGS SA, Bureau Veritas, Intertek Group Plc, Eurofins Scientific, Mérieux NutriSciences., ifp Institut für Produktqualität GmbH, ALS Limited, AsureQuality, Microbac Laboratories, and FoodChain ID Group Inc, among others.

In 2019, which region held the largest share of the global pathogen testing market?

In 2019, the pathogen testing market was predominant in North America at the global level. North America encompasses an ample amount of opportunities for the growth of pathogen testing. The rise in the incidence of foodborne diseases and thus the rising awareness towards food safety drives the demand for food pathogen testing in North America. Development in pathogen testing methods coupled with nano-biotechnology also supports the growth of the market. Increments in medical expenses and the application of genetically modified organisms in food & beverages industry also fuels the market for the same.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - Global Food Pathogen Testing Market

- SGS SA

- Bureau Veritas

- Intertek Group Plc

- Eurofins Scientific

- Mérieux NutriSciences.

- ifp Institut für Produktqualität GmbH

- ALS Limited

- AsureQuality

- Microbac Laboratories

- FoodChain ID Group Inc

Get Free Sample For

Get Free Sample For