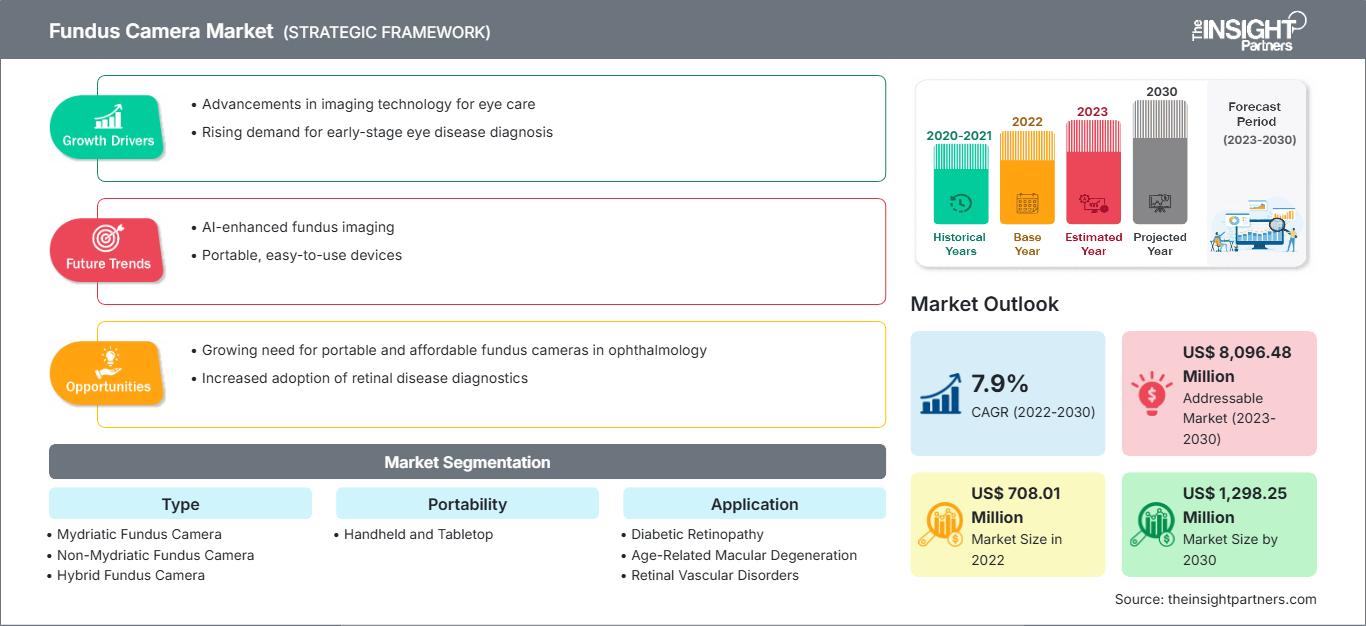

Fundus Camera Market Growth Opportunities and Forecast by 2030

Fundus Camera Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type (Mydriatic Fundus Camera, Non-Mydriatic Fundus Camera, Hybrid Fundus Camera, and ROP Fundus Camera), Portability (Handheld and Tabletop), Application (Diabetic Retinopathy, Age-Related Macular Degeneration, Retinal Vascular Disorders, and Others), End User (Hospitals, Ophthalmology Centers, and Others), and Geography (North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa)

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030- Report Date : Sep 2023

- Report Code : TIPHE100001280

- Category : Life Sciences

- Status : Published

- Available Report Formats :

- No. of Pages : 173

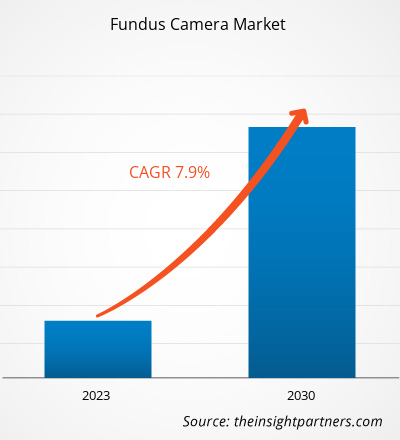

[Research Report] The fundus camera market size is expected to grow from US$ 708.01 million in 2022 to US$ 1,298.25 million by 2030; it is estimated to register a CAGR of 7.9% from 2020 to 2030.

