Fill Finish Manufacturing Market Key Players and Forecast by 2030

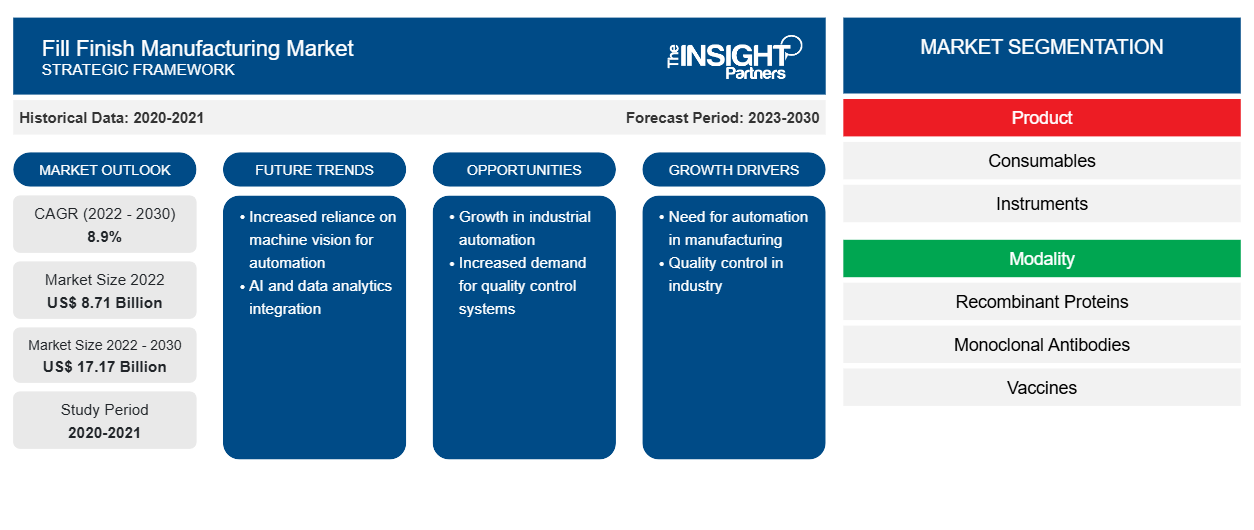

Fill Finish Manufacturing Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product [Consumables (Prefilled Syringes, Glass Vials/Plastic Vials, Cartridges, and Others), and Instruments], Modality (Recombinant Proteins, Monoclonal Antibodies, Vaccines, Cell Therapies and Biological Therapies, Gene Therapies, and Others), and End User (Contract Manufacturing Organizations, Biopharmaceutical Companies, and Others)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Status : Published

- Report Code : TIPRE00018228

- Category : Life Sciences

- No. of Pages : 182

- Available Report Formats :

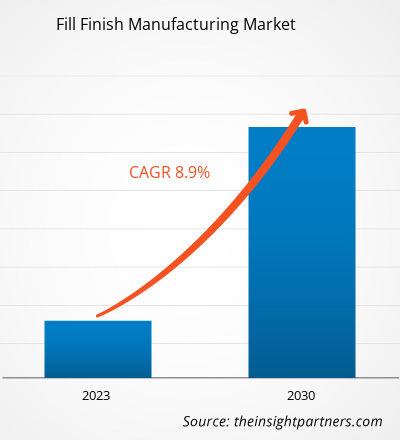

The fill finish manufacturing market size is expected to grow from US$ 8,705.58 million in 2022 to US$ 17,165.41 million by 2030; it is anticipated to record a CAGR of 8.9% from 2022 to 2030.

