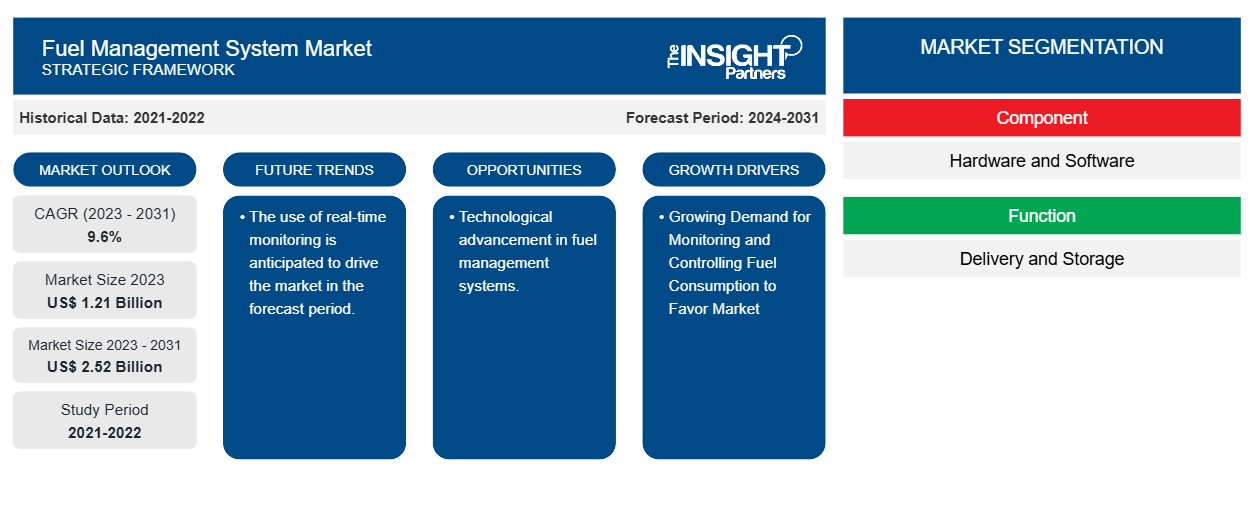

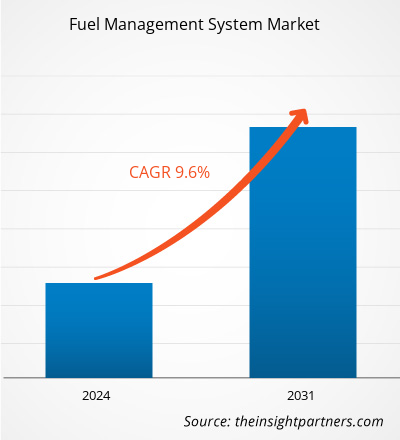

The fuel management System market size is projected to reach US$ 2.52 billion by 2031 from US$ 1.21 billion in 2023. The market is expected to register a CAGR of 9.8% during 2023–2031. Increasing demand for monitoring and controlling fuel consumption and increasing cases of fuel theft are likely to remain key trends in the market.

Fuel Management System Market Analysis

The demand for fuel management systems market is anticipated to grow with the increasing need for better fuel management to improve productivity and efficiency across several industries. Moreover, the rapid growth of e-commerce platforms to offer better customer experience has driven the supply and logistics industries to enhance IoT industries.

Fuel Management System Market Overview

A fuel management system is a type of software and hardware technology used to monitor, control, and optimize fuel consumption in various applications, such as in the transportation, construction, and energy industries. In vehicles, fuel management systems can help to ensure that fuel is being used efficiently by monitoring fuel consumption, engine performance, and other factors. This can help to reduce fuel costs, increase operational efficiency, and lower emissions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fuel Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Fuel Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Fuel Management System Market Drivers and Opportunities

Growing Demand for Monitoring and Controlling Fuel Consumption to Favor Market

The growing demand for monitoring and controlling fuel consumption is driving the fuel management systems market, as there are several benefits to monitoring fuel consumption. Benefits such as cost savings, identifying inefficiencies, reducing emissions, etc. Additionally, the demand for real-time fuel consumption monitoring is also increasing. It enables businesses to identify and address fuel waste as it happens rather than after the fact. This can help businesses reduce fuel consumption and costs in real time, which can have a significant impact on their bottom line. Considering the several benefits of monitoring and controlling fuel consumption, the fuel management system is in demand.

Technological advancement in fuel management systems.

The technological advancement in fuel management systems holds several opportunities. Technological advancements such as IoT integration, predictive analytics, machine learning algorithms, blockchain for transparency, energy-efficient vehicles, etc. These advancements can help several industries, including logistics and transportation, manufacturing and supply chain, agriculture, construction, fleet management and services, etc. Thus, technological advancement in various industries increases the demand for fuel management systems.

Fuel Management System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the fuel management system market analysis are component, function, and end-user.

- Based on component, the fuel management system market is divided into hardware and software. The software segment is anticipated to hold a significant market share in the forecast period.

- Based on function, the fuel management system market is divided into delivery and storage. The delivery segment is anticipated to hold a significant market share in the forecast period.

- By end user, the market is segmented into mining, construction and ports, transportation and logistics, oil and gas, and others. The mining segment is anticipated to hold a significant market share in the forecast period.