Analyst’s ViewPoint

The fundus camera market analysis include driving factors such as increase in diabetic retinopathy screening procedures and launches of innovative products. Further, AI integration with fundoscopy acts as a future trend for the market to grow during 2020–2030. According to the segmentation profiled in the report, based on type segment, the non-mydriatic fundus camera segment accounted the largest share in 2022. In terms of portability, the tabletop segment dominated the market by accounting maximum share. By application, the diabetic retinopathy segment will account a considerable share for the fundus cameras to dominate the market growth during the forecast period. Based on end user, the ophthalmology centers segment is expected to account the maximum share for the fundus cameras market growth during 2020–2030.

A fundus camera is a specialized low-power microscope with an attached camera with its optical design based on an indirect ophthalmoscope. Fundus photography is important for diagnosing and treating various posterior segments and other ocular diseases. Therefore, fundus cameras are portable and cheaper alternatives to table-top counterparts. For example, two fundus cameras (Pictor and Remidio) revealed high success rates of image acquisition and high image quality and upgradeability compared to table-top devices.

Market Insights

Launches of Innovative Products

Customizee This Report To Suit Your Requirement

Get FREE CUSTOMIZATIONFundus Camera Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Medical device companies focus on the development and launch of new products, along with obtaining approvals from corresponding regulatory bodies. A few of the recent developments fostering the global fundus market are mentioned below.

In October 2021, NIDEK CO., LTD. announced the launch of "Retina Scan Duo 2," a combined optical coherence tomography (OCT) and fundus camera system. The newly launched product aids in enhanced eye screening and clinical efficiency with user-friendly features. Retina Scan Duo 2 incorporates a novel image enhancement technique that generates an HD image from a single-frame image, ensuring great patient comfort.

In January 2023, Topcon Healthcare, a leading provider of medical devices and software solutions, announced the launch of "NW500," a user-friendly, robotic fundus camera ensuring to deliver reliable and sharp-quality images. The new product also enables a streamlined workflow in diagnostic laboratories, enhancing the patient experience and allowing the screening personnel to acquire retinal images in well-lit settings. Moreover, they do not need to ask patients to dilate their eyes. Further, the product provides excellent-quality color fundus images across the three traditional fixation points (disc, center, and macula) and the nine fixation positions for peripheral photography.

In June 2021, Coburn Technologies announced the launch of the HFC-1 Non-Mydriatic Fundus Camera, a new retinal camera manufactured by Huvitz, Co., Ltd. With a highly accurate autodetection technology, the products are intended to produce sharp, quick, and reliable retinal imaging and measurements.

AI Integration with Fundoscopy

An AI-based diagnosis system that uses color fundus photographs has exhibited optimal sensitivity and specificity for diabetic retinopathy screening. In China, the Artificial Intelligent Ophthalmology Group under the Intelligent Medicine Special Committee of the China Medicine Education Association has drafted and adopted guidelines for “Artificial Intelligent Diabetic Retinopathy Screening System Based on Fundus Photography” to support the incorporation of a unified standard for AI-assisted DR screening, promote the use of AI diagnostic systems in clinical practices, and improve the levels of diabetic retinopathy diagnosis and treatment. The group has also defined specifications and recommendations for AI-assisted diabetic retinopathy screening platforms based on fundus photographs by considering system hardware parameters, equipment configuration, data collection and standards, database establishment, AI algorithm requirements, content and format of an AI screening report, and AI screening follow-up plan.

Report Segmentation and Scope

Type-Based Insights

Based on type, the fundus cameras market is segmented as mydriatic fundus camera, non-mydriatic fundus camera, hybrid fundus camera, and ROP fundus camera. The non-mydriatic fundus camera segment held the largest market share in 2022. The mydriatic fundus camera accounted a significant CAGR for the fundus cameras market. A non-mydriatic fundus camera focuses on the high-definition image capturing of the optic disc, retina, and lens that can be achieved through a low-power microscope of the instrument without increasing the pupil size. Compared to the mydriatic fundus camera, one of the most significant advantages of a non-mydriatic fundus camera is its revolutionary upgrade offering bigger and clearer image capturing without pupil dilation. Also, a non-mydriatic fundus camera is patient-friendly as well as eliminates a 30-minute waiting time for pupil dilation and eye adjustment after blinking, which assists ophthalmologists in improving the efficiency of diagnosis.