Market Insights and Analyst View

Single-use disposable systems (SUDS) and single-use systems (SUS) for aseptic fill finish save time for pharmaceutical manufacturers, thereby allowing them to streamline their operations and shorten project schedules. Incorporating SUDS also helps them ensure regulatory compliance as well as confer environmental, health, and safety (EHS) benefits and facility design advantages. Furthermore, SUS accelerates the changeover fill finish operations by simplifying end-of-batch breakdown and decontamination operations; the simplification of decontamination operations involves the elimination of time-consuming cleaning and preparation steps. The SUS is now being used in fill-finish operations. Bulk biotech operations have successfully deployed single-use systems for buffer and media preparations. They are currently implementing new single-use technologies such as fermentation and chromatography systems. Recent advancements in technology are making SUDS increasingly attractive for aseptic operations. For instance, a single-use line is a perfect fit for parenteral solution products with relatively low batch sizes (50–500L) that a peristaltic pump can transfer. Thus, the rise in the use of single-use systems for aseptic fill finish manufacturing will provide future growth in the fill finish manufacturing market.

Growth Drivers and Challenges:

Biologics have emerged as a dominant force within the pharmaceutical industry, comprising the majority of top-selling drugs and representing one of the fastest-growing market segments. Since the introduction of recombinant protein-based therapies nearly three decades ago, the biologics sector has experienced robust expansion, growing at an impressive annual rate exceeding 12%. Today, more than 5,000 biopharmaceutical candidates are in the development pipeline, underscoring the sector's momentum and potential.

While biologics offer substantial profit margins due to their high therapeutic value and market demand, their development is inherently complex and capital-intensive. High research and development costs, intricate manufacturing processes, and regulatory hurdles continue to challenge biopharmaceutical sponsors. To navigate these challenges, both emerging biotech firms and large pharmaceutical companies are increasingly outsourcing critical operations to contract development and manufacturing organizations (CDMOs) and contract manufacturing organizations (CMOs). This strategic outsourcing allows companies to minimize capital expenditures, access advanced infrastructure, accelerate product timelines, and mitigate commercialization risks.

A key focus area in the biologics manufacturing process is the fill finish stage—the final, and one of the most critical, steps in drug production. Biologics require stringent aseptic conditions and specialized technologies to preserve product efficacy and ensure safety. As demand for biologics surges, the need for flexible, scalable, and compliant fill finish solutions has grown in parallel. To meet these demands, pharmaceutical manufacturers are forming strategic partnerships with CDMOs that possess advanced fill finish capabilities.

Currently, approximately 180 companies offer fill finish services tailored to biologics, operating across more than 350 specialized facilities globally. These contract service providers deliver not only state-of-the-art technology and regulatory expertise but also geographic flexibility and scalability—key attributes for global pharmaceutical players. This growing reliance on outsourced fill finish solutions reflects a broader industry trend aimed at enhancing operational efficiency, reducing time-to-market, and optimizing resource allocation in an increasingly competitive and innovation-driven biopharmaceutical landscape.

Customize This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONFill Finish Manufacturing Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Furthermore, many service providers have acquired other market players in the recent past to enhance their service offerings. For instance, Sanofi has outsourced the manufacturing of its biologics to Boehringer Ingelheim. In addition, AbbVie's operations have successfully developed and delivered drug products for more than 130 years; over 14 million small-volume parenteral (SVPs) are filled annually across the company’s global network, and the filled products are distributed within ~175 countries. Benefiting from a fully integrated Science and Technology group supporting both biologics drug substance (DS) and drug product (DP) development, AbbVie also has a good audit and regulatory track record with proven clinical and commercial success. With the state-of-the-art aseptic manufacturing line in Ireland, particularly for liquid and lyophilized biologic vials, as well as with the integration of Allergan’s SVP network, AbbVie has further expanded its capability and capacity to more than 40 million units annually. Thus, increasing demand for biologics is driving the market growth.

The role of pharmaceutical outsourcing has changed from being a small part of a business to an integral part of it. The pharmaceutical industry is transforming with the expanding product pipelines, continuous pricing pressure, and emerging markets. Competition in the CMO marketplace has escalated with the growing number of service providers in APAC. Smaller CMOs in the US and Europe are struggling to keep up with the fierce competition, and ultimately, big pharmaceutical companies or other CMOS are acquiring them. For instance, in February 2020, Altasciences, a CMO, acquired Alliance Contract Pharma. This acquisition added small molecule contract manufacturing and analytical services to Altascience's portfolio. Despite ongoing consolidation, the CMO market remains fragmented, with only a few companies achieving global reach and scale.