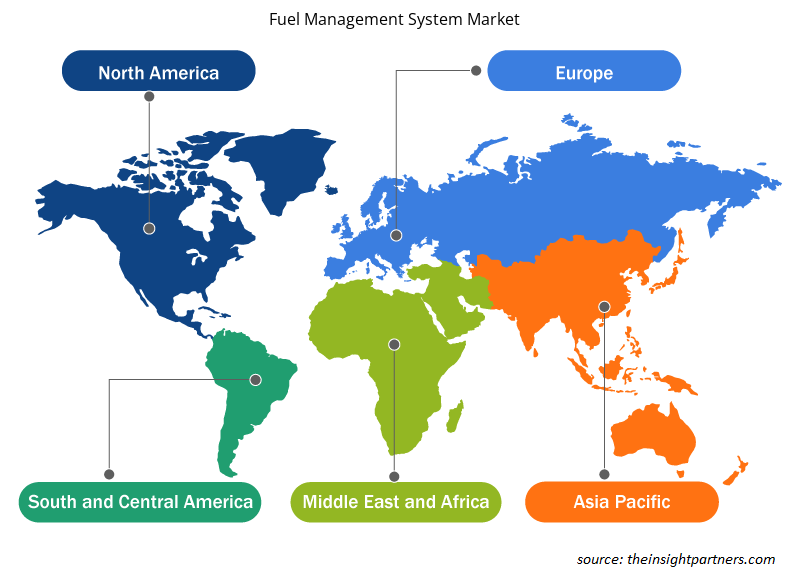

Fuel Management System Market Share Analysis by Geography

The geographic scope of the fuel management system market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

North America has dominated the fuel management system market. High technology adoption trends in various industries in the North American region have fuelled the growth of the fuel management system market. Factors such as increased adoption of digital tools and high technological spending by government agencies are expected to drive the North American fuel management system market growth. Moreover, a strong emphasis on research and development in the developed economies of the US and Canada is forcing the North American players to bring technologically advanced solutions into the market. In addition, the US has many fuel management system market players who have been increasingly focusing on developing innovative solutions. All these factors contribute to the region's growth of the fuel management system market.

Fuel Management System Market Regional Insights

The regional trends and factors influencing the Fuel Management System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Fuel Management System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Fuel Management System Market

Fuel Management System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.21 Billion |

| Market Size by 2031 | US$ 2.52 Billion |

| Global CAGR (2023 - 2031) | 9.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

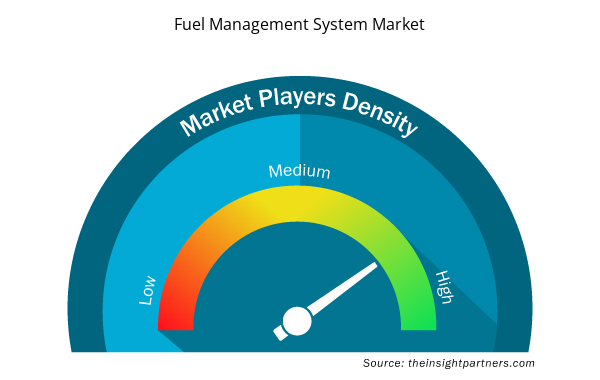

Fuel Management System Market Players Density: Understanding Its Impact on Business Dynamics

The Fuel Management System Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Fuel Management System Market are:

- Chevin Fleet Solutions

- Franklin Electric

- Gilbarco Inc.

- Multiforce Systems Corporation.

- Navig8

- Piusi S.p.A.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Fuel Management System Market top key players overview

Fuel Management System Market News and Recent Developments

The fuel management system market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the fuel management system market are listed below:

- Kongsberg Digital and Royston partnered to deliver an electronic fuel management system. The partnership will enable ship owners to optimize fuel consumption, enhance transparency, and promote decarbonization of vessel operations by combining Kongsberg Digital's Vessel Insight with Enginei – Royston's Electronic Fuel Management System. (Source: Royston, Press Company Website, February 2024)

- Airbus became a strategic partner with DG Fuels, LLC (“DGF”), an emerging leader in sustainable aviation fuel (SAF). DGF’s fuel production system is based entirely on cellulosic waste products, such as wood waste from the logging industry, and renewable energy sources, such as wind and solar power. (Source: Airbus Company Website, September 2023)

Fuel Management System Market Report Coverage and Deliverables

The “Fuel Management System Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Fuel management system market size and forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Fuel management system market trends as well as market dynamics such as drivers, restraints, and key opportunities.

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Fuel Management System market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the fuel management system market.

- Detailed company profiles.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Function, and End-User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Austria, Brazil, Canada, France, Germany, India, Italy, Mexico, Romania, Saudi Arabia, South Africa, Spain, Switzerland, United Arab Emirates, United States

Frequently Asked Questions

What is the expected CAGR of the fuel management system market?

The expected CAGR of the fuel management system market is 9.6%.

What would be the estimated value of the fuel management system market by 2031?

The global fuel management system market is expected to reach US$ 2.52 billion by 2031.

What are the future trends of the fuel management system market?

The use of real-time monitoring is anticipated to drive the market in the forecast period.

Which are the leading players operating in the fuel management system market?

The key players holding majority shares in the global fuel management system market are Chevin Fleet Solutions, Franklin Electric, Gilbarco Inc., Multiforce Systems Corporation., Navig8, Piusi S.p.A., OPW Fuel Management Systems Corporate, Orpak Systems Ltd., Banlaw, Syntech Systems, Inc., etc.

What are the driving factors impacting the fuel management system market?

Increasing demand for monitoring and controlling fuel consumption and increasing cases of fuel theft are some of the factors driving the fuel management system market.

Which region dominated the fuel management system market in 2023?

North America is anticipated to dominate the fuel management system market in 2023.

Get Free Sample For

Get Free Sample For