CX-1 Hybrid Digital Mydriatic/Non-Mydriatic (MYD/NM) Retinal Camera is Canon’s first hybrid camera and a non-mydriatic camera to use Fundus Autofluorescence (FAF) photography. The CX-1 provides five photograph modes—color, red-free, cobalt, fluorescein angiography (FA), and fundus autofluorescence (FAF).

Likewise, a standalone mydriatic fundus camera prototype was successfully developed with a prototype camera capable of operating in a point-and-shoot manner. Also, the mydriatic fundus camera provides automated image focusing and exposure with the image quality of fundus photos comparable to the existing commercial cameras. For example, the adoption of a mydriatic fundus camera is huge for screening patients suffering from diabetic retinopathy and age-related macular degeneration easily identified from fundus images.

In October 2020, Volk Optical announced the launch of "The Volk VistaView," a new portable mydriatic retinal camera for fundus imaging. The newly launched product provides high-resolution, all-glass, double aspheric optics through intuitive digital platforms that capture sharp, wide-field images and manages patient data on the device.

Portability-Based Insights

Based on portability, the global fundus cameras market is bifurcated into handheld and tabletop. The tabletop segment accounted for a larger market share in 2022. The handheld segment is expected to grow at a higher CAGR during 2020–2030. Fundus photography facilitates the detection and screening of various causes of treatable and preventable blindness, notably diabetic retinopathy (DR), age-related macular degeneration, glaucoma, and retinopathy of prematurity. A handheld camera is a smaller, portable imaging device. This tool is battery-operated and does not need a stand or table to operate. Handheld cameras tend to be more affordable than tabletop cameras. The portability and low cost contribute to the high accessibility of retinal imaging devices. Handheld cameras are used in homes, mobile clinics, and health fairs.

Modern handheld fundus cameras combined with autonomous AI systems are well-suited in DR screening without mydriasis because of the high sensitivity of detection and image quality. However, the specificity of these cameras needs to be improved with better modelling of the data. Volk iNview fundus camera by Mentor, Ohio, US, can be connected with an iPhone 6s/6/5s or iPod Touch (Gen 6) through an app. The Volk Pictor Plus is a non-mydriatic fundus camera with posterior (retinal) and anterior imaging modules; the camera uses a proprietary lens, and the application can be downloaded to take fundus images. Handheld cameras are now emerging as a new low-cost tool for DR screening, which can be conveniently used by patients who may not have access to ophthalmological care.

Application-Based Insights

In terms of application, the fundus cameras market is segmented as diabetic retinopathy, age-related macular degeneration, retinal vascular disorders, and others. The diabetic retinopathy segment accounted for the largest fundus cameras market share in 2022. Diabetes mellitus (DM) is considered to be a disease of epidemic proportions. According to the Diabetes Research Institute, 37.3 million people in the US are currently suffering from diabetes.

Diabetic retinopathy (DR) is among the most significant long-term complications of diabetes mellitus and a leading cause of blindness in individuals of aged 20–74 years. As of 2020, the number of adults in the US suffering from diabetic retinopathy was ~8 million; it is expected to reach 16 million by 2050. It can be proliferative (growing) or nonproliferative (not growing), referring to the development of abnormal blood vessels in the retina. Nonproliferative retinopathy is much more common and may not require treatment. When the regular blood vessels cut off in proliferative retinopathy, aberrant blood vessels begin to form. The proliferative form of retinopathy may cause visual loss. The course of retinopathy from nonproliferative to proliferative phases should be monitored with routine eye exams. Fundus photography is crucial in managing and documenting diabetic eye diseases. Traditionally, fundus photography has been performed using film, but recently, digital fundus photography has gained significant traction. Digital images enable easy and immediate review of images, straightforward image magnification, and ability to easily validate the images.

End User-Based Insights

By end user, the market is segmented as hospitals, ophthalmology centers, and others. The ophthalmology centers segment held the largest market share in 2022 and will register the highest CAGR during 2020–2030.