Moreover, there is a high demand for CMO services offered for niche areas such as antibody-drug conjugation and high-potency drug manufacturing, owing to the significant amounts of investments required to have these capabilities in-house. However, many pharmaceutical companies have started acquiring these facilities to gain a competitive edge over their competitors. This has led to an increase in the prices of these services, making outsourcing a difficult choice for start-ups and small pharmaceutical companies.

Report Segmentation and Scope:

The fill finish manufacturing market is segmented on the basis of product, modality, end user, and geography.

- Based on product, the fill finish manufacturing market is bifurcated into consumables and instruments. The consumables segment is further segmented into prefilled, glass vials/plastic vials, cartridges, and others.

- By modality, the fill finish manufacturing market is categorized into recombinant proteins, monoclonal antibodies, vaccines, cell therapies and biological therapies, gene therapies, and others.

- In terms of end users, the fill finish manufacturing market is classified into contract manufacturing organizations, biopharmaceutical companies, and others.

- Based on geography, the fill finish manufacturing market is segmented into North America (US, Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia Pacific (China, South Korea, Japan, Australia, India, and Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis

Based on product, the fill finish manufacturing market is bifurcated into consumables and instruments. The consumables segment is further divided into prefilled syringes, glass vials/plastic vials, cartridges, and others. The consumables segment is categorized into cartridges, vials, prefilled syringes, and other consumables such as ampoules, bottles, bags, and single-use systems. The consumables segment holds a significant market share in the fill-finish manufacturing market; it is anticipated to experience a similar growth trend during the forecast period owing to the high replacement rate compared to instruments. Also, consumables' shelf life is less, and they are usually required in large quantities. The rising adoption of prefilled syringes, varied applications of vials in lyophilization, and increasing fill-finish outsourcing are the key factors driving the consumables segment.

Based on modality, the fill finish manufacturing market is classified into recombinant proteins, monoclonal antibodies, vaccines, cell therapies and biological therapies, gene therapies, and others. Vaccine fill finish manufacturing is a critical stage in the production process. It involves filling vials with the prepared vaccine and ensuring precise quantities. This step demands stringent quality control to maintain efficacy and safety. Once filled, the vials undergo sealing and packaging. This meticulous process plays a pivotal role in delivering vaccines to the global population, safeguarding public health by meeting quality standards and regulatory requirements. Furthermore, increasing key developments related to vaccine fill finish manufacturing are driving the market growth. For instance, in May 2023, Novocol Pharma—a leading sterile injectable contract development and manufacturing organization (CDMO) in Ontario—and Moderna, Inc.—a biotechnology company that pioneered messenger RNA (mRNA) therapeutics and vaccines—announced a long-term agreement to perform aseptic fill finish, labeling, and packaging of mRNA respiratory vaccines expected to be produced in Canada. The last stage of the production cycle, known as fill-finish sterile manufacturing, entails putting the vaccine medication product into vials and preparing it for use. Furthermore, the arrangement with Novocol Pharma will increase the fill finish capacity of vaccines produced at Moderna's mRNA facility in Laval. Subject to planning and regulatory permissions, the facility is anticipated to open for business by the end of 2024.

Based on end user, the fill finish manufacturing market is classified into contract manufacturing organizations, biopharmaceutical companies, and others. In 2022, the contract manufacturing organizations segment held the largest share of the market, and it is expected to register the highest CAGR during the forecast period. Contract manufacturing organizations (CMOs) benefit pharmaceutical companies by minimizing investment requirements in facilities and drug development costs, thereby improving the net cash flow. Outsourcing is a cheaper approach that increases the efficiency of manufacturing processes. Also, it allows pharmaceutical and biotechnology companies to redirect resources to other necessary fields. CMO has been considered a niche industry in the past few years, which offered additional manufacturing capacity or specific services to pharmaceutical companies. The rising number of drug manufacturing failures led to a rise in the number of CMOs. Pharmaceutical companies traditionally had dedicated manufacturing facilities for innovative drugs in development. However, to reduce the risk of overcapacities, the demand for manufacturing outsourcing has been rising continuously.