Regional Analysis

North America dominated the fundus cameras market accounting maximum share. In North America, the US is the largest market for fundus cameras. According to the Centers for Disease Control and Prevention, age-related macular degeneration (AMD) is a leading cause of blindness and vision loss among Americans aged 65 and more. According to CDC, the geriatric population in the US is anticipated to nearly double from 48 million in 2015 to 88 million by 2050. Nearly 20 million adults in the US face some form of age-related macular degeneration.

DR is a commonly seen complexity in diabetic patients. According to the International Diabetes Federation (IDF), ~537 million adults (20–79 years of age) were living with diabetes in 2021. The same source also reported that the total number of people living with diabetes is estimated to rise to 643 million by 2030. Further, the study (updated in April 2023) by the American Association for Pediatric Ophthalmology and Strabismus (AAPOS) analyzed that annually in the US, ~3.9 million infants are born with retinopathy of prematurity. Moreover, ~14,000 of these are estimated to be affected by this condition and 90% of those affected have only mild disease, and nearly 1,100–1,500 develop disease severe enough to require medical treatment. Therefore, such a rise in the prevalence of retinopathy of prematurity, DR, and age-related macular degeneration in the population contributes to the fundus camera market growth in the US.

The report profiles leading players operating in the global fundus cameras market. These involve Nikon Corp, Topcon Corp, NIDEK CO LTD, Canon Inc, Carl Zeiss AG, Visionix USA Inc, Kowa Co Ltd, CenterVue SpA, Volk Optical Inc, and Digital Eye Center.

Fundus Camera Market Regional InsightsThe regional trends and factors influencing the Fundus Camera Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Fundus Camera Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Fundus Camera Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 708.01 Million |

| Market Size by 2030 | US$ 1,298.25 Million |

| Global CAGR (2022 - 2030) | 7.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Fundus Camera Market Players Density: Understanding Its Impact on Business Dynamics

The Fundus Camera Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Fundus Camera Market top key players overview

- In October 2022, Topcon Healthcare announced the launch of NW500—a new fully-automatic, non-mydriatic retinal camera that delivers reliable, sharp-quality imaging with enhanced capability.

- In August 2021, Thirona B.V., a global player and NIDEK CO., LTD., launched connectivity between the RetCAD artificial intelligence eye disease detection software by Thirona and the NAVIS-EX image filing software by NIDEK. This connectivity allows instant screening of age-related macular degeneration (AMD) and diabetic retinopathy (DR) on color fundus images captured by the AFC-330 and Retina Scan Duo from NIDEK.

- In February 2023, NIDEK CO., LTD., partnered with HOYA Vision Care, a leader in optical technology innovation. The global agreement between the two organizations will provides eye care professionals (ECPs) the access to a complete portfolio of cutting-edge optical instruments and products to offers patients full-service patient care, from eye examination to consultation through the delivery of high-quality spectacle lenses.

- In July 2022, Canon Medical Systems USA Inc. completed the acquisition of NXC Imaging, a medical imaging equipment distributor and service provider headquartered in Minneapolis, Minnesota, to broaden its sales and service reach in the Upper Midwest region. Canon Medical thus intends to create a sizable sales and service organization for this area, providing cutting-edge solutions and distinctive business models customized to each client's particular requirements.

Company Profiles

- Nikon Corp

- Topcon Corp

- NIDEK CO LTD

- Canon Inc

- Carl Zeiss AG

- Visionix USA Inc

- Kowa Co Ltd

- CenterVue SpA

- Volk Optical Inc

- Digital Eye Center

Frequently Asked Questions

Mrinal is a seasoned research analyst with over 8 years of experience in Life Sciences Market Intelligence and Consulting. With a strategic mindset and unwavering commitment to excellence, she has built deep expertise in pharmaceutical forecasting, market opportunity assessment, and developing industry benchmarks. Her work is anchored in delivering actionable insights that empower clients to make informed strategic decisions.

Mrinal’s core strength lies in translating complex quantitative datasets into meaningful business intelligence. Her analytical acumen is instrumental in shaping go-to-market (GTM) strategies and uncovering growth opportunities across the pharmaceutical and medical device sectors. As a trusted consultant, she consistently focuses on streamlining workflow processes and establishing best practices, thereby driving innovation and operational efficiency for her clients.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For