Many pharmaceutical companies have begun refocusing on their core capabilities, such as research and development, leading to divestments of in-house manufacturing capacities, resulting in growing reliance on CMOs for manufacturing. Further, the additional capacities in the form of CMOs mitigate the risk of supply shortages. They also offer other sites to pharmaceutical companies for implementing multisite supply strategies and holding backup capacities. For instance, in 2020, Samsung Biologics and GI Innovation signed a contract for immunochemotherapy. Under this agreement, Samsung Biologics facilitated GI Innovation with services ranging from f-cell line development to Phase I drug substance production.

Regional Analysis

Based on geography, the fill finish manufacturing market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. North America is the most significant contributor to the growth of the fill finish manufacturing market. Canada is among the fastest-developing countries in terms of the biopharmaceutical industry. Various international companies are investing in the Canadian biopharmaceutical industry. In Canada, the number of biopharmaceutical companies is rising significantly. For instance, Vancouver, British Columbia, has the majority of biopharmaceutical companies, which generate US$ 90.3 million (CAD 120 million) revenue annually. There are ~35–40 domestic biopharmaceutical companies across the country. A few of the Canadian biopharmaceutical companies include Inex Pharmaceuticals, Quest Vitamins, StressGen Biotechnologies, Stanley Pharmaceuticals, QLT Phototherapeutics, and Stemcell Technologies. Various public and private research organizations include the Center for Molecular Medicine and Therapeutics, the Biotechnology Laboratory at the University of British Columbia, the BC Cancer Research Center, the Canadian HIV Trials Network, and the Vaccine Evaluation Center. Thus, the development of the biopharmaceutical industry in the country will bolster the market growth during the forecast period.

Asia Pacific is expected to be the fastest-growing market in the coming years. In Asia Pacific, China is the largest market for fill finish manufacturing. The growth of the market is primarily attributed to the rising technological advancements in fill finish manufacturing processes in China, increasing developments by the market players, the biopharmaceutical industry’s expansion, and the growing prevalence of chronic diseases. There are more than 500 biological product/biopharmaceutical companies in China. Most of those involved in R&D were established by returnees from abroad or by Western/joint venture companies. Although estimates vary widely, analysts believe that the Chinese government spends more than US$ 600 million annually on biotech R&D through its funding initiatives. China’s national and local governments also invest in quasi-venture capital companies that invest in IT enterprises. The market players are expanding their business through organic and inorganic growth strategies. For instance, WuXi Biologics increased the capacity of prefilled syringes (PFS) to 17 million units yearly in June 2022 by opening its drug product factory in Wuxi, China. The most recent D.P. facility operated by WuXi Bio, a contract development manufacturing organization (CDMO), is called DP5, and it has an advanced isolator filling line for reliable, continuous filling services. According to the company, this provides PFS with a variety of volume delivery options, including 1.25 ml, 3 ml, and 1 mL.

Fill Finish Manufacturing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 8.71 Billion |

| Market Size by 2030 | US$ 17.17 Billion |

| Global CAGR (2022 - 2030) | 8.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Fill Finish Manufacturing Market Players Density: Understanding Its Impact on Business Dynamics

The Fill Finish Manufacturing Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Competitive Landscape and Key Companies:

IMA Industria Macchine Automatiche SpA, Nipro Medical Europe NV, Maquinaria Industrial Dara SL, Groninger and Co GmbH, SGD SA, Optima Packaging Group Gmbh, NNE AS, Stevanato Group SpA, Syntegon Technology GmbH, West Pharmaceutical Services Inc, Gerresheimer AG, Schott AG, and Becton Dickinson and Co are a few prominent players operating in the fill finish manufacturing market. These companies focus on expanding service offerings to meet the growing consumer demand worldwide. Their global presence allows them to serve a large set of customers, subsequently allowing them to expand their market share.

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For